Elastic: Reasonably Priced Search And Observability SaaS Stock

Elastic's growth rates have been compressing of late, but as we go into Q2 2021 earnings, investors should keep an eye out for its outlook.

Noting some positive and negative characteristics investors should stay mindful about.

Presently, this SaaS stock is being valued at 20x forward sales, which is middle of the road in the SaaS world.

Investment Thesis

Elastic (ESTC) has seen its revenue growth rates compress slightly during fiscal 2021. At this moment, investors are being asked to pay 20x forward sales for Elastic, which is reasonably priced when all is considered.

Indeed, paying 20x forward sales is a meaningful discount to one of its peers. Having said that, Elastic's Rule of 40 is likely to finish fiscal 2021 at approximately 28%, which leaves much to be desired.

In sum, there are more good aspects than negative detractions at this valuation, and investors would do well to keep an eye on this name.

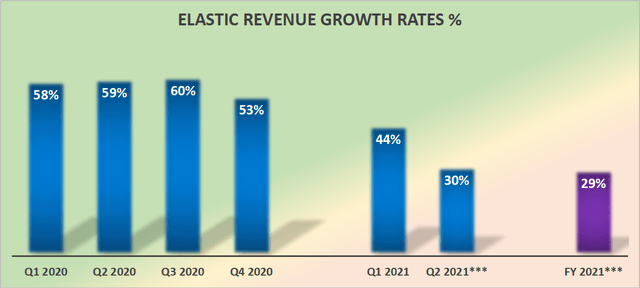

Revenue Growth Rates, The Big Unknown Going Into Earnings

Source: author's work

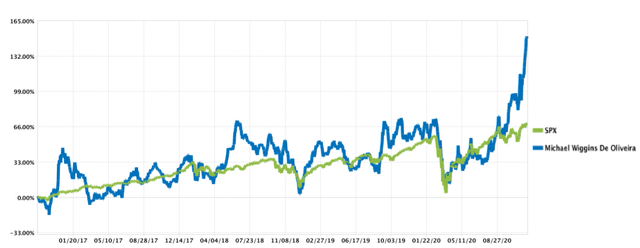

Since I last wrote on Elastic, I made a bearish call.

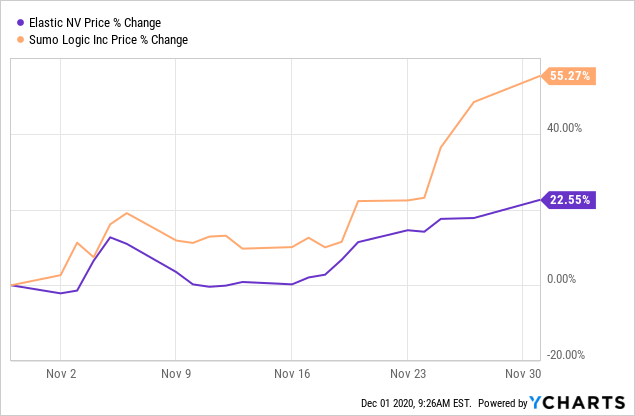

Presently, as we go into fiscal Q2 2021 earnings results (today, Dec. 2), I can see that despite my cautious approach, the stock has rallied more than 13% in just a few months.

What's more, if we compare Elastic's performance with how Sumo Logic (NASDAQ:SUMO) has performed of late, we can get a strong impression of the market's appetite for software observability stocks.

Data by YCharts

Data by YCharts

Consequently, the big question that I'm trying to ascertain is just how fast are Elastic's revenues growing?

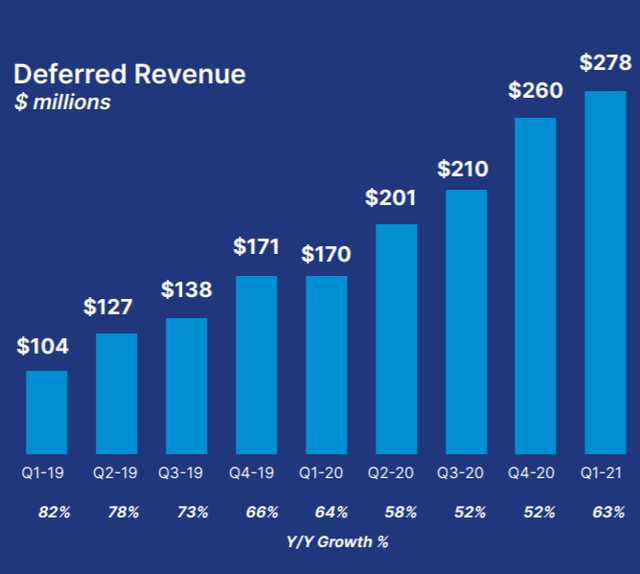

Needless to say that given that Elastic has a huge backlog of deferred revenue (see below), it has a significant amount of visibility ahead. Consequently, Elastic is able to layout attractive guidance only to subsequently beat its guidance.

Source: Elastic Investor Presentation 2020

Accordingly, we should expect Elastic to come out of fiscal Q2 2021 earnings with run rates slightly higher than 30%.

