Table of Contents

- How to register property in West Bengal?

- How to prepare and submit e-Deed?

- How to pay stamp duty and registration fee online in West Bengal?

- How to check status of e-Payment of stamp duty and other charges

- How to execute the e-Deed?

- How to book e-appointment at SRO’s office

- Procedure to follow at the SRO office

- Documents required for property registration

- How to download a copy of a deed in West Bengal?

- Other services offered by West Bengal Property Registration Department

- E-Nathikaran Helpdesk

- FAQs

For property transactions happening in West Bengal, the property buyer has to pay stamp duty and registration charges applicable on the sale of the property, to the West Bengal Property & Land Registration Department. A part of this property document registration process in Kolkata and other cities of West Bengal, can be done online. This includes submission of identity proofs, property details and preparation of the e-deed. Here is a step-by-step guide to property registration in West Bengal and details about the documents required for this process.

How to register property in West Bengal?

Step1: Visit West Bengal Property Registration Department Portal, E-Nathikaran (click here)

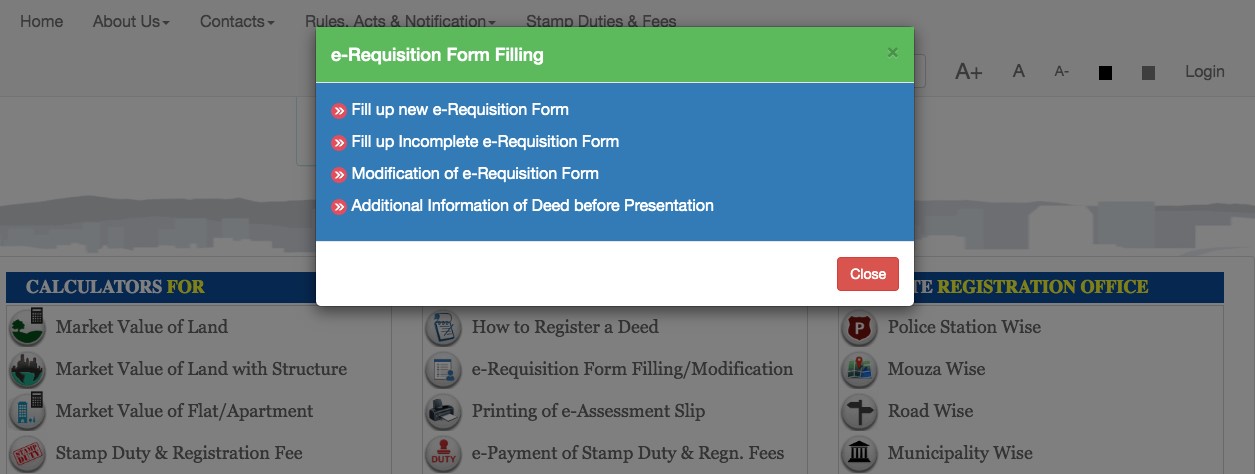

Step 2: Scroll down and click on ‘e-requisition Form Filling’. Here you need to fill a form for market value assessment, stamp and registration fee.

Step 3: All new users need to select ‘Fill up new requisition form’. If you are logging back again, you can finish your incomplete requisition form. You can also modify the e-requisition form and submit additional information about deeds, before its presentation at the sub-registrar’s office.

Step 4: All new users will be redirected to a guidelines page, where they can read the terms and conditions and rules for filling up the assessment form. Select ‘Read and Please Proceed’.

Step 5: New users need to fill three forms. The first form is ‘Applicant and Transaction’. Here, you need to feed the applicant’s details, property details and transaction-related details. The applicant could be the buyer, advocate, seller, deed writer, solicitor firm or attorney of the claimant. Save the form.

Step 6: Once you save the form, the user will be redirected to the next form – ‘Details of Seller’. Fill the details and save the form. You can also add details of more than one seller, if it is a joint property.

Step 7: Fill the details of the buyers in the next form. Add all the required details or the form will be deemed incomplete. Mention the name of all the joint buyers.

Step 8: In the last form, you need to add identifiers or witness details.

Step 9: In the next section, mention the details of the property, such as district, local body, ward number, etc.

Step 10: Once you save the form, you need to select the registration office or the place where you want to register the deed. Select the suitable office and generate your query number. This number will be used for stamp duty payment.

How to prepare and submit e-Deed?

Step 11: Now, go back to the home page and click ‘e-Registration of Deed’ and click ‘Preparation and submission of e-Deed’.

Step 12: Click ‘Read and Proceed’ and mention the query number generated in Step 10.

Step 13: Fill the requisite information, such as history of ownership, terms and conditions of purchase, which can be selected from the existing conditions, or edit it accordingly. Mention the boundary details, description of the land, common area, scribe details, memo of consideration, witness details and take a printout of the photo and the 10-fingerprint sheet, which has to be uploaded after final submission of the draft deed and before going to the sub-registrar’s office.

