DCF: An Attractively Valued High-Yield Target Term Fund With 7.1% Yield And -6.7% Discount

DCF is a bond/loan/CLO target term fund with a 7.1% yield and -6.7% discount.

DCF offers +1.5% annual alpha until liquidation in 2024.

Risks are the high concentration of non-investment grade credits.

Author's note: This article was released to CEF/ETF Income Laboratory members on November 27, 2020, with discount and yield numbers updated.

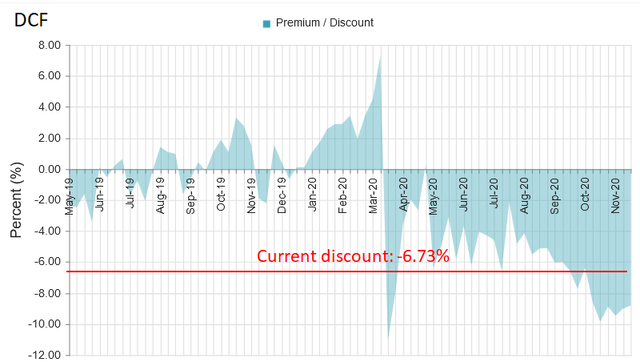

In our latest Closed-End Fund "Quality" Report, BNY Mellon Alcentra Global Credit Income 2024 Target Term Fund (DCF) was the 3rd-ranked DxYxZ fund. DCF, which is a high-yield bond/loan target term CEF, last closed with a discount of -6.73%, a 1-year z-score of -0.7, and a yield of 7.10% that was 111% covered per their last earnings report. The fund uses 27% leverage and charges a baseline expense ratio of 1.27%.

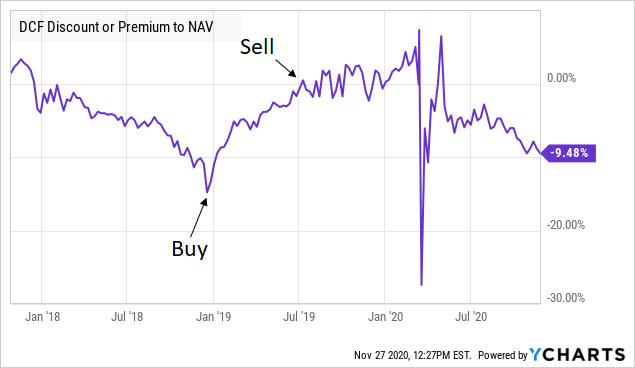

When to buy and sell target term CEFs

DCF, formerly known as the Dreyfus Alcentra Global Credit Income 2024 Target Term Fund, was previously a holding of our Tactical Income-100 portfolio, however, we sold it in July 2019 when its discount narrowed to near par. Why did we sell? Because DCF is a "Target Term" fund due to liquidate in 2024, hence, any alpha that we would gain from discount contraction had been fully harvested at that point. Remember, when a term fund liquidates, the investors get back their proceeds at par (more information on CEF term structures, see this link).

Therefore, it's a smart move to buy term funds when they are a significant discount, but when they are at par, the benefit of the term structure is lost. In the case of DCF, we initially purchased the fund in December 2018 during the market meltdown at a -13% discount, hence generating significant alpha (and a total return of +24%) six months later when we sold it near par.

The flip side of this is that one should generally not buy a term fund at a significant premium unless there is a good reason to. An exception to this would be something like our XAI Octagon Floating Rate & Alternative Income Term Trust Fund (XFLT) position in our Income Generator portfolio, which we're holding on to despite its slight premium. This is because (1) the premium is only slight, (2) the liquidation date is still far away in 2029, and (3) we believe that the underlying CLO assets are still undervalued. Our "Sell Above" target for XFLT is a +15% premium, but that is just a guide and we will reassess the situation if/when it gets there.

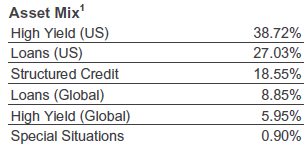

Portfolio

As of September 30, DCF's portfolio is 38.72% in US high-yield bonds, 27.03% in US loans, and 18.55% in "structured credit" which is mainly CLO debt with a smattering of CLO equity. There are also minor allocations to global loans and global bonds as well.

