Automatic Data Processing: Increased Dividend Income For 46 Years

Automatic Data Processing’s total return outperformed the Dow average for my 59-month test period by 75.92%, but it has a high PE at the present entry point.

Automatic Data Processing’s dividend yield is average at 2.2% and has been increased for 46 years in a row.

Automatic Data Processing’s three-year forward CAGR of 10% will give you good steady growth with the increasing worldwide economy.

Automatic Data Processing’s cash flow will allow the dividend to be increased each year, with cash left over for new application development.

Automatic Data Processing (ADP) is a buy for the total return and the dividend growth investor. Automatic Data Processing is one of the largest human resources products and services companies in the world. ADP is a conservative investment for the income investor who also wants good growth potential with the growing world economies and population. Automatic Data Processing has good cash flow, and the company uses some of the cash to expand its product line and to increase dividends each year. Automatic Data Processing is 6.7% of The Good Business Portfolio, my IRA portfolio of good business companies that are balanced among all styles of investing.

As I have said before in previous articles:

I use a set of guidelines that I codified over the last few years to review the companies in The Good Business Portfolio (my portfolio) and other companies that I am reviewing. For a complete set of guidelines, please see my article “The Good Business Portfolio: Update to Guidelines, March 2020”. These guidelines provide me with a balanced portfolio of income, defensive, total return, and growing companies that hopefully keeps me ahead of the Dow average.

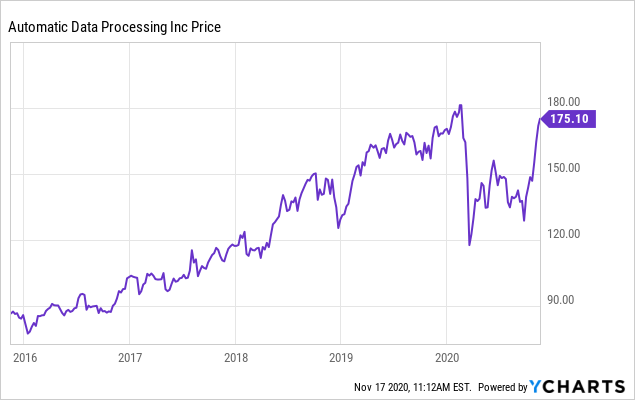

When I scanned the five-year chart, Automatic Data Processing has a great chart going up and to the right for 2016- January 2020 in a strong solid pattern when COVID-19 hit and drove the price down. ADP has almost recovered in price with the vaccine months away, making ADP a great company for growth and income.

Data by YCharts

Data by YCharts

Fundamentals and company business review

The method I use to compare companies is to look at the total return, as shown from my previous articles in the section below.

The Good Business Portfolio Guidelines are just a screen to start with and not absolute rules. When I look at a company, the total return is a key parameter to see if it fits the Good Business Portfolio’s objective. My total return guideline is that total return must be greater than the Dow’s total return over my test period. I chose the 59-month test period (starting January 1, 2016, and ending to date) because it includes the great year of 2017 and 2019 and other years with fair and bad performance.

The great Automatic Data Processing total return of 140.19% compared to the Dow base of 64.27% makes Automatic Data Processing a good investment for the total return investor that also wants some increasing income. Looking back five years, $10,000 invested five years ago would now be worth over $21,200 today. This gain makes Automatic Data Processing’s a great investment for the total return investor looking back, which has future growth as the United States and worldwide economy continues to grow.

Dow’s 59 Month total return baseline is 64.27%

|

Automatic Data Processing does meet my dividend guideline of having dividends increase for 8 of the last ten years and having a minimum of 1% yield. Automatic Data Processing has an average dividend yield of 2.2% and has had increases for 46 years, making Automatic Data Processing a good choice for the dividend growth investor. The dividend was last increased in November 2020 for an increase from $0.91/Qtr to $0.93/Qtr or a 2.2% increase. The five-year average payout ratio is moderate, at 66%. After paying the dividend, this leaves cash remaining for increasing the business of the company by expanding its product line and increasing foreign sales.

I only like large-capitalization companies and want the capitalization to be at least greater than $10 billion. Automatic Data Processing easily passes my rule. Automatic Data Processing is a large-cap company with a capitalization of $74 billion. Automatic Data Processing’s 2021 projected operating cash flow at $3.2 billion is great, allowing the company to have the means for company growth and increasing dividends each year. Large-cap companies like Automatic Data Processing have the cash and ability to buy other smaller companies and weather any storms that might come along.

Automatic Data Processing’s S&P CFRA rating is three stars or hold with a recently increased target price to $158. Automatic Data Processing’s price is above the target by 8%. Automatic Data Processing is above the target price at present and has a high forward PE of 28, making Automatic Data Processing a hold at this entry point for the dividend income and total return investor. I rate Automatic Data Processing a nibble (start a small buy) for future growth and a good growing income; quality does not come cheap. The cash flow drives ADP stock price up, and the company returns the cash to the shareholder with increasing dividends each year. Low-interest rates are a headwind since the company is not making much on the payroll float.

