Palantir's Biggest Competition

Palantir is misunderstood because of the excessive focus on government contracts, especially military and Department of Defense.

However, even comparing PLTR to commercial "off the shelf" solutions is misguided in several ways that are explored.

PLTR's primary competition is buried deep inside most organizations and will continue to cause friction, but it is certainly surmountable.

If you really want to understand Palantir (PLTR) then you need to understand the competition. For investors, billions of dollars are on the line.

First, we'll establish a foundation. Second, we'll review commercial competition. Third, we'll explore PLTR's unique advantages. Fourth, we'll look at PLTR's true competition. And finally, we'll wrap up.

What Is Palantir

According to Yahoo Finance:

Palantir Technologies Inc. builds and deploys software platforms for the intelligence community in the United States to assist in counterterrorism investigations and operations. It offers Palantir Gotham, a software platform for government operatives in the defense and intelligence sectors, which enables users to identify patterns hidden deep within datasets, ranging from signals intelligence sources to reports from confidential informants, as well as facilitates the handoff between analysts and operational users, helping operators plan and execute real-world responses to threats that have been identified within the platform. The company also provides Palantir Foundry, a platform that transforms the ways organizations operate by creating a central operating system for their data; and allows individual users to integrate and analyze the data they need in one place. Palantir Technologies Inc. was founded in 2003 and is headquartered in Denver, Colorado.

First, it's kind of weird to me that the primary focus is on the "intelligence community" which clearly disregards PLTR's growth in the commercial space. If you didn't know better, you'd think this was a military contractor only, along the lines of Lockeed Martin (LMT) or General Dynamics (GD).

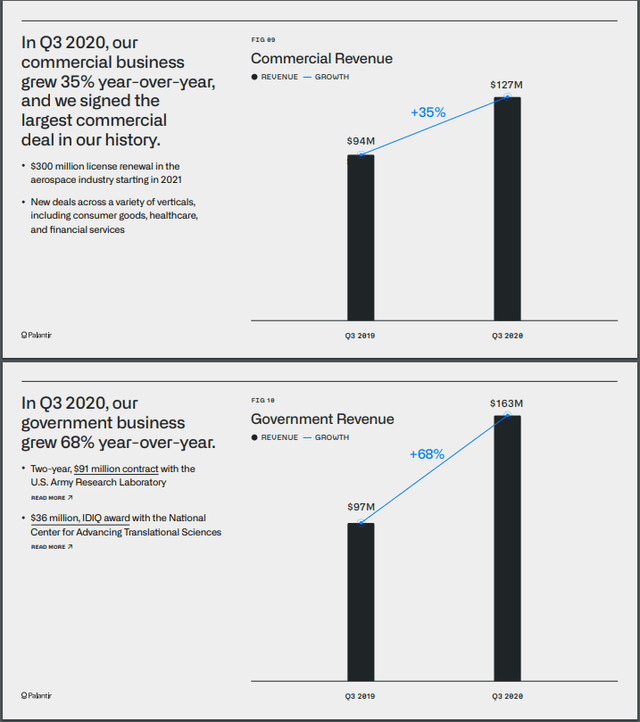

But we know that PLTR has a substantial and growing commercial business:

We also closed a 5-year $300 million renewal, mid-pandemic, with a large aerospace customer, further reinforcing Foundry as core infrastructure in the operating system of their business. Aerospace has been significantly challenged in the pandemic, and we see this as a long-term commitment to each other. This is the largest deal we have done in the commercial space, and we anticipate strong contribution margin from a customer of this scale and maturity.

And, more to the point:

Third quarter commercial revenue grew 35% year-over-year to $127 million, driven by a combination of expansion with existing customers and increasing contributions from new customers. We also closed several large deals across our commercial portfolio in the third quarter, including a $300 million renewal in the aerospace industry and multiple wins, each over $5 million in the consumer, insurance, and financial services industries.

