Ichor Holdings, Ltd.: Just Getting Started

WFE market prospects have improved and ICHR is taking share at a rapid pace.

Trade-related risks will likely dim under the Biden regime.

ICHR's GM weakness has bottomed and the share is trading at a discount to its historical average.

The manufacture of chips is rapidly becoming more advanced, and the number of fabrication layers is increasing. Semiconductor equipment plays a pivotal role in enabling the next generation of chips, providing new opportunities for capital-equipment manufacturers.

- McKinsey & Co.

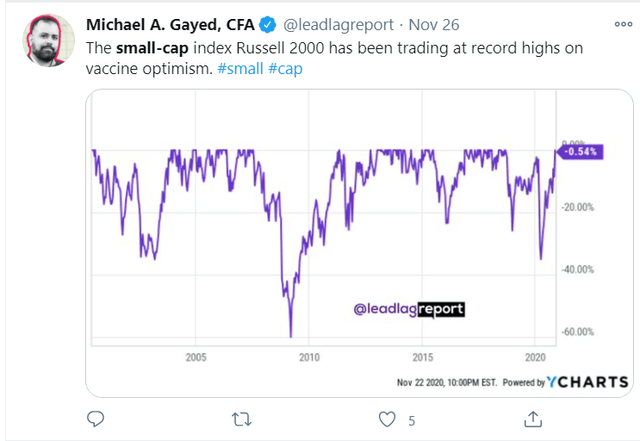

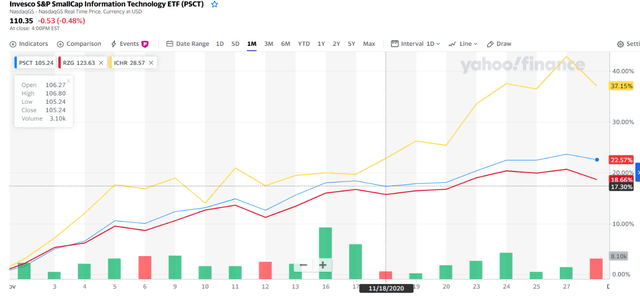

If you've been following my commentary in The Lead-Lag Report, you'd note that over the last few weeks, I've been highlighting the underlying inter-market risk-on conditions that have been supporting the broad markets; this has been keenly reflected in the effervescence of small caps which have been coasting along at a fine pace. My article today focuses on Ichor Holdings, Ltd. (ICHR) - a small-cap player that has had an impressive month, providing double the return of its peers in the small-cap pure growth space (RZG) as well as the small-cap IT space (PSCT).

ICHR is involved in the semiconductor capital equipment market, it provides gas and delivery systems and subsystems (known as fluid delivery systems/subsystems) used in the manufacturing process of semiconductor devices. OEM semiconductor players tend to outsource these services to companies such as ICHR, as it is a very critical aspect of the overall semi manufacturing process, which has become more even complex and intricate over the years; any material flaw or malfunction in the fluid delivery process can dampen yields and increase the likelihood of future manufacturing defects. This calls for more precise control of the processes and more fluid delivery content per system, which players such as ICHR specialize in.

In this article, I will look to cover some of the key factors that have been instrumental in reviving recent investor interest in the stock.

Pickup in the semiconductor WFE industry

On account of weak demand conditions, 2019 was quite a challenging year for players in the semiconductor capital equipment space; for instance, as per Gartner's estimates, the semi WFE (Wafer Fabrication Equipment) market in 2019 declined by ~6%. In 2020, this market has demonstrated a degree of resilience with momentum picking up sequentially. In the recent Q3 earnings call, ICHR management mentioned that they expect the WFE industry to finish 2020 with a c.15% annual growth, with c.5-10% growth expected to continue in 2021. Currently, most of the growth in the WFE market is coming from the etch and deposition aspect of the market - areas where ICHR is relatively strong.

Market share gains and favorable outlook

In addition to the growing market, ICHR has also been able to take share from its competitors this year and this has resulted in a very strong revenue growth performance. In Q3, revenue rose by 47% annually taking the 9M revenue growth to 55% YoY. So far, the increased outsourcing of gas panels has been instrumental in driving growth in 2020, but, going forward, the company is looking to their components and precision machining business to also start contributing. The management also highlighted a recent pickup in memory-spending which will likely continue into 2021 and serve as another tailwind. All in all, ICHR has guided to a revenue growth range of between $220m and $245m for Q4; this would imply an FY20 annual revenue growth of 45% and also represents significant market share progress as the overall WFE industry is expected to grow at c.15% for FY20. The management also highlighted that they expect this strong demand environment to continue in H1-21.

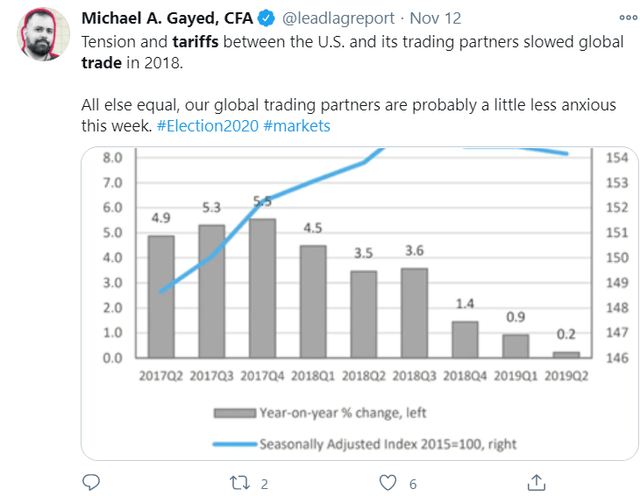

Potentially lower trade-related risks for ICHR's key clients and increased opportunities in international locations

