Natural Gas: The Outlook Is Bullish But Uncertain

This Wednesday, we expect the EIA to report 3,935 bcf of working gas in storage for the week ending November 27.

We anticipate to see a draw of 5 bcf, which is 17 bcf smaller than a year ago and 36 bcf smaller vs. the 5-year average.

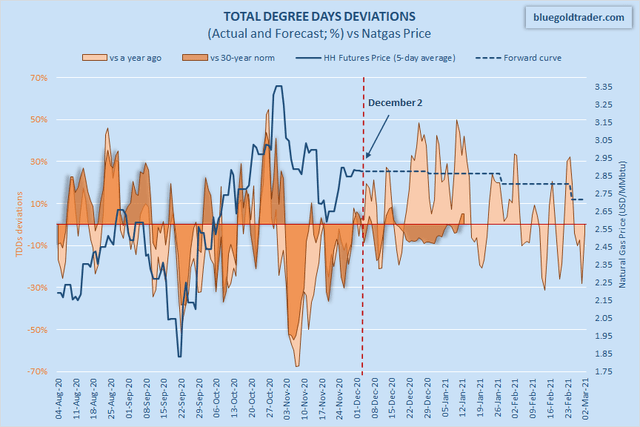

Annual storage surplus is projected to shrink by 248 bcf by January 1.

TDDs are generally projected to trend higher and remain above last year's level.

Our latest SD balance forecast (scroll down to see the last chart).

The Weather

Last week

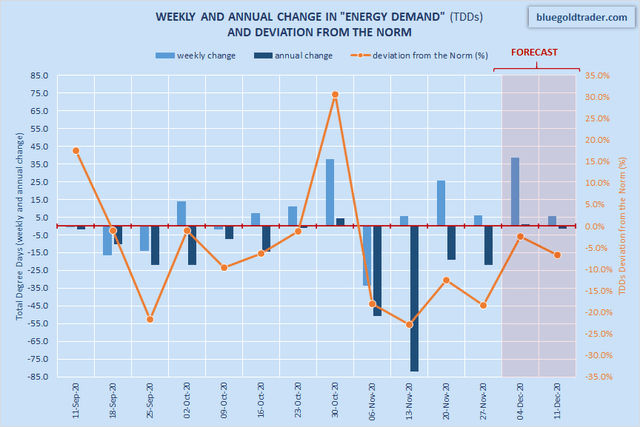

Last week (ending November 27), the number of heating degree days (HDDs) edged by 7% w-o-w (from 107 to 114). However, we estimate that total "energy demand" (as measured in total degree days, or TDDs) was 16% below last year's level and 18% below the 30-year average.

This week

This week (ending December 4), the weather conditions continue to cool down in the contiguous United States. We estimate that the number of nationwide HDDs will surge by 37% w-o-w (from 114 to 156). Total average daily consumption of natural gas (in the contiguous United States) should be somewhere between 97 bcf/d and 99 bcf/d. However, total "energy demand" (measured in TDDs) should rise by only 0.5% y-o-y, while the deviation from the norm will remain negative but will moderate substantially (from -18% to -2%).

Next week

Next week (ending December 11), the weather conditions are expected to cool down again but only slightly. The number of nationwide HDDs is currently projected to increase by 4% w-o-w (from 156 to 163). Total "energy demand" (measured in TDDs) should decrease in annual terms (-1%). The deviation from the norm will remain negative (-6.7%) - see the chart below.

Source: Bluegold Research estimates and calculations

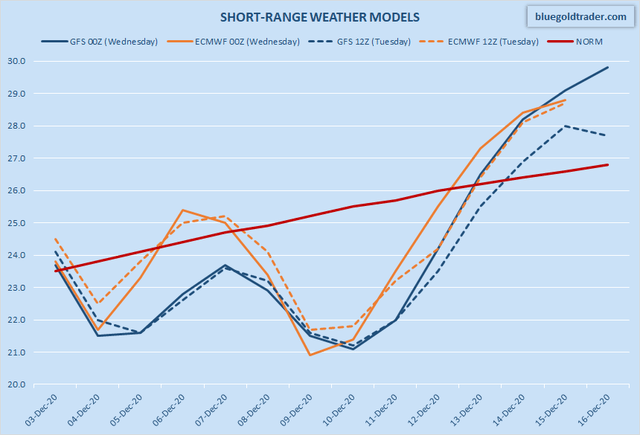

The latest numerical weather prediction models (Wednesday's short-range 00z runs) agree that, over the next 15 days, TDDs should trend higher, but should remain mostly below the norm (on average) - see the chart below. However, there is a disagreement between the models in terms of scale: the latest GFS model (00z run) is projecting 95.1 bcf/d of potential natural gas consumption (on average, over the next 15 days), while the ECMWF model (00z run) is projecting 96.1 bcf/d over the same period.

Source: NOAA, ECMWF, Bluegold Research

The latest extended-range ECMWF model shows more HDDs in week 1 – week 3, but fewer HDDs in week 4 – week 6. Consumption-wise, the model is slightly bullish vs previous update – particularly, on the front-end. Notice, however, that there is already a major bullish divergence between the latest extended-range model and the latest short-range model - particularly in the December 11 to December 15 period (see the chart below).

