Jones Lang LaSalle: Continue To Wait And Watch

Jones Lang LaSalle suspended dividends to shareholders early in 2020, in response to the impact of the COVID-19 pandemic on its operations.

The company is long established and should weather this storm.

It's believed advisable to wait and watch how this company performs for a further period ahead before considering any share purchases.

Investment Thesis

I last published an article on Jones Lang LaSalle (JLL) back on July 27, 2020, "Jones Lang LaSalle: Wait And Watch". Since then, two quarters of earnings have come in, one missing estimates, and the other strongly beating estimates. The share price has increased substantially - $98.39 at time of the July 27 article and currently $135.21. Dividends were suspended early in 2020 so no dividend payments have been made in the intervening period. Since my July article, analysts' consensus EPS estimates for JLL for 2022 have slipped from $12.68 to $11.98. Analysts' low EPS estimates have reduced from $11.23 to $10.87. The strong Q3-2020 result is tempered by the CEO's comments on the Q3-2020 earnings call,

Overall, third quarter results were at the upper end of our expectations due in part to favorable onetime items that are not expected to benefit future quarters to the same extent.

Also, despite being above expectations, Q3-2020 non-GAAP EPS of $2.99 was still well down on the $3.52 for Q3-2019. The muted outlook is further reinforced by the fact consensus EPS estimate for 2022 of $11.98 is well below FY2019 reported non-GAAP EPS estimate of $13.70. Returns from investment in JLL shares over the last six years have mostly been very poor. Investors clearly paid too much over the last six years, and the shares still appear more than fully priced at present. A wait and watch approach continues to be appropriate. A detailed analysis of the company's financials and its outlook appears below.

Looking for share market mispricing of stocks

What I'm primarily looking for here are instances of share market mispricing of stocks due to distortions to many of the usual statistics used for screening stocks for buy/hold/sell decisions. The usual metrics do not work when the "E" in P/E is distorted by the impact of COVID-19. And if the P/E ratio is suspect, so too, then, is the PEG ratio similarly affected. I believe the answer is to start with data at the end of 2019, early 2020, pre-COVID-19 and compare to projections out to the end of 2022, when hopefully the impacts of COVID-19 will have largely dissipated. Summarized in Tables 1, 2, and 3 below are the results of compiling and analyzing the data on this basis.