Yes, certainly, it's true that total government revenue rose 68% year-over-year to $163 million. And yes, that was driven primarily by growth in U.S. government business. But here's the truth, plain and simple:

Source: PLTR Q3 2020 Presentation

Source: PLTR Q3 2020 Presentation

Despite this clear proof, I believe many investors think that PLTR is almost exclusively a government supplier. In fact, I would venture that those who have heard of PLTR, but maybe haven't invested, would believe that PLTR is almost entirely into military or pseudo-military contracts.

Yet, according to these two pictures alone, nearly 44% of PLTR's total revenue comes from commercial business. Even if this isn't exactly right, the grand point remains. PLTR is not an exclusive military contractor, despite its roots.

Now, come in close because this also tells us that PLTR's primary competition is most certainly not LMT, GD, any other military industrial outfit. Yes, they might "compete" - today and in the future - but they are not the key competition that PLTR faces. At best, they compete in the same space, but not too much against each other, so to speak.

I want to really push this point. The government isn't making hard funding decisions between LMT and PLTR, for example. If anything, LMT would be the prime contractor and PLTR would be the subcontractor. I see co-opetition far, far more likely than anything head-to-head.

So, if defense contractors like LMT and GD aren't the primary competition, it certainly seems like we need to look elsewhere.

The Commercial Competition Story

I'll cut to the chase. If you're expecting me to name a singular public or private company that competes directly with PLTR, like gladiators in the pit, then you're going to be disappointed I'm afraid. However, let's take a quick look at what others say.

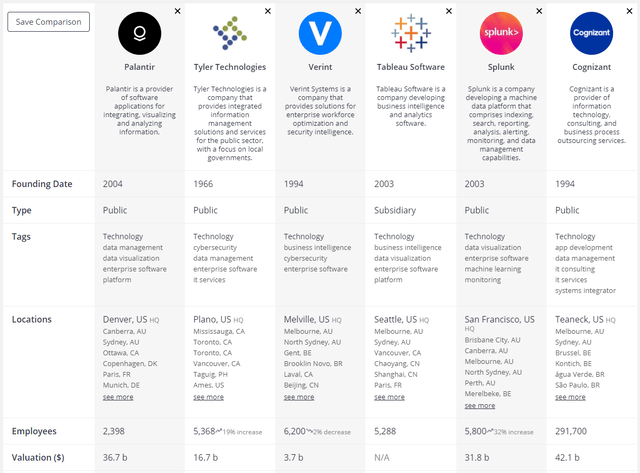

Here's one attempt by Craft:

But, PLTR does way more than all of these companies combined. As I've explained previously in What Palantir Is Not, they are not a big data company or a services company. They offer visualization, deep analytics, machine learning, and increasingly powerful artificial intelligence capabilities.

But, PLTR does way more than all of these companies combined. As I've explained previously in What Palantir Is Not, they are not a big data company or a services company. They offer visualization, deep analytics, machine learning, and increasingly powerful artificial intelligence capabilities.

Here's another attempt by Datanyze:

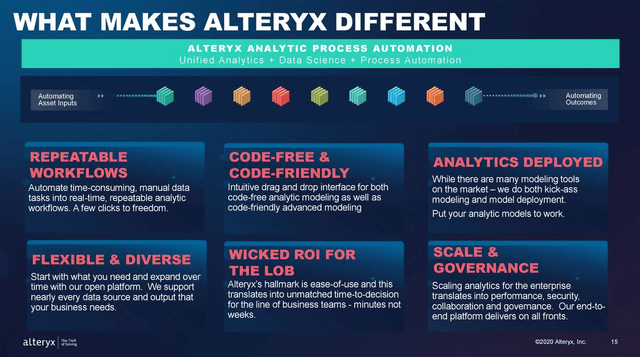

Looking closer at Alteryx (AYX), for example, we see that they provide an end-to-end data science and analytics platform for enterprises.

Source: AYX Q3 2020 Presentation

Source: AYX Q3 2020 Presentation

While there is absolutely overlap, there's still not intense competition between PLTR and AYX, or these other companies. For example, PLTR allows users to create domain models with full linking capability between data sources. Put another way, there's more robust data integration, greater object-domain extraction, and more opportunities for new insights without running direct structured queries. I would argue that PLTR allows for easier "discoverability" by people who are not data scientists, and who are embedded in the field.

