W. W. Grainger: Discounted With A Re-Segmenting Catalyst

W. W. Grainger appears well-positioned to outgrow the broader MRO market through and post-COVID.

Margin expansion toward the 15-16% range also appears to be on the cards long term.

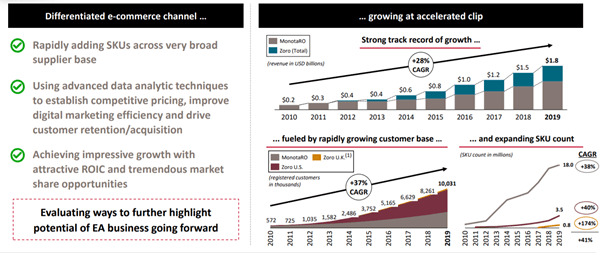

The crown jewel remains the high-growth Endless Assortment businesses, Zoro, and MonotaRO, the latter of which commands an ~10-11x EV/Sales multiple.

With growth accelerating through COVID, a pending FAS 131-driven re-segmenting catalyst should unlock some trapped value.

I believe there is a potential value unlocking catalyst on the horizon for W. W. Grainger (GWW). Given FAS 131 rules dictate segment reporting is required if an operating segment generates 10% of revenue/profit/assets, this should mean the Endless Assortment assets will have to be broken out separately (vs. embedded in the "other businesses" line currently). In turn, this should focus the GWW narrative around the underlying sum-of-parts value - conservatively assuming Zoro commands a discounted EV/Sales multiple vs. MonotaRO (~10-11x EV/Sales), this would imply the core GWW business is trading at a deeply discounted ~7x EV/EBITDA currently.

Well-Positioned for Outgrowth Post-COVID

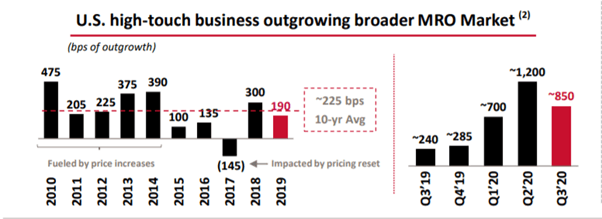

As 3Q20 showed, GWW is capable of sustaining outstanding core growth, even coming off the COVID peak. Case in point - GWW's outperformance relative to the MRO market was still at ~850bps in 3Q (vs. the ~225bps historical average). Part of this was down to COVID-driven sales, which remain elevated. But a manufacturing recovery across the customer base also played a key role and that bodes well for the post-COVID outlook.

Source: Investor Presentation

That said, pockets of weakness remain across COVID-impacted industries like airlines, cruise lines, and hospitality customers. This is being offset for now by "non-disrupted" customers (e.g., manufacturing, hospital, and government), which represent a larger share of GWW's customer base. As COVID normalizes post-vaccine, though, expect significant demand tailwinds from the "disrupted" customer base to kick in for GWW.

Long term, the key debate remains around the sustainability of e-commerce - while there were concerns of e-commerce demand being a one-off, management's observation of higher repeat rates from new GWW customers gives me confidence in underwriting continued outgrowth going forward.

The good news is that, those who have repeated, the number is much higher than in the past. The repeat rates are similar to the past, but we have a much bigger funnel. And we're starting to get those customers to be regular purchasing customers, so we've seen really nice, attractive customer acquisition through this period, and we think that really helps bode well for the future. We feel very confident in our 300 to 400 basis point outgrowth in the US business." - 3Q20 Transcript

Margin Expansion Adds to the Long-Term Growth Story

Adding to GWW's targeted ~300-400bps of YoY market share gains is a compelling margin expansion story within the core business. Although gross profits will likely be tempered by elevated sales of lower-margin pandemic-related products and a surge in holiday freight rates (recall that management guided to 4Q gross margins at down ~220bps YoY), GWW expects to drive operating margin expansion toward the ~15-16% range over time (vs. ~11% currently). The key margin expansion lever is SG&A, which at ~2.5-3% per year will be outpaced by revenue growth in the mid-single-digit percentage.

