Gray Television has been growing substantially over the last couple of years, for the large part driven by acquisitions.

Shares have also provided attractive returns. Year-to-Date 2020, however, share prices have declined in spite of a recovery that has already followed the big pandemic related plunge in last March.

There's a top-line challenge ahead. 2021 comes with uncertainty about the advertising revenue, which is still the key source of revenue for the company.

There are also potential benefits from recovery of non-political ad revenue to pre-pandemic levels, unlocked synergies with acquired companies and growing retransmission revenues.

If Gray Television can indeed benefit while focusing on cost efficient operations, I believe there's a substantial upside for the shares. The current valuation is attractive and I'm cautiously bullish.

Just recently, in November 2020, I wrote an article about an important peer of Gray Television (GTN), (GTN.A) here on Seeking Alpha, namely about Nexstar (NXST). One reason for doing that was, naturally, that I was curious if investing in Nexstar made sense. Another reason was that I was interested to see to what extend US broadcasting companies are similar to European broadcasters. Note that in the weeks and months prior to the Nexstar article, I wrote a whole bunch of articles about European broadcasters. I found some good investment opportunities, at least in my opinion anyway, and I was wondering about how attractive the US broadcasters are and if it would be a good idea to invest. After Nexstar, Gray Television is my second US broadcaster for review.

Before going into Gray Television, I wanted to quickly recap some of the learnings from the Nexstar article. My own conclusion about Nexstar was that 2021 will bring a top-line challenge and I'm not sure how that will get reflected in the Nexstar shares. Nexstar's PB ratio is rather high in comparison with peers at the moment, so at the current share price I'm staying on the side-line. Commenters generally agree with the top-line challenge, but some of the commenters don't agree with my conclusion to stay on the side-line and remain bullish. They trust in retransmission revenues to compensate for declining non-political ad revenue. Next to that, they point out that non-political advertising may indeed be under pressure, but political advertising keeps growing from one election to the next. In 2021 it will become clear how things will pan out for Nexstar. For now, as a follow up, I'm taking these learnings from the Nexstar article into account, namely the importance of retransmission and the political ad revenue cycle, and I'm going to make sure to touch on these in my review of Gray Television.

Even in the age of streaming there's still value in old fashioned broadcasting, especially with the attractively priced shares of some of the broadcasting companies in Europe and the US. Is Gray Television one of such attractive investments? After the review of a number of European broadcasters and Nexstar, and more or less knowing what to look for, let's now have a look at Gray Television in more detail.

Gray Television has two common stock listings: (GTN) and (GTN.A). So this article covers both. The key difference between the two stocks is that the Class A has ten votes, while the other common stock only has one. There's a small explanation about this in the investor relations section on the Gray website. There's some rights attached to the common stock that can explain any difference in trading price between the two classes. As shown in below graph, the common was trading at $17.80 and the class A at $15.65 at the time of writing.

Data by YCharts

Data by YCharts

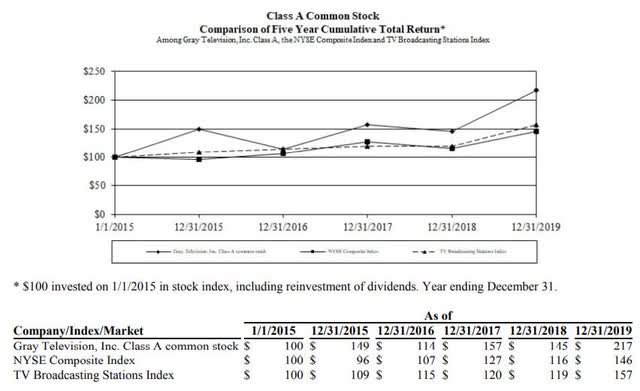

The shares have not yet reached their pre-pandemic levels of well over $20, but they have already recovered substantially from the dip in March of this year. Long time investors in the company have had a good run in the last years as the below stock performance overview from the 2019 annual report shows. The total return of the Gray shares has beaten the NYSE Composite index and the sector index.

Source: Gray Television 2019 annual report

Source: Gray Television 2019 annual report

The performance of the class A shares is similar to the common shares as shown by the below overview:

Source: Gray Television 2019 annual report

Source: Gray Television 2019 annual report

The history of Gray stock performance may be encouraging, but that's no guarantee that the future will be just as bright. Some may say that market trends, such as streaming, Over-the-Top, cut-the-wire, and even 5G are enough reason to avoid broadcasters. This brings me to my investment thesis for broadcasting, which I'll reuse to evaluate Gray Television as well. It was also the basis for my previous reviews of broadcasters. My thesis is that it only makes sense to invest in a broadcaster if:

(1) the advertising revenue trend is positive, because this proves that the broadcaster is successful in coping with the sector challenge that advertising spend shifts to social media, OTT services and other media outside linear TV

(2) the operating expenses are under control, because this means that a broadcaster doesn't spend too much on operations to run the services

(3) the valuation of the company is attractive, because the entry price has to be right.

