Sears Holdings: How To Buy 17 Dollars For 17 Cents

Sears Holdings and the unsecured creditors committee have over $1.3 billion in cash listed as new equity/credit bid funds.

According to tax expert Robert Willens, the net value of net operating losses and tax credits is worth at least $2.2 billion.

Sears Holdings' common stock is currently worth at least $17 a share in cash, net operating losses, and unencumbered asset proceeds.

Sears shareholders and bondholders should view ESL as its parent company and guarantor of the unsecured debt.

This is another update article on Sears Holdings (OTCPK:SHLDQ). This is my eighth post-bankruptcy article, and because things are moving faster now, I will be writing about Sears on a regular basis.

Because of the complexity of 368 tax reorganizations, and the difficulty in valuing the many non-retail businesses owned by Sears prior to bankruptcy, few investors realize that billions of dollars of value is left at the company and/or due to the company from the sale of the prepetition unencumbered assets. The challenge for most is getting past the drastic decline in stock price and getting to the company's value. In the end, valuation is all that matters. The stock price in 2012 or 2016 doesn't matter now.

I have over 25 years' experience as a bankruptcy consultant and debt buyer in complex bankruptcy cases, so I am investing within my circle of competence. I made over 30X investing in General Growth Properties' (BAM) bankruptcy in 2009 during the Great Recession (this is documented in previous Sears articles). This opportunity is much greater than my investment in General Growth Properties.

If you do not invest for the long term and/or do not buy stocks based on gross undervaluation, buying more of a stock after a decline of 99% seems counterintuitive. Most investors would feel a great loss instead of just doing another valuation and buying more if a disparity still exists or, in this case, has gotten significantly wider. Finding a company within my circle of competence, trading for 17 cents a share but worth at least $17, is extremely rare and may never happen again in my lifetime, so I am all in with Eddie Lampert with no doubt whatsoever.

Eddie S. Lampert and Eric L. Moore after the last annual meeting

ESL Investments is the Parent of Sears Holdings

If you analyze Sears Holdings in isolation and not in relation to its parent, ESL Investments, you will see what appears to be a "Dying" and/or "Failed" retailer with significant outstanding debts entering into its 26th month in bankruptcy.

However, if we view Sears as a subsidiary having outstanding debts to its parent company, ESL, a few others and billions in prepetition unencumbered assets, this creates a very different financial and legal scenario for all constituents. This distinction also changes who is ultimately liable to the PBGC for the unfunded pension liability.

This distinction also changes the tax effect of the sales transaction which transferred substantially all of the assets of Sears Holdings to Transform Holdco for $5.2 billion (another wholly-owned subsidiary of ESL).

When using this view, the sales transaction between ESL Investments and Sears Holdings is more akin to a parent company transferring assets from one subsidiary to another, because ESL controls Sears Holdings and Transform Holdco, and as far as ESL is concerned, nothing has changed. Below is a list of the entities in the ESL Group of companies:

- ESL owns and/or controls 100% of Transform Holdco (New Sears).

- ESL owns and/or controls 48.4% of Sears Holdings Stock (Old Sears).

- ESL owns and/or controls 68% of Lands' End (NASDAQ:LE) Stock.

- ESL owns and/or controls roughly 68% of Seritage Growth Properties (NYSE:SRG).

- ESL owns and/or controls 100% of Sears Hometown and Outlet Stores.

Because of Eddie Lampert and ESL's control position and control and/or ownership of over 50% of these entities, we must view it as the legal parent of Seritage Growth Properties, Lands' End, Sears Holdings, Transform Holdco (New Sears), and Sears Hometown and Outlet Stores.

When we view Sears as a subsidiary of a solvent parent company, with cash, real estate, marketable securities and other valuable and/or profitable subsidiaries, the financial and legal picture for creditors and shareholders is drastically different.

For example, paying off and/or reinstating and extending the maturity of the outstanding non-ESL/Cyrus Investment bond debt of roughly $600 million owed to a subsidiary with a parent company with over $9 billion in assets is not a herculean task.

In fact, the Pension Benefit Guaranty Corporation views ESL as the parent company of Sears Holdings, and therefore it and/or the other subsidiaries are legally responsible for the pension underfunding, not Sears Holdings alone. See Controlled Group Liability ERISA § 4062(A) [29 U.S.C. § 1362].

