The euro has experienced a significant rally in the past 8 months in this weak USD environment, rising from a low of 1.0640 in mid-March to 1.20 this week.

Central banks will certainly not let their exchange rate appreciate indefinitely, as a strong currency tends to weigh on inflation expectations.

The ECB meeting on Thursday is largely priced in, therefore the EURUSD spot rate could continue to move higher in the short term.

However, the upside gains remains limited, as policymakers will start to react to a strong euro; there could be a "hidden" cap at 1.25.

In addition, the lack of economic activity amid the high reliance on tourism for some countries will certainly lead to higher political uncertainty in the medium term.

Introduction

The euro has experienced a significant rally in the past 8 months in this weak USD environment, rising from a low of 1.0640 in mid-March to 1.20 this week, and investors have been wondering how high the EURUSD can rise until we hear a response from EZ policymakers. We do know that central banks do not target exchange rates, but they can influence them through the use of QE programs, and will certainly start to intervene more if the exchange rate appreciates significantly, as a strong currency tends to weigh on both the economic recovery and inflation expectations.

- What should we expect from ECB meeting on Thursday (December 3rd)?

- How much upside is there left on EURUSD?

USD medium-term drivers

1. Real rate differential and "twin deficits" suggest lower US dollar

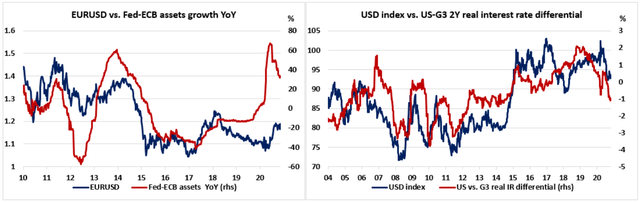

Over the past few months, investors have become increasingly bearish on the US dollar due to the significant divergence in the annual change in asset growth between developed market central banks and the Fed. While the Fed’s assets have nearly doubled since the start of the year to USD 7.2 trillion, other major central banks such as the ECB or the BoJ have been less aggressive in their intervention and expanded the size of their balance sheets by 45% and 22%, respectively. Figure 1 (left frame) shows that the EURUSD exchange rate has strongly co-moved with the central banks’ asset growth in the past 12 years, and that the massive rise in Fed’s assets relative to the ECB is therefore pricing in a stronger euro.

Another important driver of currencies in the medium term is the real interest rate differential. Figure 1 (right frame) shows that the fall in US real yields in the past year has eventually weighed on the US dollar in the past 8 months; US 2Y real yield has been falling since the end of 2018 at a much faster pace than the rest of major economies (G3: Euro, UK and Japan), bringing the 2Y interest rate differential from over 2% to -1.1% in the past two years.

Figure 1

Source: Eikon Reuters, RR calculations

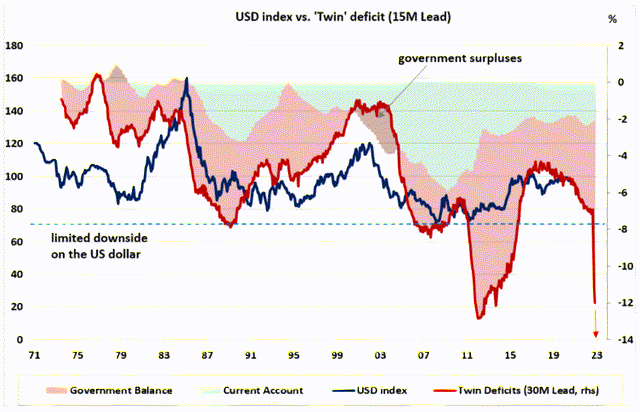

One important chart that also supports the bearish USD narrative is that of the US "twin" deficits (fiscal and current account), which has historically acted as a strong 15-month lead of the USD index, as we can see in Figure 2 (higher twin deficits generally lead to a weaker USD). The constant deterioration of the US twin deficits over the past few years amid the significant increase in government spending should lead to a gradual depreciation of the US dollar in the coming 2 years.

