Five Below Earnings Review: Green Light For Further Upside

Five Below delivered one of the most impressive all-around beats in its history, with double-digit comps setting a record.

It is likely that the retailer will pick up from where it left off in January 2020, as COVID-19 disruptions have been proving to be temporary.

FIVE is no longer the bargain that it was in June, but investor sentiment is unlikely to take another 2020-like hit in the new year.

Not long ago a painful disappointment, Five Below (FIVE) has become one of the best-performing stocks in my All-Equities SRG portfolio in the second half of 2020. Shares have been up about 25% in the fourth quarter alone, as the stock is now nearly ten percentage points ahead of the S&P 500 (SPY) YTD.

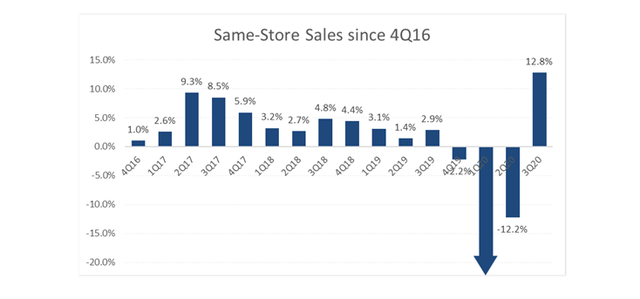

On December 2, after the closing bell, the retailer provided more reasons for investors to remain bullish. In the third quarter, Five Below delivered one of the most impressive all-around beats in the retailer's history as a public company. Revenue growth of 26% YOY was the highest ever, while comps of 12.8% beat consensus 5.3% by a mile and a half.

Credit: company's website

The worst is in the rear view mirror

Across the P&L, it was hard to find much weakness in Five Below's numbers. Comps in the double-digits not only returned to normal: they surpassed what the retailer had become accustomed to seeing prior to the pandemic (see graph below). These same-store results were somewhat telegraphed last quarter, when comps for reopened locations had already reached a historically high 6% and suggested solid demand recovery – provided that Five Below could keep its doors open.

The other impressive feat in the quarter was the number of net new stores launched: 118, the largest number since the record-breaking fourth quarter of 2018. Despite the pandemic having put Five Below's footprint expansion plans on hold for the first two quarters of the year, the trailing twelve-month number of store openings has already caught up with the historical average, largely confirming that COVID-19 did not permanently impact the growth story.

Source: D.M. Martins Research, data from multiple company reports

Footprint expansion, by the way, is a key tenet in the investment thesis. As Five Below grows, it can better leverage its fixed costs to create margin expansion in the future, including those associated with the two new distribution centers in the Southeast and in Texas.

While I do not expect the bottom-line benefits of scale to manifest meaningfully until well into next year, I was already pleased to see margins improve YOY in the third quarter. On a GAAP basis, op profit nearly doubled due to opex leverage, and so did EPS. At this pace, the current estimate for 2019 to 2021 EPS CAGR of 11%, an already respectable number given the disruptive nature of the 2020 pandemic, is already starting to look a bit too conservative.

More upside to come

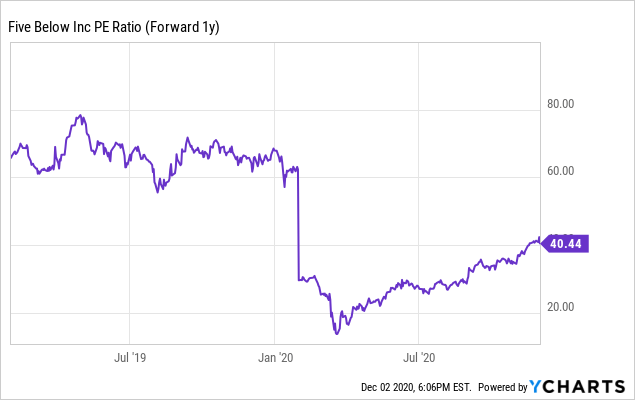

Yes, FIVE is no longer the bargain that it was in June, when I suggested that investors "toss the quarter and focus on the rest of 2020." Since then, shares have climbed more than twice as much as the S&P 500 and are currently pushing against all-time highs. See next-year P/E chart below.

Still, I believe that FIVE has quite a bit of runaway ahead to move forward. I believe that the retailer has left the worst of the pandemic behind, while investor sentiment and confidence are unlikely to take another 2020-like hit in the new year.

Data by YCharts

Data by YCharts

Other than this last wave of COVID-19 cases in the US potentially leading to store closures once again (possibly the last buy-on-dip opportunity in the foreseeable future, if one materializes), it seems likely to me that Five Below will pick up from where it left off in January 2020: further footprint growth, TAM expansion from the "Five Beyond" concept, leaner operations (e.g. self checkout) and gains of scale helping to push margins higher.

A helping hand

FIVE is just a small piece of my All-Equities Storm-Resistant Growth, a portfolio that has handily outperformed the S&P 500 through bull runs and market corrections. To dig deeper into how I have built a risk-diversified strategy designed and back-tested to generate market-like returns with lower risk, join my Storm-Resistant Growth group. Take advantage of the 14-day free trial, read all the content written to date and get immediate access to the community.

Disclosure: I am/we are long FIVE. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.