AerCap: Potential Capital Structure Arbitrage Opportunity

COVID-19 has severely impacted the AerCap, causing the stock to trade at depressed valuations.

Debt markets allow AerCap to raise debt at an investment grade of ~3-4% interest while equity markets are pricing in high default chances and declining ROE, valuing AerCap at ~0.5x P/BV.

A reversion of valuation to a conservative 0.9x P/BV suggests ~60% upside from current levels.

Draconian assumptions have already been priced in at current levels, providing a good margin of safety for equity holders.

Moving forward, deleveraging efforts of airlines serve as key tailwinds for aircraft lessors.

Elevator Pitch

AerCap’s (NYSE:AER) share price is down 40% YTD on COVID-19 fears revolving around the air travel industry. With Moderna and Pfizer’s announcement of their vaccines being highly effective, stocks viewed as COVID-19 losers are likely to experience buying pressure.

At current levels, there also seems to be a disconnect between the debt and equity markets, with the debt markets suggesting that the equity is severely mispriced. Moving forward, with deleveraging being the main focus of many airlines post COVID-19, I believe AerCap to be the main beneficiary in the shift towards an asset-light business model.

With a proper pair trade strategy, I believe investors can limit their downsides by hedging out systematic vaccine-related risks as well as customer-specific risks.

What's priced in at current levels?

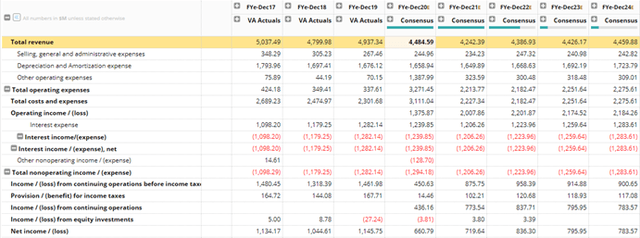

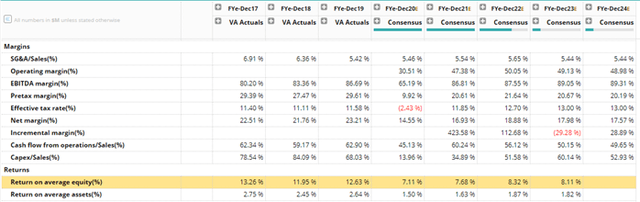

Source: S&P Capital IQ

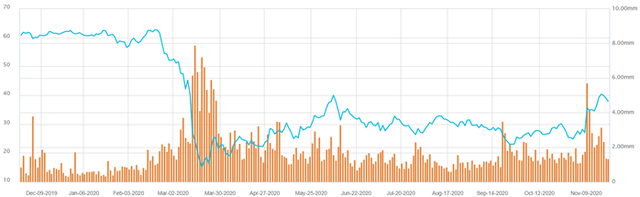

AerCap’s share price is down 40% YTD predominantly due to COVID-19 fears. Although prices seem to have inflected after the vaccine news was released, I believe there is still significant upside from current levels.

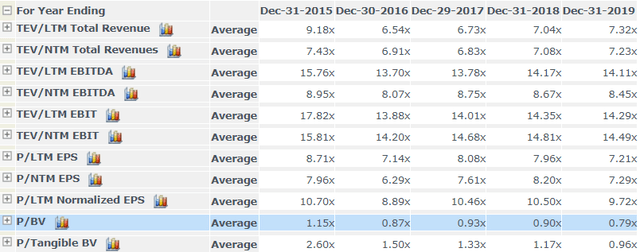

AerCap currently trades at ~0.5x P/BV which is way below the 5 year mean of 0.9x P/BV, signaling that the market is either pricing in high impairments to BV and/or a declining ROE moving forward.

Source: S&P Capital IQ

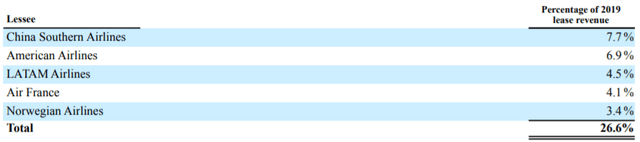

High default risks by other existing customers have likely been priced in, especially after 2 of AerCap's largest customers Norwegian Air and Latam Air filed for Chapter 11 bankruptcy during the pandemic.

