Chemours: Confluence Of Near-Term Headwinds Keep Me On Hold

Chemours has shown positive signs of a TiO2 volume recovery in its most recent quarter, but the extent to which price declines contributed remains unclear.

End-market uncertainties also weigh on the near-term fluoroproduct outlook.

The overhang from environmental liabilities and the potential negative implications for the resumption of share repurchases is an additional factor to keep an eye on.

Considering the risks, I think there are better ways to play the TiO2 cycle.

Chemours (CC), spun out of DuPont in 2015, is a leading producer of titanium dioxide (TiO2), fluoroproducts, and chemical solutions. As its recent results showed, TiO2 volumes seem to be trending in the right direction, but it remains unclear the extent to which lower pricing contributed. Furthermore, weakness in key fluoroproducts end-markets also weighs on the near-term outlook. Finally, CC does face an environmental liability overhang, which, in addition to the risk of a slow fundamental recovery, keeps me neutral on the shares.

An Improving TiO2 Picture at Chemours?

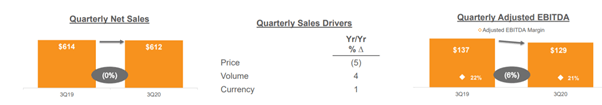

The fact that CC posted the strongest TiO2 volume performance within its peer group was a positive surprise and likely implied the company clawed back lost share in FQ3. The extent of the Y/Y volume outperformance was especially notable - the +4% Y/Y volume growth represented a c. 13 percentage pts swing relative to Tronox (TROX) at -9% Y/Y. The caveat, however, is that CC also posted deeper price declines relative to peers at -5% Y/Y (TROX pricing was at -1% Y/Y). Therefore, it remains unclear the extent to which pricing contributed to the favorable volume improvement.

Source: Chemours FQ3 '20 Presentation Slides

Nonetheless, management did point to FQ4 TiO2 volumes posting at least flat Q/Q growth in FQ4 - a significant improvement relative to typical seasonality patterns. Considering this comes off strong FQ3 volumes as well, the FQ4 guidance is positive. Additionally, management also sees improvements in most TiO2 end-markets, with the most notable improvement in laminates (in-line with TROX commentary). This suggests a supportive backdrop into fiscal 2021, although I would note the risk of incremental pricing pressure in future quarters (following the price cuts in FQ3).

Fluoroproducts Headwinds Weigh on the Fundamental Outlook

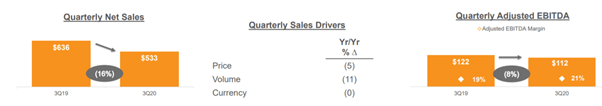

In contrast, fluoroproducts segment EBITDA of $112 million (-8% Y/Y) reflected the ongoing challenges within the segment. Key drivers of the EBITDA decline include lower net sales (volumes at -11% Y/Y; pricing at -5% Y/Y), partially offset by cost-cutting initiatives. The result came despite Opteon volumes doubling Q/Q on the back of a rebound in auto production, as fluoropolymers lagged due to its positioning "further back in the supply chain" as a Tier 2/3 supplier.

Source: Chemours FQ3 '20 Presentation Slides

Looking ahead, the segment outlook is clouded by several earnings headwinds, from TiO2 volume headwinds to lower HFO (hydrofluoroolefin) conversion in automobiles - both of which will weigh on fluoroproducts earnings. The weaker near-term outlook seems consistent with CC's guidance for continued weakness in fluoropolymer demand in its FQ2 commentary, as the business typically faces a lag relative to end-market demand fluctuations. Additionally, refrigerant seasonality and any sluggishness in the pace of an auto production recovery are risks.

Cost and Capex Cuts in FQ4 to Sustain EBITDA Resilience

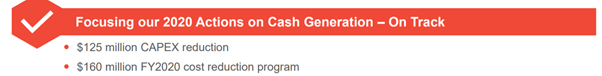

Amid the headwinds, CC will focus on what it can control, which means more cost reductions - management has targeted $160 million of cost cuts in fiscal 2020, with a further 20% to be retained in fiscal 2021. In addition, CC will also be targeting capex reductions, with its fiscal 2020 capex lowered by $125 million to $275 million.

