LiqTech International Inc.: Pounding The Table As O&G Takes Shape Plus Black Carbon And NOx Opportunities Are Ahead Of Plan

LiqTech International is in the middle stages of supplying ceramic silicon carbide filters to closed-loop scrubber manufacturers for the IMO 2020 regulatory implementation cycle, which is expected to peak in 2024.

Large shipowners are returning to the market ordering and installing scrubbers, taking a longer-term view of the opportunity.

120+ ports worldwide have banned the use of open-loop scrubbers. Additionally, the European Parliament's environmental committee recently voted to support an open-loop ban, potentially adding 4000 ships to LiqTech International’s TAM.

The company is entering the O&G filtration market through a JV in the Middle East. The O&G market provides longer-duration revenue opportunities and higher ASPs per job, plus 49% of the profits from the JV.

The recent announcement of an earlier-than-anticipated entry into the black carbon and NOx reduction markets provides another large and exciting market opportunity for this relatively small company.

Our regular readers will know that at 1035 Capital, we focus on a catalyst-driven investment philosophy. We have written on LiqTech International (LIQT) twice in the past, and will use this article to update and refine our previous thesis. For readers interested in a more detailed background of the company and its end-markets, you can read our previous articles on LIQT here and here. At 1035, each company that we purchase must have a catalyst to improve sales growth, margin levels, or asset efficiency. In the case of LIQT, we believe we have found a rare triple threat, i.e., a company that can improve all three of these metrics concurrently. Throughout this article, we will highlight and elaborate on what we believe to be the most significant catalysts for LIQT going forward.

One method we employ at 1035 Capital to discover new names is thematic investing, and this is how we originally became interested in LIQT. One of the investment themes we followed going into 2020 was the new regulation, IMO 2020, which is a newer regulation that lowers the sulfur content of marine fuel. Unfortunately, COVID put a significant dampener on much of the enthusiasm around international shipping and trade for much of 2020.

While this scenario is clearly negative for those companies that were set to benefit from IMO 2020, like LIQT, there are green shoots in burgeoning demand from Asia, as well as the implications of now having multiple COVID-19 vaccines ready for the market. In the case of LIQT, we believe investors are myopically focused on the previously deteriorated outlook for marine scrubbers due to COVID-19’s impact on international trade. Meanwhile, they are overlooking some other equally or even more important factors for the company. For example, they are discounting LIQT’s significant prospects in converting open-loop scrubbers to closed-loop systems resulting from increasing international pressure to ban the use of open-loop scrubbers. Additionally, investors are overlooking the recently announced significant opportunities in black carbon and NOx reduction, not to mention the enormous opportunity unfolding currently in oil and gas. Needless to say, there is no shortage of shots on goal for LIQT, and we believe the company is well-positioned to take advantage of these opportunities with its recently upgraded and expanded manufacturing base.

Scrubber Primer

Before we go too much further into the new markets and the associated opportunities, let’s step back and look at some of the moving pieces in the marine scrubber market. Starting with the types of marine scrubber units, there are two main styles of scrubber: open and closed-loop. The biggest difference between the two is that open-loop scrubbers discharge their waste product into the ocean, whereas closed-loop scrubbers store the waste onboard and discharge it at a port to be handled in an environmentally friendly manner. The intent of IMO 2020 was to reduce the amount of sulfur emissions being released into the atmosphere. Open-loop scrubbers dump the waste from the scrubbing process directly into the oceans, which contravenes and undermines the spirit of the regulation. For this reason, there is considerable interest in a worldwide open-loop scrubber ban among key stakeholders.

LIQT manufactures silicon carbide filters for closed-loop scrubbers as well as open to closed-loop conversion kit systems. The company is the market leader in closed-loop silicon carbide filters for IMO 2020-compliant marine scrubbers. In the past, management has suggested the company has more than 50% market share in the EU and probably closer to 25-33% in Asia. Based on this market share, LIQT is well-positioned to benefit from increased environmental regulation in the shipping industry broadly, but more specifically, the emerging shift toward closed-loop scrubbers and away from open-loop is especially helpful for the company.

