Best And Worst Q4 2020: Mid Cap Blend ETFs And Mutual Funds

The Mid Cap Blend style ranks seventh in Q4'20.

Based on an aggregation of ratings of 21 ETFs and 341 mutual funds in the Mid Cap Blend style.

ONEV is our top-rated Mid Cap Blend style ETF and JDPNX is our top-rated Mid Cap Blend style mutual fund.

The Mid Cap Blend style ranks seventh out of the twelve fund styles as detailed in our Q4'20 Style Ratings for ETFs and Mutual Funds report. Last quarter, the Mid Cap Blend style ranked sixth. It gets our Neutral rating, which is based on an aggregation of ratings of 21 ETFs and 341 mutual funds in the Mid Cap Blend style. See a recap of our Q3'20 Style Ratings here.

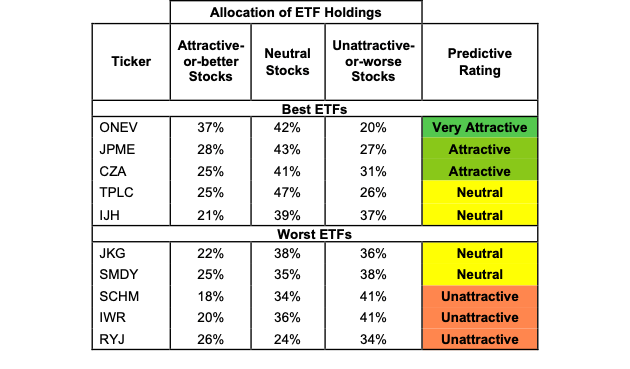

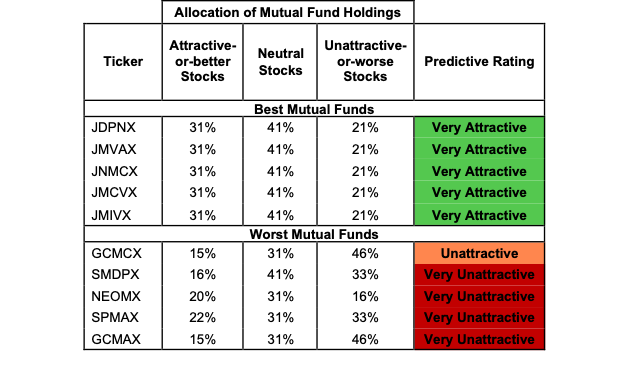

Figures 1 and 2 show the five best and worst rated ETFs and mutual funds in the style. Not all Mid Cap Blend style ETFs and mutual funds are created the same. The number of holdings varies widely (from 17 to 2431). This variation creates drastically different investment implications and, therefore, ratings.

Investors seeking exposure to the Mid Cap Blend style should buy one of the Attractive-or-better rated ETFs or mutual funds from Figures 1 and 2.

Figure 1: ETFs with the Best and Worst Ratings – Top 5

* Best ETFs exclude ETFs with TNAs less than $100 million for inadequate liquidity.

* Best ETFs exclude ETFs with TNAs less than $100 million for inadequate liquidity.Sources: New Constructs, LLC and company filings

Five ETFs (MIDF, XMHQ, AFMC, RVRS, CSD) are excluded from Figure 1 because their total net assets are below $100 million and do not meet our liquidity minimums.

Figure 2: Mutual Funds with the Best and Worst Ratings – Top 5

* Best mutual funds exclude funds with TNAs less than $100 million for inadequate liquidity.

* Best mutual funds exclude funds with TNAs less than $100 million for inadequate liquidity.Sources: New Constructs, LLC and company filings

Victory RS Investors Fund (RSIYX, RSIKX, RIVCX) is excluded from Figure 2 because its total net assets are below $100 million and do not meet our liquidity minimums.

State Street SPDR Russell 1000 Low Volatility Focus ETF (ONEV) is the top-rated Mid Cap Blend ETF and Janus Henderson Mid Cap Value Fund (JDPNX) is the top-rated Mid Cap Blend mutual fund. Both earn a Very Attractive rating.

Invesco Raymond James SB-1 Equity ETF (RYJ) is the worst rated Mid Cap Blend ETF and Goldman Sachs Mid Cap Value Fund (GCMAX) is the worst rated Mid Cap Blend mutual fund. RYJ earns an Unattractive rating and GCMAX earns a Very Unattractive rating.

The Danger Within

Buying a fund without analyzing its holdings is like buying a stock without analyzing its business and finances. Put another way, research on fund holdings is necessary due diligence because a fund’s performance is only as good as its holdings’ performance.

Performance of Holdings = Performance of Fund

Analyzing each holding within funds is no small task. We perform this diligence with scale. More of the biggest names in the financial industry (see At BlackRock, Machines Are Rising Over Managers to Pick Stocks) are now embracing technology to leverage machines in the investment research process. Technology may be the only solution to the dual mandate for research: Cut costs and fulfill the fiduciary duty of care. Investors, clients, advisors and analysts deserve the latest in technology to get the diligence required to make prudent investment decisions.

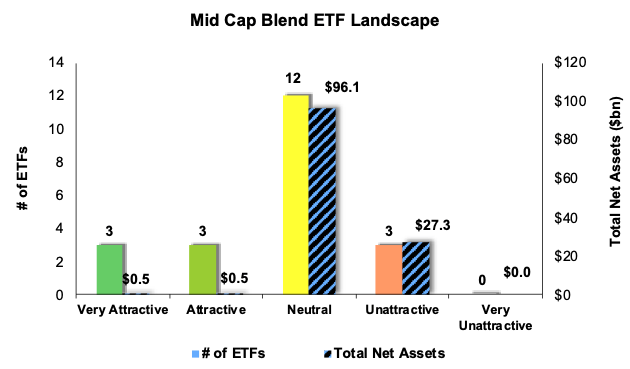

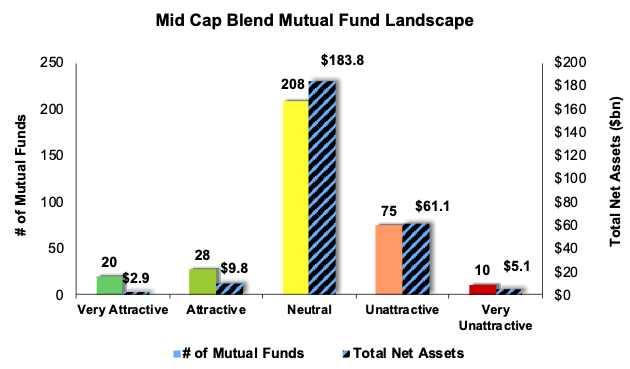

Figures 3 and 4 show the rating landscape of all Mid Cap Blend ETFs and mutual funds.

Figure 3: Separating the Best ETFs from the Worst Funds

Sources: New Constructs, LLC and company filings

Sources: New Constructs, LLC and company filingsFigure 4: Separating the Best Mutual Funds from the Worst Funds

Sources: New Constructs, LLC and company filings

Sources: New Constructs, LLC and company filingsThis article originally published on Oct. 22, 2020.

Disclosure: David Trainer, Kyle Guske II, and Matt Shuler receive no compensation to write about any specific stock, style, or theme.

Get our long and short/warning ideas. Access to top accounting and finance experts.

Deliverables:

1. Daily - long & short idea updates, forensic accounting insights, chat

2. Weekly - exclusive access to in-depth long & short ideas

3. Monthly - 40 large, 40 small cap ideas from the Most Attractive & Most Dangerous Stocks Model Portfolios

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.