Source: Investor Presentation

Within the other >$2bn of business (online and endless assortment), a lower gross margin profile and SG&A in the ~17-18% range should net to a total operating margin of ~13%. That said, there are margin expansion levers here as well - in Japan, for instance, there are inefficiencies on the operation and customer acquisition side to tap into.

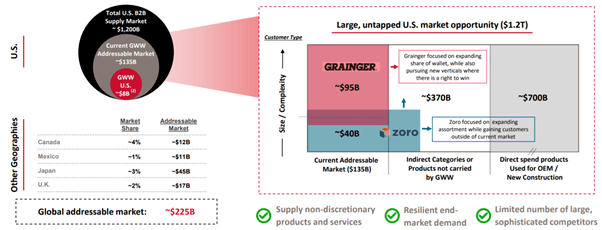

Chasing a $40bn Market Opportunity with Zoro

The US Zoro addressable market opportunity currently stands at a sizeable ~$40bn, which in addition to the fragmented nature of the market, drives an extensive growth runway. While the Amazon Business threat looms large, there are some fundamental differences - Amazon Business leans more towards computer and office supplies, for one, while Zoro mainly competes with other online players and local hardware stores. The Zoro customer profile is also generally characterized by less complex operations with a broad product focus, and where inventory management solutions add limited value.

Source: Investor Presentation

With business increasingly shifting online, even at the smaller customer level, Zoro has a compelling growth runway within the US. Per management, it sees a ~3-year period over which it hopes to have its Zoro business strong enough to stand on its own. I see upside to this target should management leverage MonotaRO (Japan-based leading MRO e-commerce direct marketer which GWW holds a stake in) learnings, particularly in terms of growing and executing on the Zoro opportunity. Based on recent numbers, the outlook is strong as Zoro has already reached ~5m SKUs (1.5m SKUs added YTD). This isn't just a growth story either - alongside revenue growth, Zoro's incremental margins have a clear path to ~15-20% (i.e., gross profit adjusted for variable marketing cost) - in line with MonotaRO.

Source: Investor Presentation

Re-segmenting Catalyst to Unlock Zoro Value

That said, the bigger problem is that Zoro remains embedded within the "Other Businesses" line, which has likely resulted in the underlying value being unrecognized. But with growth accelerating due to the COVID tailwind, re-segmenting the endless assortment segment will likely be the next step (FAS 131 rules dictate segment reporting is required if an operating segment generates 10% of revenue/profit/assets), which should crystallize some of the trapped value here. Expect an outcome by year-end or next year at the latest. Context from the 3Q call below:

We are evaluating the need to think about any segmentation, and we'll talk about that and our position on that at the end of the year -- or with next year. So we have -- we are evaluating that, and we work with our auditors to make sure we understand requirements. So that's still to come." - 3Q20 Transcript

Purchase Core GWW at a Discount

While GWW continues to outperform through COVID, the crown jewel is its high-growth Endless Assortment businesses (MonotaRO + Zoro), which continued to post >20% YoY growth in 3Q. Yet, the Endless Assortment growth and margin opportunity continue to be under-appreciated by investors - a sum-of-the-parts analysis reveals Mr. Market is placing a significant discount on core GWW at the current implied 7.3x EV/EBITDA multiple. But with Endless Assortment set to breach the 10% threshold (per FAS 131), I see a re-segmenting catalyst ahead. Downside risks include COVID-driven business shutdowns, increased competitive pressures, and supply chain disruptions.

USD'm | |

GWW Mkt Cap | 21,860 |

(+) Net Debt FY20e | 1,760 |

= GWW EV | 23,620 |

(-) MonotaRO 51% Stake | 7,591 |

(-) Zoro @ 7x EV/ FY21e Sales | 6,300 |

= Implied GWW Core EV | 9,729 |

(/) GWW Core EBITDA | 1,330 |

= Implied GWW Core EV/EBITDA | 7.3x |

Source: Company Filings, Author's Est

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.