(Source: DCF Factsheet)

DCF runs a fairly "junky" portfolio, with only 1.27% of its portfolio investment-grade rated. The percentage of BB-rated credits, the highest rung of the non-investment grade ladder, is only 18.19%.

(Source: DCF Factsheet)

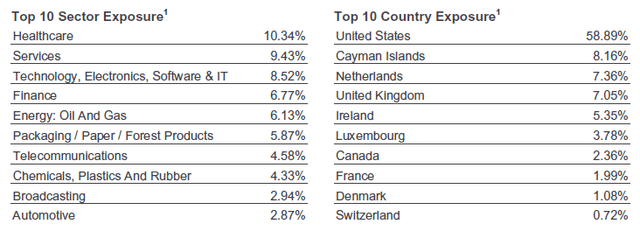

The tables below show the sector and country exposures of the fund. The most salient exposure for me is the "Energy: Oil and Gas" sector which accounts for 6.13% weight. This isn't a small exposure, but it's not huge either.

(Source: DCF Factsheet)

Distribution

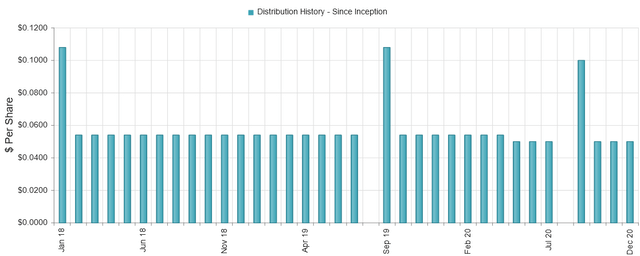

Like most non-investment grade CEFs, the fund was forced to reduce its distribution due to COVID impacting the whole spectrum of the economy. After maintaining a $0.054 monthly distribution for the 2.5 years or so since launch (October 2017), the fund cut the distribution to $0.050 in May of this year, a -7.4% decrease. (Note that the apparently large distributions in the chart below are just an artifact; this is due to the pay date for both August and September distributions falling in the same month of September).

(Source: CEFConnect)

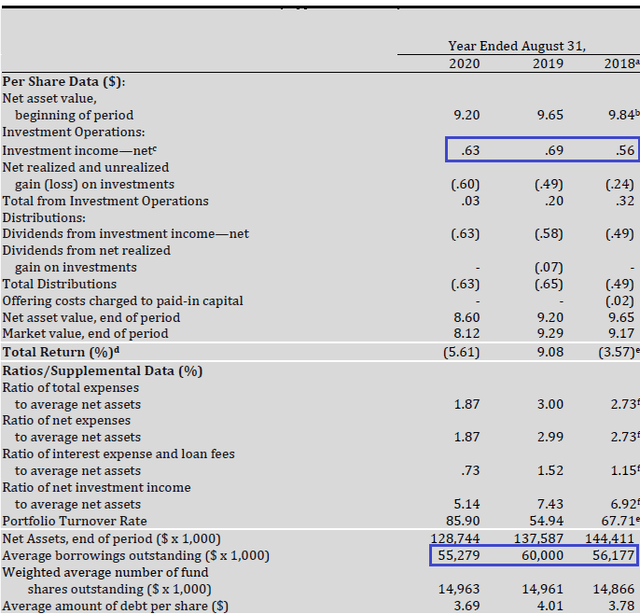

The fund's most recent annual report, covering the year ended August 31, 2020, was released last month. We can pick out a few key trends from the Financial Highlights below. The first is that there has been a mild decrease in the net investment income ("NII") of the fund this year, from $0.69 to $0.63/share (-8.7%). Part of this could be due to lower interest rates decreasing the coupon payments from the fund's loan portfolio, while another part could be due to the minor deleveraging that the fund has undergone this year. Compared to the same time last year, the fund shed about -8% of borrowings (from $60 million to $55.3 million), although it should be noted that this only brings the fund back to the level of borrowings that it had in 2018.