Source: Chemours FQ3 '20 Presentation Slides

This means that even in fiscal 2021, the cost environment should remain broadly similar to fiscal 2020, with most of the earnings improvements likely to come from volume growth. As such, I see CC sustaining a resilient high-teens EBITDA margin for fiscal 2021, although the medium-term outlook remains unclear as the cost cut benefits eventually fade.

Potential Environmental Liabilities Weigh on the Balance Sheet Position

In the meantime, CC remains in negotiation with DuPont (DD) with regard to potential environmental liabilities. The interests of both parties are clear - while CC is pushing to cap its liabilities, DuPont is aiming to set the sharing threshold as high as possible. The outcome and the timeline, however, remain far from clear at this juncture. Encouragingly, however, the DuPont CEO has been on the record outlining his belief that both companies should come to a resolution of their dispute. Nonetheless, there have been no concrete developments thus far. From the Dupont FQ3 transcript:

"Yeah. Well, first of all, the arbitration has started up with Chemours on that. And there probably won't be any decision on that until kind of mid-next year if you look at the timeline on it. But we continue to talk to each other about the settlement.

In fact, Mark Vergnano, the CEO of Chemours, and I actually just talked this Monday. A couple of open points. We continue to get closer, and then we'll see if we can get it to the finish line. So that's paralleling along while the arbitration starts."

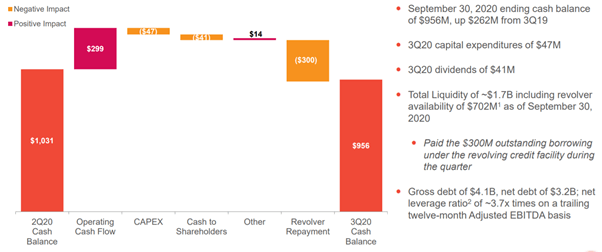

On a positive note, CC's liquidity position should tide it through any near-term headwinds - the company currently has access to c. $1.7 billion in liquidity ($956 million cash on hand and a $702 million revolver). However, on-balance-sheet leverage remains elevated at c. 4x LTM Net Debt/EBITDA, with off-balance-sheet legal liabilities an unknown. As things stand, the cash generation alone should be sufficient to service the debt load, with cost and capex cuts driving FCF higher Y/Y to $252 million in FQ3. Beyond that, however, balance sheet constraints could limit CC's ability to resume share repurchases this year. Assuming underlying end-market conditions are favorable, my base case is for repurchases to be resumed next year.

Source: Chemours FQ3 '20 Presentation Slides

Final Take

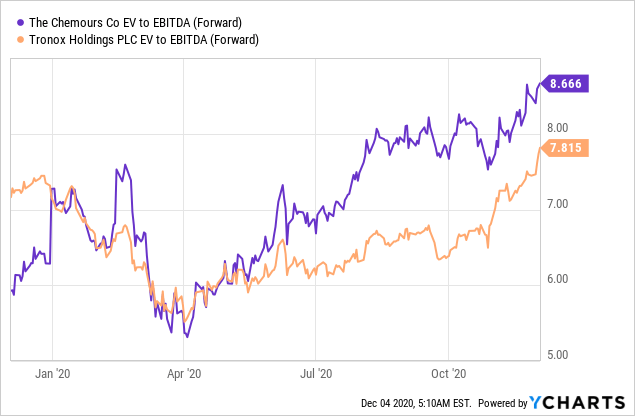

While there were some positive signs in FQ3, especially with regard to the improving TiO2 volumes, it remains unclear the extent to which pricing declines contributed to the volume uplift. Furthermore, with plenty of uncertainties ahead, fluoroproducts EBITDA faces headwinds and may not recover to pre-COVID-19 levels for a while, pending a full recovery in industrial and automotive demand. I would also highlight the risk of a negative outcome with regard to CC's environmental liabilities, and therefore, I am neutral on the shares pending visibility into the status of the company's liability exposure. Investors looking for a TiO2 play may find better value in closest peer Tronox, considering it trades c. 1 turn lower and does not have a material litigation overhang.

Data by YCharts

Data by YCharts

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.