Source: AerCap Investor Relations

As such, the street has priced in lackluster revenue performance and declining ROE over the next 5 years.

Source: Visible Alpha Consensus Estimates

The Mispricing

COVID-19 has indeed severely impacted the AerCap, causing the stock to trade at depressed valuations. Debt markets are confident in AerCap’s future, hence letting them raise debt at an investment grade of ~3-4%. However, equity markets are pricing in high default chances and declining ROE in the future, causing AerCap to trade at ~0.5x P/BV.

As Mark Twain once said: "History does not repeat itself, but it often rhymes". Given that equity markets usually trail debt markets at assessing unknowns, I believe that the current set-up provides an opportunity for a capital structure arbitrage opportunity. More can be read here in a report published by FTSE Russell exploring the efficiency of the debt markets.

The only logical explanation to this dislocation in valuation is that the equity markets are either pricing in (I) declining ROE or (II) large impairments on AerCap's book value.

Variant View 1: Perpetual ROE decline over the next 5 years is over bearish

I believe that fears are grossly overblown, and declining ROE is not reasonable given strong tailwinds in the future.

Firstly, (other than staying afloat) deleveraging would be the top priority of many airlines coming out of the pandemic. Channel checks across different airlines have also pointed this fact out.

I think it’s too soon to tell at this point. I think what you heard in Ed’s comments is that we are going to continue to focus on paying down debt as soon as we get to cash breakeven – Paul Jacobson, Delta Airlines Q3 earnings call

However, with the flexibility that I've outlined, we have the ability to proactively repay debt and delever our balance sheet over the next several years when we return to a normalized revenue environment. – Doug Parker, American Airlines Q3 earnings call

Hence, in order to deleverage, the industry is likely to shift from asset-heavy models (owning planes) to asset-light models (leasing planes). This can be done by (I) selling off their existing aircraft to pay down debt and/or (II) delaying or canceling future aircraft orders and choosing to lease them instead. Similarly, channel checks with aircraft lessors have also yielded similar hypotheses:

Related to the first question, Jamie, the pace at which operating leasing will hit 50%, the velocity has increased. There is no doubt in my mind that as airlines come out of this crisis that their number 1 focus will be deleveraging their balance sheet, particularly those who have taken on governments’ involvement. – Aengus Kelly, AerCap Q3 earnings call

In fact, one aspect of this pandemic crisis has emerged clearly, and that is the role of the leasing industry. It has strengthened considerably. For many years, I have said that the leasing industry provides a much needed buffer and capital provider to the airlines and OEMs – John Plueger, Air Lease Q3 earnings call

Secondly, I believe AerCap has a strong economic moat that is often overlooked. In this industry, sheer size and credit history are key competencies that are extremely hard to replicate:

- Being the largest aircraft lessors in the world, AerCap has a huge amount of bargaining power over suppliers like Boeing and Airbus (AerCap is their largest buyer). This gives them priority access to new aircraft at favorable prices.

- Good credit rating history and ability to leverage on size have allowed the firm to borrow at extremely low rates, way below smaller firms (where banks would require a higher default premium). This allows them to enjoy superior net interest spreads and hence operating margins as compared to smaller players.

Variant View 2: Future impairment risks are already priced in

Assuming no ROE changes, doing a simple back-calculation at current valuations would suggest that the market is implying a 9-10% impairment on the book value of the aircraft after accounting for leverage effects. The industry average seems to suggest an 8% mark up of market value from BV for aircraft. Thus, this gives AerCap a 17-18% impairment margin of safety from current prices.

Impairments are assessed by comparing carrying values to the discounted cash flow of future lease payments over the life of the asset in addition to a residual value assumption.

- During the Great Recession when peak-to-trough appraised aircraft values declined ~20%, AerCap booked impairment to book value of just under 2%.