The Apollo Factor

Even if we did a bake-off between AYX (or others) and PLTR, we'd likely run into something critical, and that is Apollo. Here's the official marketing spiel:

Palantir Apollo is the continuous delivery software that powers our SaaS platforms, Foundry and Gotham, in the public cloud and beyond. Apollo works around the clock to put our latest features in the hands of customers. It eliminates the tradeoff between stability and speed by delivering continuous, automated updates without disrupting operations. It's why our platforms power mission-critical operations for the world's most important institutions.

With Apollo, our customers have the full stack, from data integration to front-end operational applications, where and when they need it. Everything north of compute, installed in hours.

Unlike most potential competition, PLTR via Apollo is a full stack that deploys in very little time, institutionally speaking. Furthermore, it's not trivial that Apollo is indeed deployed end-to-end, as a full stack, and not simply a tool, or data visualizer, or aggregator.

In fact, I would call it a "layer" - not just in the tech stack. It becomes part of the entire organization, whereby PLTR's goal is clear. In fact, they state that their products, including Apollo are:

"... designed to be the central operating system of a modern enterprise."

Source: PTLR Investor Day Video

You might think that because I'm long PLTR and that I'm bullish that I completely drink the Kool-Aid. But, I'm fully aware that some companies like AYX and Snowflake (SNOW) could very well beat PLTR, at least in some niche, with some customer, or even in some robust technical capability.

Snowflake stands out as perhaps the most promising of the bunch. The data-warehousing company checks all the boxes as a best-in-class cloud-software market leader with an open-ended opportunity for growth. According to Bloomberg Intelligence analyst Mandeep Singh, only 30% of data analytics is now performed in the cloud, putting Snowflake in a great position to take share from the legacy on-premise vendors. And its results have been stellar. In its latest quarter ending in July, Snowflake’s sales increased 121% compared with the period a year earlier, a markedly higher growth rate versus other public cloud stars such as Datadog Inc.

But the counterpoint is that PLTR isn't out to collect and store data whereas that's exactly what SNOW is meant to do according to experts:

Snowflake is fundamentally built to be a complete SQL database. It is a columnar-stored relational database and works well with Tableau, Excel and many other tools familiar to end users. Snowflake has its own query tool, supports role-based security, multi-statement transactions, full DML, windowing functions and everything else expected in a SQL database. It’s the SQL you know and love – be gone, lesser-than imitators!

In the entire PLTR Investor Day video, the word "storage" doesn't even show up one time, based on my text analysis. But, I'm getting too far afield.

Here's what really matters. PLTR isn't directly competing against SNOW any more than it's competing against AYX, which I explained above. Even where there's a ton of overlap, "competition" isn't the right frame of reference, or frame of mind.

Putting this in more favorable terms, I see a rich and robust future for AYX, SNOW and PLTR. The market is growing so fast, that there are likely to be many winners. In a way, it comes down to knowing what's your cup of tea as an investor, because there's plenty of room and runway.

The Big Revelation

If you skipped down here, I understand. You want to know who PLTR is up against. Fortunately, the answer is simple, but the implications are deep:

We compete against our customers, more specifically against our customers desire to build their own solution internally.

Source: PLTR Investor Day Presentation

In other words, PLTR is fighting against organizational inertia. Or, putting it differently, they are trying to beat the dreadful disease of... not invented here.

Like any organization, the government has a built-in bias - an imperative - to live and grow. At a minimum, the government has a desire to build their own internal solutions, versus pulling products off the shelf. They believe they are different, with unique problems. We'll come back to this.

For now, just keep in mind that some government projects have invested billions of dollars over several years to get a solution. But, the results don't always manifest. So, when a company like PLTR can come along and offer a full solution - and even better a "full stack" - the customer is going to listen.