On the recent Q3 20 earnings call, CEO Sune Mathiesen commented that:

“It's important to understand that we continue to benefit from a macro transition by vessels away from open-loop scrubbers and towards closed loops scrubbers, which are enabled by the company's filtration technology.

This transition to close loop systems may accelerate with the potential of a global ban on open-loop systems that are currently being discussed. For those that have not yet seen it, a majority of the European Parliament's environmental committee recently voted to outfields and ban open-loop scrubbers. We believe that this will further drive the transition towards closed-loop scrubbers and ultimately provide an opportunity to convert some 4000 already installed open scrubbers.”

We believe that the broader trend toward increased environmental regulations, especially in international shipping, can be seen in the earlier-than-expected initial orders out of China for black carbon and NOx reduction. Separately, but also important for LIQT, is that we are also beginning to hear of shipowners who are complaining of substandard parts, and poor installations from some of the newer and less reputable Asian scrubber and filter suppliers. Over time, this could shift more market share toward the European market, where LIQT has traditionally enjoyed a higher market share than in Asia. Combine this with the new markets in oil and gas, black carbon and NOx reduction, industrial membranes, and power plants, which we will discuss shortly, and we think the stock can more than double over the next 12-18 months.

Building a Stronger Foundation

In our experience, we have found that asset efficiency is a very important driver of earnings and, ultimately, stock prices over time. LIQT’s asset efficiency has been uneven in the last 18 months due to a slowdown in demand, combined with an unexpected furnace failure in Q319. The furnace failure led to a significant reduction in 2H19 production, revenues, and thus, asset efficiency. The shortfall led to a steep decline in the stock price, which was further exacerbated by the onset of COVID-19. What was lost in all the doom and gloom at that time was the fact that LIQT management had already planned to retire all four of its original furnaces and to replace them with new, more-efficient versions that have roughly 3 times the capacity.

As a reminder, in early March 2020, many ship owners wanted to delay drydocking and scrubber retrofits to capture the very high, but fleeting day-rates caused by the COVID-19-induced economic shutdown. While counterintuitive, the significant demand shifts brought on by COVID-19, and resulting shipping price increases, naturally deferred scrubber installations. While certainly not a good thing at the time, the deferrals allowed LIQT to deal with its furnace issues and put the company on an even better foundation. While the market experienced significant disruption early in 2020, LIQT was able to fulfill customer demand and continue to upgrade its manufacturing capacity. Additionally, during COVID-19, management announced the closure of its manufacturing plant in the US to lower operating costs in order to help the company through the pandemic. The decision was made easier now that the company has expanded capacity in its Denmark facility. While an unfortunate outcome for the workers in the US, the plant closure removes unneeded overhead, creating a leaner footprint and providing for better operating leverage on future revenue growth.

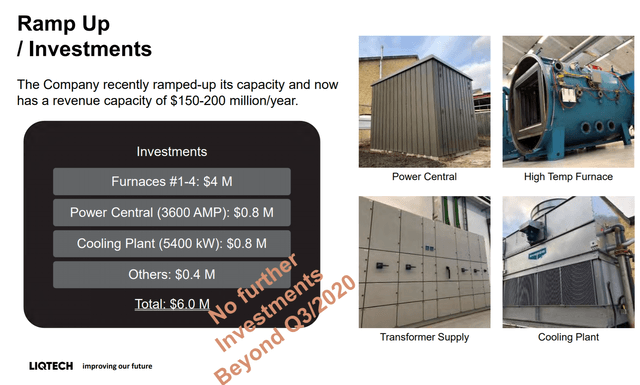

With the new furnaces now installed, it positions the company well to drive new record revenues as well as margins and improved asset efficiency over time. As we mentioned earlier, our research indicates a combination of accelerating growth, improving margins and asset efficiency can lead to powerful stock moves. The slide below from LIQT's most recent investor presentation highlights that with the new furnaces in place, the company now has a revenue-generating capacity of $150-200 million/year, with limited additional cap-ex required to attain this.

