StoneX Group: A Game-Changing Acquisition Makes Its Valuation Even More Discounted

StoneX Group Inc. is a financial services company involved in value-added and back office support to financial markets.

The company's recent acquisition of Gain Capital Holdings appears to have been done on favorable terms for StoneX.

Combined with its existing business, this acquisition makes StoneX even more discounted from its current valuation.

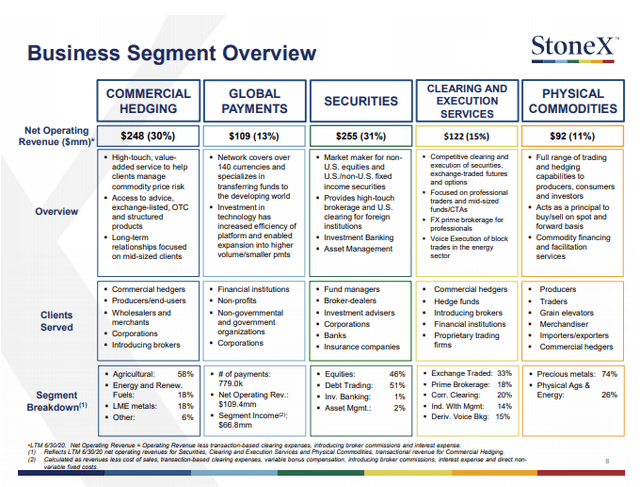

StoneX Group Inc. (SNEX) is a financial services company that provides institutional access to its clients to various global markets through several digital platforms, end-to-end clearing and execution services along with high touch service and deep expertise.

Source: Company Presentation, August 2020 Q3 Reporting

I believe the company represents good value at the current price based on its financial metrics alone. Its recent acquisition of GAIN Capital Holding appears to be a true game-changer for StoneX as it appears to have been acquired at a bargain valuation. The company is also relatively unknown to investors, recently changing its company name and ticker symbol. Finally, I believe the monetary landscape the world appears to be headed toward both during and post the COVID-19 pandemic will be a large tailwind for StoneX’s markets.

The Business

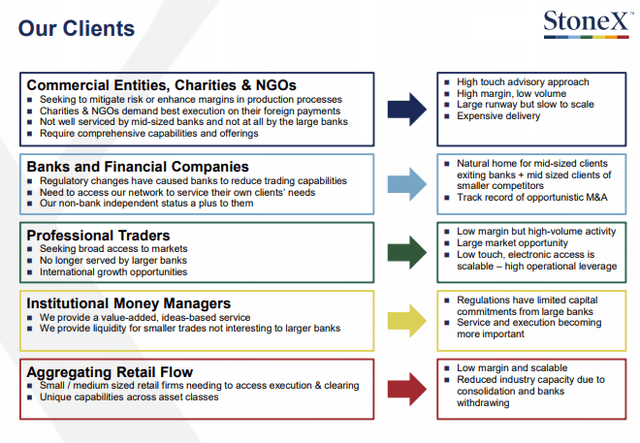

As detailed above, StoneX has a wide range of financial services to meet its client’s needs.

Source: Company Presentation, August 2020

These services are a mix of value-added services that give better, faster information to investors and traders worldwide while also doing some of the back-office work required for financial markets, such as clearing and execution and global payments. StoneX gives access to 36 derivative exchanges, all securities markets, foreign exchange markets and provides a source for bi-lateral OTC liquidity. In their own words:

“We deliver this access with support throughout the entire lifecycle of a trade – from consulting and “boots-on-the-ground” intelligence, to best execution, to post-trade clearing, custody and settlement. In these ways, StoneX enables clients to use the global markets ecosystem to achieve their business, trading and investment goals through one trusted partner.”

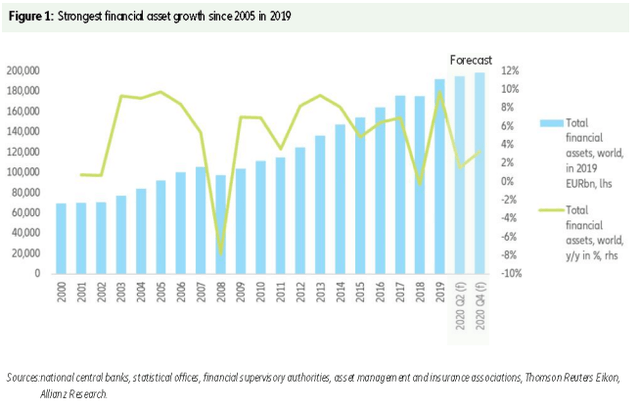

The growth in worldwide financial assets has continued to increase substantially over the last decades with just a brief drop during the 2008 financial crisis:

Source: Allianz Report on Wealth, 2020

These assets will continue to search for returns in whichever markets provide the best options, with StoneX’s suite of products being well-suited to meet this macro trend.

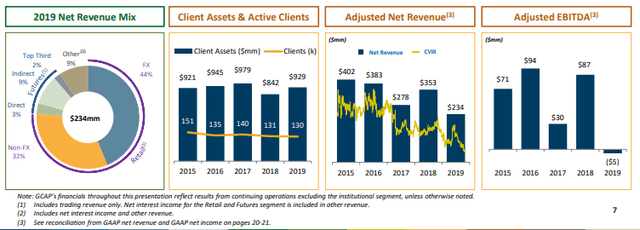

To help augment its business, StoneX took advantage of its balance sheet by acquiring Gain Capital Holdings (GCAP) on February 27, 2020 for $6 a share; this deal closed on July 31, 2020. SA contributor Jeremy Raper has done significant research into this deal with this particular twitter feed illuminating some of the advantages. I share Jeremy’s view on this acquisition as well. In StoneX’s presentation on the deal, it is hard not see how compelling it is for StoneX:

- Purchase price was $236.2m in equity value, a redemption of $92m in GCAP convertible notes and an estimated $24.4m in transaction costs to bring the total deal value to $352.6m.

