Investors Should Consider Annaly Preferred Shares Over Common

Annaly Capital recently announced redemption of its Series D preferred shares, leaving three other preferred issues outstanding.

Annaly has endured two series of headwinds in 2019 and during the COVID-19 pandemic.

While Annaly appears to be stabilizing, I believe the preferred shares provide the best opportunity for income investors.

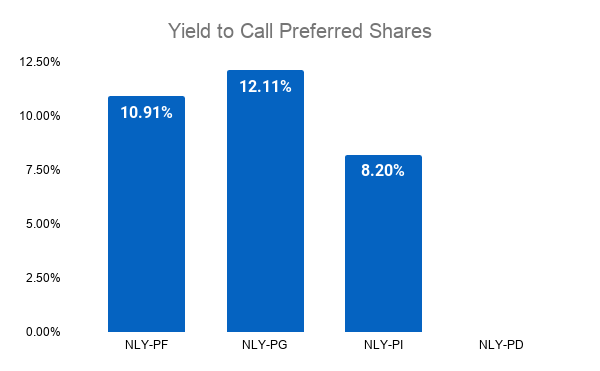

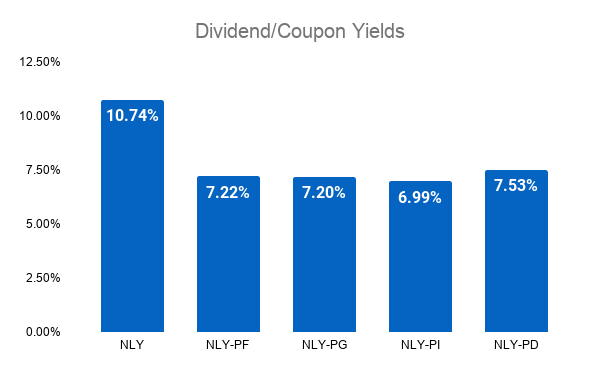

Annaly Capital Management (NYSE:NLY) recently announced they would be redeeming their series D preferred shares (NLY.PD) later this month. The retirement reduces the company's dividend obligations and will take pressure off its cash flow outflows. Despite the retirement, Annaly will continue to trade three preferred shares that are currently not callable. On its face, the series G shares may hold some arbitrage with a higher yield to call than its peers. However, the coupon yields between the remaining preferred shares are rather comparable around 7%. For income investors, the preferred shares provide less income, but are safer, than the common shares.

Source: 12/3/2020 Pricing in High Yield Digest Database

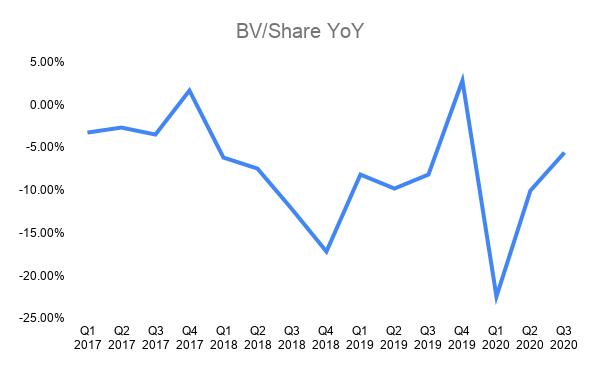

Annaly's common share dividends have suffered the brunt of the industry headwinds with cuts occurring last year and after the COVID-19 pandemic hit. Additionally, the company's book value, which influences its common share price, has seen negative year-over-year changes in virtually every quarter of the previous three years. For income investors, the 10% dividend yield may not be worth the depreciating value of the shares and the threat of a declining dividend.

Source: Seeking Alpha

Source: Earnings Data Uploaded into High Yield Digest Database

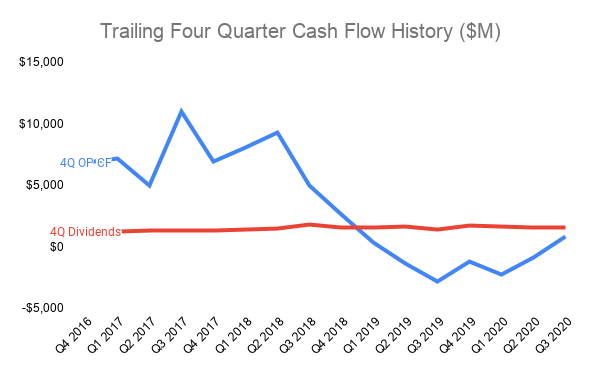

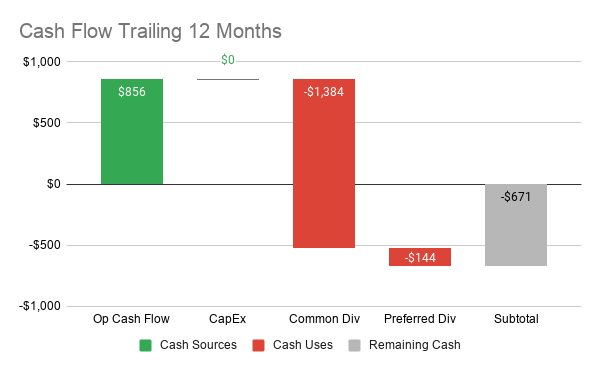

The cause behind the company's dividend cuts likely came from its impressive decline in operating cash flows. While not the only determining factor, I have come to believe that operating cash flows are leading indicators to dividend problems in mREITs as it forces these companies to either sell investments or borrow more money to cover its dividend obligations. Both options are typically futile as mREITs already require high leverage and their assets invested in securities in order to generate the incomes demanded by investors. Over the last twelve months, the company has spent $671 million more in dividends than generated from operating cash flow.