(Source: LIQT October 2020 Investor Presentation)

We believe the new capacity positions the company well to support a return of scrubber demand plus additional demand from the emerging new markets. It is also worth noting that LIQT also has options, and the space, to add two additional new high-capacity furnaces, if it chooses to exercise that. You may be asking what good is all that extra capacity for a company expected to generate $23 million in revenue in 2020. This is a fair question, and the answer lies the macro shifts toward closed-loop scrubbers, large shipping companies taking a longer-term view of the scrubber market and the company’s accelerating expansion into new markets. Before we dive into the new markets, let’s first round out the discussion of IMO 2020 and marine scrubbers by digging into the conversion kit opportunity and a few other noteworthy items in the scrubber business.

Scrubber Market Opportunities

Despite the near-term disruption from COVID-19 which caused demand for shipping to fall precipitously, the IMO 2020 regulation remains a significant opportunity for LIQT. Our research indicates that 2024 is likely to be the peak year for IMO 2020 compliant scrubber installations. At the beginning of 2020, management expected more orders for scrubbers this year than in 2019, which, given COVID-19, is probably no longer a valid assumption at this point. Nonetheless, as the spread between high- and low-sulphur fuel normalizes and vaccines are distributed and global economies reopen, scrubbers will again become more attractive to ship owners. Additionally, as mentioned earlier, we are seeing signs that the bigger, more well-capitalized shipping companies are returning to their previous scrubber installation plans, taking an optimistic longer-term view of the opportunity, and looking past the near-term market disruption.

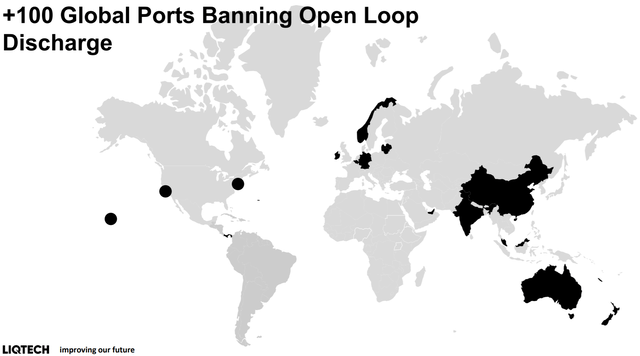

(Source: LIQT October 2020 Investor Presentation)

The global regulatory environment is shifting in LIQT’s favor, as shown in the slide above, with more than 100 ports around the world having already banned the use of open-loop scrubbers. CEO Sune highlighted on the Q3 earnings call that the majority of the European Parliament’s environmental committee recently voted to implement a ban on open-loop scrubbers. Combined, these are indicators of movement toward a worldwide ban, which many in the industry expect soon, perhaps even within the next 12 months. This macro backdrop should continue to support increasing interest in closed-loop scrubbers as well as conversion kits.

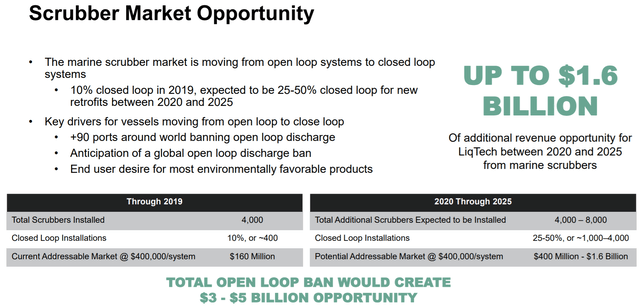

As shown in the slide below, today there are roughly 4,000 ships with open-loop scrubbers installed or on order, compared to only roughly 1,000 total closed-loop scrubbers installed to date. As a result of these new restrictions, closed-loop scrubbers, and/or scrubber conversion kits are becoming more attractive to ship owners. Currently, the closed-loop penetration on greenfield installs is approaching 50% from as low as 15-20% penetration just 2 years ago. The increased international pushback against open-loop scrubbers is benefiting LIQT by moving a larger portion of the scrubber TAM into its opportunity set, providing a significant growth opportunity despite COVID-19-related disruptions, as highlighted in the slide below.