Figure 2

Source: Eikon Reuters, RR calculations

2. But demand for safe haven may benefit USD reserve status

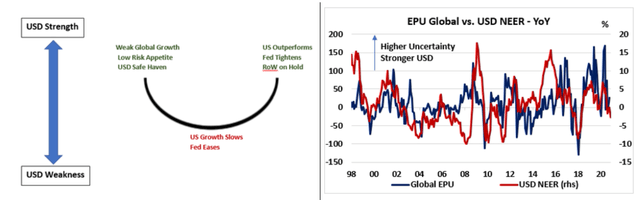

While the main drivers of the US dollar in the medium term imply further weakness in the USD in the medium term, demand for the world currency tends to rise when volatility surges, which implies that investors are still looking at the USD as a "risk-off" currency in periods of high uncertainty. Figure 3 (left frame) represents the "USD smile theory"; the dollar generally tends to depreciate when US growth slows relative to the rest of the World and when the Fed eases aggressively, but then regain power when global growth slows and uncertainty rises as the risk appetite for risky assets falls and investors rush for safe havens (JPY, US Treasuries, Gold and USD).

With most of the European economies under national lockdown (which is also expected to be announced in the US), global growth is expected to dramatically weaken this winter, which should increase political and economic uncertainty and therefore limit the downside risk on the US dollar. Figure 3 (right frame) shows the strong relationship between the EPU index, which is a measure of economic uncertainty based on newspaper coverage frequency, and the Broad USD index (NEER); higher uncertainty has led to a stronger USD in the past 25 years.

Figure 3

Source: Eikon Reuters

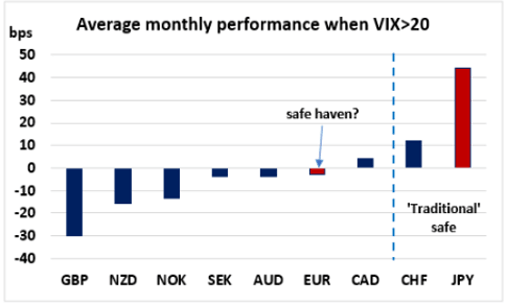

The euro also tends to perform relatively poorly against the US dollar in high-volatility regimes. Figure 4 shows the monthly average performance of the most liquid currencies relative to the dollar when the VIX rises above 20 in the past 30 years; as expected, the yen is the currency that benefits the most when price volatility rises, averaging 45bps in monthly returns. On the other hand, investors do not seem to view the euro as a refuge currency, with EURUSD averaging -4bps in monthly returns when the VIX rises.

Figure 4

Source: Eikon Reuters, RR calculations

Euro strength: a quandary for the ECB

1. A stronger euro weighs on the economic activity and inflation

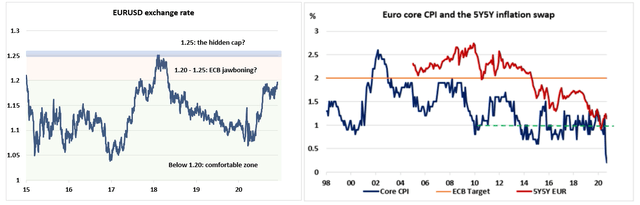

Despite the significant rise in EURUSD since March, the ECB’s Governing Council left all policy parameters unchanged at the October meeting (in line with expectations). However, we think that with the euro slowly approaching a key resistance at 1.25 (Figure 5, left frame), the ECB will be forced to react. A strong euro left unchecked would impact the economic "recovery" and weigh on inflation expectations. While exchange rate targeting remains outside the official mandate of the ECB, they can influence them through the use of unconventional monetary policies.

Thus, we think that the upside gain is limited and that the risk-reward for the single currency is more skewed to the downside. In addition, Figure 5 (right frame) shows that inflation measures have been constantly falling in recent years and currently stand well below the ECB’s 2 percent target. We observe that core CPI has remained below 2 percent since the start of 2003 and has been oscillating around 1 percent for the duration of the past cycle (excluding the COVID-19 shock). In his last few speeches at the ECB, former President Mario Draghi mentioned many times that policymakers will not accept an inflation rate at around 1 percent and the Governing Council was going to do "whatever it takes" to lift inflation expectations. Hence, it is clear that Euro policymakers will not accept a EURUSD exchange above 1.25, and one efficient way to weaken the single currency in the medium term would be to surprise the market by increasing the current pace of asset purchases (QE).