(Source: DCF Annual Report)

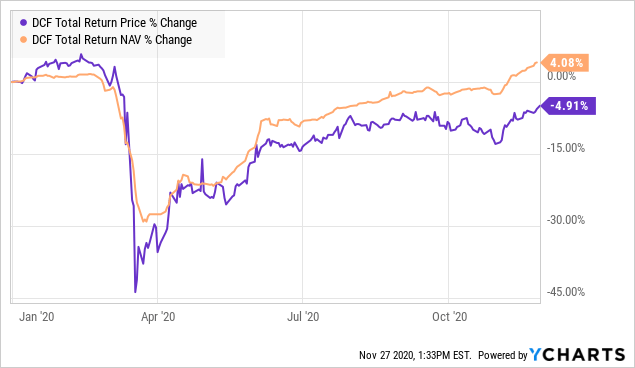

Performance

One evidence that the deleveraging has not had a huge impact on DCF is the observation that the fund's total return by NAV is now positive for the year. If the fund was forced to unload assets at firesale prices at the bottom of the crisis, it would have had a much harder time regaining lost ground in the swift rebound that occurred afterward. Notice the price return lagging, which is due to the fund's widening discount.

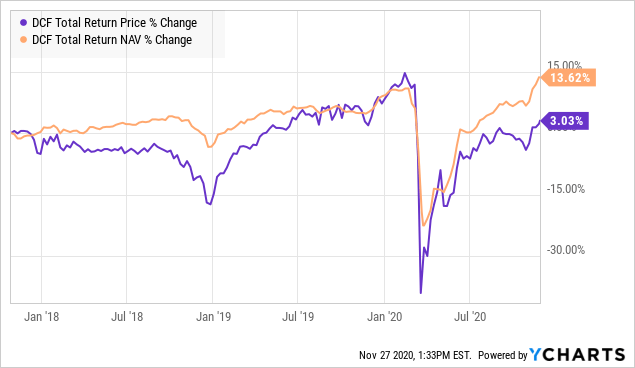

Since its inception three years ago, DCF has recorded a +13.62% total return by NAV. Not too shabby considering the COVID crisis in between.

Other notes

Just two weeks ago, there was a recent announcement from DCF stating that they changed leverage providers to Société Générale. The credit facility is charged at a rate of LIBOR + 160 bps, a very competitive rate. This replaces a previous private facility that I could not find much information on, other than the average rate for the year ended August 31, 2020, was 2.33%. Given the current low LIBOR rate, this means that interest expenses should be even lower next year.

BNY Mellon Alcentra Global Credit Income 2024 Target Term Fund, Inc. (DCF) (the "Fund") today announced entry into a new $68 million credit facility with Société Générale. The new credit facility agreement replaces the credit facility agreement with the Fund's previous credit facility provider. The initial term of the new credit facility agreement is through November 18, 2022. The credit facility is secured by the Fund's investments. Borrowings under the new credit facility are at an interest rate of L+ 160 basis points (with a zero basis point floor). Additional information about the Fund and its use of leverage can be found in the Fund's annual and semi-annual shareholder reports, which are available on the Fund's website. Information about the new credit facility agreement will be available in the Fund's next semi-annual shareholder report.

Another positive is that the baseline expense ratio was only 1.14% for the last year (although it averaged ~1.5% for the two years prior). This is very low relative to other dynamic bond/loan funds and CLO funds.

Summary

The main attraction for DCF is its -6.7% discount coupled with its target term mandate to liquidate on December 1, 2024. This gives over +1.5% of alpha per year from discount contraction alone, and another +2% return per year should the fund meet its target NAV return of $9.85 (the current NAV is $9.06). However, the target NAV return is explicitly not a guarantee and may be dependent on many factors such as the economic performance of the portfolio. Hence, I would not bank on the NAV return, however, the alpha from discount contraction alone is valuable in its own right and is still large at these levels.

(Source: CEFConnect)

The main risks of the funds are economic in nature, due to the high preponderance of low-rated credits in the portfolio. A second shutdown and its consequences could send the portfolio value down in a hurry, though, of course, that is not a problem unique to DCF. One final reminder is that for target term funds, they tend to unwind their portfolios, reduce leverage, and move to cash in their final year, so distributions are likely to decrease significantly during the windup period.

Profitable CEF and ETF income and arbitrage ideas

At the CEF/ETF Income Laboratory, we manage ~8%-yielding closed-end fund (CEF) and exchange-traded fund (ETF) portfolios to make income investing easy for you. Check out what our members have to say about our service.

To see all that our exclusive membership has to offer, sign up for a free trial by clicking on the button below!

Disclosure: I am/we are long XFLT. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.