- Younger fleet inherently less at risk of impairments -> more years of remaining useful life means more years left for a recovery in asset value/lease rates following any short-term downturns in either

- BOCA fleet Age 3.4 years v. AerCap's average fleet age was 6.1 years, AirLease at 3.5 years and FLY Leasing at 7.6 years

Regarding the actual market value of the aircraft in AerCap's fleet, it is evident that the actual realizable value of the aircraft in their fleet are still above book value. This is seen from the fact that during the pandemic, AerCap was still able to attain steady gains on aircraft sales.

| 1Q19 | 2Q19 | 3Q19 | 4Q19 | 1Q20 | 2Q20 | 3Q20 | |

| Gains on Sale of Airlines | 6.3% | 15.6% | 7.2% | 6.7% | 22.0% | 5.3% | 11.4% |

Source: Author's Calculations

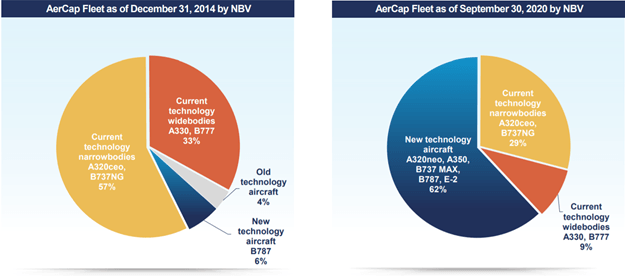

Furthermore, AerCap is actively pursuing a fleet re-optimization towards newer aircrafts that are at less risk to impairment. New aircrafts currently account for 62% of their fleet.

Source: AerCap Q3 Presentation

The company has also recently impaired $915 million in value from its aircraft in Q3 mostly coming from their older wide-body aircrafts. Impairments from new technology aircraft is unlikely moving forward and the company has rightfully guided so:

As for new tech aircraft, which make up 62% of the fleet, these are aircraft that airlines are transitioning into. They're most in-demand aircraft types. They'll form the backbone of the global fleet for the next 25 years. So really, as I said in my prepared remarks, looking out today, we don't see any more meaningful impairments in any parts of our fleet. – Pete Juhas, AerCap Q3 earnings call

Credit Line Sustainability

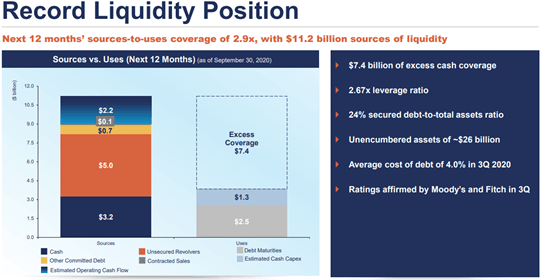

It seems like the most plausible chance of a funding crisis for now would be a decline in their credit ratings, as that would severely increase their funding costs and squeeze their margins. However, given that their credit ratings have only just been re-rated and the company has ample liquidity coverage, an increasing cost of debt is unlikely. Sell-side analysts are similarly estimating a lower average cost of debt going forward with tightening credit spreads (indicating improving private creditworthiness.)

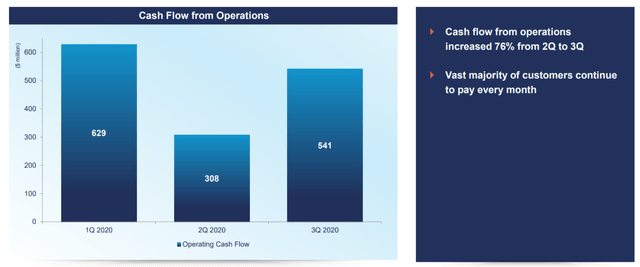

Source: AerCap Q3 Presentation

Furthermore, senior secured notes make up 37% of the total aircraft collateral NAV while 78% of the senior unsecured tranche is also covered by collateral. While there may be covenants in place to protect the senior creditors, I do not foresee much issues with increasing leverage in the future if the company so requires it.

Revenue Sustainability

The company continues to book revenues during the pandemic as airlines still have to pay for leases even if the planes are grounded. However, it is to be noted that revenues for 2020 are lower as the company does not continue to book revenues for customers that are going through Chapter 11 filings.

In order to help customers tide through the pandemic, the company has allowed deferrals for select customers. As such, revenues are still booked but recorded on the balance sheet as accounts receivable. This may be a concern to investors as many may question how much of this accounts receivable the company is able to get back. However, cash collection has improved drastically since Q2 and the company guides that they expect to collect most or if not all of their accounts receivables.