It hasn't always been smooth, however, because PLTR had to file suit against the US Army. I like how The Generalist summed it up:

... in 1994, Section 2377 of the Federal Acquisition Streamlining Act (FASA) was passed. This required the US federal government to consider commercially available software to fulfill its needs, rather than hiring contracts to create something bespoke.

The law was largely ignored until 2016, when Palantir won a suit against the US Army, challenging the decision to pursue a custom-built solution for its "battlefield intelligence system." The decision was upheld by the US Court of Appeals, paving the way for increasingly large contracts for Palantir.

But, to be very clear, this is a Federal law. That is, 2377 is about commercial item preferences for the entire U.S. Government, not just the Department of Defense. Let that rattle around your mind for a minute.

Here's some added color directly from the Investor Day Presentation:

We've calculated our total addressable market to be approximately 120 billion. It's spread roughly equally between our two business segments.

In the commercial segment, we're calculating this based on 6,000 of the largest companies in the world, but we're excluding those that are based in China and Russia.

There's significant space to grow here. As we're currently penetrating less than 3% of the global 2000 on the government side, we see similar opportunity for expansion, both in the US and abroad.

And given the growing instability in the world today, our products will be needed more than ever. In closing, I'd like to walk you through our long-term targets.

Note that these numbers are on an adjusted basis and are excluding stock-based compensation while we're positioned strongly.

Today, we are focused on our long range target model. This will be gross margin in excess of 85% contribution margin in excess of 70% and operating margin in excess of 35%.

Concentration Risk Is Nonsense

This explains the true size of the addressable market opportunity. Further, I included the comments (see above) about margins, to keep your mind clear on how PLTR can grow and enjoy very healthy margins. Although I risk hyperbole, I would say that the opportunity is tremendous.

You'll also notice that this assessment is inclusive of governments and commercial opportunities. Huge organizations are being targeted by PLTR for good reason and the so-called "customer concentration" problem is nonsense.

The records show that Palantir has just 125 corporate and government customers, a relatively small number for a large, publicly-traded tech company. Two-thirds of its revenue comes from its top 20 customers, raising concerns that it could lose business as long-running government contracts are renegotiated.

Source: Washington Post

I think counterpoint is simple and Andrew Carnegie said it best:

"Don’t put all your eggs in one basket" is all wrong. I tell you "put all your eggs in one basket, and then watch that basket."

We're talking about government after government, excluding China and Russia. And, we're also concerned with 6,000 of the largest companies in the world. There is indeed significant room to grow.

Wrap Up: Central Operating System of Organizations

PLTR does face commercial competition but it's largely trivial. For the most part, it's a non-issue because of features and functionality, but also market focus, delivery and intentions. PLTR is playing a different game. PLTR also has exceptional inertia, plus aggressive long-term goals, in a huge swim lane.

Their real competition isn't found out in the market but instead right inside the government itself - and commercial organizations - plus their organizational engineers and vested interests. But, PLTR will continue to steamroll, because it provides an entire business stack by way of Gotham and Foundry, powered by Apollo. In short, it's way faster and way more economical, and leadership eventually embraces the value proposition. Perhaps it's a true paradigm shift.

I do not see any competitor posing an existential risk to PLTR. Nonetheless, per PLTR's S-1, there are plenty of risks and threats:

- Growing expenses

- Slowing revenue growth

- Long sales cycles

- Customer concentration

- Fluctuating business results

- Potential seasonality

- Slowing pace of innovation

- Hacking and security breaches

- Uncontrollable positive growth

- Inability to find and retain more talent

- Negative news and social media

So, yes, there are many risks. But, the players in this market all face these same risks. Interestingly, I don't see much direct competition. However, these risks do highlight another future enemy: PLTR itself. The business must not relax or let up, or give way at this point. Complacency cannot be allowed.

In my opinion, and based on the research provided, it appears PLTR has something like a monopoly, or at least a wide moat. It adds to my bullish thesis. And, I continue holding my PLTR common shares, and PLTR LEAPS.

Disclosure: I am/we are long PLTR, GD. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.