Source: NOAA, ECMWF, Bluegold Research

In absolute terms, projected short-range TDDs are now above last year’s level (+0.6%) but are still below the norm (-6.2%). Actual TDDs are currently projected to trend lower until Dec. 9 but are then projected to rise sharply. Notice that TDDs are mostly projected to remain above last year's level (see the chart below).

Source: NOAA, ECMWF, Bluegold Research

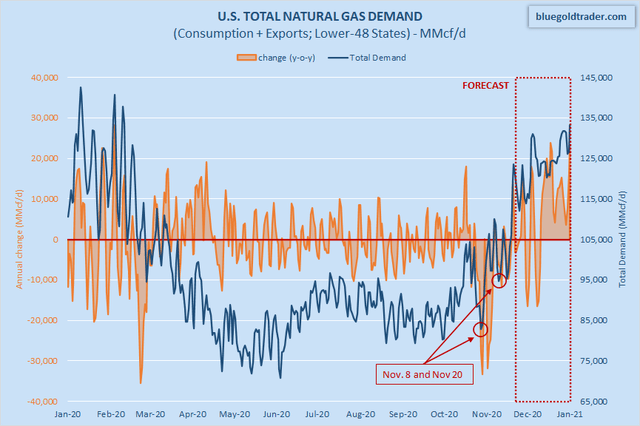

Over the next 15-day period, total natural gas demand (consumption + exports) is expected to average 120.1 bcf/d (adjusted for probability), which is 1.6 bcf/d higher than a year ago. Consumption (7-day average) is projected to increase by +8.4% over the next 7 days (from 92.5 bcf/d today to 100.3 bcf/d on December 9). Overall, total natural gas demand is now projected to trend higher and remain mostly above last year's level (see the chart below).

Source: Bluegold Research estimates and calculations

Supply

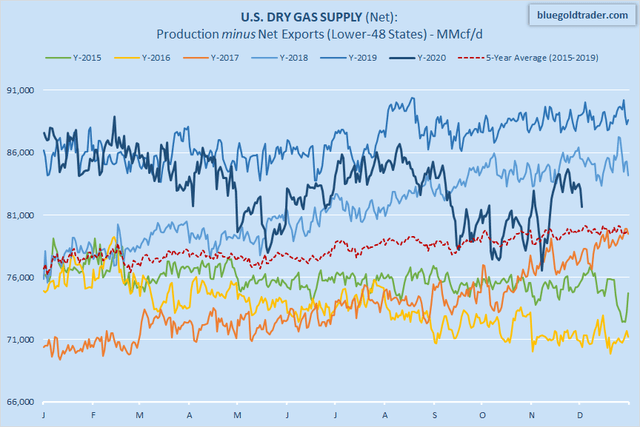

Dry gas production is currently estimated at 91.7 bcf/d (-0.2 bcf/d from yesterday). Net supply (calculated as production + imports - exports) has risen above the 5-year average but has started to trend lower lately (see the chart below). Net supply is currently estimated at 81.7 bcf/d (-7.4 bcf/d y-o-y).

We currently expect net supply in the contiguous United States to average 81.32 bcf/d over the next three months (December-January-February), -5.77 bcf/d y-o-y.

Source: Bluegold Research estimates and calculations

Storage Report

This week, the U.S. Energy Information Administration should report a smaller change in natural gas storage compared to the previous week. We anticipate to see a draw of 5 bcf (3 bcf smaller than the comparable figure in the ICE's latest report for the EIW-US EIA Financial Weekly Index, 17 bcf smaller than a year ago and 36 bcf smaller than the 5-year average for this time of the year). Annual storage surplus is currently projected to shrink by 248 bcf by January 1. The storage surplus relative to the 5-year average is projected to shrink by 215 bcf over the same period (from +286 bcf to +71 bcf).

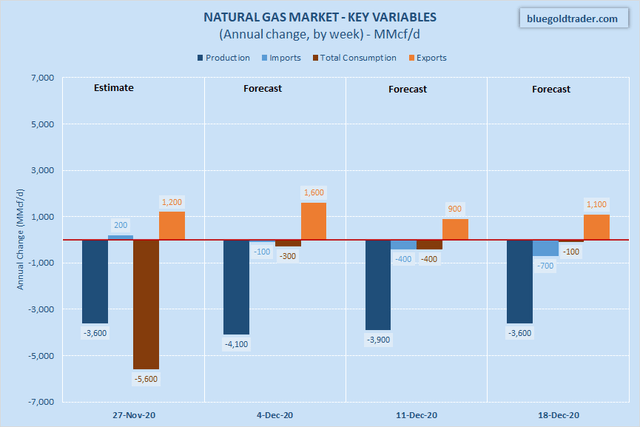

Key Market Variables (change, y-o-y)

Source: Bluegold Research estimates and calculations

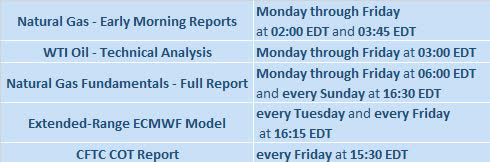

Thank you for reading this article. We also write daily and weekly reports, covering key variables in U.S. natural gas market (supply, demand, storage, prices and more). We provide the following to subscribers: We are offering a two-week free trial. Come and join us.

We are offering a two-week free trial. Come and join us.

Disclosure: I am/we are long NG1:COM. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.