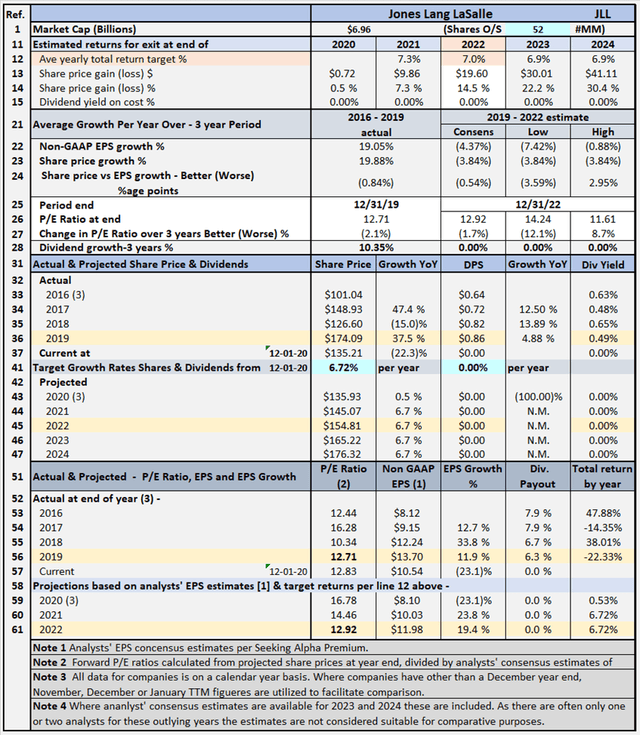

Table 1 - Detailed Financial History And Projections

Table 1 documents historical data from 2016 to 2019, including share prices, P/E ratios, EPS and DPS, and EPS and DPS growth rates. The table also includes estimates out to 2022 for share prices, P/E ratios, EPS and DPS, and EPS and DPS growth rates (note estimates are shown for analysts' EPS estimates out to 2024 where available, but these are considered not as reliable). Table 1 allows modeling for target total rates of return. In the case shown above, the target set for total rate of return is 7% per year through the end of 2022 (see line 12), based on buying at the December 2 closing share price level. The table shows to achieve the 7% return, the required average yearly share price growth rate from December 2, 2020 through December 31, 2022, is 6.72% (line 41). Table 2 below summarizes relevant data flowing from the assumption of a target 7% total return.

Targeting a 7% Return

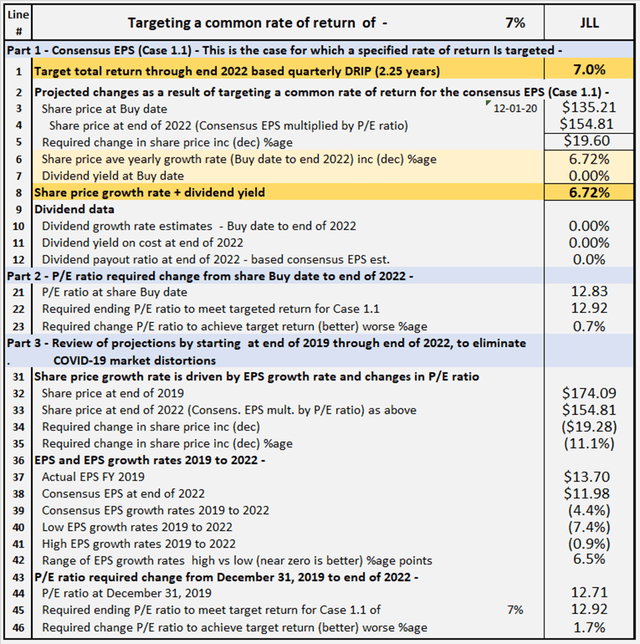

Table 2 - Targeting a 7% return

Table 2 provides comparative data for JLL, assuming share price grows at rates sufficient to provide total rate of return of 7%, from buying at closing share price on December 2, 2020 and holding through end of 2022. All EPS estimates are based on analysts' consensus estimates per SA Premium.

Comments on Table 2 are as follows

Part 1 - Consensus EPS (Case 1.1) (lines 1 to 12)

Part 1 shows the amounts the share price would need to increase to achieve a 7% rate of return through end of 2022. The share price would need to increase from the present $135.21 to $154.81 at end of 2022, for the 7% rate of return to be achieved.

Part 2 - Required change in P/E ratio to achieve Target 7% return (lines 21 to 23)

Part 2 shows the amount the P/E ratio would need to increase or decrease by, from buy date to end of 2022, to achieve the share price level at the end of 2022 necessary to achieve the targeted 7% return. For JLL, the P/E ratio at buy date needs to increase by 0.7% through end of 2022 for the 7% return to be achieved. Being able to achieve a targeted return with very little change in the P/E ratio would normally be regarded as a positive. However, due to the distortions of earnings and sentiment owing to the COVID-19 pandemic, it's difficult to judge whether the change in P/E ratio is a positive or the result of a distorted starting point. To overcome this difficulty, in Part 3, I review the necessary change in P/E ratio from a different, pre-COVID-19 starting point.

Part 3 - Projected change in P/E ratios from 2019 to 2022 (lines 31 to 46)

In Part 3, I start with the share price at December 31, 2019, before the impact of the COVID-19 pandemic on earnings and market sentiment. The end point is projected share price at end of 2022, when it's assumed the market and earnings are no longer materially impacted by the pandemic. For JLL, the share price can decrease by $(19.28) from $174.09 at December 31, 2019 to $154.81 at end of 2022, and as detailed in Part 1, at $154.81, the targeted 7% rate of return would be achieved. For JLL, there are a number of givens in our assumptions. Using these givens, the change in the share price from December 31, 2019 to end of 2022, can be expressed as mathematical formulae as follows:

(A) Change in share price, due to effect of EPS growth rate, equals share price at beginning multiplied by (1 plus average yearly EPS growth rate) to the power of number of years invested.

