Jones Lang LaSalle: Valuation Discount Justified By Relatively Lower Profitability

Jones Lang LaSalle's revenue mix is in the spotlight, as its Property & Facility Management service line has proven to be more defensive than its Leasing and Capital Markets businesses.

The company's adjusted EBITDA margin expanded by +0.9 percentage points in 3Q 2020 due to cost optimization efforts, but it is still relatively less profitable than its larger peer, CBRE.

Market share gains and acquisitions have been key growth drivers for Jones Lang LaSalle, and COVID-19 could provide opportunities for the company to accelerate its growth.

Jones Lang LaSalle trades at consensus forward FY 2020 and FY 2021 P/E multiples of 17.1 times and 13.8 times, respectively.

Elevator Pitch

I have a Neutral rating on commercial real estate services firm Jones Lang LaSalle Incorporated (JLL).

Jones Lang LaSalle's revenue mix is in the spotlight, as the company's Property & Facility Management service line has proven to be more defensive than its Leasing and Capital Markets businesses. However, it is encouraging that the pipelines Jones Lang LaSalle's Leasing and Capital Markets service lines are improving, implying that service fee revenue for these two service lines could potentially recover in subsequent quarters. The company's adjusted EBITDA margin expanded by +0.9 percentage points in 3Q 2020 due to cost optimization efforts, but it is still relatively less profitable than its larger peer CBRE Group, Inc. (CBRE). Counterintuitively, COVID-19 could provide opportunities for the company to accelerate its growth with regard to market share gains and acquisitions.

Jones Lang LaSalle trades at consensus forward FY 2020 and FY 2021 P/E multiples (normalized earnings as estimated by sell-side analysts) of 17.1 times and 13.8 times, respectively. The company's valuation discount relative to CBRE Group based on forward P/E multiples is justified by its relatively lower profitability in terms of EBITDA margins.

A Bullish rating for Jones Lang LaSalle can only be justified if the fee revenue for company's Leasing and Capital Markets service lines recover and the gap in profitability between the company and CBRE is narrowed. As such, I see a Neutral rating for the stock as justified for now.

Company Description

Jones Lang LaSalle is the second-largest company in the global commercial real estate services market, trailing market leader CBRE Group. As of September 30, 2020, the company has more than 92,000 employees working at in excess of 80 countries around the world.

The company's four segments are its Americas, EMEA (Europe, Middle East and Africa), Asia-Pacific markets and its global investment management business LaSalle Investment Management, which accounted for 61%, 18%, 18% and 3% of its revenue, respectively, in the first nine months of FY 2019.

Jones Lang LaSalle's three core service lines, Leasing, Capital Markets, and Property & Facility Management, contributed 32%, 21%, 22% of the company's 9M 2020 service fee revenue, respectively. Its two other service lines, Project & Development Services and Advisory, Consulting & Other, represented 14% and 11% of the company's year-to-date service fee revenue, respectively.

Revenue Mix In The Spotlight

Jones Lang LaSalle's business operations has been negatively impacted by COVID-19, which is no different from what many other companies in the real estate industry experience. However, there is a divergence in the financial performance of the company's three core service lines, Leasing, Capital Markets, and Property & Facility Management, which puts its revenue mix in the spotlight.

Service fee revenue for Jones Lang LaSalle's Property & Facility Management service line increased by +3% YoY and +1% YoY to $320 million and $870 million in the 3Q 2020 and 9M 2020 financial periods, respectively. It is noteworthy that Property & Facility Management is the company's sole service line (among the five) that delivered positive growth this year. In contrast, the Leasing service line's revenue fell by -30% YoY and -26% YoY in 3Q 2020 and 9M 2020, respectively. Notably, Jones Lang LaSalle's Capital Markets service line reversed from a +24% YoY increase in service fee revenue in 1H 2020 to a -43% YoY drop in service fee revenue for 3Q 2020.

It is clear from Jones Lang LaSalle's financial results that the Property & Facility Management service line is relatively more defensive compared to the company's other service lines. In its March 2020 investor presentation, Jones Lang LaSalle noted that the Property & Facility Management service line's "agreements are typically 3-7 years in duration," which implies recurring revenue from multi-year contracts. The company also highlighted in its 3Q 2020 earnings call on November 2, 2020, that the Property & Facility Management service line is a beneficiary of structural tailwinds, as "corporate occupiers and investors seek our services due to increased building management standards."

In comparison, the company's Leasing and Capital Markets service lines are much more cyclical in nature, as they are dependent on transaction volumes, which vary from month to month. The lack of visibility due to the coronavirus pandemic has inevitably led to a lower number of transactions, which hurt Jones Lang LaSalle's Leasing and Capital Markets service lines.

