KT Corp. is unbelievably cheap.

Yet, a very favorable catalyst is approaching quickly.

2021 will also benefit from the removal of negative coronavirus effects on top of that catalyst.

Before anything else, I should say that KT Corporation (KT) is so unbelievably cheap in the middle of an expensive stock market that it should require no catalyst to produce good returns going forward. However, as we’ll see, there is indeed a positive catalyst coming down the pike.

Why do I say KT Corp. is unbelievably cheap?

Well, we’re talking about a stable, high-margin business, based not just on mobile telephony but also on broadband access, IPTV and having even a cloud infrastructure segment. Still, of course, the mobile telephony business dominates. This stable business - even under the effects of coronavirus (which depressed current growth and profitability) - at $11.05 trades at just ~2,3x EV/EBITDA. And even under the present high demands of 5G investment, it goes for just ~6.4x EV/(EBITDA-capex).

Those numbers might seem empty. But consider the following: the entire U.S. market, comprised on average of businesses worse than KT Corp., trades at ~15.8x EV/EBITDA (using January 2020 numbers, before coronavirus struck).

It’s not just me calling it cheap, either. KT decided to launch a large (~5% of shares outstanding) buyback simply because the company considers itself undervalued:

Kyung-Keun Yoon

[Foreign Language] Let me first respond to your question about share buyback. The assessment of the management is that the current share price compared to the intrinsic value of KT is significantly undervalued. As we have communicated in May, we even at a very conservative forecast, we think that we will be able to achieve [KRW1 trillion] of standalone operating profit [come year 2022]. We are confident the further improving our fundamentals and we expect our equity prices, share prices to actually show an uptrend going forward.

The undervaluation, as we saw, is very evident compared to a wildly overheated market. It's also very low in absolute terms, inside or outside a low-interest rate environment.

The 5G Catalyst

So, what is this 5G catalyst?

KT is hardly the only international mobile telephony company that’s trading at very depressed valuations. This is so even though these companies went through the coronavirus pandemic without suffering significant losses. A large part of the reason for this undervaluation is because most telecoms are now going through a 5G investment cycle.

The 5G deployment temporarily inflates operating costs as well as capex (capital expenditures, investment in long-lived assets whose usage spans years). This elevated capex reduces free cash flow significantly. The current market is so enamored with stories that even though KT is cheap on its currently inflated current capex needs, the 5G capex story is still punishing it.

So, why will 5G now turn into a positive catalyst at all? I won’t even consider the beneficial effects it can have on usage or ARPU (Average Revenue Per User). What’s most important is that 5G capex is peaking.

It’s peaking earlier at KT because the company started investing in 5G earlier. Already 20% of its subscriber base in on 5G plans, and by the end of the year, KT expects this to be 25%. This “peaking capex” isn’t just theoretical, either, because...

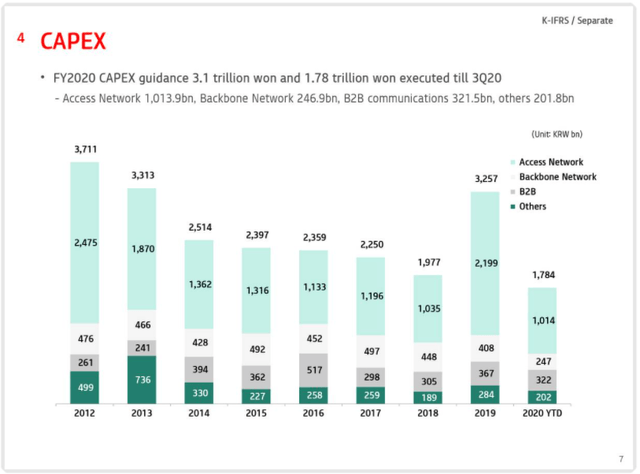

Source: KT Telecom Q3 Earnings Presentation

... already in 2020, the company's capex guidance (3.1 trillion won) stands below the 2019 expenditure (3.26 trillion won). Thus, the peak is likely already in the rear-view mirror even as I write this.

Moreover, considering the 1.78 trillion won spent on the first 3 quarters, it seems possible that KT will come below its own capex guidance. 2021 is likely to be lower still. As capex goes lower, the same EBITDA/operating cash flow will generate more free cash flow. And the market might well go from hating KT to suddenly loving it.

Moreover, 2021 will also see benefits from the end of the coronavirus “problem”. After all, international roaming will likely compare positively versus 2020. And the non-mobile telephony businesses will also likely gain from the end of this saga.

Hence, there you have it - not only is KT extraordinarily cheap compared to nearly all U.S. quoted stocks, but it’s actually facing a very favorable fundamental development: the 5G spending peak.

Conclusion

KT is likely to trade much higher. Even if the company traded at $22.10 (100% higher), it would still carry a ridiculously low 3.5x EV/EBITDA. This move higher will likely have as a spark the recognition by the market that KT has already reached the 5G capex wave summit, and capex will go substantially lower from here.

I should also add that there are other mobile telecoms in the same boat as KT, though a bit further behind in terms of reaching this 5G capex peak. I believe that when the 5G peak catalyst starts being noticed, it will affect many different stocks.

A final note. When Gazprom (OTCPK:OGZPY) went through the same process (a capex peak), due to finishing the Power of Siberia and TurkStream pipelines, the stock reacted very favorably for a while. That happened even in the context of rapidly declining European natural gas prices (a very unfavorable development which, at the time, killed the euphoric rally).

Idea Generator is my subscription service. It's based on a unique philosophy (predicting the predictable) and seeks opportunities wherever they might be found, by taking into account both valuation (deeply undervalued situations) and a favorable thesis.

Idea Generator has beaten the S&P 500 by around 11% since inception (in May 2015). There is a no-risk, free, 14-day trial available for those wanting to check out the service.

Disclosure: I am/we are long KT. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.