Now, the question which matters most here is whether Elastic will simply reaffirm its full-year guidance, or will it actually raise its full-year guidance higher than 29% y/y for fiscal 2021?

Attractive Operating Leverage, But Mediocre Rule of 40

Moving on, Elastic has a net expansion rate of 130%. This is roughly level with Datadog's (DDOG) expansion rate and would be largely accepted as being above average, even amongst the best SaaS stocks - high performing SaaS stocks typically average around 115% to 120%.

However, what we've seen of late is that many SaaS stocks are companies with substantial portions of their revenues derived from usage-based models. With these companies, what happens is when demand increases, there's a spike in usage, which drives up net retention rates.

But then the customer becomes dissatisfied with the higher billing, and at the soonest opportunity, that customer falls out of using the company's products, leading to customer attrition, even though net expansion rates remain high: >100%.

In the case of Elastic, its revenues are partially derived on a usage-based model, but according to its 10-K, "we generally invoice annually in advance for subscription agreements at least one year in duration".

In other words, for Elastic there's a mixture when it comes to its revenue sources of both usage and prepaid contracts. Therefore, there shouldn't be any nasty surprises on its revenue line.

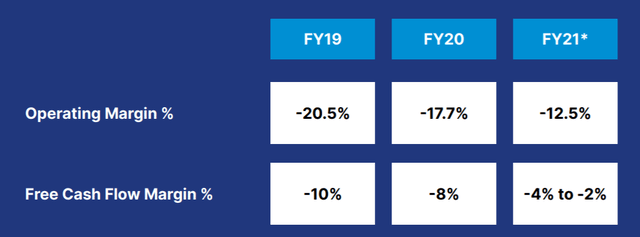

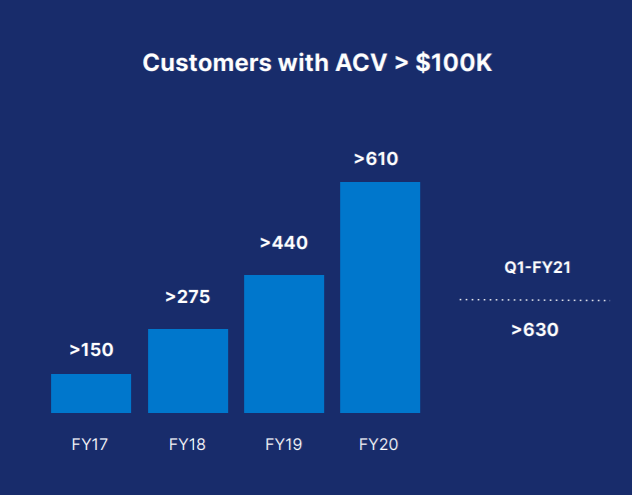

Source: Elastic Investor Presentation 2020

Indeed, as you can see above, there's been a steady increase in Elastic's customer base, with FY 2020 seeing customers with an annual contract value of plus $100K crossing into more than 630 as of fiscal Q1 2021.

Ultimately, having a steady and increasing number of customers taken together with price raises lends itself towards a very healthy business, with positive operating leverage.

Source: Elastic Investor Presentation 2020; *Elastic Guidance

Above we can see that with the passage of time, Elastic has made significant progress on its free cash flow margins, as it migrates away from negative 10% free cash flow margins and towards negative 4% to -2% for fiscal 2020.

Having said that, we are now left with the issue of why Elastic doesn't trade at a particularly large multiple: its Rule of 40. Elastic's Rule of 40 is likely to finish fiscal 2021 at about 28%. Obviously, in a world where many SaaS stocks are reporting higher than this, investors have been drifting towards those SaaS stocks, and I believe this has left an opportunity for Elastic at this valuation.

Valuation - Not Unreasonably Expensive, Still Some Upside Potential

On the one hand, Elastic is being priced at 20x forward sales, but we should keep in mind that Elastic's fiscal 2021 finishes in April 2021.

Nevertheless, if we compare Elastic with Datadog's valuation, Datadog is being priced at 38x forward sales. Thus, investors are obviously very optimistic that Datadog will deliver investors very high rates of return, and that in comparison, Elastic will not be able to out-surprise investors.

The Bottom Line

Elastic is not the cheapest SaaS stock available, but it's also very far from being particularly expensive either - a middle ground stock if you will.

When Elastic announces its highly awaited fiscal Q2 2021 results Wednesday, after hours, investors should stay attuned to see if it meaningfully raises its full-year guidance or simply reaffirms it. I'm a big believer that no news is good news, and as long as Elastic continues to deliver, investors will be rewarded for staying the course.

Strong Investment Potential

My Marketplace highlights a portfolio of undervalued investment opportunities - stocks with rapid growth potential, driven by top quality management, while these stocks are cheaply valued.

I follow countless companies and select for you the most attractive investments. I do all the work of picking the most attractive and profitable businesses.

Investing Made EASY

As an experienced professional, I highlight the best stocks to grow your savings: stocks that deliver strong gains.

- Honest and reliable service.

- Hand-holding service provided.

- Very simply explained stock picks. Helping you get the most out of investing.

- Helpful advice together with videos.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: The author is long SUMO.