Mizuho Financial: All Eyes On Dividends And Cross-Shareholdings

Mizuho Financial expects to maintain its full-year dividends of JPY75 per share for FY 2021, despite its relatively weak capital position and the negative impact of COVID-19 on its earnings.

Mizuho Financial has set a target of decreasing its cross-shareholdings by a further JPY 300 billion by March 2022, but its plans could be possibly delayed due to the coronavirus pandemic.

Mizuho Financial trades at 0.39 times P/B and 9.5 times consensus forward FY 2021 (YE March) P/E, and it offers a consensus forward FY 2021 dividend yield of 5.6%.

Elevator Pitch

I have a Neutral rating on Japanese financial services group Mizuho Financial Group, Inc. (MFG) [8411:JP].

Mizuho Financial's key investment merit is its attractive consensus forward FY 2021 and FY 2022 dividend yields of 5.58% and 5.59%, respectively. Notably, Mizuho Financial expects to maintain its full-year dividends of JPY75 per share for FY 2021 (YE March), despite its relatively weak capital position and the negative impact of COVID-19 on its earnings. Nevertheless, a dividend cut in FY 2022 and beyond cannot be ruled out completely, and Mizuho Financial could see a valuation de-rating if that happens.

Also, Mizuho Financial has set a target of decreasing its cross-shareholdings by a further JPY 300 billion by March 2022, but its plans could be possibly delayed due to the difficulty of meeting people during the coronavirus pandemic. Cross-shareholdings are perceived as negative from the perspective of corporate governance, and Mizuho Financial is likely to suffer from a certain degree of valuation due to its significant proportion of cross-shareholdings.

Mizuho Financial trades at 0.39 times P/B and 9.5 times consensus forward FY 2021 P/E. While the stock's valuations are undemanding, I will upgrade my rating on Mizuho Financial to Bullish, only if its capital adequacy position improves and the company makes significant progress in reducing its cross-shareholdings.

Readers have the option of trading in Mizuho Financial shares listed either as ADRs with the ticker MFG or on the Tokyo Stock Exchange with the ticker 8411:JP. For those shares listed as ADRs, average daily trading value for the past three months is decent at $0.9 million but lower than that for the Japan-listed shares.

For those shares listed in Japan, there are limited risks associated with buying or selling the shares in terms of trade execution, given that the Tokyo Stock Exchange is one of the major stock exchanges that's internationally recognized, and there's sufficient trading liquidity. Average daily trading value for the past three months exceeds $100 million, and market capitalization is above $32 billion, which is comparable to the majority of stocks traded on the US stock exchanges.

Institutional investors which own Mizuho Financial shares listed in Japan include Nomura Asset Management, The Vanguard Group, Daiwa Asset Management, Geode Capital Management, and Dimensional Fund Advisors, among others. Investors can invest in key Asian stock markets either using U.S. brokers with international coverage such as Interactive Brokers and Fidelity, or international brokers with Asian coverage like Hong Kong's Monex Boom Securities and Singapore's OCBC Securities.

Company Description

Established in 2002 with the merger of three Japanese banks (Fuji Bank, the Industrial Bank of Japan, and Dai–Ichi Kangyo Bank) Mizuho Financial Group is one of Japan's three major financial institutions alongside Mitsubishi UFJ Financial Group, Inc. (MUFG) [8306:JP] and Sumitomo Mitsui Financial Group, Inc. (SMFG) [8316:JP]. Mizuho Financial is the country's second largest banking group with a 7.6% domestic share of loans as of end-FY 2020. In contrast, Mitsubishi UFJ Financial Group and Sumitomo Mitsui Financial Group are Japan's largest and third largest banks with market shares of 8.8% and 7.1% (in terms of domestic loans), respectively, as of March 2020.

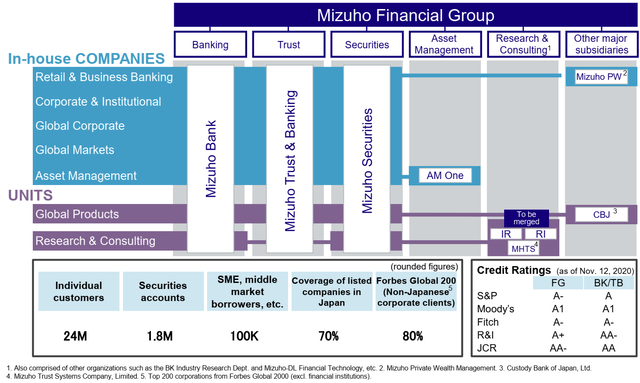

An Overview Of Mizuho Financial's Various Business Segments

Source: Mizuho Financial's 1H FY 2021 Financial Results Presentation Slides

Dividends In The Spotlight

One of Mizuho Financial's key investment merits is its relatively attractive forward dividend yield of 5.6%. Mizuho Financial has consistently paid out full-year dividends per share of JPY75 (comprising an interim dividend of JPY37.5 per share and a final dividend of JPY37.5 per share) for six consecutive years between FY 2015 and FY 2020. As a result, the majority of sell-side analysts have assumed that Mizuho Financial will maintain the company's full-year dividends per share of JPY75 for FY 2021 and FY 2022.

Earlier, there were concerns that Mizuho Financial could possibly cut its dividends for FY 2021, due to the negative impact of COVID-19 on its business operations and financial performance. The company has guided for FY 2021 earnings of JPY350 billion, which will imply a -22% YoY decline as compared to its FY 2020 net income of JPY448.5 billion.