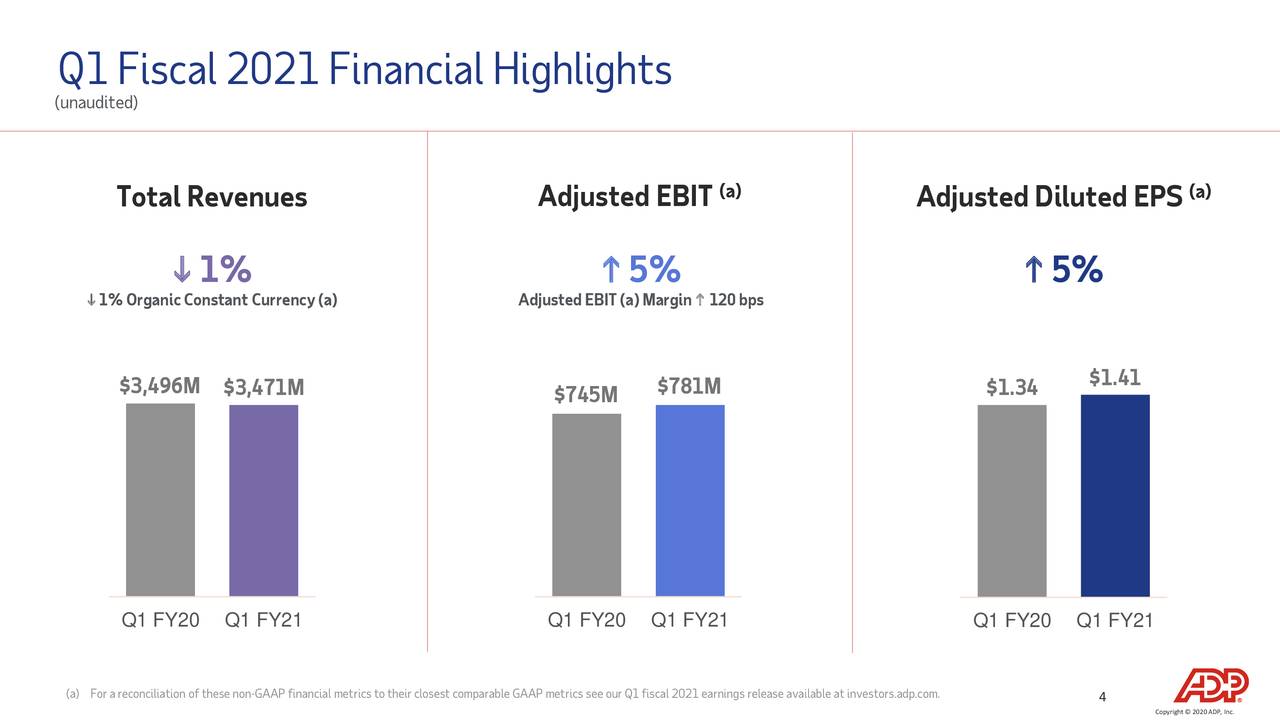

I look for the earnings of my positions to consistently beat their quarterly estimates. For the last quarter on January 29, 2020, Automatic Data Processing reported earnings that beat expected at $1.52 by $0.08, compared to last year at $1.34. Total revenue was higher at $3.67 billion more than a year ago by 5.2% year over year and missed expected total revenue by $20 million. This was a great report with a bottom-line beating expected, and the top line increasing and a bottom-line increase compared to last year. The next earnings report will be out in late January 2021 and is expected to be $1.24 compared to last year at $1.50, a decrease. The graphic below shows earnings for Q1 of 2021.

Source: Q1 Earnings call slides

One of my guidelines is would I buy the whole company if I could. The answer is yes. The total return is great, and the increasing dividend for 46 years makes a good combination of growth and income. The Good Business Portfolio likes to embrace all kinds of investment styles but concentrates on buying businesses that can be understood, makes a fair profit, invests profits back into the business, and also generates a fair income stream. Most of all, what makes ADP interesting is the long-term growth of the world economy, giving you an increasing growth in the human resources sector.

Automatic Data Processing is the largest provider of human resources data processing in the United States and foreign countries. Its segments include Employer Services and Professional Employer Organization Services.

Overall Automatic Data Processing is a good business with 10% CAGR projected growth as the United States and foreign economies grow going forward, with the increasing demand for ADP’s services. The good dividend income brings you cash as I continue to see further growth as the world economy grows. As interest rates decrease, so will ADP’s earnings on the payroll float, but this decrease is easily overtaken by the gain from product innovation sales increases.

The paraphrase below from the 1st quarter earns call. Considering the Covid-19 virus, the company delivered revenue of $3.5 billion, down just 1% on both reported and organic constant currency basis. RUN continues to grow, and they now exceeded 700,000 RUN clients for the first time, surpassing pre-COVID levels to the mid-market. They are seeing clients showing more interest in fully outsourced HRO solutions to the enterprise space. International sales were also strong as the company closed several larger deals that were previously put on hold as prospects were waiting for a more stable environment to proceed. What makes ADP strong is there continued focus on driving innovation. ADP was given the Top HR Product award at the annual HR Tech Conference. This marks a record-setting six consecutive years that they have been recognized at the conference for breakthrough technology innovations. This year, they were recognized for their Next Gen Payroll engine. The Next Gen engine added another 100 clients during the first quarter.

