Altimmune: Needs To Focus On NasoVAX

Altimmune went up on unsubstantiated reports of Covid-19 work where its key asset is NasoVAX.

The company also has interests in such diverse distractions like NASH, Hep B, solid tutors and so on.

Altimmune should focus on its core asset, NasoVAX.

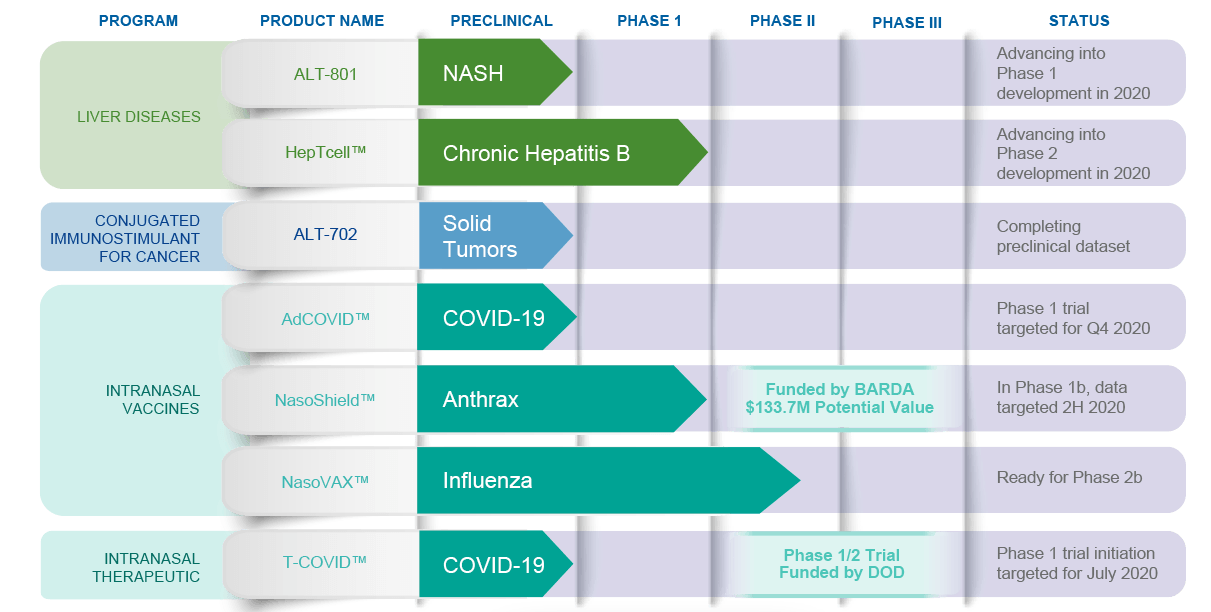

Altimmune (ALT) is an influenza vaccine developer - this is how I will characterize it now - that has recently had a good run riding the Covid-19 wave. While the stock has now settled down, lingering effects of the joyride still remain - a bit of dizziness, a little of lightheadedness, and the funny feeling that maybe we can conquer the world with our pipeline, which looks like this:

But if you look at it closely, you can see that this pipeline is mostly what accountants call bill padding. This $400mn company with about $200mn in cash is not going to find treatments for all sorts of incurable diseases like NASH, Hepatitis B, solid tumors etcetera as well as various antivirals at one go - not today, probably not ever. Yet it has this show of strength in its pipeline, and it looks impressive - but looks are deceptive.

I have neither the time nor the inclination to pursue every indication they have on this list and show why I think it doesn’t make sense. Especially since most of them do not have enough data anyway. My point is just this - most microcaps that do well do so when they stay focused. That’s how you develop depth. It takes a huge effort just to target one of these indications properly. NASH, for example, is a mega-billion-dollar market where not a lot of proper development is happening. Altimmune could have targeted just NASH. Solid tumors are another such area of oncology where a lot remains to be done. Altimmune could have just addressed solid tumors. It tries to do everything, and when that happens, I doubt if anything will be done well.

Three aspects of the pipeline need discussion. One is Altimmune’s sudden move in the Covid-19 area, given the huge competition, with everyone and their friends developing a treatment for Covid-19 this year. This is what raised the company from being a $1.5 stock price $50mn nanocap in March to a $1bn respectable looking company by mid-July. They have now fallen back to the $12 range, yet $400mn is still a long way from $50mn, and we need to ask ourselves two questions - one, was there any merit in the spike based on Covid-19 alone, and two, if there isn’t, is there any merit, based on, say NasoVAX, for ALT to still be a $400mn company instead of going all the way back to where it was in March? I mean, what changed with NasoVAX that justifies this raise, if Covid-19 doesn’t?

