How Tidal ETF Trust - RPAR Risk Parity ETF Continues To Make All-Time Highs

Diversified multi-asset class investors have been struggling a bit in the fourth quarter. So, how come ARIS' Risk Parity ETF is at a peak?

The fund's "secret sauce" is diversification beyond most investors' comfort zone and into less appreciated asset classes.

I believe that RPAR is a great substitute, rather than merely a complement, to the S&P 500.

After nearly losing their marbles in February and March, equity investors are likely to end 2020 happy and well into the black. In fact, the S&P 500 (SPY) just reached all-time highs in early December, against all the odds in a year of global pandemic.

However, not all investors have been celebrating lately. The 30-year treasury yield has been on a steady climb from 1.2% to 1.7% since early August, causing government bond (TLT) investors to be well under water as 2020 approaches the end. Gold (GLD), a shiny star through mid-third quarter, is currently in a 12% drawdown from its peak. Commercial real estate (VNQ) still needs to climb nearly 20% only to reach its February highs.

Diversified multi-asset class investors, therefore, have been struggling in the fourth quarter. Stocks (and yes, bitcoin) have been pretty much the only winners in the past several weeks. Yet, despite the unfavorable market environment, ARIS' Risk Parity ETF (RPAR), which allocates only one-fourth of the portfolio to global equities, has just made all-time highs.

How could this be?

Source: Michael Shannon @ Unsplash

A quick recap

For the benefit of those less familiar with risk parity, the investment strategy consists of "balancing a portfolio's risk exposures to attain a greater chance of investment success than what is offered by traditional, equity-centric approaches to asset allocation". In other words, risk parity is all about distributing the eggs across many different baskets, including investing in asset classes that many of us pay little attention to - like inflation-linked bonds, or TIPS (LTPZ).

The consequences of using a risk parity approach to investing have historically been very appealing. Those include (1) lower portfolio volatility relative to a return target, (2) less painful drawdowns and (3) minimized risk of buying assets at a peak or selling them at a bottom.

RPAR's secret sauce

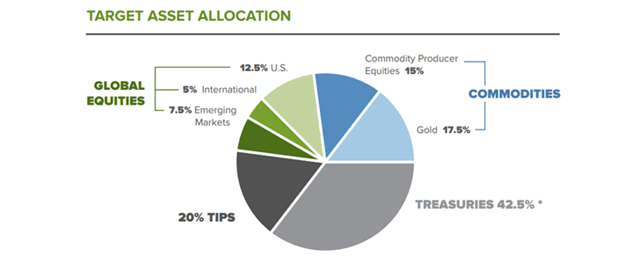

To understand how RPAR has just reached all-time highs despite the recent selloff in so many non-equity asset classes, it helps to look at the fund's allocation target. See pie chart below.

Source: Fact sheet

The goal is for RPAR to be about 120% exposed to risk assets of different kinds (to verify, add the percentages above). The leverage is currently achieved through a long position in ultra long-term treasury futures, which is used to boost the expected returns of a portfolio that would otherwise be a bit too conservative for most growth investors.

One of the reasons why RPAR has been doing well lately, although probably not the most important, is the ETF's diversification outside domestic stocks. In the fourth quarter, risk appetite increased while the US dollar lost steam. These two factors favored international equities, including emerging market ones. Both categories have been beating the S&P 500 by just about three percentage points since the start of October.

Out of left field

But the two "more obscure" of RPAR's allocations are precisely what seem to have made the most difference lately. I am willing to bet that very few growth investors have anything close to 35% of their portfolios allocated to TIPS and commodity producer equities, like energy and materials stocks.

Inflation-linked bonds, or TIPS, have not done all that well in the fourth quarter, as treasury yields have been rising consistently since August. But the fact that long-term TIPS have stayed around breakeven levels in the fourth quarter is remarkable, considering that the price of nominal treasuries (TLT) of similar maturity has dipped nearly 4% during the same period (see graph below).

Data by YCharts

Data by YCharts

I think that RPAR's managers deserve credit for positioning the portfolio for a potential increase in inflation expectations - and, as a consequence, a spike in bond yields. The strategy is consistent with my views that investing in TIPS is much more of a smart way to protect a portfolio than merely an appealing high-conviction bet.

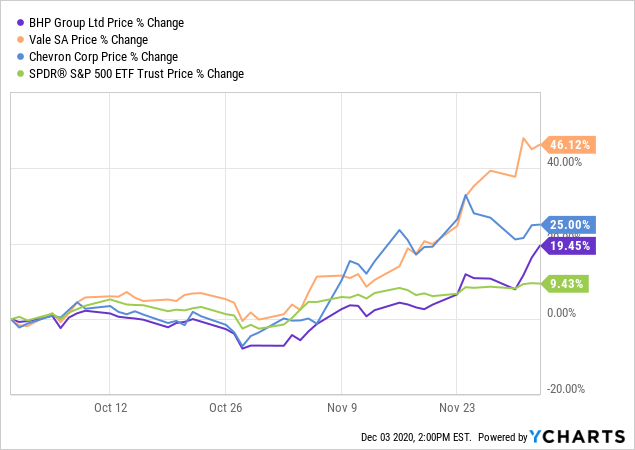

Regarding commodity producers, their stocks have benefited from the post-election shift to risk-on behavior in the markets. RPAR invests in names like BHP Group (BHP), Vale (VALE) and Chevron (CVX), among others in their respective sectors. These groups of stocks have been having a killer quarter so far, as the chart below depicts.

Data by YCharts

Data by YCharts

What to make of it

A lazy conclusion would be to think that RPAR has been making all-time highs recently because the portfolio has been invested in some of the "right themes" in the fourth quarter. While this is generally an accurate observation, the better lesson can be learned by looking at the root causes of the fund's solid performance.

RPAR continues to prove, despite being only about one year old, that broad diversification works. In addition, the ETF's allocations into asset classes that many investors tend to ignore - including international stocks, energy and materials, and inflation-linked bonds - illustrate how broad diversification should ideally extend beyond most investors' comfort zone.

I continue to believe that, over time, risk parity will beat the risk-adjusted performance of a stock-only strategy. For this reason, I remain very bullish on RPAR. I believe it to be a great substitute, rather than merely a complement, to the S&P 500.

Beating the market by a mile

In 2018, I developed a multi-asset portfolio that has been outperforming RPAR and the S&P 500 by a good margin. To dig deeper into how I have built a risk-diversified strategy designed and back-tested to generate market-like returns with lower risk, join my Storm-Resistant Growth group. Take advantage of the 14-day free trial, read all the content written to date and get immediate access to the community.

Disclosure: I am/we are long CALL OPTIONS ON SPY, TLT, GLD, AND VNQ. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.