AAAU: More Upside For This Unique Gold ETP

AAAU is a unique ETF which allows physical delivery of gold and is secure in that it is owned by the government of Western Australia.

Changes in the dollar suggest that gold is likely going to rally over the coming year.

Momentum tendencies in gold tend to carry forward, which is bullish AAAU at this point.

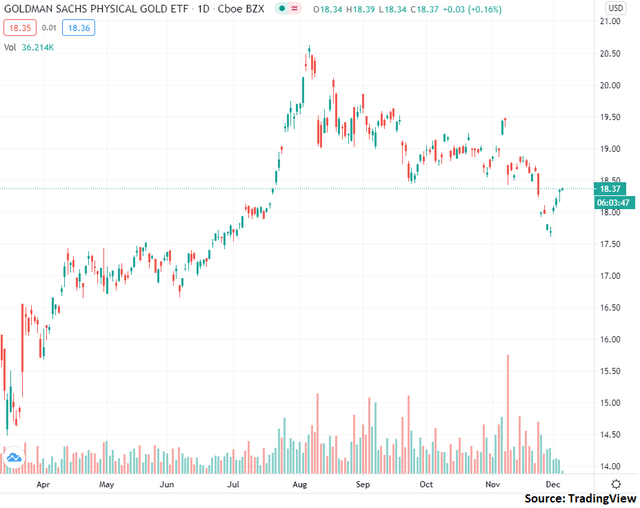

It's been a strong year for shareholders of the Perth Mint Physical Gold ETF (NYSEARCA:AAAU) with shares rallying nearly 25% over the past year on the back of a strong gain in gold.

Source: TradingView

While shares have fallen somewhat over the past few months, I believe that AAAU is still a strong hold. In this piece, I will discuss the key benefits of this ETF as well as the fundamental reasons why I believe it will see strong performance in the months ahead.

About AAAU

Within the gold ETP space, there is a fairly wide variety of products available to investors. AAAU is one of the most unique products offered to gold traders in that it actually allows physical delivery of the commodity through the redemption of shares.

Put simply, physical delivery of the underlying commodity linked to the actual holding of shares is extremely rare and basically unheard of in the commodity ETP space. The benefit of this approach to shareholders is that it helps assuage any sort of fears regarding either the solvency of the underlying fund or any sort of mismatch between AUM and actually physical gold holdings (a problem which can plague some ETFs in the industry). Additionally, AAAU is actually owned by the government of Western Australia which adds another layer of security to shareholders in that the odds of an independent ETF provider failing and unwinding assets is likely significantly higher with than that of a government.

Put simply, AAAU is an ETF which you can buy and hold to track gold and also exercise an option to convert your shares into gold. It is a fund which gives strong peace of mind to investors who desire additional layers of security as compared to rival funds.

All this said, however, AAAU is a gold-linked ETP: where gold travels, so will AAAU. So let's dig into gold's fundamentals to understand where this ETP is likely headed.

Gold Markets

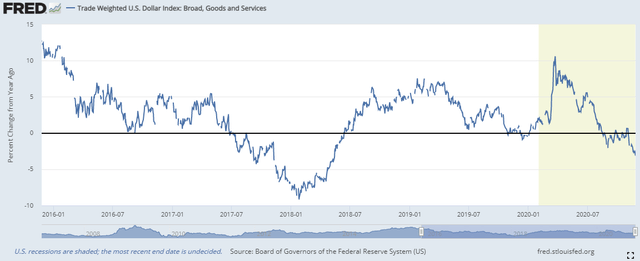

If you haven't been watching the dollar index recently, then the following chart may come as a bit of a surprise.

Source: FRED

What this chart shows is the one-year percent return in gold. Earlier this year, the dollar rose strongly as the coronavirus spread and investors sought safety in U.S. markets, similar to prior economic crises. This influx of capital led to the dollar index gaining upwards of 10% on a year-over-year basis during the mid-to-late March time frame.

However, since then, we have witnessed a consistent trend of the dollar weakening. The markets have essentially signaled that the crisis mode has largely ended and funds are flowing out of the United States once again. As of the last week, we have seen the dollar enter the territory of year-over-year declines of over 3%.