Source: SEC 10Q/K Data Uploaded into High Yield Digest Database

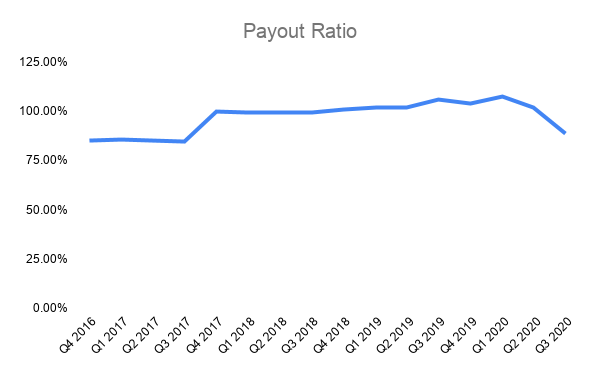

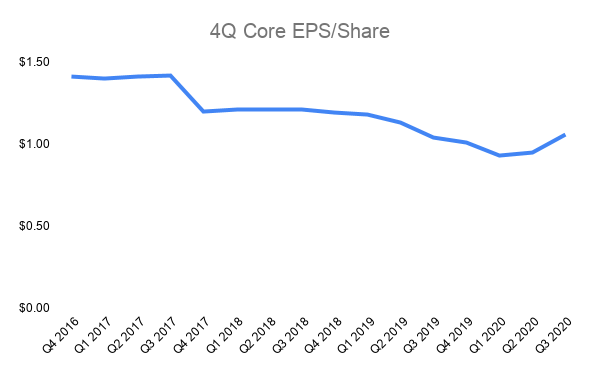

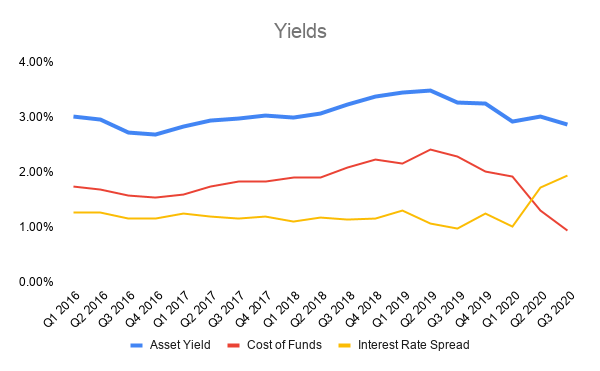

Despite the headwinds, there are signs showing that Annaly is turning the corner and may have a good case for acquiring the common shares. The company's core earnings per share over a twelve-month period bottomed in the first quarter and has rebounded over the next two quarters. Additionally, the company's payout ratio has declined to levels indicating the common share dividends may be more sustainable. Finally, the company's net interest spread has increased noticeably over the last two quarters, thanks to a decline in the cost of funds.

Source: Earnings Data Uploaded into High Yield Digest Database

Source: Earnings Data Uploaded into High Yield Digest Database

Overall, Annaly appears poised to take advantage of lower interest rates and higher mortgage volumes to bounce back from the 2019 headwinds and COVID-19 pandemic. Despite these opportunities, I believe the common shares are too great of a risk, considering the company's long-term book value drag and history of recent dividend cuts. For income investors and those set to receive cash for the series D redemption, I am recommending an investment in the other preferred shares.

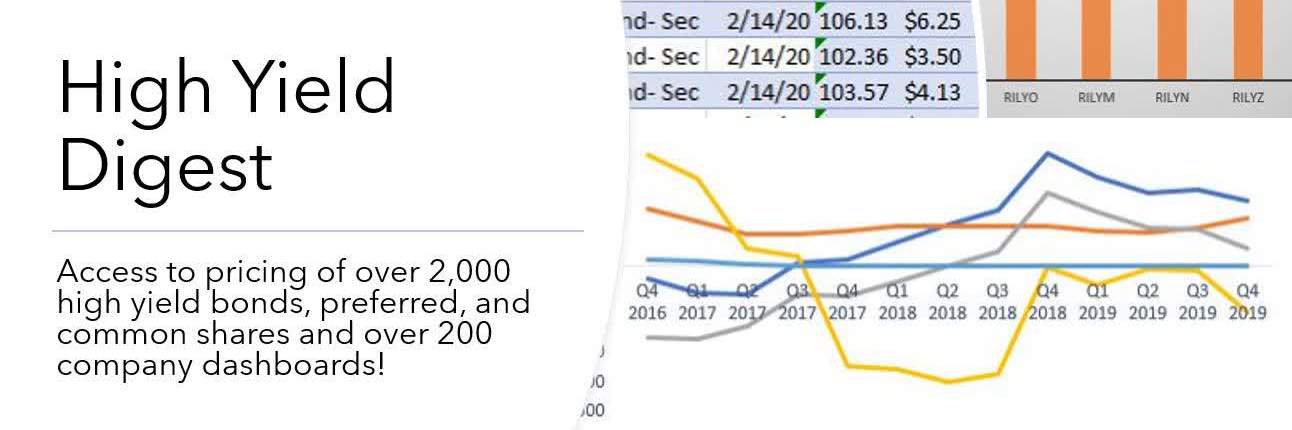

Want more high yield ideas? Check out High Yield Digest for access to my real-time portfolio with trade alerts, along with company dashboards and exclusive ideas!

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.