Step 14: Check the draft deed thoroughly and submit it for approval from the department. The applicant will get an SMS when the draft e-Deed is approved/rejected, which usually happens within 24 hours of application.

Step 15: If the e-Deed is approved, the applicant has to make the stamp duty and registration fee payment.

How to pay stamp duty and registration fee online in West Bengal?

Step 16: Go back to the home page and select ‘e-payment of Stamp Duty and registration fees’.

Step 17: Feed the query number and query year. Enter the bank details of the buyer, if there is any refund to be credited.

Step 18: You will be redirected to the payment portal. Choose ‘Payment of Taxes and Non-Taxes revenue’.

Step 19: Choose ‘Directorate of Registration and Stamp Revenue’ in department category and select ‘Payment of Stamp Duty’.

Step 20: Fill in all the details such as depositor’s name, query number, etc. Proceed with the amount and payment details. Confirm all the information and make the payment through net banking. Save the government reference number (GRN) for future purposes.

How to check status of e-Payment of stamp duty and other charges

Step 21: Now go back to the home page and click ‘status of e-Payment’ and enter the query number generated in Step 10 and GRN number generated in Step 20. Once you have verified the payment, you need to submit the approved e-Deed by e-signing it.

How to execute the e-Deed?

Step 22: Execute the e-Deed by e-signing, using your Aadhaar card. An OTP will be sent to you on the mobile number linked with the Aadhaar card. If you do not have an Aadhaar card, you can take a printout of the execution sheet prepared by the system and present it while visiting the sub-registrar’s office.

Step 23: After executing it, submit the e-Deed for presentation and generate the acknowledgement certificate as a token of successful submission. From here on, no modification will be allowed in the sale deed.

Step 24: After final submission, upload the TI sheet, by affixing your self-attested photograph and fingerprints of the executants. The link is under the ‘e-Registration of Deed’ option. This sheet should be uploaded before you proceed to the sub-registrar’s office.

How to book e-appointment at SRO’s office

Step 25: Book the e-appointment from the home page by clicking ‘e-appointment of sale deed’ by mentioning the query number.

Procedure to follow at the SRO office

Step 26: Present yourself at the SRO office where your documents will be verified and uploaded. Take all the original documents, along with the attested photocopies.

Step 27: Here, your deed will be scanned and fingerprint and signature will be captured, if you have not executed your e-Deed in Step 22.

Step 28: Once the application is verified, your deed will be delivered, which will be digitally signed by the registrar’s office.

Documents required for property registration

- Identity proof: Aadhaar card, Voter ID, PAN card, passport, driving licence.

- Assessment slip which has the market value, stamp duty and registration fee applicable on the property.

- PAN card or Form 60, along with identity card and address proof of both the parties.

- Stamp duty and registration fee payment acknowledgment.

- Permission from authority, if applicable.

How to download a copy of a deed in West Bengal?

Step 1: Visit E-district portal (click here)

Step 2: Register yourself, by submitting your full name, mobile number and email address.

Step 3: Once registered, you can login and download the certified copy of a deed, by submitting the deed number and other details as required.

Other services offered by West Bengal Property Registration Department

* West Bengal land record search: You can also search land records and property registration online on the WB Registration portal. Mention the first name and/or last name, year of property registration and district where the property was registered. The results will be displayed on the screen.

* Calculation of stamp duty and registration fee: You can also calculate the stamp duty and registration fee to be paid for different kinds of property transactions. Select the local body and feed in the market value. This option is available on the left column under ‘Calculator Section’.

* Locate the nearest registration office: If you are not sure which the closest sub-registrar’s office is, you can search on the portal. Scroll down and click any of the available filters to search for the closest office. You can search the registration office police station-wise, road-wise or municipality-wise.

* Correction of legacy deed: If you want to make corrections in your legacy deed, you can visit the WB Registration portal and click ‘Request for Correction (Legacy Deed)’. You will be redirected to a new page, where you need to submit details pertaining to the district, sub-registrar’s office, deed number and deed year. The results will be displayed on screen and you can proceed with the request.

*Calculation of market value: You can calculate the market value of your land, property, flat/apartment through this portal. To calculate the market value, mention the following information:

- District

- Local body

- Thana

- Jurisdiction area

- Local body name

- Plot number

- Khaitan number

- Proposed land use

- Nature of land in ROR

- Encumbered status

- Purchaser details

- Litigation status

- Total area of land

Check out properties for sale in Kolkata

E-Nathikaran Helpdesk

Property buyers and applicants can reach out to the West Bengal Property and Land Registration Department using the following credentials:

Drop a mail at adsrerac.igr-wb@nic.in

You can also contact the administration on this number: 033-2225 9145

FAQs

How can I check ownership of land in West Bengal?

You can check ownership of land in West Bengal on the Banglarbhumi portal, as mentioned in this article.

How can I download my copy of deed in West Bengal?

You can download the copy from the WB registration portal, by following the above procedure.

How can I check land value in West Bengal?

You can check land value on WB registration portal by following the procedure mentioned in this article.

Comments 0