(Source: LIQT October 2020 Investor Presentation)

LIQT’s recently announced open- to closed-loop scrubber conversion kit is meant to address the burgeoning conversion opportunity for the company as more shipowners look at ways to salvage their initial investment in open-loop scrubbers. It is also important to understand that all of the open-loop scrubbers on ships today were installed within the last few years. This means that many of the shipowners are open to an incremental $500k investment to convert over to a closed-loop system just to maintain the value of the initial investment, rather than scrap the millions they have already spent on an open-loop scrubber. LIQT’s conversion kit comes with a roughly $50k higher ASP than its greenfield closed-loop product, which has an average ASP to LIQT of roughly $450,000. The higher ASP, combined with a significantly larger market size, provides an attractive $3-5 billion TAM opportunity in open-loop conversion kits, plus another $1.6 billion remaining TAM in greenfield scrubber installations. All of this in a portion of the market investors appear to think is dead.

Shifting gears to the margin front for marine scrubbers, management has not rested on its sales success within the marine market and has been proactive in looking at ways to improve margins. LIQT has been busy optimizing its scrubber product, which is driving higher margins on its newer models through intelligent insourcing and improved manufacturing efficiency. With the launch of the Mark VII product, the margins of future scrubber installations should exceed 20% EBITDA, driving an accelerating earnings growth story for this relatively unknown industrial company. Given the multiple new end-markets and opportunities, we anticipate that LIQT can maintain accelerating sales and earnings growth for the next few years.

Earlier, we touched on the currently narrow high-to-low sulfur fuel spread driven by COVID-19 slowing near-term demand for scrubbers, which is a headwind for the company. However, we want to convey our expectation that the spread, and thus the attractiveness of scrubber installations, should revert and widen over time. To inform our opinion, we looked at some comments from management teams of companies installing the product. Firstly, our thesis that scrubbers remain attractive has thus far been supported by LIQT management’s claim that they have seen delays in installations but not cancelations in orders to date. Additionally, Scorpio Tankers (STNG), which is one of the bigger public proponents of scrubbers, has continued to support the intermediate- to long-term value of scrubber installations on their ships. On STNG’s last earnings call, it commented that even at these low spreads, which the company expects to normalize in the next 6-12 months, it is saving $1000-2000 per day on scrubber equipped vessels.

Furthermore, Nick Confuorto, COO of CR Ocean Engineering, recently commented that he expects negative conditions for scrubbers are temporary and that oil refiners won’t keep selling low-sulfur fuel at rock-bottom prices as they have during COVID-19. The implicit comment there is that the high- to low-sulfur spread will widen and improve the payback times, and thus, attractiveness of scrubber installations. We believe, this phenomenon will play out as the market becomes comfortable with the idea that the economy is not likely to shut down again due to COVID-19.

Furthermore, on LIQT's Q3 earnings call, Sune Mathiesen said, “The slowdown that started in March and is improving over the last quarter, and we are seeing increased market activity.”

When considered in light of the macro tailwinds of the market shifting toward closed-loop scrubbers as well as the recent complaints regarding the quality of competitive product offerings from Asia, we think investors are far too bearish on the marine scrubber opportunity for LIQT. Beyond sulfur dioxide emissions, there is also a broader trend toward increasing environmental regulation in the international shipping segment, which is providing the company with additional new opportunities in black carbon and NOx reduction.

While the IMO 2020 scrubber market is an exciting opportunity for LIQT, it is a finite market that has unfortunately endured significant disruption from COVID-19, all of which is well-known and discussed above. However, there is currently a significant misunderstanding of the duration and growth within the scrubber market. In addition to this, where things get really exciting for LIQT is the part of the story most investors are overlooking entirely: the newly emerging growth markets the company is pursuing.

New Market Opportunities: Oil and Gas

The recently announced development, on the Q2 earnings call, of the formation of a water JV with a major E&C company in the Middle East is a big step for LIQT. The JV will develop and run water filtration plants for O&G companies in a 3-country region. Demand from these companies is being driven by water preservation and remediation from countries where freshwater is quite scarce. Additionally, our research indicates that LIQT’s proprietary filter system allows the company to filter a barrel of water at about half the cost companies are currently paying to truck their used water away, providing a strong economic case for producers to adopt LIQT’s technology. This JV, which LIQT will own 49% of, is a very interesting development for the company because it provides two opportunities for it to diversify its revenue stream: through the sale of O&G filters, as well as the revenue generated from operating the wastewater recycling businesses.

