As we step into December, the fears of bears taking control remain high as we trade near crucial resistance levels. But, the last 10-years data suggests that bulls remained in control of D-Street.

candlestick chart world financial stock market vector illustration

The last month of the year 2020 is already upon us. In the past, the month of December has been good for equity markets, but considering the fact that benchmark indices have rallied more than 70 percent since March lows, some consolidation cannot be ruled out.

Both Sensex and Nifty50 have gained by about 7 percent each so far in the calendar year. Most market experts after the recent rally have upgraded their price target for the next 12 months which suggests that there is more upside, but the real action will be in individual stocks.

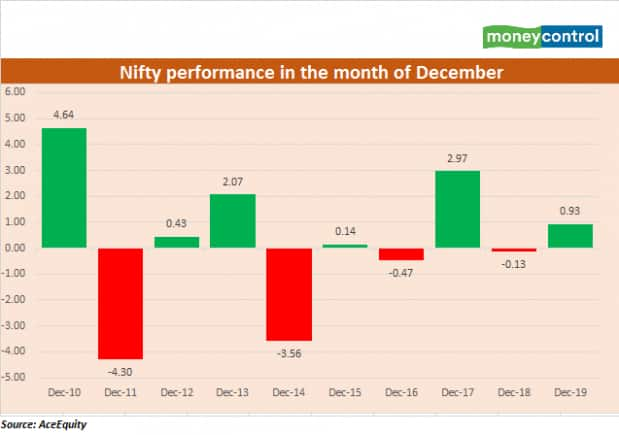

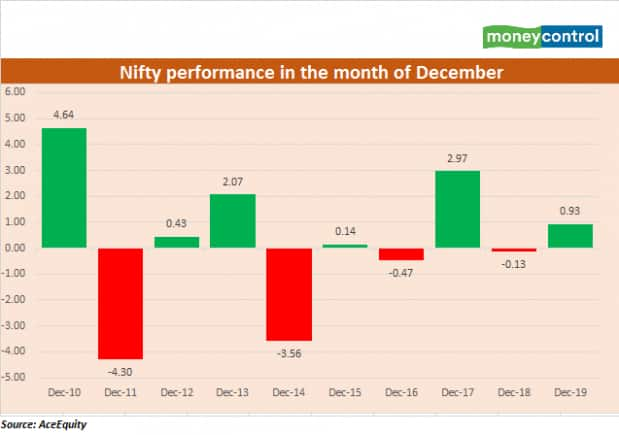

As we step into December, the fear of bears taking control remain high as we trade near crucial resistance levels. But, the last 10-years' data suggests that bulls remained in control of D-Street in at least 6 out of the last 10 years.

The Nift50 rallied the most in the year 2010 when the index rose by over 4 percent, followed by the year 2017 when it gained nearly 3 percent, and in the year 2013, it rose by a little over 2 percent.

The index fell in 4 out of the last 10 years. It plunged nearly 4 percent in the year 2011, followed by 3.5 percent decline in the year 2014 and a 0.4 percent fall in 2016.

November – a month of record highs. The S&P BSE Sensex rallied above 44,000 to hit a record high of 44,827 for the first time in history while the Nifty50 surpassed Mount 13K to hit a record high of 13,145.

Foreign investors net bought Rs 65,317.13 crore worth of Indian equities in November, the highest-ever inflow in a single month.

The inflow in November has taken the total year-to-date FII inflow to Rs 1,07,562.09 crore, which was much higher than Rs 82,741.32 crore inflow seen in the same period the previous year.

Benchmark indices posted their best monthly return since April 2020. The S&P BSE Sensex rose 11.4 percent while the Nifty50 rallied by 11.39 percent. Hence, some consolidation cannot be ruled out, suggest experts but the trend is likely to continue.

“The markets saw a steep crash in March following the global onset of COVID-19 but since then have seen an equally swift recovery, making the indices YTD positive and Nifty50 crossing the coveted 13000-mark smartly,” Umesh Mehta, Head of Research, Samco Group told Moneycontrol.

“The rally is primarily driven by two factors, the better-than-expected earnings reported by companies followed with cost and operational efficiencies across sectors and the huge flush of liquidity coming into the markets. These two factors have been major supporters of the rally and as long as liquidity supports the markets, the trend is expected to continue as we exit 2020,” he said.

We could see a knee-jerk reaction largely on account of profit-taking but if there is no bad news bulls could well remain in control and dominate D-Street. The December series rollover was also strong.

“Looking at the market condition, the trend seems to continue being dominated by the bulls. The year started with a fresh high of 12,430 but later the pandemic took over the control which leads to the plunge in the market,” Gaurav Garg, Head Research, CapitalVia Global Research Ltd told Moneycontrol.

“The bulls have taken the charge by dominating 7 out of 8 months by making higher highs and hitting a fresh high in November. With a month left for the calendar year to end one can expect domination of bulls over the bears as long as Nifty respects the level of 12,500,” he said.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

_2020091018165303jzv.jpg)