Client concentration is something that one is likely to see with most small-cap companies and with ICHR, this is something that is very pronounced. As per the annual report, about 85% of ICHR's group sales is tied to two customers - Lam Research (LRCX) and Applied Materials (AMAT), so any headwinds related to these two clients tend to weigh on ICHR's shares. Under the Trump regime, steep tariffs have been a key feature and the general trade environment with East-Asian nations has been tense and uncertain. The Trump government has been attempting to blacklist Chinese semi player - SMIC and this will weigh heavily on LRCX and AMAT's prospects as they are key suppliers whose prospects are keenly tied to semiconductor CAPEX spending in the Asian regions. However, going forward, I expect these trade and tariff-related risks to be less troublesome under the Biden regime and a more conciliatory environment would be good for ICHR's key clients.

In addition to that, I was also quite enthused to learn of ICHR's increased penetration in the chemical and liquid delivery Korean and Japanese markets. In mid-2018, ICHR had entered the Korean market and has since been building adding capacity and clients there. For ICHR to see further expansion in its valuation multiple, it will need to reduce its client concentration and also widen its geographic diversification. In the latest earnings call, management mentioned that Korea and Japan would be key contributors in 2021, with Japan expected to contribute more in H2-21 (ICHR is currently in discussion with 3-4 Japanese OEMs).

GM weakness has likely bottomed out, although some COVID-19 risks remain

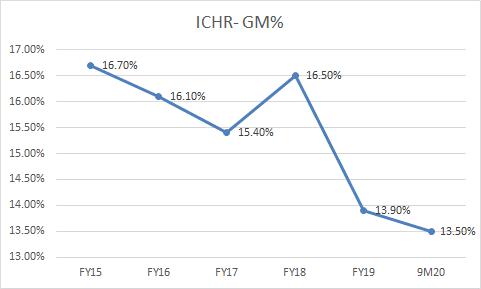

The trajectory of ICHR's GM (gross profit margins) is something that investors keep a close eye on, and any positive developments here have the potential to aid ICHR's valuation multiple, as the GM has been sliding for a few years.

Source: YCharts

In H1, ICHR has had to deal with a range of GM related headwinds such as increased material sourcing costs, increased freight costs, and higher COVID-19 related costs tied to the health and safety of their global workforce. The first two headwinds have dimmed as we've progressed through 2020, but COVID-19 related costs have continued to impact the business (albeit at a slower pace). In Q1 and Q2, the COVID-19 impact on GMs was -1%, but this has since improved to -0.5% in Q3. Management believes this headwind will continue to be in place for the start of 2021. Another contributing factor is the mix of products; as mentioned previously, ICHR has been selling a lot of gas panels this year and this has brought down the overall GM mix (gas panel margins tend to be lower than group average). Regardless, I believe we may have seen the worst in the GM fall and continue to expect the GM to trend up in the quarters ahead, as the sales mix will likely shift towards more component and precision machine products which are higher margin than gas panels. In addition to that, they are also in the midst of carrying out an ongoing cost reduction program that should continue to aid the GM. Worth noting that they've guided to a 50bps sequential improvement in the Q4 margin and this would be in keeping with the general trend of improving quarterly progress in the GMs.

Conclusion

Investors looking for an interesting small-cap story may consider looking at ICHR. As I mentioned recently in The Lead-Lag Report, December has traditionally served as a month with low volatility and a generally optimistic stance. This should continue to aid the prospects of small caps such as ICHR that have gained c.40% over the last month on account of some of the tailwinds I've highlighted above. Despite this recent surge, the valuations of the stock remain attractive. As per YCharts estimates, the stock currently trades at a forward P/E of 13.4x, which represents a 13% discount to its long-term multiple of over 15x. ICHR is also on course to deliver superior earnings growth, but the current forward PEG (Price to Earnings growth) multiple doesn't reflect this. As per YCharts estimates, the company is on course to report an FY21 EPS of 3.076 which would imply FY21 earnings growth of c.30%, yet the stock currently trades at a discounted forward PEG of only 0.18x, well below its long-term average of 0.50x.

Like this article? Don't forget to click the Follow button above.

Anticipate Crashes, Corrections, and Bear Markets

Anticipate Crashes, Corrections, and Bear Markets

Sometimes, you might not realize your biggest portfolio risks until it's too late.

That's why it's important to pay attention to the right market data, analysis, and insights on a daily basis. Being a passive investor puts you at unnecessary risk. When you stay informed on key signals and indicators, you'll take control of your financial future.

My award-winning market research gives you everything you need to know each day, so you can be ready to act when it matters most.

Click here to gain access and try the Lead-Lag Report FREE for 14 days.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This writing is for informational purposes only and Lead-Lag Publishing, LLC undertakes no obligation to update this article even if the opinions expressed change. It does not constitute an offer to sell, a solicitation to buy, or a recommendation regarding any securities transaction. It also does not offer to provide advisory or other services in any jurisdiction. The information contained in this writing should not be construed as financial or investment advice on any subject matter. Lead-Lag Publishing, LLC expressly disclaims all liability in respect to actions taken based on any or all of the information on this writing.