The second aspect is its Hepatitis B program, another indication where it actually has data which we can discuss and analyse as a reflection of the rest of its padded up pipeline. How was this Phase 1 data that they came out with in early 2019? They have a Phase 2b trial running now. Did the Phase 1 data justify the Phase 2b? The Hep B market is highly differentiated, with a variety of novel approaches happening. Where does HepTcell stand in this space? How much value can we put to it?

The third and final aspect I want to understand is where Altimmune’s real value lies - the NasoVAX program. How was the data? How is the competitive difference? What sort of value can we assign to ALT based on NasoVAX?

If you look at Altimmune’s chart, you can see a few inflection points. Yahoo Finance used to have a nice feature when it was working - it used to provide news items related to these inflection points right on the chart, so you knew what pushed a stock up, or pulled it down. This chart doesn’t have that, but I will provide the news items below the chart.

The first inflection point was from February 28, when the stock doubled overnight. The news was here:

Altimmune nearly doubles after advancing intranasal coronavirus vaccine

As we can see, this was a coronavirus news. Altimmune took what it had - the intranasal thing - and applied it to coronavirus. And the market let the stock double overnight.

Those were the heydays of coronavirus, when all you had to do was stand on a prominent corner of Wall Street and yell “coronavirus vaccine,” and you would make a lot of money - such was the panic. I had seen a lot of unheard-of biopharma make money this way in those days. So, what did Altimmune say? All it said was - “I may have something.”

Altimmune says it has completed the design and synthesis of the vaccine and is now advancing it toward animal testing and manufacturing.

Under ordinary circumstances, such an announcement wouldn’t make Wall Street bat an eyelid, but those were not ordinary times.

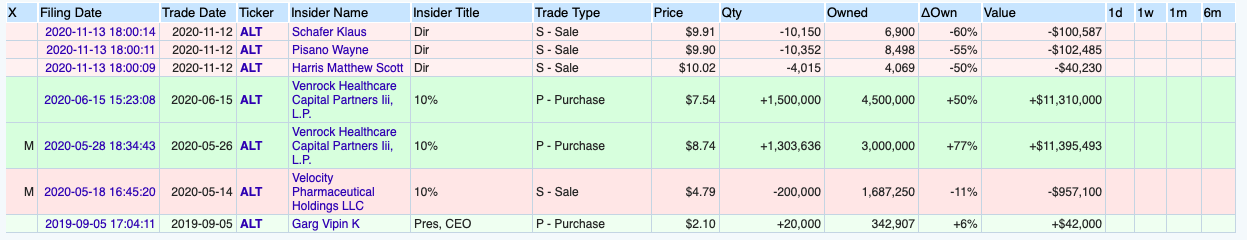

The next inflection point was around June end-ish, when we had a slew of news. The first one was a certain bio-targeted fund buying a relatively huge stake in the company.

Venrock Capital buys 1.5M shares in Altimmune

This happened in May-June.

Here’s Altimmune’s somewhat sad-looking insider transactions data:

I have no comments on this chart except to say that Venrock bought at $8ish on average, and within a month it shot up to $33ish. I wonder if they considered selling out then. Today it is back at $12ish. That’s a 50% rise in what, 6 months? But that doesn’t beat a 500% rise in 20 days.

So anyway, Altimmune really took off in early July after this news:

Altimmune up 25% on positive COVID-19 vaccine data

What did they actually say? All they said was that in a preclinical trial, AdCOVID showed "strong" serum neutralizing activity and "potent" mucosal immunity in the respiratory tract.

Note strongly, though, that the respiratory tract referred to here doesn’t belong to humans. It belongs to mice. The medicine, as we know all too well, has to travel a long way from the murine respiratory tract to a human before we can make sense of its efficacy. And yet the stock went from below $10 to over $30 in a matter of days mostly around when this news came out.

Someone, at least, noticed. We have a very interesting looking news item on Seeking Alpha:

Altimmune builds cash hoard to fund COVID-19 vaccine and NASH candidates

The most important story here was that this company, which had no more than about $30mn in cash as of March, had “Raised $199.4M in new capital since Q1,” and today, by December, it has over $200mn. This was a spectacular success, and the company should use it to develop its NasoVAX program properly.