Sears Holdings received a $1.2 billion cash infusion

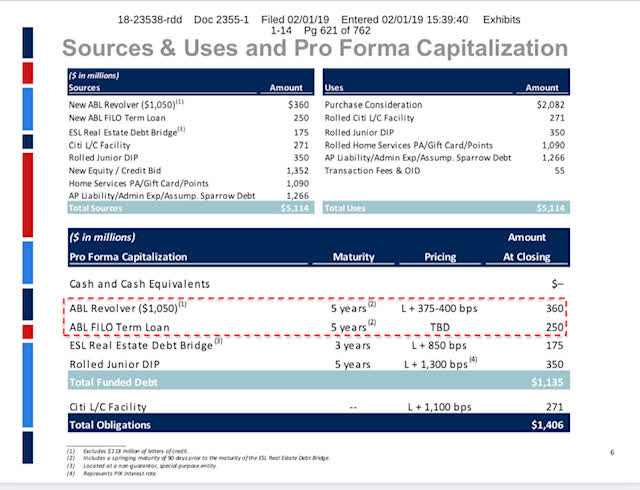

Unbeknownst to most shareholders, the company received a cash infusion of $1.2 billion from ESL in February 2019 (See document 2355-1 Page 607) and (Doc 2355-1 Page 621).

The $1.2 billion in cash received must be distributed pursuant to the bankruptcy plan

Sears Holdings disclosed in its Chapter 11 Plan that it desires to complete a 368(A). Tax reorganization Doc 1730 Page 22 reads in part:

Whereas, the parties desire and intend that the transactions set forth in this agreement, together with the Bankruptcy Plan (as defined below),will unless buyer elects otherwise pursuant to this agreement,(i) constitute one or more plans of reorganizations thereunder and (ii) satisfy the ownership requirements set forth in section 382(L)(5)(A)(ii) of the code.

When we take a look at the asset purchase agreement (document 1730 page 32), we see that the cash and securities received by Sears Holdings must be distributed pursuant to the bankruptcy plan. Below is an excerpt from page 32:

"Distribution Requirement" shall mean the requirement that each Seller (except if and to the extent (x) Buyer elects, in accordance with this Agreement, that the transactions set forth in this agreement with respect to such seller shall not be treated as a tax reorganization, or (y) if requested by such seller, designated tax advisor is unable to deliver a tax opinion that the transactions set forth in this agreement with respect to such seller may be treated as a tax reorganization).

Shall distribute the securities consideration received by it to Persons qualifying as holders of “securities” of such Seller for purposes of section 354[1] of the code.

Shall distribute all of the cash[3] received pursuant to Section 3.1(a), as well as all of its other property pursuant to the Bankruptcy Plan.

Shall dissolve no later than the end of the third taxable year ending after the Closing Date.

Conclusion

ESL disclosed that if all of its Sears Holdings debt and warrants were converted to equity, it would own 73.6% of Sears Holdings or roughly 156,724,205 shares of common stock. This means that roughly 206,000,000 outstanding shares will exist.

Eddie Lampert has already contributed $1.2 billion in cash to Sears Holdings as new equity and $35 million to the unsecured creditors committee, but the mainstream financial press missed this, because they are still following the narrative that Sears is only a "dying retailer" or a "zombie company," not a diverse group of valuable individual companies with very valuable owned/leased real estate. (See my first article here).

I am still a buyer of stock, bonds (and warrants if anyone sells their recovery rights to me). Assuming 206,000,000 shares, I believe the stock is worth at least $17 a share because of:

- The cash infusion of $1.2 billion in new equity .

- The $2.2 billion in net operating losses and tax credits (covered in this article) and based on information provided by Robert Willens, president of the tax and consulting firm Robert Willens LLC in New York and an adjunct professor of finance at Columbia University Graduate School of Business.

- The sale of prepetition unencumbered asset proceeds.

- The sale of prepetition encumbered assets above lien value.

I attributed no recovery in the ongoing lawsuit between ESL and Sears Holdings and the unsecured creditors committee.

My next article will do a deep dive on the potential unencumbered asset recoveries and their valuation, but here is a hint: The assets are conservatively worth more than $3 billion. One of them sold for $1 billion already. Stay patient and invest at your own risk.

I have attached a few of the key bankruptcy documents, articles and other research documents to assist you in your research journey.

- DOC_1730_ASSET_PURCHASE_AGREEMENT.pdf

- Bankruptcy_s_Corporate_Tax_Loophole-NOL_s_LARGE_PRINT.pdf

- SHLD_DOC_3596_APRIL_2019.pdf

- SHLDQ_DOC_3199_MOR_MARCH_2019.pdf

- SHLDQ_DOC_2785_MOR_JAN_FEB_2019.pdf

- 368_A_1_Reorganization_With_a_drop.pdf

- SHLDQ_955-2.pdf

- SHLDQ_DOC_866_JUNIOR_DIP_DECLARATION_REICKER.pdf

- SHLDQ_DOC_865_JUNIOR_DIP_DECLARATION.pdf

Disclosure: I am/we are long SHLDQ. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.