We believe the market is overlooking the company’s significant potential in oil and gas water filtration. This opportunity has the potential to provide several significant catalysts over the next 12 months in the form of large contract announcements, revenue, and is arguably the largest opportunity for the company over the next few years - even bigger than IMO 2020 itself. The success of LIQT’s marine scrubber filters and some recent regulatory changes in the Middle East are the catalysts driving increased interest in the company’s on-site wastewater filtration technology, which is used to filter and reuse produced water rather than trucking it to a wastewater injection well to put the produced water into underground storage.

(Source: LIQT October 2020 Investor Presentation)

LIQT has spent more than 5 years refining its water filtration technology for the oil and gas markets. For reference, on average, each barrel of oil pumped in the Middle East can produce up to 10 barrels of dirty water, as shown on the slide above. With such a significant amount of produced water being created, it provides an enormous opportunity to filter and reuse this water. According to our research, the oil and gas TAM in just the 3 initial countries the JV operates in is well north of $10 billion, with the worldwide opportunity perhaps even 10x larger.

Our research and management's increasing confidence of a significant oil and gas win in the next few months indicate that O&G revenues are expected to outpace scrubber installation revenue in 2021. Additionally, we expect the first mega project announcement for this market within the next 12-15 months. For reference, the company considers a mega project one that requires more than $50 million of LIQT filter content over multiple years. Combined, these two events should help investors understand the titanic shift in opportunity set occurring below the surface of LIQT.

Digging a little deeper into this opportunity, our research indicates that the LIQT revenue content in an O&G project is in the mid-single digit millions per project, on average, compared to less than $500K for a closed-loop marine scrubber install. As a result of a much bigger TAM and significantly higher ASPs, the revenue opportunity is significantly larger than any of the other end-markets the company is currently exploring. Additionally, the company will own 49% of the water JV that was developed to build and operate water filtration plants for this market. This is an interesting scenario for the company, because it locks up the initial customer for LIQT’s O&G filter technology, one that LIQT is not exclusive to, and provides them a long-term earnings stream different from the manufacturing of filters, diversifying the business. In several conversations with management, they have reiterated that the potential profits on the water JV are gravy, because the company will be manufacturing and selling filters at standard commercial prices to the JV. In the minds of management, the sale of the filters is LIQT’s primary goal with this JV, and the rest is a bonus opportunity.

As mentioned above, the details on the water JV are still sparse, but looking across the spectrum of other water players, including WTTR, CWCO, and PCYO, we see EBITDA margins in the industry ranging from the high teens to mid-20’s percent. Until we get more information on the business model and profitability of LIQT’s JV, we will not incorporate it into our model. However, we wanted to highlight for readers that this is an additional potential earnings stream for the company going forward. The more important part of this JV, in our opinion, is the fact it will diversify earnings away from the manufacturing of filters for marine scrubbers.

New Market Opportunities: Black Carbon, NOx, Power Plants, Industrial Filters, and Membranes - Oh my!

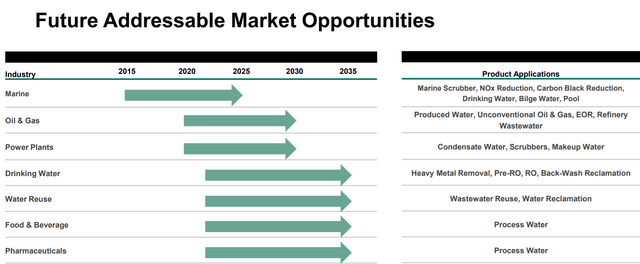

LIQT is currently exploring opportunities in additional new-end markets beyond O&G, such as black carbon, NOx reduction, power plants, industrial filtration, and so on, as shown in the slide below. All of these opportunities are significant in size relative to the size of LIQT, with TAMs in the billions for each of the new markets. While NOx and black carbon were anticipated to be mid-term opportunities the last time we wrote on the company, since then, management has begun receiving orders from their largest customers in Asia for black carbon reduction technology, accelerating LIQT’s entrance into this market.

