Both 50-DMA, and 200-DMA levels are used widely by the traders to determine the short-term, as well as the long term, strength of a stock or an index.

Representative Image (Image: Pixabay)

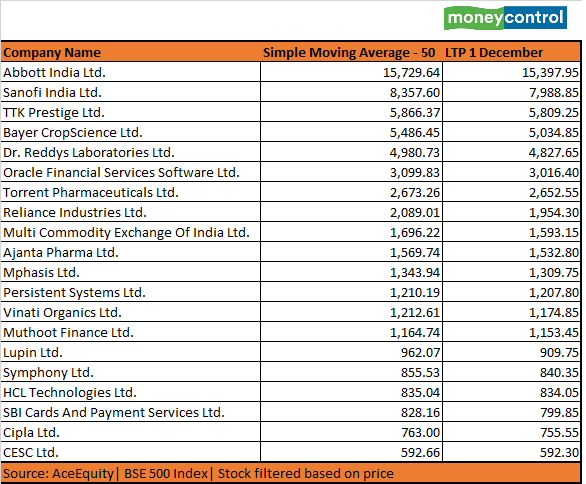

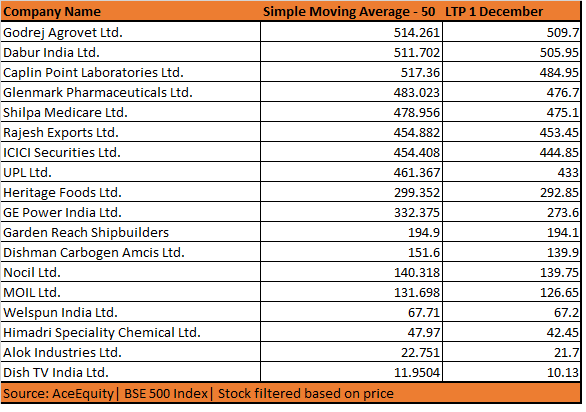

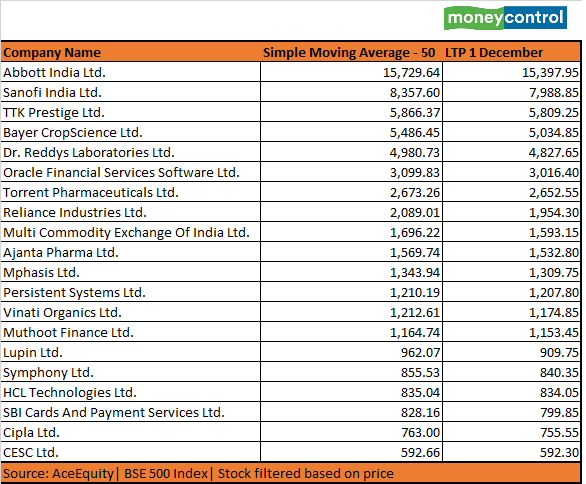

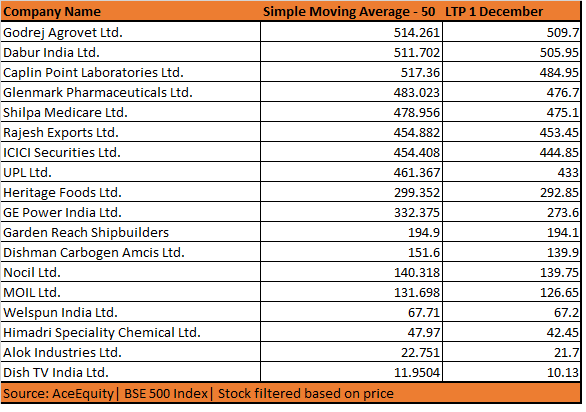

The liquidity wave has taken benchmark indices to fresh record highs in November and pushed many stocks in the BSE500 above their 200-Days Moving Average (DMA), but there are 38 stocks that are still trading below their 50-DMA (short-term trend).

A brief look at the data suggests that stocks in the pharma, as well as IT space are consolidating after the recent rally in the year 2020. Both Pharma, and IT indices are the top-performing indices of the year 2020 and thus some consolidation was on the cards, suggest experts.

A stock that is trading below the 50-DMA is considered weak or a laggard, but only a handful of stocks can be considered a contra buy based on business fundamentals, suggest experts.

“Most of the 38 stocks are from the IT or Pharma sector and these sectors are in a consolidation phase. The basic rule while trading using 50-DMA is to wait for the price action to cause a breakout and placing Stop loss in the opposite direction of 50-DMA,” Ashis Biswas, Head of Technical Research, CapitalVia Global Research Limited told Moneycontrol.

“Therefore, investors can place a stop loss of the weekly low and wait for the breakout above 50-DMA. Fresh investment can be made once the breakout is complete and the price is sustaining/consolidating above the 50-DMA,” he said.

Stocks that are trading below their 50-DMA or the short-term trend include names like Abbott India, TTK Prestige, Bayer Cropscience, OFSS, Torrent Pharma, Ajanta Pharma, Dr Reddy’s Laboratories, Mphasis, Lupin, HCL Technologies among others.

Role of 50-DMA and 200-DMA:

Both 50-DMA and 200-DMA levels are used widely by the traders to determine the short-term, as well as the long-term, strength of a stock or an index.

A stock that is trading below the 50-DMA is considered to be in a downtrend while the one which is trading above the 200-DMA mark is considered to be in an uptrend.

“Usually, Moving Averages like 50 and 200-Day indicate medium to long term strength prevalent in the ongoing trend. If more number of stocks are trading above the said averages, it suggests broad-based participation in the market rally hinting at a stronger uptrend in the current up move,” Mazhar Mohammad, Chief Strategist – Technical Research & Trading Advisory, Chartviewindia.in told Moneycontrol.

Currently, there are 38 stocks that are trading below the 50-DMA and more than 460 stocks in the S&P BSE 500 index that are trading above the 200-DMA mark.

“In such a scenario any correction in these scrips which eventually leads to the test of these averages can be considered as an opportunity to create fresh long positions,” he said.Mohammad further added that when the trend in broader markets is strong and some scrips fail to catch up and still trade below 50 and 200-day moving averages then it means they are still in the bear phase and hence they should be avoided as they will continue to remain as laggards.

Contra Bets:

Stocks that are trading below their 50-DMA are considered weak and trading should be avoided, but those who can take a little bit of risk could look at few stocks especially in the pharma space, suggest experts.

“From the mentioned list there are lot of stocks from the pharmaceutical sector, which is trading sideways over the past few months after a sharp outperformance from April 2020 to September 2020,” Vikas Jain, Senior Research Analyst at Reliance Securities told Moneycontrol.

“We believe one should adopt contra bets in the sector from here as we are witnessing positive momentum over the past few days in stocks from the pharmaceutical sector,” he said.

Jain further added that stocks that look good from the list are Muthoot Finance, Dabur, and UPL as risk-reward is in favour of longs with a stop loss of 5-7% and reward of 15-18% from current levels.

For stocks that are trading above the 200-DMA – investors can look at booking profits in some of them, and reallocate money towards defensive sectors like Pharma, and consumption.

“In terms of trading we will have to book profit in stocks which had a strong up move over the past few weeks and move to defensive sectors like Pharma and Consumer from current levels,” says Jain.

“One should keep a trailing stop loss of 5% from the current price or can think of exiting the stock if it breaks the short term moving average of 20 days indicating some reversal,” explained Jain.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

_2020091018165303jzv.jpg)