= $174.09*(1-4.4%)^3 = $152.23

(B) Change in share price due to change in P/E ratio equals share price adjusted for EPS growth rate multiplied by (1 plus/minus percentage change in P/E ratio).

= $152.23*(1+0.7%) = $154.09

The decrease of $21.86 ($174.09 minus $152.23) due to the negative average yearly EPS growth rate is cumulative, and share price will continue to decline; the longer the shares are held and the growth rate continues negative. The increase of $1.86 due to a change in the P/E ratio ($154.09 minus $152.23) has a one-off effect. A continuing high or low P/E ratio has no impact on future share price growth, only a change in P/E ratio affects share price, not the level of P/E ratio.

Next, rather than targeting a specific rate of return, I look at historical P/E ratios to see the potential impact on returns of a reversion to these levels of P/E ratio. First of all, I should explain a little about the Dividend Growth Income+ Club approach to financial analysis of stocks.

Understanding The Dividend Growth Income+ Club Approach

Total Return, Dividends, Share Price

The only way an investor can achieve a positive return on an investment in shares is through receipt of dividends and/or an increase in the share price above the buy price. It follows what really matters in share value assessment is the expected price at which a buyer will be able to exit shares, and expected cash flow from dividends.

Changes in Share Price

Changes in share price are driven by increases or decreases in EPS and changes in P/E ratio. Changes in P/E ratio are driven by investor sentiment toward the stock. Investor sentiment can be influenced by many factors, not necessarily stock-specific.

"Equity Bucket"

Earnings are tipped into the "Equity Bucket" for the benefit of shareholders. It's prudent to check whether distributions out of and other reductions in the "Equity Bucket" balance are benefiting shareholders.

JLL's Projected Returns Based On Select Historical P/E Ratios Through End Of 2022

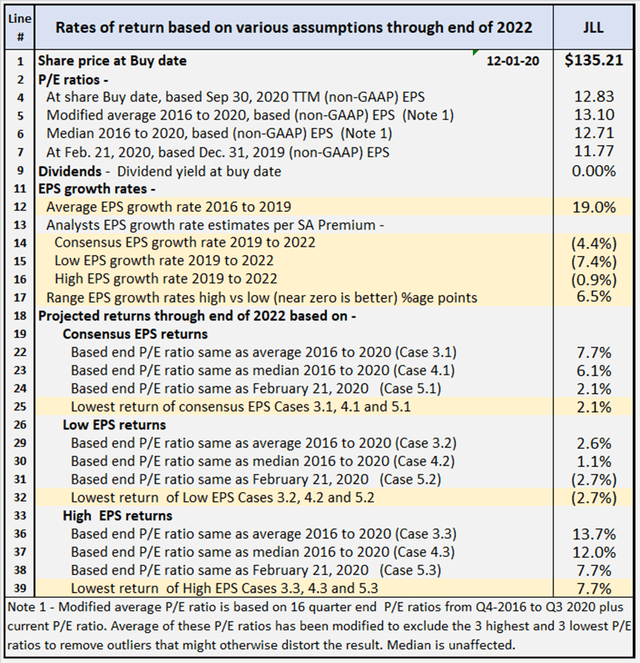

Table 3 below provides additional scenarios projecting potential returns based on select historical P/E ratios and analysts' consensus, low and high EPS estimates per Seeking Alpha Premium through end of 2022.

Table 3 - Summary of relevant projections JLL

Table 3 provides comparative data for buying at closing share price on December 2, 2020 and holding through the end of 2022. There is a total of nine valuation scenarios, comprised of three EPS estimates (consensus, low and high) across three different P/E ratio estimates. Comments on contents of Table 3 follow.