(Source: LIQT October 2020 Investor Presentation)

On LIQT’s Q3 earnings call, Sune Mathiesen said that “the black carbon and NOx reduction products... are a very exciting opportunity, with the market potential being much, much bigger than any market we've ever worked in. And let's take a step back and help you understand how this opportunity came to be, which is significantly ahead of our internal training and expectations.”

The opportunity in black carbon and NOx reduction is based on LIQT's Diesel Particulate Filter (“DPF”) technology, which the company has been manufacturing and selling for use in diesel trucks for almost 20 years. DPF technology was created to remove particulates from on-road diesel trucks. Currently, the majority of the market is in Asia, and in 2019, the company sold about $5.7 million of DPF filters. Governments, particularly China, are now turning their focus to the reduction of NOx and black carbon emissions from diesel engines in other industries, such as marine shipping. While we have anticipated this shift for some time, the increasing requests from LIQT’s Asian customers show the market is unfolding faster than we had anticipated. We believe this will ultimately lead to a set of IMO regulations similar to what we saw for sulfur dioxide reduction from IMO 2020 at some point in the future.

Discussing this new market opportunity, the CEO went on to comment that the company has completed engineering work and has now entered into commercial negotiations regarding DPF technology for the marine market with numerous Asia-based clients. Importantly, one of the entities LIQT is currently in negotiations with is its largest customer in marine scrubbers. This company is based in China, and approached LIQT about working together to leverage their relationships in the region and providing LIQT’s DPF capabilities to their customers.

To help size this opportunity, our research indicated that one average-sized marine ship would use an equivalent of 500 on-road truck DPF filters, showing how much larger the average job is for the marine market versus the traditional DPF business. Additionally, on the Q3 call, the CEO highlighted that there are more than 125,000 inland vessels in China that would also need access to LIQT’s DPF technology, in addition to the country’s large ocean-going marine fleet.

“Over the past couple of months, market conversations have significantly picked up steam, and we are now in advanced negotiations with customers to deliver on systems. Further having worked with our partners in China for a number of years now, in the marine industry, we are confident that we are in an ideal position to become one of the market leaders in this emerging industry, leveraging our 20 years' experience from the DPF industry, and the recent success in the marine scrubber market.

And let me just be clear about something I said at the beginning, the market potential for Black Carbon and NOx reduction is much, much bigger than any market we have worked in. The opportunity has come much quicker than we originally expected and I look forward to being able to share more exciting news on this front in the New Year.”

- LIQT Q3 earnings call

While the opportunities in NOx and black carbon reduction are coming in ahead of plans, management has reiterated that any successes in this market do not take anything away from the progress and opportunities in O&G. We look forward to additional announcements in this market to help us better incorporate this opportunity into our estimates. We will now shift gears to some of the more intermediate-term opportunities.

Starting with the power plant opportunity, LIQT is beginning in Europe, where there are more than 3000 power plants that are potential customers for the company’s silicon carbide filters. Power plants are expected to have an average revenue opportunity of around $750k, which is about 65% higher than the closed-loop scrubber revenue opportunity per unit and about 50% more than the open- to closed-loop conversion kit. Therefore, the EU power plant equates to a European TAM of more than $2 billion. On the Q2 20 earnings call, management commented that many of these power plants in the EU are owned by the government. As such, with COVID-19, the projects on this front have slowed recently, but none have been canceled. While management previously expected meaningful revenue from the power plant market in 2020 and acceleration going forward, it now appears the ramp may be pushed out. Thankfully, very little to none of this was included in sell-side earnings estimates, and it remains an upside opportunity.

During the same Q2 call, LIQT also announced the availability of a standalone filter press that can be used for industrial purposes. We believe that this product launch and the concurrent announcement regarding the development of a second-generation filter with a smaller pore size signals the company's entrance into the pharmaceutical and beverage filtration markets. While these are large markets, they have significant and well-entrenched competition. As a result, these are large and real opportunities, but they are likely to have much longer sales cycles than some of the other new markets the company is pursuing.

