Ford: A Bullish Breakout Approaches

Since September, Ford has rallied by more than 43% as positive earnings results have been fueled by relatively stable consumer buying activity in the automotive sector.

But in spite of the stock’s prospects for a sustained breakout rally, Ford still looks relatively cheap when it’s compared to the rest of the market.

In our view, this looks like a classic short-squeeze setup and this is the type of event that could send share prices much higher, very quickly.

Since September 24th, shares of Ford Motor Company (NYSE: F) have rallied by more than 43%. For the company, positive earnings results have been fueled by relatively stable consumer buying activity in the automobile sector (even during the height of the coronavirus pandemic period) and credit metrics within the industry have also seen clear improvements.

As a result, we believe that the automobile sector has been one of the few areas of the market that managed to avoid significant coronavirus-related disruptions over the last few quarters. For these reasons, we expect to see Ford stock successfully break-out above important psychological resistance levels at $10 per share and this is the type of event that could put investors on a solid path toward extended gains in 2021.

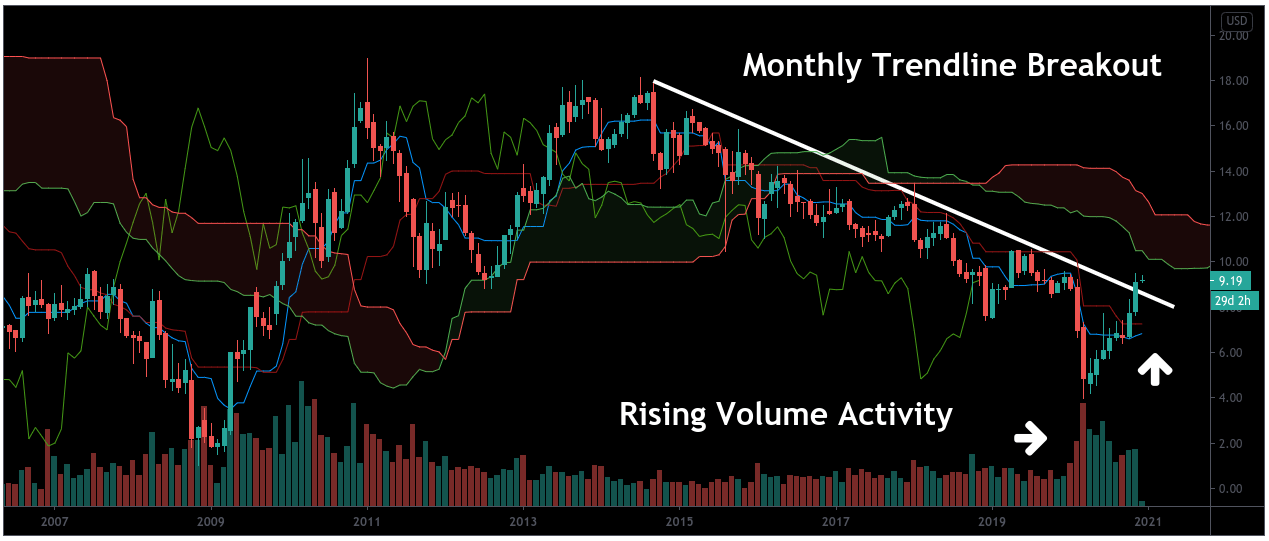

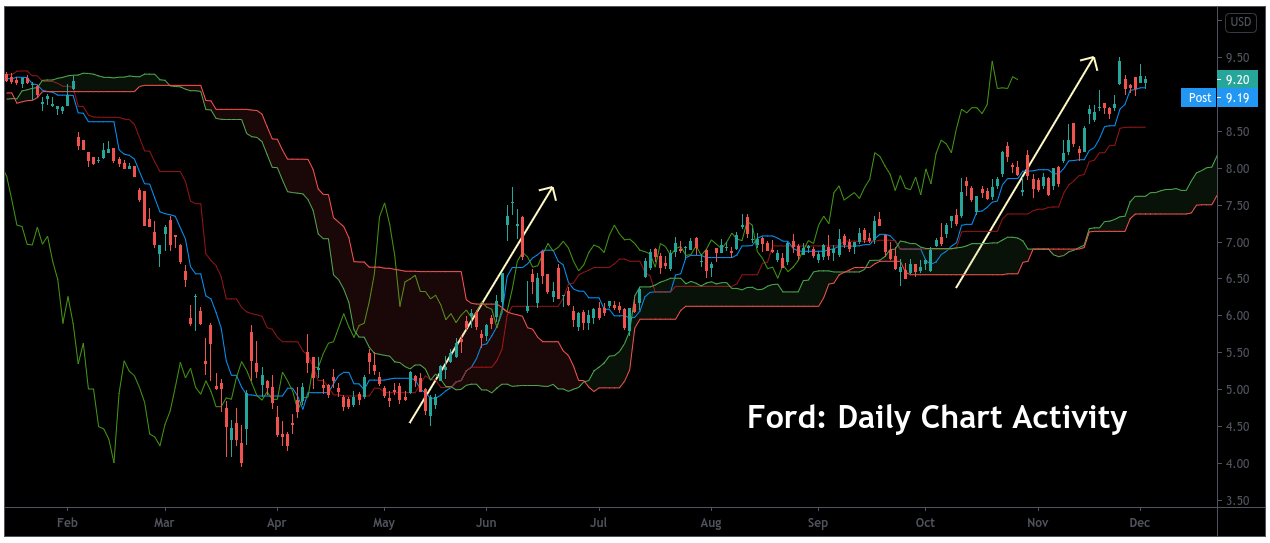

Source: Author via Tradingview

In the above chart, we can see that shares of Ford stock are breaking above trendline resistance near $8.90. Interestingly, these structures coincide quite nicely with the stock’s pre-coronavirus highs and we think this makes it much more likely that bearish traders might start to see stop losses tripped if the rally extends much further. In our view, this looks like a classic short-squeeze setup, which means that this is the type of event that could send share prices much higher.