Consensus, low and high EPS estimates

All EPS estimates are based on analysts' consensus, low and high estimates per SA Premium. This is designed to provide a range of valuation estimates ranging from low to most likely, to high based on analysts' assessments. I could generate my own estimates, but these would likely fall within the same range and would not add to the value of the exercise. This is particularly so in respect of well-established businesses such as JLL. I believe the "low" estimates should be considered important. It's prudent to manage risk by knowing the potential worst-case scenarios from whatever cause.

Alternative P/E ratios utilized in scenarios

- The actual P/E ratios at share buy date based on actual non-GAAP EPS for September 30, 2020, TTM.

- A modified average P/E ratio based on 16 quarter-end P/E ratios from Q4 2016 to Q3 2020 plus current P/E ratio in Q4 2020. The average of these P/E ratios has been modified to exclude the three highest and three lowest P/E ratios to remove outliers that might otherwise distort the result.

- A median P/E ratio calculated using the same data set used for calculating the modified average P/E ratio. Of course, the median is the same whether or not the three highest and lowest P/E ratios are excluded.

- The actual P/E ratio at February 21, 2020, share price, based on FY 2019 non-GAAP EPS. The logic here is the market peaked around February 21, 2020, before any significant impact from COVID-19 became apparent, and after FY 2019 results had been released. This makes the P/E ratios at February 21, 2020, reflective of most recent data before distortion of P/E ratios by the impact of the coronavirus pandemic. Note - while valid for most stocks, for JLL, the P/E ratio of 59.78 at Feb. 21, 2020 does not appear representative of a normal level of P/E ratio for this company.

Reliability of EPS estimates (line 17)

Line 17 shows the range between high and low EPS estimates. The wider the range, the greater disagreement there is between the most optimistic and the most pessimistic analysts, which tends to suggest greater uncertainty in the estimates. There are six analysts covering JLL through end of 2022. In my experience, a range of 6.5 percentage points difference in EPS growth estimates among analysts is on the high side, suggesting lower confidence level in the forecasts is warranted.

Projected Returns (lines 18 to 39)

Lines 25, 32 and 39 show, at a range of historical P/E ratio levels, JLL is conservatively indicated to return between negative (2.7)% and 7.7% average per year through the end of 2022. The negative (2.7)% return is based on analysts' low EPS estimates and the 7.7% on their high EPS estimates, with a 2.1% return based on consensus estimates. Those are the lowest of the returns under the consensus, low and high EPS scenarios. At the high end of the projected returns for JLL, the indicative returns range from 2.6% to 13.7%, with consensus 7.7%. The difference between best and worst cases is an indication of a degree of uncertainty in analysts' estimates.

Review Of Historical Performance For JLL

JLL: Historical Shareholder Returns

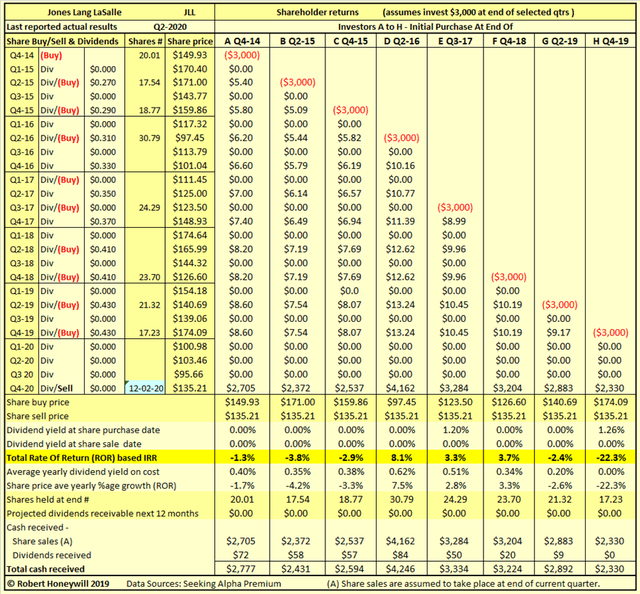

In Table 4 below, I provide details of actual rates of return for JLL shareholders investing in the company over the last six years.