Valuation Model

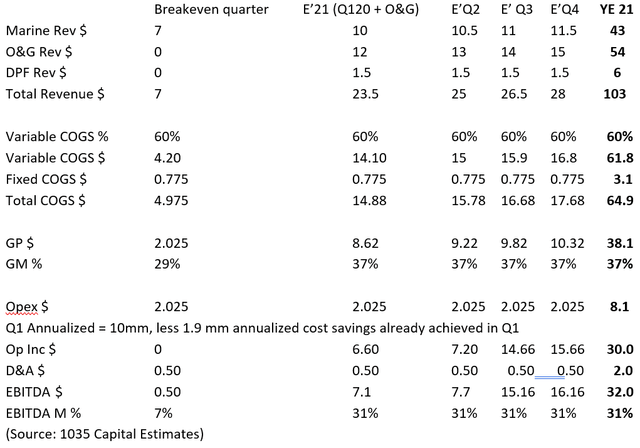

Using Sune’s comments from the 1Q and 2Q earnings calls, we developed the model below, based on the assumption that LIQT breaks even with a quarterly revenue run rate of $7 million, the contribution margins from newer products, and opex savings of nearly $10 million announced on the 1Q call. We also added the comment that management expects oil and gas revenue to be larger than marine revenue in '21, as guided by Sune. However, we hold DPF sales relatively flat despite this new emerging opportunity, providing additional upside to our estimates. From these assumptions, we lay out the model and valuations tables below.

Estimate of LIQT Earnings Power (all numbers in millions)

Valuation - Sensitivity Analysis

FY 21 EV/EBITDA

2.5x = ($32M EBITDA x 2.5)/19.7M shares outstanding = $4.06

5x = ($32M EBITDA x 5)/19.7M shares outstanding = $8.12

7.5x = ($32M EBITDA x 7.5)/19.7M shares outstanding = $12.18

10x = ($32M EBITDA x 10)/19.7M shares outstanding = $16.25

12.5x = ($32M EBITDA x 12.5)/19.7M shares outstanding = $20.30

15x = ($32M EBITDA x 15)/19.7M shares outstanding = $24.37

FY 21 P/Sales

1.5x = ($103M Sales x 1.5)/19.7M shares outstanding = $7.84

2x = ($103M Sales x 2.0)/19.7M shares outstanding = $10.46

2.5x = ($103M Sales x 2.5)/19.7M shares outstanding = $13.07

3x = ($103M Sales x 3.0)/19.7M shares outstanding = $15.69

3.5x = ($103M Sales x 3.5)/19.7M shares outstanding = $18.30

4.0x = ($103M Sales x 4.0)/19.7M shares outstanding = $20.91

Conclusion

In our opinion, the near- and longer-term earnings opportunities provided by LIQT’s new end-markets, as well as a locked-in customer for the oil and gas filters, should help alleviate investors' concerns regarding the longevity of the scrubber opportunity. We believe this concern has kept investors from applying a higher multiple to the shares, especially in the wake of COVID-19.

We expect to learn much more about oil and gas, black carbon, NOx, industrial/new filters, as well as the power plant opportunities in the company's coming quarters, but want to reiterate that all of these new markets have higher ASPs, margins, and provide end-market diversification as well as longer-duration revenue opportunities for the company.

We believe these factors will all be viewed positively by the market, leading to multiple expansion as well as accelerating earnings growth. Keep an eye out for the first oil and gas project announcement, which we anticipate in early 2021, and then a larger second order with a major customer in mid-2021. Additionally, keep an eye out for more color on opportunities for black carbon and NOx reduction in China as we enter the new year. Together, we think these announcements will be game-changing for LIQT and its investors, highlighting the bright future ahead for the company. We are currently estimating a 1-year target price of $15 for LIQT, or 100% of today’s price of about $7.50 at the time of writing.

If you enjoyed this article and would like to be alerted of new publications, please follow us by going to the top of the page and clicking the "Follow" button or click here.

Disclosure: I am/we are long LIQT. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Additional Disclosure: 1035 Capital Management, LLC is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Upon request, the advisor will provide a list of all recommendations made during the past twelve months. Past performance is not indicative of future results.