For Gray Television, being a US broadcaster, I'd add that the political ad revenue trend needs to be positive and that the retransmission business needs to be growing. These two added characteristics are specific for US broadcasters. They are not applicable to European broadcasters.

Gray Television revenue: up in 2020, challenged in 2021

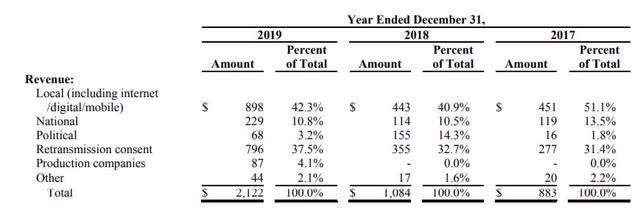

Total revenue has more than doubled between the beginning of 2017 and the end of 2019. The below table from the Gray Television 2019 annual report shows the split of the revenue and the total per year:

Source: Gray Television 2019 annual report

Source: Gray Television 2019 annual report

Total revenue in 2019 amounted to $2,122 million, while it didn't even reach the billion mark in 2017 ($883 million). This large growth of revenue is mainly visible in the local and national ad revenue and the retransmission related revenues. The political ad revenue is not so important in the period 2017-2019, but this is very significant in the election year 2020 as will be discussed further on. The local and national ad revenue declined slightly in 2018 in comparison with 2017, but it then grew significantly in 2019. The main cause for that growth was the Raycom acquisition that closed at the beginning of 2019. It is important to note that non-political ad revenue has been under pressure for broadcasters in general in the last couple of years as is directly visible in the 2018 vs 2017 numbers, while it's not visible in 2019 due to the effect of the Raycom business. Acquisitions can drive growth of non-political ad revenue, but the underlying trend is that this is declining continuously. This is a finding with both European and US broadcasters. There's an underlying decline with Nexstar, which can only be seen when correcting for its acquisition of Tribune Media. Similarly, there's an underlying decline with Gray Television, which becomes visible when correcting for its correction for its acquisition of Raycom.

Focusing on 2020, the quarterly revenue numbers clearly show a pandemic related dip in the second quarter when total revenues were only $451 million.

| $ x million | 20-q3 | 20-q2 | 20-q1 | 19-q4 | 19-q3 | 19-q2 | 19-q1 |

| total revenue | 604 | 451 | 534 | 579 | 517 | 508 | 518 |

Source: author compilation of numbers from Gray Television quarterly reports

If we look at the key buckets of revenue in the first three quarters of 2020, as shown below, it becomes clear that the political ad revenue, related to the presidential elections, has compensated decline of the other advertising revenue. Political ad revenue is already at $185 million for 2020 YtD, while it was only $68 million in 2019. Management has stated that political ad revenue is likely to end up well over $300 million for the year.

| Largest quarterly revenue categories 2020 ($ x million) | Total YtD | 20-q3 | 20-q2 | 20-q1 |

| Local and national ad revenue | 684 | 236 | 198 | 250 |

| Political ad revenue | 185 | 128 | 21 | 36 |

| Retransmission revenue | 650 | 217 | 220 | 213 |

Source: author compilation of numbers from Gray Television quarterly reports

The local and national ad revenue over 2019 amounted to $1,127 million, while the first three quarters of 2020 only brought in $685 million so far. For the full year, a drop of between 15 and 20% seems likely for local and national ad revenue, which is over a $200 million drop YoY. This size of decline is percentage-wise in the same ball park as declines with other broadcasters.

Looking at the quarterly retransmission revenue, I'd expect this to show growth in 2020 with respect to 2019. If total 2020 retransmission revenues end up around $870 million, this would mean a $74 million YoY increase.

So to summarize, overall, 2020 will likely show a growing top line for Gray Television. The political ad revenue and the growth of retransmission revenue will easily compensate the lower local and national ad revenue.

Looking forward to 2021, however, a growing top line is not so likely. The political ad revenue will then drop back by at least $200 million, the local and national ad revenue will likely not fully recover to 2019 levels and retransmission revenue growth is not likely to compensate for those declines. So just like with Nexstar, some quarterly reports showing a declining top line can be expected in 2021 if there's no new acquisitions.

Operating expenses growth exceeds revenue growth

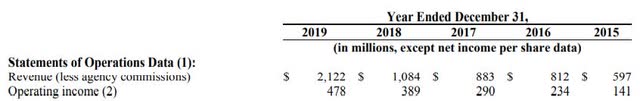

The below table from the 2019 annual report shows the revenue and operating income trends in the last five years:

Source: Gray Television 2019 annual report

Source: Gray Television 2019 annual report

The revenue growth and operating income growth show a substantial difference in pace. Operating income grows much slower than the total revenue. The explanation for this is simply that operating expenses have been rising faster than the top line. The below table further illustrates this statement:

| $ x million | 2019 | 2018 | 2017 |

| Total revenue | 2,122 | 1,084 | 883 |

| Operating expenses | 1,644 | 695 | 593 |

Source: author compilation of numbers from Gray Television annual reports

The total revenue in 2019 grew by $1,038 million (from $1,084 to $2,122 million), which was a 96% growth. The operating expenses grew by $949 million (from $695 to $1,644 million), which was a 137% growth. These faster rising operating expenses lead to deteriorating margins. Worded differently, an additional dollar in ad revenue costs more than an additional dollar in expensive operations. Other broadcasters are showing similar pressures on the margins, such as ProSiebenSat.1, as a European example.