Furthermore, Mizuho Financial's capital position is not as strong as that of its peers. As of September 30, 2020, Mizuho Financial's Common Equity Tier 1 or CET1 ratio was 11.57%. In contrast, the CET1 ratio for its peers Mitsubishi UFJ Financial and Sumitomo Mitsui Financial were higher at 12.52% and 16.02%, respectively. In a company presentation in June 2020, Mizuho Financial addressed this issue by highlighting that the company "determined that a sufficient level of capital adequacy can be maintained even when considering the effects of COVID-19", and it noted that "there was no particular concern (regarding capital adequacy) under either current capital requirements nor on a Basel III fully-effective basis." However, Mizuho Financial acknowledged that "Mizuho’s level of capital is behind that of the other Japanese megabanks."

It came as a relief to investors that Mizuho Financial maintained its interim dividend per share at JPY37.5 for 1H FY 2021 and also guided for a final dividend per share of JPY37.5 for 2H FY 2021. Nevertheless, a cut in dividends in FY 2022 and beyond cannot be ruled out completely, given Mizuho Financial's relatively weak capital position and the possibility that COVID-19 might take a longer-than-expected time to be contained in Japan.

Cross-Shareholdings Draw Attention

Apart from dividends, cross-shareholdings are another factor that has a significant impact on Mizuho Financial's valuations. Similar to many large Japanese corporations, Mizuho Financial has a significant proportion of cross-shareholdings, which is seen as negative in terms of corporate governance, and it also exposes the company to impairment losses unrelated to the core business.

Cross-shareholdings are not an uncommon phenomenon in Japan. According to a 1999 book titled Asian Eclipse authored by Michael Backman, "around 60% of Japan's outstanding company shares are held by other companies" and "Mitsubishi Group itself endorses the estimate that today, around a quarter of the shares in each of its 26 biggest companies are owned by other group members."

To Mizuho Financial's credit, the company has reduced its cross-shareholdings from approximately JPY7 trillion more than a decade ago to JPY1.4 trillion as of March 2019. The company has set a target of decreasing its cross-shareholdings by a further JPY 300 billion by March 2022. Mizuho Financial's cross-shareholdings were reduced by -JPY208.3 billion from JPY1,419.8 billion as of March 31, 2020 to JPY1,211.5 billion as of September 30, 2020, but approximately half of the decrease in cross-shareholdings was attributable to impairment losses (decrease in share prices of the shares of the listed companies held by Mizuho Financial).

It is noteworthy that the company's plans to reduce its cross-shareholdings could possibly be delayed because of the coronavirus pandemic. At the company's Investor Relations Day in September 2020, Mizuho Financial disclosed that "face-to-face negotiations for the sale of shares have been difficult" and its clients' (whose shares it holds) "business results have been negatively impacted."

A Lack Of Diversification Could Be A Positive Factor In The Age Of Digital Disruption

Mizuho Financial is less diversified as compared to its peers Mitsubishi UFJ Financial Group and Sumitomo Mitsui Financial Group. Although Mizuho Financial has a presence in banking, asset management, and securities like its peers, the company does not have credit card and consumer finance businesses.

Instead, Mizuho Financial collaborates with other partners to make up for its lack of diversification in certain business areas. For example, Mizuho Financial has partnered with consumer credit company Orient Corporation to introduce an integrated credit card and ATM card.

In the new digital era where traditional credit card and consumer finance business operations could possibly be disrupted, Mizuho Financial might have an edge over its rivals because of its lack of diversification, as it can be more agile in adapting to changes in the digital payments and consumer lending markets. Mizuho Financial noted in a company presentation in June 2020 that "collaboration is necessary for transforming into a new type of financial group" and it is considering "a joint development with partners or participation in projects developed by partners" for future digital transformation initiatives.

Valuation

Mizuho Financial trades at 0.39 times P/B based on its share price of JPY1,344 as of December 2, 2020. As a comparison, its three-year and five-year mean P/B multiples were 0.48 times and 0.52 times, respectively. The stock is also valued by the market at consensus forward FY 2021 (YE March) and FY 2022 P/E multiples of 9.5 times and 7.9 times, respectively.

Market consensus expects Mizuho Financial to achieve ROEs of 4.2% and 4.8% for FY 2021 and FY 2022, respectively.

Mizuho Financial offers consensus forward FY 2021 and FY 2022 dividend yields of 5.58% and 5.59%, respectively.

As per the peer valuation comparison table below, Mizuho Financial is valued at a slight premium to its peers based on P/B, forward P/E and forward dividend yield metrics.

Peer Valuation Comparison For Mizuho Financial

| Stock | Trailing P/B Multiple | Consensus Forward One-Year P/E | Consensus Forward Two-Year P/E | Consensus Forward One-Year ROE | Consensus Forward Two-Year ROE | Consensus Forward One-Year Dividend Yield | Consensus Forward Two-Year Dividend Yield |

| Mitsubishi UFJ Financial Group | 0.35 | 9.2 | 7.7 | 3.8% | 4.3% | 5.5% | 5.8% |

| Sumitomo Mitsui Financial Group | 0.38 | 9.7 | 7.2 | 4.1% | 5.2% | 6.1% | 6.3% |

Source: Author

Risk Factors

The key risk factors for Mizuho Financial include an unexpected cut in dividends, and a longer-than-expected time to reduce the company's cross-shareholdings.

Asia Value & Moat Stocks is a research service for value investors seeking value stocks with a huge gap between price and intrinsic value, leaning towards deep value balance sheet bargains (i.e. buying assets at a discount e.g. net cash stocks, net-nets, low P/B stocks, sum-of-the-parts discounts) and wide moat stocks (i.e. buying earnings power at a discount in great companies like "Magic Formula" stocks, high-quality businesses, hidden champions and wide moat compounders). Sign up here to get started today!

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.