- StoneX expected to generate a return of capital of $100m in capital synergies to de-lever.

- At the time of the deal, StoneX expected between $21m and $30m in cost synergies with GCAP.

- Assumed a regular run rate EBITDA of $29m. However, in the deal presentation this was near the low (ignoring anomalous 2019 results).

Source: StoneX/GCAP Deal Presentation, February 2020

If we look at the gross purchase price but take out the $100m in capital return, we end up with a purchase price of $252.6m. We can then consider StoneX’s estimate of EBITDA of $29m or look at the 4-year average pre-2019, which is $70.5m; even if we include 2019 in the average, GCAP’s average EBITDA is $55.4m over this 5-year period, well above StoneX’s estimate.

For the sake of near-term focus, we can then take the $21m in assumed synergies to give us a range of multiples that StoneX paid for GCAP:

StoneX Estimate | 5-Year Average | 4-Year Average (pre-2019) | |

EBITDA | $29.0m | $55.4m | $70.5m |

Synergies | $21.0m | $21.0m | $21.0m |

Net Pro-Forma EBITDA | $50.0m | $76.4m | $91.5m |

EV of Deal Net of Capital Return | $252.6m | $252.6m | $252.6m |

EV/EBITDA multiple of deal | 5.05 | 2.9x | 2.76x |

Source: Company Deal Presentation February 2020, Author Assumptions

Even in the conservative assumptions, StoneX got a tremendous deal in its acquisition. There was some question at the time whether the deal would go through as some shareholders/directors of GCAP likely saw this same benefit. The deal did indeed close, but we have not seen the full effects of the deal yet as it closed in July, one month into StoneX’s Q4 which has not yet been reported. The company did give some guidance as to how well GCAP was doing on their Q3 conference call though:

“The GAIN business has had an incredible run, breaking all of their prior records over the last two quarters. In the second quarter, they produced net revenue of $101 million, with net income of $14.3 million. On our share count, that would equate to an incremental EPS of around $0.75.”

This clearly tracks closer to the 5-year average than StoneX’s estimate at the deal time which makes this deal look extremely accretive for StoneX.

Valuation

There are a lot of moving parts to valuing StoneX at this point with the potentially game-changing GCAP acquisition not factored into current published results. First, let us pull together StoneX’s results with some estimates for GCAP. I annualized GCAP's Q2 performance detailed in StoneX's Q3 earnings release and conference call:

StoneX TTM | GCAP Proforma | Combined | |

Revenue | $1.253B | $0.404B | $1.657B |

EBITDA | $199m | $$115.6m | $314.6m |

Add: Cost Synergies | +$31m | $31.0m | |

EBITDA Proforma | $334.6m |

Source: Company Presentations, Financial Statements, StoneX Q3 results and conference call

If we compare this to StoneX’s pro-forma EV of $1.57B + $0.35B = $1.92B issued for StoneX, we have a compelling valuation at 1.15x revenue and 5.7x EV to EBITDA.

By way of comparison, MSCI Inc. (MSCI) is a competitor on some fronts as far as the analytics side of the equation; it has much higher margins as it does not provide back-office services like StoneX does. Its recent 12-month metric includes revenues of $1.658m, EBITDA of $914.7m and an enterprise value of $36.4B; this gives its metrics multiples of 21.9x revenue and 39.8x EV/EBITDA. Even including some discount for StoneX’s lower margins, this seems like much too low a multiple for StoneX. If we even apply a modest 10x EV to EBITDA for StoneX, we get a market cap of $334.6m x 10 less $350m in GCAP debt financing less $370m other debts = $2.626B / 19.2m shares outstanding to give a share price of $136.77 or 119% north of the current share price of $62.41

I believe the company’s year-end results will potentially provide investors a catalyst as it should include 2 months of GCAP’s results in it, on top of strong results for StoneX on its base business. Some capital allocation moves by management such as debt reduction or even a dividend would give a further tailwind for shares. Any debt reduction would also give a fiscal dividend to the company’s bottom line

The valuations above pre-supposes that the company can continue to operate at this rate. I believe the current monetary environment will continue to see fund flows into assets, which will allow StoneX’s business to continue to have tailwinds behind it. It will require some further analyst coverage to start to get StoneX onto investor radars as well, but a strong story with GCAP’s integration should continue to boost the company’s prospects. I would not be surprised to see the company do further acquisitions either as it rolls up more complementary businesses; this brings both opportunity and risk as I don’t think they will all be as clear a winner as GCAP appears to be.

The Takeaway

StoneX is a very inexpensively-priced play on the continued growth in the financial management industry and financial assets in general. The company has made an opportunistic acquisition that is not yet reflected in its financials, which already prices the company at a discounted valuation.

I would like to thank Seeking Alpha contributor Jeremy Raper, who you can find on Twitter @puppyeh1, who brought the idea to my attention while it was in the middle of acquiring GCAP. I would encourage you all to give him a follow on both platforms. Should you have any questions or comments, feel free to comment below or send me a DM.

Disclosure: I am/we are long SNEX. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.