Table 4

For many stocks where I create a table similar to Table 4 above, I find a wide range of returns indicating a degree of volatility and risk. Table 4 above shows the results for JLL were negative returns for five of eight different investors, each investing $3,000 over the last five years and holding to the present. A further two investors achieved low single digit returns of 3.3% and 3.7%. Only one investor achieved a reasonable return of 8.1%. These rates of return, ranging from positive 8.1% to negative (22.3)%, are not just hypothetical results. They are very real results for anyone who purchased shares on the various dates and held through to December 2, 2020. In the above examples, the assumed share sale price is the same for all investors, illustrating the impact on returns of the price at which an investor buys shares.

Checking JLL's "Equity Bucket"

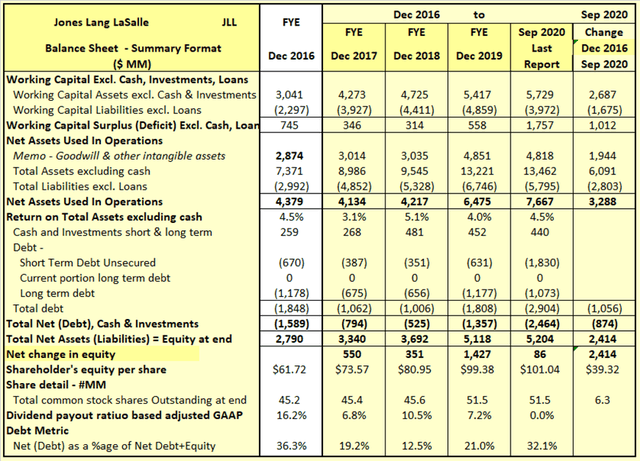

Table 5.1 JLL Balance Sheet - Summary Format

Table 5.1 shows JLL has increased net assets used in operations by $3,288 million over the last 3.75 years. The increase was funded by $2,414 million in equity and $874 million in net debt. The $2,414 million increase in shareholders' equity over the last 3.75 years is analyzed in Table 5.2 below.

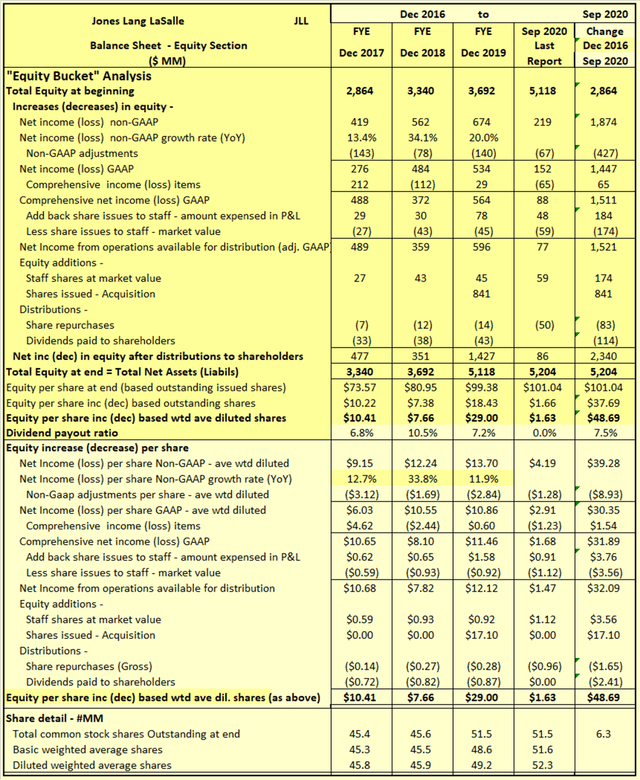

Table 5.2 JLL Balance Sheet - Equity Section

I often find companies report earnings that should flow into and increase shareholders' equity. But often the increase in shareholders' equity does not materialize. Also, there can be distributions out of equity that do not benefit shareholders. Hence, the term "leaky equity bucket." I find this happening to some extent with Jones Lang LaSalle, as explained below.

