Corporate Office Properties: Safe 4.2% Yield From Government-Related Tenants

COPT has demonstrated its recession resiliency, with FFO/share growth and strong occupancy metrics.

It has an active development pipeline, and management plans to deleverage the balance sheet in the current quarter.

I find the shares to be undervalued, and the dividend to be safe and attractive in this low-yield environment.

Investors in the currently expensive market are hard-pressed to find a relatively high and safe yield. On December 2nd, the S&P 500 (SPY) reached an all-time high, with a 14% gain since the start of the year. This has brought its dividend yield down to just 1.5%. Most investors who are looking to layer in new money will find a hard time funding their living expenses on such a paltry yield.

This brings me to Corporate Office Properties Trust (OFC), which offers a much higher 4.2% dividend yield that is backed by a safe tenant base. Plus, the share price still hasn’t recovered, as it’s still down by 11% since the start of the year. In this article, I evaluate what makes COPT an attractive buy at the current valuation. So, let’s get started.

(Source: Company website)

A Look Into COPT

Corporate Office Properties Trust is a REIT that is focused on owning and acquiring properties that are primarily leased to the U.S. government and its contractors for defense/IT purposes. As of September 30th, 2020, it owns 174 properties, with 88% of the annualized rental revenue stemming from Defense/IT locations and the remaining 12% from regional office properties. In 2019, it generated $643 million in total revenue.

What I find attractive about COPT is the recession-resilient nature of its portfolio, due to the mission-critical nature of its government and defense contractor tenants, who are engaged in national security, defense, and information technology-related activities. This durability played out in the latest quarter, in which FFO/share grew by 5.9% YoY, from $0.51 in Q3’19 to $0.54 in Q3’20. Plus, portfolio occupancy remained strong at 94%. This is a slight improvement from the prior quarter (Q2’20), in which occupancy was 93.6%, and a 90 basis points improvement from the end of 2019, during which occupancy was 93.1%. This improving occupancy metric in spite of the COVID-19 pandemic demonstrates the “all-weather” nature of COPT’s portfolio.

Plus, demand for COPT’s properties remain high. This is supported by the strong tenant retention rate on lease renewals. For the third quarter and the first nine months of the year, renewal rates were 89% and 84%, respectively, far surpassing the previous record of 80% retention set back in 2017. COPT’s properties also are not affected by pandemic shutdowns due to the high-security nature of the work, which cannot be performed remotely. As such, only a small number of tenants’ employees are able to work from home.

Looking ahead, I see COPT as being able to meaningfully grow its top and bottom lines, as supported by the active development pipeline. The development pipeline consists of 12 properties, with some of it expected to be completed by year-end, as noted by management during the recent conference call:

At the end of the quarter, we had 12 buildings comprising 1.6 million square feet under development that are 84% leased. We placed into service 600,000 fully leased square feet in the quarter and 1.2 million fully leased square feet in the 9 months.

Before year-end, we expect to place over 0.5 million square feet in service that are 100% leased, bringing our total for the year to nearly 1.8 million square feet that are fully leased and increasing the size of our core portfolio by nearly 10% during the year. Our ability to place large volumes of stabilized development projects into service generates highly visible, low-risk EBITDA that maintains our strong balance sheet and drives cash flow growth.”

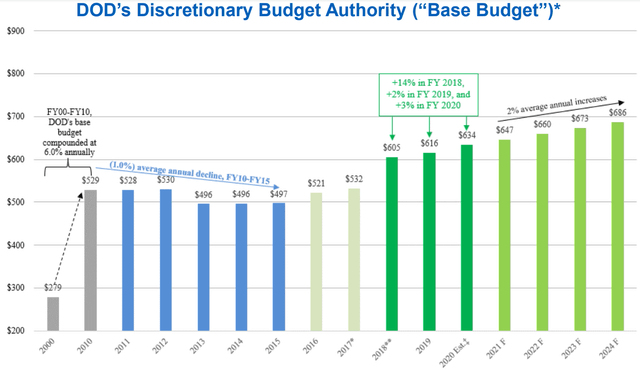

COPT’s reliance on Defense/IT-related tenants is also a risk, as cuts in the Department of Defense’s budget could adversely affect its tenants. I see this as a low-risk event in the near term, as Congress passed a continuing resolution on the FY 2021 budget. Plus, as seen below, the DoD’s budget has grown at a compound rate of 5% in the years 2015-2020.

(Source: November Investor Presentation)

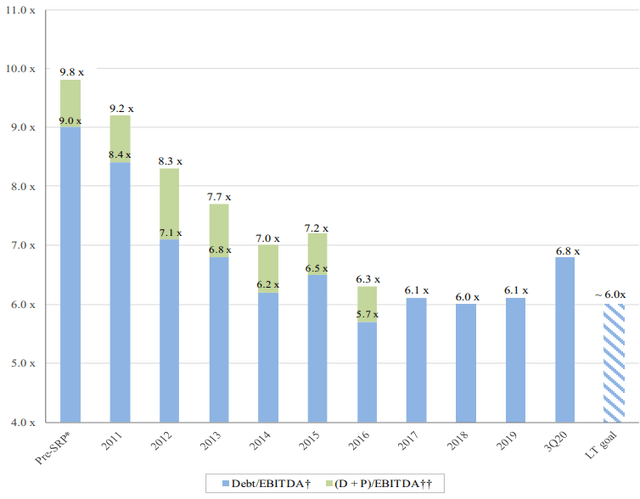

Turning to the balance sheet, the net debt-to-EBITDA ratio is somewhat high, at 6.8x, which is above the 6.0x that I generally prefer to see for REITs. However, the fixed charge coverage ratio remains strong, at 3.9x. Plus, management expects to reduce the leverage ratio to the 6.2x-6.4x range by the end of this year, after raising ~$165 million of equity through selling joint ventures. COPT maintains an investment grade rating of BBB-. As seen below, management has made solid progress in reducing the company’s leverage over the past decade.

(Source: November Investor Presentation)

I find the 4.2% dividend yield to be both safe and attractive, especially in this low-rate environment, with a payout ratio of just 53%. While dividend growth has been nonexistent, I see potential for future increases, as management has been using retained funds for deleveraging the balance sheet and property development.

Investor Takeaway

Corporate Office Properties Trust has demonstrated its resiliency in the current environment, with strong occupancy and FFO/share growth. I’m encouraged by the record retention rate that the company has seen on lease renewals, and by the active development pipeline, which is expected to contribute to both the company’s top and bottom lines.

COPT is also largely unaffected by shutdown measures, as the majority of its tenants’ employees are required to work onsite, due to the sensitive nature of their jobs. Meanwhile, I expect deleveraging in Q4, which would bring the debt metrics towards what I consider to be a safe range.

I see the shares as being undervalued at the current price of $26.26, with a forward P/FFO of 12.6, based on the midpoint of 2020 FFO/share guidance of $2.09. For a durable REIT with near-term growth prospects and a BBB- rated balance sheet, I would expect shares to trade at a P/FFO around 15. Analysts seem to agree that the shares are undervalued, with a consensus Buy rating and an average price target of $29.15. Buy for income and growth.

Thanks for reading! If you enjoyed this piece, then please click "Follow" next to my name at the top to receive my future articles. All the best.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This article is for informational purposes and does not constitute as financial advice. Readers are encouraged and expected to perform due diligence and draw their own conclusions prior to making any investment decisions.