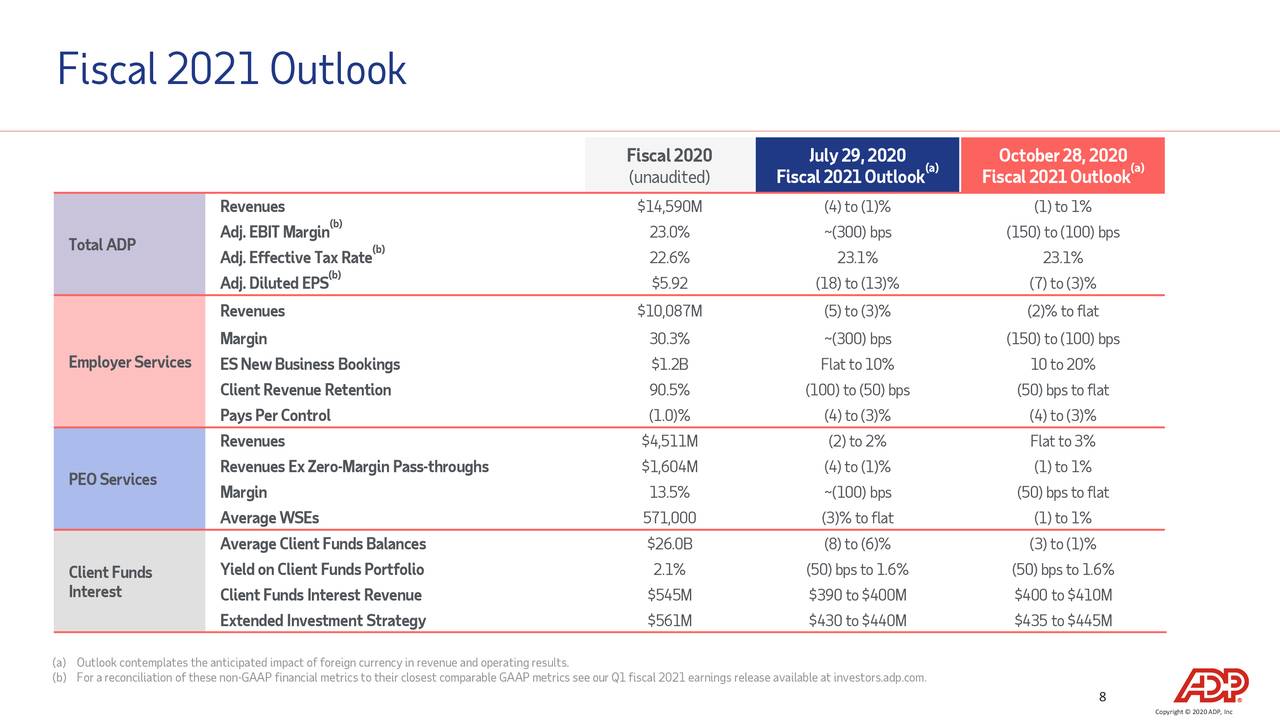

The graphic below shows the outlook for 2021.

Source: Q1 Earnings call slides

This shows the feelings of top management for the continued growth of the Automatic Data Processing business and shareholder return. ADP has good growth long term and will continue as the world’s employment budgets grow with the world economy. The next years projected growth is lower than normal because of the COVID-19 pandemic but should return to normal as the vaccines take control in the late 2021 year.

Conclusions

Automatic Data Processing is a good investment choice for the total return and dividend growth investor with its average dividend yield with increases for 46 years and high total return. Automatic Data Processing is 6.7% of The Good Business Portfolio and will be held and watch it grow. ADP will be held in the portfolio and will be trimmed when it reaches 8% of the portfolio. I buy what I consider great businesses that are fairly priced, but value investors will want to wait for a better entry point if it ever happens. Good growing businesses do not come cheap, but over time, they grow and grow. If you want a solid growing dividend income and good total return in the human resources data processing business, ADP may be the right investment for you.

The total return for the Good Business Portfolio is ahead of the Dow average from 1/1/2020 to November 27 by 1.57%, which is a gain above the market gain of 4.81% for the portfolio. Each quarter after the earnings season is over, and I write an article giving a complete portfolio list and performance. The latest article is titled “The Good Business Portfolio: 2020 3rd Quarter Earnings and Performance Review”. Become a real-time follower, and you will get each quarter’s performance and portfolio companies after the next earnings season is over.

Disclosure: I am/we are long BA, JNJ, HD, DHR, MO, PM, MCD, PEP, DLR, AMT, ADP. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Of course, this is not a recommendation to buy or sell, and you should always do your own research and talk to your financial advisor before any purchase or sale. This is how I manage my IRA retirement account, and the opinions of the companies are my own.