On the positive side of things, there are signs of improvement in Jones Lang LaSalle's Leasing and Capital Markets pipeline, which point to revenue recovery in the quarters head. As of September 30, 2020, the company's pipeline for its Capital Markets service line grew in the high single digits as compared to the Capital Markets pipeline as of June 30, 2020. Jones Lang LaSalle also disclosed at the company's recent 3Q 2020 results briefing that its "fourth quarter U.S. gross leasing pipeline increased 16% from 3 months prior."

Cost Savings Boosted Profit Margins

Jones Lang LaSalle's adjusted EBITDA only decreased by -19% YoY to $244 million in the third quarter of FY 2020, as compared to a relatively larger -23% YoY decline in service fee revenue to $1.4 billion in 3Q 2020. The company's adjusted EBITDA excludes restructuring & acquisition charges, gains and losses on disposition, and net non-cash MSR (Mortgage Servicing Rights) and mortgage banking derivative activity, as per its recent 10-Q.

The adjusted EBITDA margin expanded by +0.9 percentage points to 17.4% in 3Q 2020, and this is largely attributable to the company's cost optimization efforts. Year-to-date, Jones Lang LaSalle's efforts to optimize the company's cost structure are expected to deliver $135 million of permanent cost savings on an annualized basis going forward.

Separately, the company also benefited from $240 million of non-permanent cost savings (of which $120 million was recognized in 3Q 2020) derived from government relief and lower variable costs resulting from reduced business activity; these costs are likely to be reinstated in future. Jones Lang LaSalle's 3Q 2020 adjusted EBITDA margin, if excluding $120 million of non-permanent cost savings, was slightly under 9%.

However, it is noteworthy that the company's adjusted EBITDA margin was 10.6% for the 9M 2020 financial period, as compared to CBRE Group's relatively higher 9M 2020 adjusted EBITDA margin of 15.2%. The difference in relative profitability between Jones Lang LaSalle and CBRE Group could potentially explain why Jones Lang LaSalle trades at a discount to its larger peer.

Please note that the EBITDA margin calculations are based on a percentage of service fee revenue.

Market Share Gains and Acquisitions

Market share gains and acquisitions have been key growth drivers for Jones Lang LaSalle, and COVID-19 could provide opportunities for the company to accelerate its growth.

The company noted at its 3Q 2020 earnings call on November 2, 2020, that it has gained "disproportionate market share in this current environment." This is largely because Jones Lang LaSalle has spent more money to build its technological capabilities as compared to its smaller peers, which allowed the company to serve its clients remotely, and its key customers include major companies in the technology sector that are still thriving despite the pandemic.

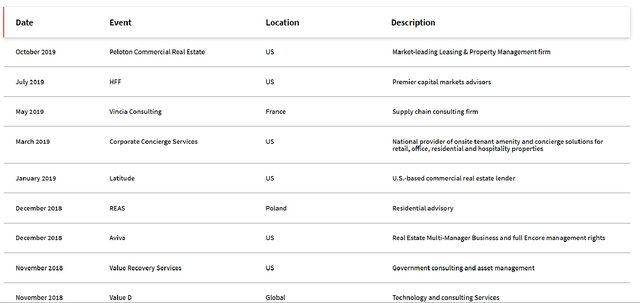

Acquisitions have also been a key component of Jones Lang LaSalle's growth strategy, as per the table below. It is natural that sub-scale players in the commercial real estate services market could find it challenging to remain afloat in the current environment, and some of them could be acquisition candidates for market leaders like Jones Lang LaSalle. At its recent 3Q 2020 results briefing, the company acknowledged that "the opportunities (for mergers & acquisitions) are increasing quite significantly at the moment," although it highlighted that "we haven't seen anything which we would think was worth spending our shareholders' money on."

Some Of Jones Lang LaSalle's Recent Acquisitions

(Source: Jones Lang LaSalle's Corporate Website)

Valuation and Risk Factors

Jones Lang LaSalle trades at consensus forward FY 2020 and FY 2021 P/E multiples (normalized earnings as estimated by sell-side analysts) of 17.1 times and 13.8 times, respectively, based on its share price of $138.94 as of December 3, 2020. In contrast, CBRE Group is valued by the market at 23.2 times consensus forward FY 2020 and 20.0 times consensus forward FY 2021 P/E. Jones Lang LaSalle's valuation discount relative to CBRE Group based on forward P/E multiples is justified by its relatively lower profitability.

Jones Lang LaSalle offers consensus forward FY 2020 and FY 2021 dividend yields of 0.1% and 0.5%, respectively.

The key risk factors for Jones Lang LaSalle include a longer-than-expected time taken for the fee revenue for the Leasing and Capital Markets service lines to recover to pre-COVID-19 levels, a failure to narrow the gap in profitability between the company and CBRE over time, and overpaying for future acquisitions.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.