The general root cause for the shrinking margins with some broadcasters is that they are diversifying their services by launching streaming and ecommerce offerings. These new services are more expensive to operate than linear TV. Diversification comes with operational costs.

In the case of Gray, there's also another cause at play, which is that operational synergies between all the acquired companies have not yet been reaped, while operating expenses have continued growing. The good news is that Gray Television can improve the margins in the coming years by focusing on the cost efficiency of the operations. Management acknowledges this by stating in the press that synergies will only come to full fruition over the course of a number of years.

Attractive valuation

Using the current share prices for both classes of common stock mentioned at the start of the article, I arrive at a market capitalization of ~$1.7 billion. The current book value of the equity stands at ~1.45 billion. The PB-ratio is thus around 1.2, which is the same level as most of the European broadcasters I reviewed. It's surprisingly lower than Nexstar, which has roughly a twice as high PB ratio. I prefer to look at the PB ratios at this point in time, because the earnings have been very volatile for broadcasters. Earnings have dropped a lot for many of the players in 2020, which makes the PE ratio temporarily high. To compare broadcasters by looking at PE ratios is not very helpful at the moment.

I can only guess as to why Nexstar has a much higher PB ratio. One reason could be that Nexstar pays a growing dividend, while Gray only returns money to shareholders by conducting share buybacks. Another reason can be that investors appreciate the chances of Nexstar to solidify a market leader position in the US.

Other consideration: debt and share buybacks

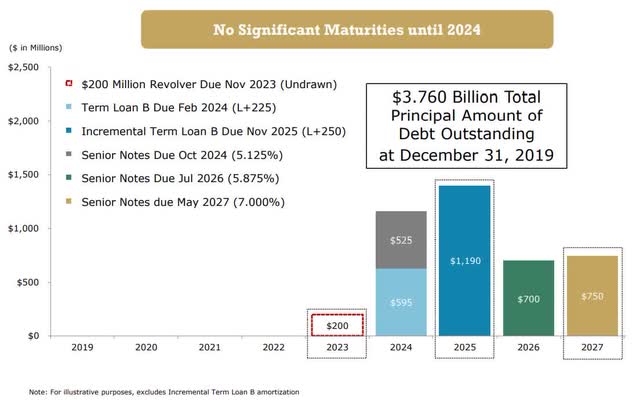

Gray Television has a sizable debt. The good news is that the first maturities only occur in 2024. This leaves plenty of time to reduce leverage or improve liquidity before renegotiations start. I'd rate the risk of any default very low. The likelihood of another sizable acquisition is also very low given the current debt burden. I think that Gray Television has more to gain from optimizing their own operations than from acquiring yet another company.

Source: Gray Television Guggenheim presentation 2020

Source: Gray Television Guggenheim presentation 2020

Gray Television is conducting a share buyback program. In my opinion, the effect of this program for the shareholders is similar to a low single-digit dividend which comes unannounced when the share price is relatively low. I think that management was right to make use of the lower share prices earlier this year. As shares become more expensive and reach $20 or more, it may become better to switch to debt repayment or cash dividends. It's a positive that management has the flexibility to do so.

Risks

The key risks with an investment in Gray Television is a slow or absent recovery of ad revenue and the inability of management to get control over the operating expenses. The behavior of the advertising market is to a large extend outside the control of Gray Television, while cost control is to a large extend within control of the company. Given the expectation that things will return to normal over the course of 2021, I'd expect non-political ad revenue to recover some lost ground. Management will have time to focus on cost efficiency in the absence of new acquisitions. 2021 will show how this will pan out.

Conclusion and investor takeaway

Gray Television has many similarities with other broadcasters and with Nexstar. 2020 was a good year with the political ad revenue. 2021 will probably bring a top-line challenge. Operating expenses are rising faster than the growth rate of the total revenue. Retransmission revenues are continuously growing.

Looking at the PB ratio, Gray Television is more attractive than Nexstar though. Therefore, I'm cautiously bullish on Gray Television and I may take a long position soon. I think that Gray Television shares can reach pre-pandemic prices in the $20 range if management focuses on cost efficient operations

My investment thesis for broadcasting that I used as a basis for this article is borrowing from other articles that I've recently written about European traditional broadcasters, such as RTL Group (OTC:RGLXF), ProSiebenSat.1 (OTCPK:PBSFF), Atresmedia (OTC:AIOSF), Mediaset (OTCPK:MDIUY), and Télévision Française 1 Société anonyme (OTCPK:TVFCF).

Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in GTN, GTN.A over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.