Figure 5

Source: Eikon Reuters

2. EURUSD moves before and after ECB meeting

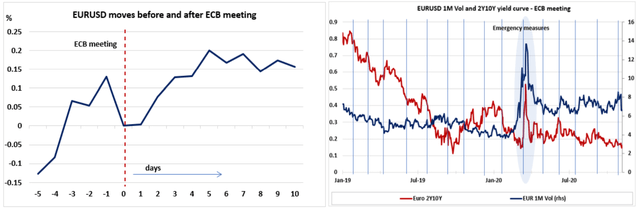

In this section, we look at the average cumulative returns of EURUSD 5 days prior and 10 days after the ECB meeting in the past 5 years. Figure 6 (left frame) shows that EURUSD has generally trended higher in the past few years, averaging up to 0.2% in cumulative returns in the week following ECB meetings.

In Figure 6 (right frame), we chart the dynamics of the 1M ATM vol and the 2Y10Y yield curve around ECB meetings (blue lines) over the past two years to see if you could observe any interesting patterns after policymakers’ decision. First, we observe that with the exception of two meetings (including the March emergency meeting), the 2Y10Y yield curve tends to flatten for a few days following the ECB announcement. When we look at the 1-month ATM implied volatility, the evidence is less clear, but most of the announcements were followed by a compression of volatility. Therefore, if the December meeting turns out to be a "non-event", we would expect volatility to decrease in the following days.

Figure 6

Source: Eikon Reuters, RR calculations

3. December: A likely non-event for the euro?

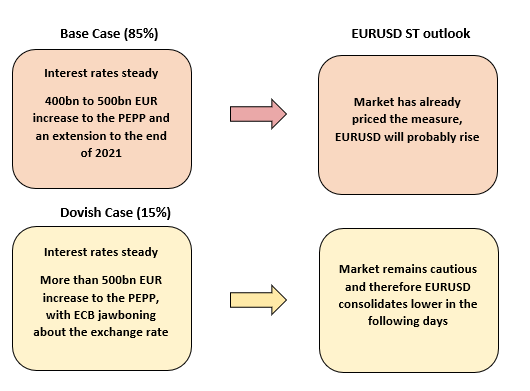

Unless the ECB surprises the market - as it did back in May 2014, with Draghi announcing that the ECB was "ready to act" in June to tackle the low inflation - our base case is to see a slightly higher euro following the December meeting. At the October meeting, the ECB kept the interest rate on the main refinancing operations, marginal lending facility and deposit facility steady at 0%, 0.25% and -0.5%, respectively. In addition, the EUR 1.35 trillion Pandemic Emergency Purchase Program (PEPP) that runs until at least June 2021 was left unchanged, but the ECB hinted the market that it will increase it and extend it until the end of 2021.

We expect policy rates to remain unchanged at the December meeting, with a 400-500 billion EUR increase to the PEPP program with an extension until the end of 2021. We think that this is largely priced in by the market, and therefore, we do not expect a strong reaction of the euro; we could actually see a stronger EURUSD following the meeting.

Key euro downside risks in the medium term

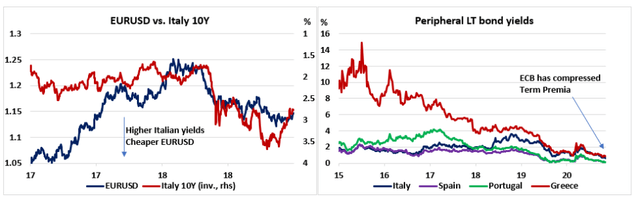

Since the European Sovereign debt crisis, one of the key risks for the euro is a sudden divergence in long-term yields between European core and peripheral countries. For instance, the political instability in Italy in early 2018 led to a dramatic increase in the 10Y BTP yield and strongly weighed on the EURUSD exchange. Figure 7 (left frame) shows that the rise in the Italian 10Y yield from 1.75% to over 3% in the first half of 2018 led to a significant consolidation in EURUSD from 1.25 to 1.15.

However, the ECB’s sizeable asset purchases in recent years have compressed term premia across all the term structures in the Euro area, and therefore, we do not expect long-term interest rates to rise despite southern economies heavily exposed to tourism (i.e., Portugal, Greece).