Source: AerCap Q3 Presentation

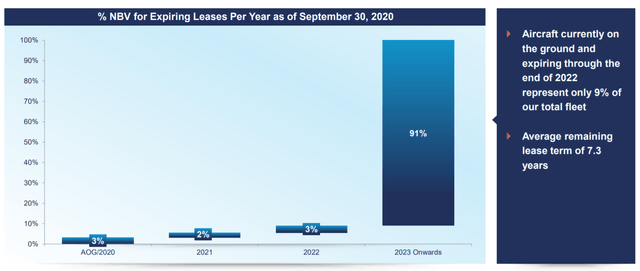

Regarding the leases that are due to expire soon (loss in revenue), AerCap has relatively few leases expiring through the end of 2022 (9%) which gives them good revenue visibility moving forward.

Source: AerCap Q3 Presentation

Customer Default Risk

Portfolios of leading lessors comprise of leading airlines. Default risks are minimized as cancellations are tantamount to a default, with the consequences being extremely dire for the airline moving forward. In the industry, it’s likely that if an airline suddenly cancelled an order, all the lessors would probably not want to do business with that airline in the future.

In addition, even the manufacturers, such as Airbus and Boeing, which are likely even more selective, may not even sign an aircraft purchase agreement to sell an aircraft to that airline or may only do so with very unfavourable terms for the airline. Consequently, I believe many reputable airlines would not take this risk. I see in the aviation market that the bargaining power of lessors is still, on average, higher than that of the airlines due to the much higher concentration of market share.

Competitive Dynamics

Air Lease - AerCap has been weighed down by news of defaults by their customers Norwegian Airlines and LATAM Airlines. Previous acquisition financing junior debt tranches skew the average cost of debt upwards. Adjusting acquisition financing out, AerCap is on par with peers like Air Lease in terms of financing costs. Air Lease does however have an advantage with their newer fleet, which gives the company a higher collateral to borrow against. However, their stock price has significantly recovered and the risk to reward dynamics of Air Lease do not interest me as much as AerCap.

BOC Aviation - BOC is heavily subsidised by bank of china and get ridiculous rates as China strives to enter this market. However, BOC is extremely highly levered and tightening laws in China may make it hard for them to finance aircrafts in the future.

Valuation

AerCap currently trades at ~0.5-0.6x P/BV while it has historically been trading at a 5 year average of 0.9-1.0x P/BV. Assuming a reversion to the lower bound historical valuations (0.9x P/BV) would suggest and ~60% upside from current levels assuming no additions or future impairments to book value.

Furthermore, it is to be noted that AerCap is currently the largest shareholder in Norwegian Airlines. Given that their stake in Norwegian Airlines is currently valued at 0 with other losses already priced in by the market, investing in AerCap at current levels also provides a nifty 'equity kicker' to investors at 0 cost should Norwegian Airlines be able to resturcture.

Potential Catalysts

- Positive vaccine news and/or/consequently leading to lower COVID-19 cases

- Successful re-structuring of customers in Chapter 11 bankruptcies (Norwegian and LATAM Airlines)

- Lower impairments moving forward

- Uptick in demand from aircraft leasing

Conclusion and Trade Structuring

I've seen many argue that investing in AerCap's bonds may be a more prudent option at this time. However, given the dislocation in valuation between AerCap's debt and equity at this juncture, I would prefer the risk to reward of the equity to the debt as I do not forsee much upside to the bonds from current levels.

For the more risk averse investors who wish to hedge out the risks associated with vaccine uncertainty and focus on the capital structure arbitrage opportunity, one could consider a pair trade. One could consider going long AerCap(AER) and going short American Airlines (AAL) at this juncture.

Source: S&P Capital IQ

Both of the stocks have a very strong correlation between each other. Observing their share price movements to vaccine news, I believe that increasingly positive news would cause AER to rise higher than AAL while disappointing news would depress AAL a lot more than AER given the fragility of AAL's balance sheet.

Furthermore, given that AAL is one of AER’s key customers, going short AAL also hedges out the default risk that AER has from its customer exposure to AAL.

Disclosure: I am/we are long AER. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.