Explanatory comments on Table 5.2 for the period Jan. 1, 2017, to March 31, 2020:

- Reported net income (non-GAAP) over the 3.75-year period totals to $1,874 million, equivalent to diluted net income per share of $39.28.

- The company shows strong net income growth through end of 2019. For 2017 and 2018 EPS, growth rate was slightly below net income growth rate due to increases in average diluted shares. The increased share numbers were primarily due to issue of shares to staff, offset in part by share repurchases. For 2019, net income growth rate was 20.0%, but EPS growth rate only 10.9%. The much lower EPS growth rate was due to increase in share count as a result of shares issued for the HFF acquisition in July 2019 (see p. 101 2019 10-K).

- The non-GAAP net income excludes $427 million of items regarded as unusual or of a non-recurring nature in order to better show the underlying profitability of JLL. These adjustments increase reported non-GAAP EPS over the 3.75-year period by $8.93 per share.

- Other comprehensive income includes such things as foreign exchange translation adjustments in respect to buildings, plant, and other facilities located overseas and changes in valuation of assets in the pension fund - these are not passed through net income as they fluctuate without affecting operations and can easily reverse in a following period. Nevertheless, they do impact on the value of shareholders' equity at any point in time. For JLL, these items were $65 million, and increased GAAP compared to non-GAAP equity per share by $1.54 over the 3.75-year period.

- There were share issues to employees, and these were a significant expense item. The amounts recorded in the income statement and in shareholders' equity, for equity awards to staff, totaled $184 million ($3.76 EPS effect) over the 3.75-year period. However, the market value of these shares is estimated to be slightly lower by $10 million ($0.20 EPS effect) than the amount recorded for stock compensation expense purposes over the 3.75-year period.

- By the time we take the above mentioned items into account, we find, over the 3.75 year period, the reported non-GAAP EPS of $39.28 ($1,874 million) has decreased to $32.09 ($1,521 million), added to funds from operations available for distribution to shareholders.

- Issues of staff shares, assessed at estimated market value, effectively increased equity by an estimated $174 million over the 3.5 year period, and the issue of shares for part settlement of the HFF acquisition, further increased equity by $841 million. These increased funds available for distribution to $2,536 million. Of this $2,536 million, $83 million was expended on share repurchases and $114 million was paid in dividends to shareholders, leaving a balance increase in shareholders' funds of $2,340 million.

JLL: Summary and Conclusions

Based on analysts' estimates of future earnings, the stock appears overpriced at present. If the high range of analysts' EPS estimates were achieved, satisfactory returns through end of 2022 are indicated. But at consensus or low EPS estimates indicative returns are poor to strongly negative. The company could be of interest at a lower share price, subject to waiting to see how the company performs, if and when the COVID-19 pandemic is brought under control.

Your Feedback Is Always Welcome

If you found this article interesting or helpful, please consider "following" me by clicking the button at the top, or "Like this article" below, as this will help me in building an audience and gaining greater fulfillment from sharing my investment ideas with you on Seeking Alpha. And, of course, I welcome you sharing your opinion or perspective by commenting below.

Dividend Growth Income+ Club - Register today for your Free Trial.

Click Triple Treat Offer (1) Your Free 2 Week Trial; (2) 20% Discount New Members; (3) Bespoke reviews for tickers of interest to subscribers.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Disclaimer: The opinions in this document are for informational and educational purposes only and should not be construed as a recommendation to buy or sell the stocks mentioned or to solicit transactions or clients. Past performance of the companies discussed may not continue and the companies may not achieve the earnings growth as predicted. The information in this document is believed to be accurate, but under no circumstances should a person act upon the information contained within. I do not recommend that anyone act upon any investment information without first consulting an investment advisor and/or a tax advisor as to the suitability of such investments for their specific situation. Neither information nor any opinion expressed in this article constitutes a solicitation, an offer, or a recommendation to buy, sell, or dispose of any investment, or to provide any investment advice or service. An opinion in this article can change at any time without notice.