DocuSign: Pull Forward Headwinds

DocuSign beat analyst estimates in FQ3, but the stock remains priced for perfection.

The company has already added more new customers YTD than the last two years combined.

The stock trades at 28x FY22 sales targets while the business faces headwinds from pulled forward business.

As with other tech stocks, DocuSign (DOCU) has had a phenomenal year. The question investors have to ask is whether COVID-19 vaccines will cool off demand for digital transformation tools. My investment thesis remains negative on the stock up near $240 in after-hours trading and a $50 billion market cap as the market is not accurately pricing in a likely slowdown in 2021.

Image Source: DocuSign website

Pull Forward

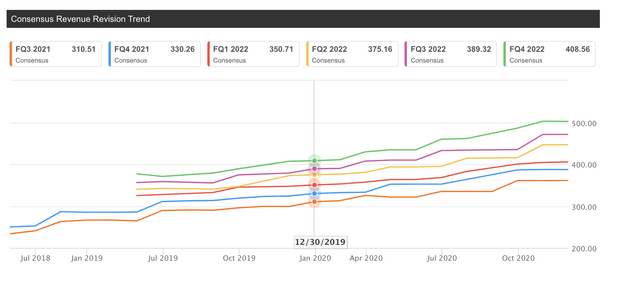

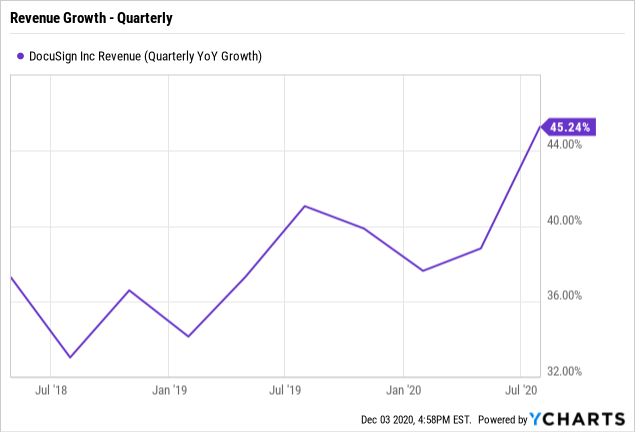

As with most digital transformation based software tech companies, DocuSign faces the biggest risk that revenues are pulled forward into 2020 making the growth path in 2021 very difficult. As the below chart highlights, the company was regularly growing in the 30% to 40% range heading into the year.

Data by YCharts

Data by YCharts

DocuSign was clearly a strong growth story heading into the COVID-19 induced work-from-home situation. Business and consumers alike were already preferring solutions allowing them to sign documents online versus prior methods of either visiting an office or having to scan signed documents and email.

The new Agreement Cloud allows businesses to track, act and prepare the whole contract process. DocuSign continues to innovate in the document and eSignature space so investors should have confidence the company will constantly expand the now estimated $50 billion TAM.

For FQ3, DocuSign generated revenue of $382.9 million for growth of 53% to push beyond the upside band of previous growth limits. Bookings even grew 63% over last year to $440.4 million. The company should see some strong growth in FY22 due to the bookings growth to end FY21.

The fundamental problem here is that these big numbers in FY21 turn into tough comps in FY22. At the same time, vaccines will alleviate some of the pressures for digital transformation next year. IT departments pulling forward new digital processes in 2020 will take much needed breaks in 2021 while spending more time focusing on the next steps in transformation after being rushed to implement services this year just to keep business going.

CEO Dan Springer even acknowledged this pull forward issue during the FQ3 earnings call. The company expects numbers to pull back from the accelerated growth rate here in FQ3:

I don't think we would say we expect that to happen again by any means next quarter. But the growth has been very strong and has been consistent. So the tricky part to your question is in the post-pandemic, I have no idea when that's coming and anymore than anything other people on this call, my sense is that, it has been accelerant to our business. So there would be some lack of that accelerant in the - occurring in a post-pandemic world.

Another way to view this pull forward story is that FQ4 revenues were originally targeted at $330 million when the fiscal year started. The company is now guiding to revenues topping $400 million with a mid-point goal of $406 million.

Source: Seeking Alpha earnings revisions

In a normal 30% growth environment, DocuSign would've only reached a $430 million revenue target next FQ4. Now just 30% growth next year will push FQ4'22 revenues to reach $528 million. Remember, this number is just 30% growth next year, a major deceleration from the 50% growth forecast for the current quarter, but the revenue total is nearly $100 million higher.

Maybe the best view of customer pull forward is the huge growth in the customer base this fiscal year. The company ended FQ3 with 822K customers, up 233K customers this year so far. In the last two fiscal years, DocuSign only added ~100K customers for each year.

Source: DocuSign presentation

As the company enters FY22 in February, the sales department is going to have a much smaller list of potential new customers. In fact, one has to wonder how many customers needing to complete contracts didn't sign up for an online eSignature or contract tool already this year.

Stretched Value

My previous work discussed the stretched value when the stock was trading at just $216 and the after-hours price of $240 just exacerbates this issue. In addition, DocuSign lists a higher diluted share count with an upper limit of 210 million shares now leading to a fully diluted market cap of an incredible $50 billion here.

Remember, DocuSign only forecasts FY21 (Jan.) revenues of $1.43 billion. Since the company even agrees that revenue pull forwards are an issue for a vaccine dominated FY22, the stock shouldn't trade at 28x FY22 revenues of $1.82 billion.

One only needs to go back and look at some of the hot WFH and virus plays back when the year started. DocuSign, Twilio (TWLO) and Teladoc Health (TDOC) were all stocks trading much closer to 10x forward sales in a more normal economy.

Data by YCharts

Data by YCharts

So in a more normal environment these stocks trading at 30x forward sales would lose 2/3s of the multiple via multiple contraction. Considering the natural headwinds in 2021, one has to assume the risk is for weak growth to cause even lower multiples. The market always tends to overreact with the current 30x multiples being exhibit number 1.

Takeaway

The key investor takeaway is that DocuSign is priced for perfection while the business faces headwinds next year from pulled forward contracts. Customers aren't likely to return to paper contracts, but the company is likely to see limited growth next year leading to multiple contraction. As the stock heads back to normal levels from prior to COVID-19 shutdowns, investors need to avoid DocuSign.

If you'd like to learn more about how to best position yourself in under valued stocks mispriced by the market, consider joining Out Fox The Street.

The service offers a model portfolio, daily updates, trade alerts and real-time chat. Sign up now for a risk-free, 2-week trial to start finding the next stock with the potential to double and triple in the next few years.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.