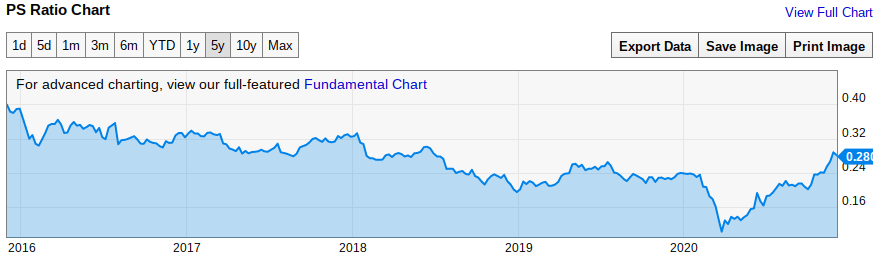

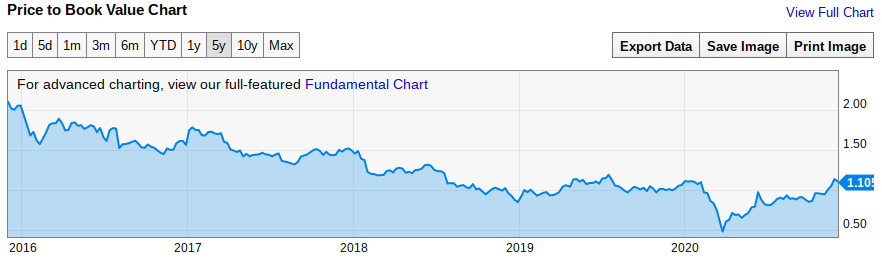

Source: YCharts

In spite of the stock’s prospects for a sustained breakout rally, Ford still looks relatively cheap when it’s compared to the rest of the market. Ford is currently trading with a price/sales ratio of 0.28x and a forward price/earnings ratio of 8.49x, so we think that there is clear potential for continued upside before bearish analysts would be able to make a credible argument that F is becoming an expensive stock to own.

Source: CNBC, Youtube

However, this bullish scenario would probably not be readily apparent if we were to focus only on the automotive industry analyst reports that have been issued over the last several quarters. As a recent example, we can consider the November stock downgrade from Morgan Stanley, which rested on the argument that Ford’s strategy for entering the electric car market is “not fully clear.”

But these criticisms appear to be somewhat double-sided because Morgan Stanley also noted that Ford has shown a "sense of urgency" in these emerging parts of the global automotive market. Moreover, Morgan Stanley’s downgrade was not reflexive of the industry as a whole and this suggests that the bank still believes the automotive market remains favorable.

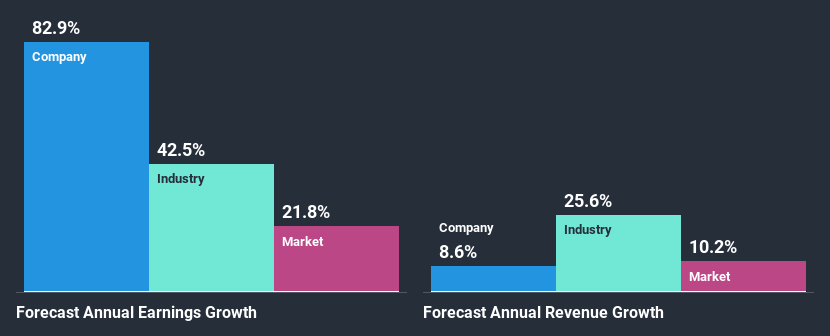

Source: Simply Wall Street

Fortunately, we can say that this optimism for the industry as a whole appears to be supported by the underlying numbers. Going forward, Wall Street currently expects to see excellent annual revenue growth of 25.6% and this is more than double what is expected for the rest of the market.