Figure 7

Source: Eikon Reuters

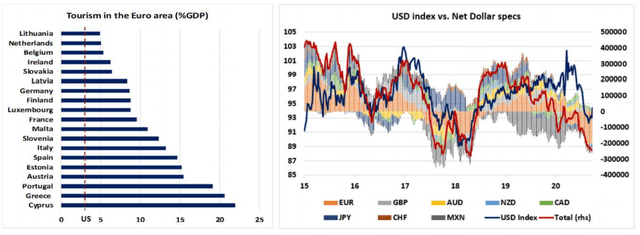

Notwithstanding this, we expect the euro to weaken amid a dramatic surge in political risk in the Euro area due to the lack of economic activity. For instance, the economic restrictions imposed by governments to fight the pandemic will disproportionately impact weak economies in the periphery; Figure 8 (left frame) shows the contribution of travel and tourism to GDP for all the economies in the Euro area (over 20% for Greece and Cyprus, and nearly 15% for Spain). In Spain, which is probably one of high-risk countries in the Euro area, the lack of industries in addition to banks’ strong exposure to EM markets (i.e., Turkey) will weigh on the financial markets in the medium term and increase the political pressure between regions (Catalonia).

Figure 8

Source: Eikon Reuters, CFTC, European Commission

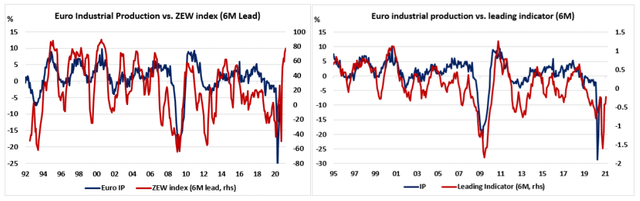

We know that investors were slightly bullish on the Euro area amid the strong rebound in business surveys such as the ZEW index (figure 9, left frame) or the ISM manufacturing PMIs; however, we are confident that the rebound in surveys was mostly attributed to the partial recovery in stocks following the massive liquidity injections from the ECB. Our leading economic indicator, which is built using a range of financial and economic variables, does not imply a rebound in industrial production in the next 6 months to come (Figure 9, right frame). We expect economic surprise indices and business sentiment to deteriorate strongly as growth contracts well into Q1.

Figure 9

Source: Eikon Reuters, RR calculations

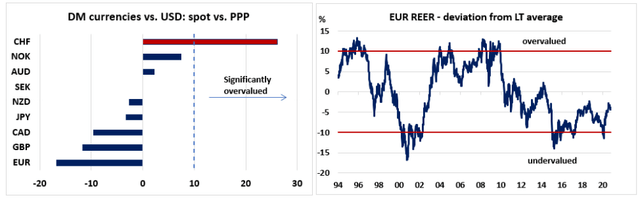

Finally, despite its cheap valuation according to a range of "fair" value metrics - Figure 10 (left frame) shows that the euro is nearly 18% undervalued relative to the USD according to the OECD PPP model - we think that the upside gain on the single currency remains limited in the medium term for two reasons. First, policymakers are likely to intervene in the market if EURUSD rises towards the 1.25 resistance, as a stronger euro will dramatically weigh on the economic recovery and inflation expectations. Second, political risk in Europe can make a surprise comeback during the second wave of lockdowns, as the lack of economic activity could result in social unrest, in particular in the countries whose economies are skewed towards services, travel and leisure.

Figure 10

Source: Eikon Reuters, OECD, RR calculations. PPP = purchasing power parity.

Closing thoughts

Even though the ECB hinted the market of more easing measures announced at the December meeting, we do not think that policymakers will surprise the market, and our base case is a 400-500 billion euros PEPP extension until the end of 2021. Historically, "non-event" meetings have generated a positive bounce on EURUSD spot rate in the next few days following the decision.

Limited upside gains on EURUSD: Despite its cheap valuation according to a range of fair value metrics, the upside gain on EURUSD remains limited, as we think that policymakers will start to react to a strong euro, as it will weigh on both the economic recovery and inflation expectations.

Medium-term risk on EURUSD: The lack of economic activity amid the high reliance on tourism for some countries (i.e., Spain, Portugal) will certainly lead to higher political uncertainty in the medium term and limit upside gains on the euro.

Did you like this? Please click the "Follow" button at the top of the article to receive notifications.

Disclosure: I am/we are long BTC, EURUSD, GBPUSD. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.