Affirm Begins U.S. IPO Process With $100 Million Filing

Affirm has filed to raise $100 million in an IPO, although the final figure may differ.

The company provides 'buy now pay later' and other financial service technologies to merchants and consumers.

AFRM has grown impressively through the pandemic but is still generating high operating losses.

Quick Take

Affirm Holdings (AFRM) has filed to raise $100 million in an IPO of its Class A common stock, according to an S-1 registration statement.

The firm provides innovative and transparent payment card processing services to merchants and card holders.

AFRM has grown impressively through the pandemic although the firm still generates high operating losses.

I’ll provide an update when we learn more about the IPO’s pricing and valuation assumptions.

Company & Technology

San Francisco, California-based Affirm was founded to improve the transparency of payment card transactions while adding value to merchants using a digital and mobile-first approach.

Management is headed by founder, Chairman and CEO Max Levchin, who was previously a co-founder of PayPal, among other ventures.

Below is a brief overview video of CEO Levchin on lending to consumers during the pandemic:

Source: CNBC Television

The company’s primary offerings include:

Point of sale solution

Various payment options, including 'Buy now pay later'

Consumer app

Affirm has received at least $1.3 billion from investors including Khosla Ventures, Founders Fund, Lightspeed Venture Partners, Jasmine Ventures and Shopify (SHOP).

Customer/User Acquisition

The firm acquires consumer users through its mobile app on major mobile platforms such as Apple and Google.

Affirm seeks to provide its services through merchant partners. It pursues major merchant partners through a direct outreach approach.

Sales and Marketing expenses as a percentage of total revenue have been uneven as revenues have increased, as the figures below indicate:

Sales and Marketing | Expenses vs. Revenue |

Period | Percentage |

Three Mos. Ended Sept. 30, 2020 | 13.0% |

FYE June 30, 2020 | 4.9% |

FYE June 30, 2019 | 6.4% |

Source: Company registration statement

The Sales and Marketing efficiency rate, defined as how many dollars of additional new revenue are generated by each dollar of Sales and Marketing spend, dropped to 3.8x in the most recent reporting period, as shown in the table below:

Sales and Marketing | Efficiency Rate |

Period | Multiple |

Three Mos. Ended Sept. 30, 2020 | 3.8 |

FYE June 30, 2020 | 9.8 |

Source: Company registration statement

Management states that its dollar-based merchant retention rate was 100%, indicating no net merchant churn.

Market & Competition

According to a 2020 market research report by Coherent Market Insights, the global market for 'Buy now pay later' services and offerings was an estimated $7.3 billion in 2019 and is expected to reach $33.6 billion by 2027.

This represents a forecast high forecast CAGR of 21.2% from 2020 to 2027.

The main drivers for this expected growth are an increasing demand for payment options by consumers as well as continued innovation in offerings by financial service providers.

Also, the fashion and garment industry accounted for the largest market share in demand, representing 52.2% of overall demand in 2019.

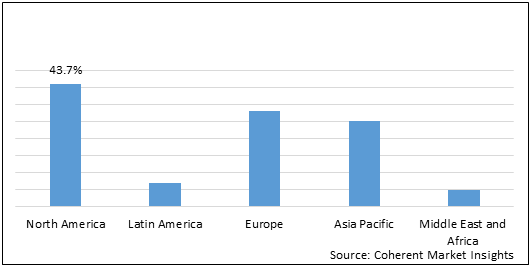

North America held the dominant market share by region, at 43.7% in 2019, as the chart shows below:

Major competitive or other industry participants include:

Afterpay

Zippay

VISA (V)

Sezzle

PayPal (PYPL)

Splitit

Latitude Financial Services

Klarna

Humm

Openpay

Financial Performance

Affirm’s recent financial results can be summarized as follows:

Sharply growing topline revenue

Uneven operating losses and margin

Nearing breakeven cash flow from operations

Below are relevant financial results derived from the firm’s registration statement:

Total Revenue | ||

Period | Total Revenue | % Variance vs. Prior |

Three Mos. Ended Sept. 30, 2020 | $ 173,978,000 | 97.8% |

FYE June 30, 2020 | $ 509,528,000 | 92.7% |

FYE June 30, 2019 | $ 264,367,000 | |

Operating Profit (Loss) | ||

Period | Operating Profit (Loss) | Operating Margin |

Three Mos. Ended Sept. 30, 2020 | $ (44,623,000) | -25.6% |

FYE June 30, 2020 | $ (107,790,000) | -21.2% |

FYE June 30, 2019 | $ (127,441,000) | -48.2% |

Net Income (Loss) | ||

Period | Net Income (Loss) | |

Three Mos. Ended Sept. 30, 2020 | $ (15,275,000) | |

FYE June 30, 2020 | $ (125,803,000) | |

FYE June 30, 2019 | $ (134,568,000) | |

Cash Flow From Operations | ||

Period | Cash Flow From Operations | |

Three Mos. Ended Sept. 30, 2020 | $ (2,304,000) | |

FYE June 30, 2020 | $ (71,302,000) | |

FYE June 30, 2019 | $ (87,649,000) | |

Source: Company registration statement

As of September 30, 2020, Affirm had $684.4 million in cash and $1.27 billion in total liabilities.

Free cash flow during the twelve months ended September 30, 2020, was negative ($74.9 million).

IPO Details

Affirm intends to raise $100 million in gross proceeds from an IPO of its Class A common stock, although the final figure may be as high as $1 billion.

Class A common stockholders will be entitled to one vote per share. Class B holders, which include the founder/CEO Levchin and venture capital firm investors, will be entitled to 15 votes per share.

The S&P 500 Index no longer admits firms with multiple classes of stock into its index.

Management says it will use the net proceeds from the IPO as follows:

We intend to use the net proceeds for general corporate purposes, including working capital, sales and marketing, engineering and technology, and corporate development. We cannot specify with certainty the particular uses for the net proceeds from this offering. Accordingly, we will have broad discretion over the uses of the net proceeds of this offering.

Management’s presentation of the company roadshow is not available.

Listed bookrunners of the IPO are Morgan Stanley, Goldman Sachs, Allen & Company, RBC Capital Markets, Credit Suisse, Barclays, Truist Securities, Siebert Williams Shank and Deutsche Bank Securities.

Commentary

Affirm is seeking public funding for its growth initiatives and general working capital needs.

The company’s financials show strong topline revenue growth but continued significant operating losses.

Affirm derives its income from a variety of sources, including merchant fees, consumer loan interest and various interchange fees.

Notably, 28% of FYE June 30, 2020’s revenues were from one merchant, Peloton (PTON). Peloton accounted for 30% for AFRM’s revenues in Q3 2020.

Sales and Marketing expenses as a percentage of total revenue have been uneven; its Sales and Marketing efficiency rate has dropped markedly in the most recent reporting period.

The market opportunity for ‘buy now pay later’ and related services has grown substantially in recent years as e-commerce activity has grown and is projected to grow in the medium term at a high rate, so the firm has an industry tailwind in its favor.

Morgan Stanley is the lead left underwriter and IPOs led by the firm over the last 12-month period have generated an average return of 69.8% since their IPO. This is a top-tier performance for all major underwriters during the period.

Affirm is well positioned to appeal to younger demographics, so I look forward to learning more about management’s pricing and valuation assumptions for the IPO.

I’ll provide an update when we have that information.

Expected IPO Pricing Date: To be announced.

Gain Insight and actionable information on U.S. IPOs with IPO Edge research.

Members of IPO Edge get the latest IPO research, news, and industry analysis.

Get started with a free trial!

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.