In September, David E. Shaw became a 5% beneficial owner of Altimmune. By this time, Altimmune’s prospects had fallen - it was now trading at $12. Mr. Shaw, of course, is a genius trader billionaire computer algorithmic trading whiz biochemistry scientist, etc. So he knows better than most of us. So maybe Altimmune will rise again.

Starting from around this time, ALT stock started falling again along with a host of second-tier corona-vaccine developers as people came to realize that the big name first tier developers will be making the vaccine within a very short time. Seeking Alpha has a nice chart that shows this:

During all this time, very little actual development was happening at Altimmune in their “real” pipeline. There was a development in June for HepTcell - the FDA signed off on the Phase 2 trial design. Not a major news. The FDA usually signs off. No news on NasoVAX. Indeed, the only NasoVAX news we have on Seeking Alpha was from last year - here it is.

Coming back to HepTcell, I will defer to the expertise of fellow author “Biologics” who has written 10 articles on ALT and is clearly the in-house expert. He says that the HepB market is too diverse, and HepTcell’s data too unimpressive for him to have a high opinion on its prospects. I haven’t studied that data - both links he provided lead me to “404” error pages on the Altimmune website. However, in a separate press release, I found the following data:

All dose combinations showed excellent tolerability and met the primary endpoint of safety. In the two adjuvanted HepTcell arms, T cell responses against HBV markedly increased over baseline compared to placebo. Altimmune plans to advance the program into Phase 2 development.

So far so good, but like Biologics says - and I agree with him - the market is really very differentiated and such early data does not impress.

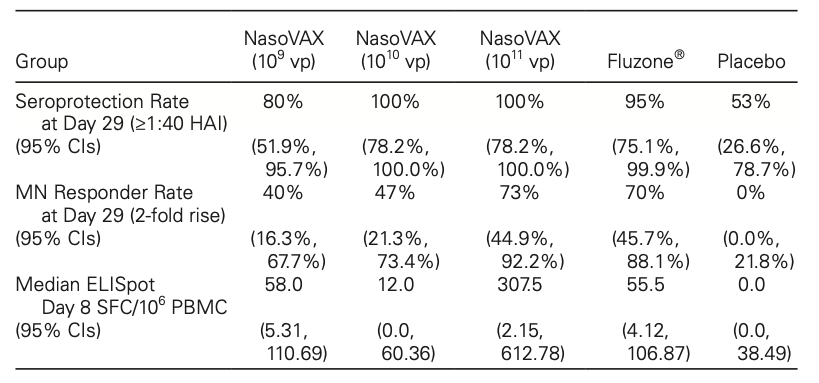

Finally, we will look at NasoVAX. Again, the conclusive article is by Biologics, here. This is an intranasal influenza vaccine that tries to compensate for some of the shortcomings of the current influenza vaccines in the market. Specifically, it addresses the reducing effectiveness of regular vaccines which are unable to target the various strains of the virus as they develop. In order to work around these numerous genomic strains, a new type of vaccines, the so-called recombinant adenoviral (RAD) vectors are used. These can effectively elicit a robust immune response while also protecting against new strains. However, these RAD vaccines have a problem - most people have pre-existing immunity to the RAD vector. This is where NasoVAX comes in. Its intranasal route of administration is a potential workaround against the pre-existing immunity, and has low side effects. A single dose of NasoVAX has been shown to be superior to intramuscular injection in a specific train of virulent flu virus. The data I am referring to is as follows:

Background NasoVAX is a replication-deficient adenovirus-based vaccine designed to express influenza hemagglutinin in nasal epithelial cells when given as a nasal spray. In preclinical studies, NasoVAX was associated with divergent strain protection. Prior preclinical and clinical studies with the vector demonstrated lack of impact from baseline adenovirus immunity.

Methods Sixty healthy adults were randomized to an A/California 2009-based monovalent NasoVAX formulation at doses of 109, 1010, or 1011 viral particles or saline placebo, all given as a 0.25 mL nasal spray in each nostril. Subjects were followed for safety, including solicited local and systemic side effects. Immune measures included hemagglutination inhibition (HAI) and neutralizing antibody (MN) at days 1, 15, 29, 90, and 180, and γ-interferon ELISpot at day 1 and 8. A parallel cohort of 20 similar subjects were dosed with Fluzone® injectable influenza vaccine containing an A/California 2009 component and had assessments at the same timepoints. The laboratory was blind to treatment assignment for these comparator samples.