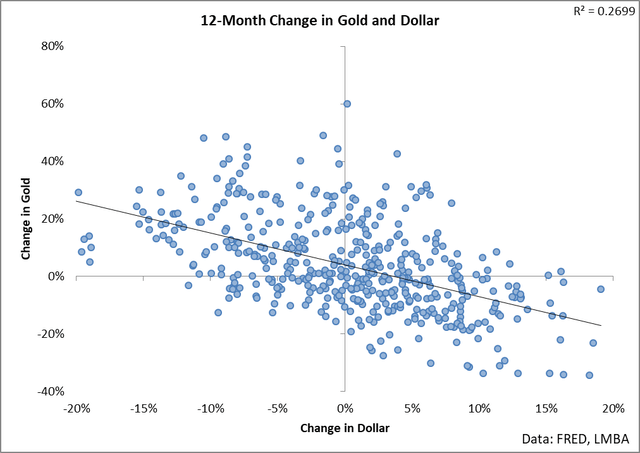

Most investors are aware of the clear trend between changes in the dollar and changes in the price of gold: as the dollar falls, gold rises.

Source: Author's calculation of FRED and LMBA data

This relationship makes economic sense - as the dollar falls in value, it takes more dollars to purchase the same ounce of gold so the price of the commodity increases. However, what investors may not be aware of is the tendency for past changes in the dollar to actually inform future changes in the price of gold.

Source: Author's calculation of FRED and LMBA data

What this chart shows is the average future one-year return in gold grouped by the past one-year change in the dollar. As you can see, there's a clear trend: the greater the decline in the dollar, the greater the future performance gold tends to see.

As mentioned previously, the dollar has just recently entered the territory of more than 3% declines on a year-over-year basis. Historically speaking, this is a very bullish signal for gold with history showing that the average movement following this type of environment is a price gain of 24% for gold traders. Not only is the average high, but the skew of the data is also very bullish with average gains of 36% historically seen compared to average losses of only 8%. The data also shows that rallies have occurred in 72% of all years following similar declines in the dollar. In other words, the data is giving a strongly bullish signal for AAAU at this point.

Not only is the dollar supportive of a gold trade at this point, but momentum is also favoring gold traders.

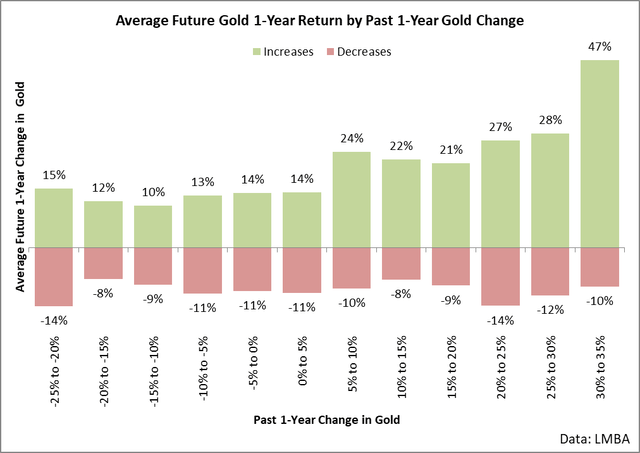

Source: Author's calculations of LMBA data

Over the past year, we have seen gold rally by around 24%. Historically speaking, there's a very clear trend in gold's data in that past rallies tend to see future strength with movements of this size generally seeing gold increase by 19% in the following year. Similar to our prior study, the skew in gold's returns is also favorable with average upside movements tending to outpace downside movements.

Source: Author's calculations of LMBA data

What the above chart shows is the average upside and downside movements seen in the price of gold following price changes of a certain degree. For example, given that we've seen a past gain in gold of around 24%, history shows that upside movements from here tend to average 27% while downside declines only average 14%. From a probabilistic standpoint, the data is also favoring further upside with history showing that 82% of all following one-year movements result in gains.

Put simply, I believe the data is very favorable for AAAU traders at this point. Changes in the dollar as well as price momentum are each indicating that there's a 70-80% chance that gold will rally and history shows that these rallies could be as high as 30%. We obviously don't know how the future will unfold, but the data is clearly indicating that now is a strong time to buy gold, and if you prefer the safety and optionality of AAAU, then it is certainly a good choice at this time.

Conclusion

AAAU is a unique ETF which allows physical delivery of gold and is secure in that it is owned by the government of Western Australia. Changes in the dollar suggest that gold is likely going to rally over the coming year. Momentum tendencies in gold tend to carry forward which is bullish AAAU at this point.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.