But what is even more encouraging here is the fact that Ford is actually expected to almost double the annual growth in earnings that is expected or the automotive industry. Of course, this gives us an excellent backdrop for the establishment of new long positions (even with the continued arguments that the stock itself is heading into important psychological resistance levels).

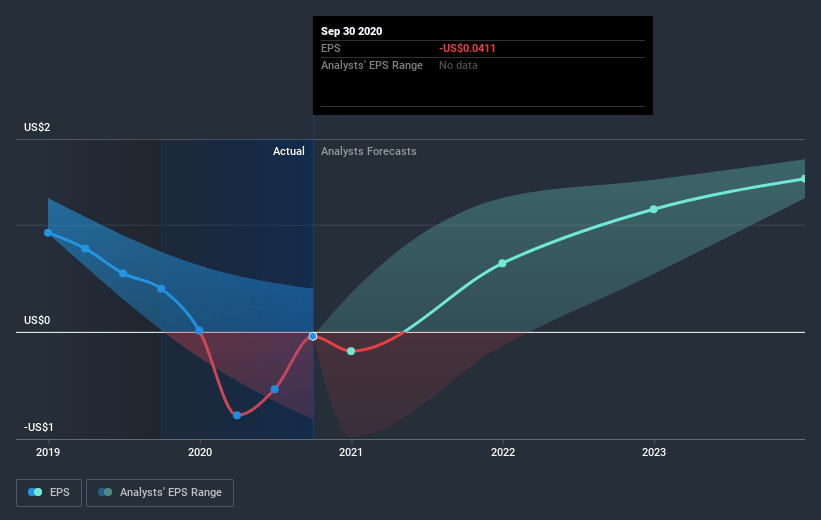

Source: Simply Wall Street

As we can see, the market’s long-term earnings expectations remain quite healthy —in spite of Wall Street’s apparent disinterest in the stock. Next year, growth in Ford’s earnings results is expected to surge and this looks likely to continue well into (at least) 2023.

Source: YCharts

Further evidence that Ford shares might have the potential to outperform its competitors in the industry can be found in the stock’s price/book value, which currently stands at 1.1x. When compared to the rest of the U.S. automotive industry, this figure is actually quite striking.

In reality, this is because the U.S. automotive industry currently trades with an average price/book value of 6.5x and this tells us that there are significant divergences when we analyze the various ways Ford is being valued amongst its competitors.

Source: CNBC, Youtube

As one of the market’s best value plays, market guru Jim Cramer seems to agree that Ford is setting up to vault the $10 level because the company’s core auto market is ready to surge. Of course, this means that investors would see an added benefit if the company is able to reinstate its excellent dividend and all of this suggests strong potential returns for the stock as we head into 2021.

Source: Author via Tradingview

In our final chart, we can see that the post-coronavirus rally in Ford stock has unfolded in a series of clear bullish waves that began near the middle of May 2020. We did see a bit of a corrective period that stretched from the middle of June to the beginning of October but this is when the company’s earnings event risk helped favor the bullish outlook by a wide margin.

In late October 2020, Ford’s third-quarter earnings results crushed analyst expectations with an EPS figure of $0.65 (against the market’s pessimistic estimates of just $0.19). Ford’s revenue figure also beat analyst expectations (at $34.7 billion against estimates calling for revenues of $33.5 billion).

In large part, these positive results were based on unexpected strength in consumer demand during the COVID-19 trading period but we expect these bullish trends to continue with an even greater force once the macroeconomic framework returns to “normal” in 2021.

For all of these reasons, we believe that Ford shares remain a strong buy - even after the post-coronavirus rallies that have been benefiting shareholders for the last several weeks. Of course, traders encounter some selling pressure as we approach the upcoming psychological resistance level at $10 per share but we think any sideways trading activity could be relatively brief and downside moves should be viewed as a new opportunity to buy the stock.

Thank you for reading. Now, it's time to make your voice heard.

Reader interaction is the most important part of the investment learning process. Comments are highly encouraged! We look forward to reading your viewpoints.

Disclosure: I am/we are long F. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.