CareTrust REIT: Good Things Come In Small Packages

CareTrust is a relatively smaller healthcare REIT that has maintained steady performance and raised its dividend this year.

Management recently boosted guidance for the full year, and the deal pipeline has recovered to over $100 million.

CareTrust should benefit from the growing adult senior population over the next decade. I see value in the current share price.

In the healthcare REIT space, the larger players such as Ventas (VTR) and Welltower (WELL) often get most of the attention. In this article, I’m focused on the smaller CareTrust REIT (CTRE), whose equity market cap is currently just under $2 billion. While the aforementioned bigger players were forced to cut their dividends this year, CareTrust actually grew its dividend, given the essential nature of its assets. I evaluate what makes CareTrust a buy at the current valuation. So, let’s get started.

(Source: Company website)

A Look Into CareTrust

CareTrust REIT is a healthcare REIT with a geographically diversified portfolio of 214 properties (as of September 30, 2020) spread across 28 states and 23 operators, with triple-net leases in place. The company has over $1.7 billion in property investments in SNF (skilled nursing facilities), ALF (assisted living facilities), and independent living facilities.

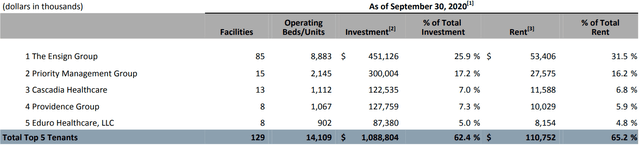

Currently, skilled nursing facilities make up 72% of the overall portfolio, while Assisted/Independent Living and Campuses (SNF+ALF) make up the rest. Texas and California have the most properties with 38 and 34, respectively. As seen below, the Ensign Group (ENSG) is CareTrust’s top tenant, comprising 31.5% of total rent, and the top 5 operators combined comprise 65% of total rent.

(Source: Q3’20 Investor Presentation)

CareTrust continues to weather the current environment rather well. In the latest quarter, Q3’20, normalized FFO/share was flat on a QoQ basis, at $0.34, and down by just a penny on a YoY basis. As noted by management, the tenants are managing through the challenges of COVID-19, after some initial stress early in the pandemic. Plus, CareTrust continues to collect virtually all of its rent, with a 99% rent collection rate. I’m also encouraged to see that management boosted 2020 guidance, from $1.32 to $1.34 previously, during Q2’20, to $1.36 to $1.37. This represents a 2.6% boost to guidance at the midpoints.

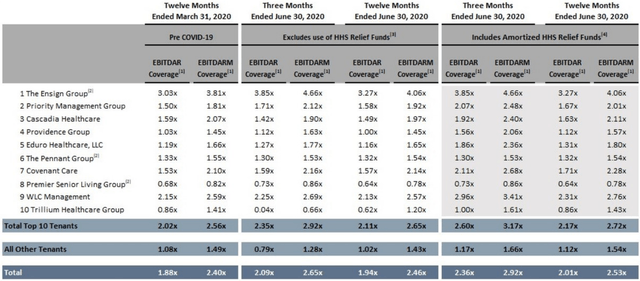

The overall tenant portfolio remains in good shape. As seen below, tenant EBITDAR coverage on a total basis, without HHS relief funds, was 2.09x for the three months ended June 30th. This compares favorably to 1.88x for the three months ended March 31st, which was largely before the effects of COVID-19.

(Note: Tenant rent coverage reporting is always one quarter in arrears, hence figures for the 3 months ended June 30th are the latest available.)

(Source: Q3’20 Investor Presentation)

One risk worth noting is the rather low EBITDAR coverage (without HHS relief funds) of Trillium Healthcare Group as well as that of the non-top 10 as a group, which represents 16.8% of CareTrust’s total rent. As such, I see continued relief as being necessary for some of the tenant base. I see this risk as being mitigated by the $30 billion in unallocated CARES Act funding, which management noted during the November earnings call. Plus, management noted that Trillium’s Q3 coverage is looking better than that in Q2.

While 2020 has certainly been a disruptive year, I see CareTrust getting back on its footing in its return to growth, as management noted that the deal pipeline is back to the $125-150 million level. This is further supported by the recent acquisition of four post-acute facilities in November, in the Dallas-Fort Worth area, for $47.6 million. These properties have strong EBITDAR rent coverage over 2.0x, and are under a master lease with Ensign - which, as shown earlier, has the best EBITDAR coverage among CareTrust’s top 10 tenants.

The master lease structure is beneficial to CareTrust, as it provides an added layer of protection. This means that a tenant with multiple properties under a master lease is obligated to pay rent on all the properties, lest the entire lease goes into default.

In the long term, I see CareTrust benefiting from the fast-growing senior population. According to the U.S. Census Bureau, the 65+ age group is growing at a faster rate than the general population, with about 10,000 baby boomers reaching this age group every day, and by 2030, over 1 in 5 U.S. residents will be of retirement age. Plus, 35 states currently have CON (certificate of need) laws, which limits the supply of skilled nursing facilities. As such, I see CareTrust benefiting from the secular growth of the senior population over the next decade.

Meanwhile, CareTrust maintains a solid balance sheet, with net debt-to-normalized EBITDA of 3.1x, which sits well below the company’s target leverage range of 4.0x-5.0x. It has no borrowings under its $600 million revolving line of credit, and has $24 million worth of cash on hand as of November. Plus, the dividend was raised earlier this year, and I find the forward dividend yield of 4.8% to be attractive and safe, at a payout ratio of 73%.

Investor Takeaway

CareTrust has weathered the current environment rather well, with steady FFO/share performance and strong rent collection. While some of its tenant base needs ongoing HHS relief funds, the overall portfolio remains healthy. Looking forward, I see CareTrust returning to growth, as its deal pipeline has recovered to the $100 million+ level. In the long term, I expect CareTrust to benefit from the fast-growing adult senior population over the next decade.

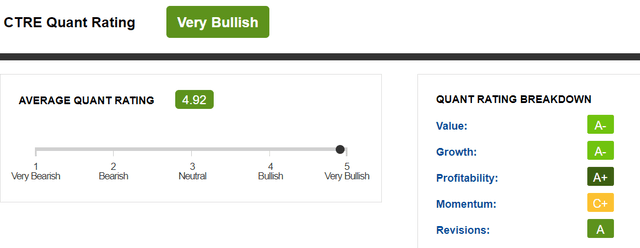

Given the aforementioned, I see value in the shares, at the current price of $20.81 and forward P/FFO of 15.2 (based on the midpoint of 2020 guidance). Analysts have a consensus Buy rating (score of 4.2 out of 5) and an average price target of $21.67. Plus, Seeking Alpha has a Very Bullish Quant rating, with a score of 4.9 out of 5, and high marks on Value, Growth, and Profitability metrics. Buy for income and growth.

(Source: Seeking Alpha)

Thanks for reading! If you enjoyed this piece, then please click "Follow" next to my name at the top to receive my future articles. All the best.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This article is for informational purposes and does not constitute as financial advice. Readers are encouraged and expected to perform due diligence and draw their own conclusions prior to making any investment decisions.