Results NasoVAX was well tolerated with no serious adverse events and no fever. Solicited symptoms such as nasal congestion, sore throat, and headache did not increase with dose and were not statistically different than placebo. Available immune response data are shown below.

Conclusion NasoVAX intranasal influenza vaccine was well tolerated and elicited comparable antibody responses and nearly 6-fold higher cellular immune responses than a licensed injectable vaccine.

Now, FluZone is an intramuscular injection, with its associated deficiencies just discussed. AstraZeneca (NASDAQ:AZN) has an intranasal spray, but it is a live attenuated vaccine which has its own set of problems. There are these two types of influenza vaccines, intranasal, and parenteral. The former is live attenuated, while the latter is inactivated but non-mucosal. NasoVAX seems to have found the best of both worlds. This document from Altimmune, a clinical trial protocol, has a lot of details. Key points relevant to our discussion are, one, the issues with competing product FluMist:

The other point is about NasoVAX’s and its key differences:

Bottom line

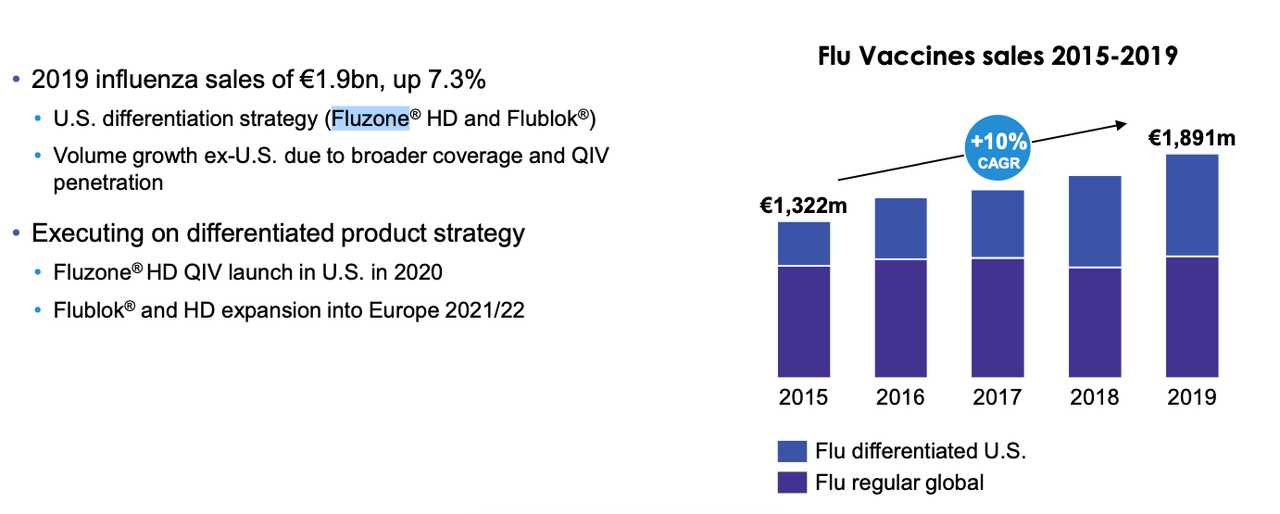

The global influenza vaccine market size was valued at $3.96 billion in 2018, and is projected to reach $6.20 billion by 2026, at a CAGR of 5.9% from 2019 to 2026. Much of this market is owned by Sanofi (NASDAQ:SNY) products:

If NasoVAX can get even a fraction of this pie, that will be huge for Altimmune.

My beef with ALT - as I said in this article - is twofold. One, why waste time on an entirely new space like NASH when it has this as-yet undeveloped potential in the pipeline? Two, why does ALT stock have to go up based on the pure accident of the coronavirus pandemic?

Other than that, this could be a nice addition to someone’s very speculative portfolio once things settle down.

About the author

Thanks for reading. At the Total Pharma Tracker, we offer the following:-

Our Android app and website features a set of tools for DIY investors, including a work-in-progress software where you can enter any ticker and get extensive curated research material.

For investors requiring hands-on support, our in-house experts go through our tools and find the best investible stocks, complete with buy/sell strategies and alerts.

Sign up now for our free trial, request access to our tools, and find out, at no cost to you, what we can do for you.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.