Theravance Biopharma Is A Buy

Today, we revisit Theravance Biopharma for the first time in over a year.

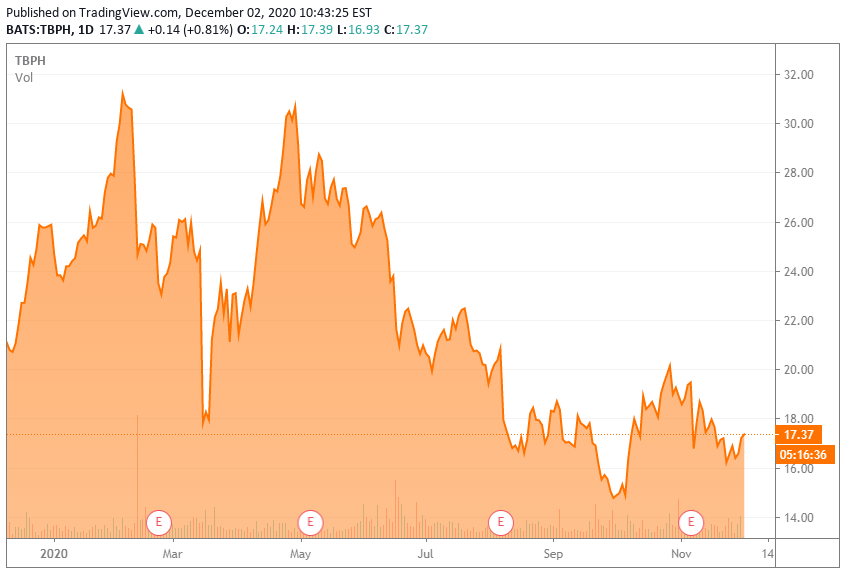

The stock has had a challenging year in 2020, but there are some potentially significant catalysts on the horizon in 2021.

We update our investment thesis in full on Theravance in the paragraphs below.

Today, we revisit a small cap biotech concern for the first time since August of 2019. Like so many in this sector, the company and the stock have had a challenging 2020. However, it has some potential significant catalysts on the horizon in the coming year. We take a look at the current state of the company and provide a full investment analysis in the paragraphs below.

Company Overview

Theravance Biopharma (TBPH) is focused on developing novel and potentially best-in-class therapeutics to address the unmet needs of patients being treated for serious conditions in the acute-care setting. The company is based in the Cayman Islands. The stock currently has an approximate market cap of $1.1 billion and sells right at $17.50 a share.

Recent News

The pandemic has impacted both timelines for numerous trials the company has underway. It also has been negative for the rollout of YUPELRI (nebulized revefenacin) which was approved in 2018. YUPELRI is the first and only once-daily, nebulized bronchodilator approved in the US for the maintenance treatment of patients with COPD.

The product is marketed by both Theravance and Mylan and the company is entitled to 35% of sales in the United States. The company is entitled to a lower percentage of royalties in sales outside the States as approved, as well as various other milestone payments from Mylan. An article in 2018 here on Seeking Alpha projected Theravance's peak portion of sales will eventually come to $400 million annually. YUPERLI provided Theravance with $13 million in net sales in the third quarter. After share costs, YUPERLI revenue was $11 million in the quarter. Non-cash collaboration revenue came in at $7.3 million during the quarter primarily attributed to the Janssen collaboration agreement for TD-1473.

Theravance is entitled to approximately 5.5-8.5% (tiered) of worldwide net sales of a product from GlaxoSmithKline (GSK) called TRELEGY. Gross sales of TRELEGY came in at a bit more than $250 million in the third quarter of this year, up from just under $175 million in the same period a year ago. Here is how the company footnoted this in their quarterly report:

As reported by Glaxo Group Limited or one of its affiliates (GSK); reported sales converted to USD; economic interest related to TRELEGY (the combination of fluticasone furoate, umeclidinium, and vilanterol, (FF/UMEC/VI), jointly developed by GSK and Innoviva, Inc.) entitles the Company to upward tiering payments equal to approximately 5.5% to 8.5% on worldwide net sales of the product (net of Theravance Respiratory Company, LLC [TRC} expenses paid and the amount of cash, if any, expected to be used in TRC over the next four fiscal quarters). 75% of the income from the Company's investment in TRC is pledged to service outstanding notes, 25% of income from the Company's investment in TRC is retained by the Company."

The company also noted about what is going on in regards to a third partner in TRELEGY in its quarterly report:

On June 10, 2020, the Company disclosed in a Form 8-K that it had formally objected to Theravance Respiratory Company, LLC ("TRC") and Innoviva, as the manager of TRC, regarding their proposed plan to use TRELEGY royalties to invest in certain privately-held companies, funds that would otherwise be available for distribution to the Company under the terms of the TRC LLC Agreement. The Company intends to continue to seek to protect its interests in this matter consistent with the dispute resolution procedures of the TRC LLC Agreement. In this regard, the Company initiated an arbitration proceeding against Innoviva and TRC in October 2020 challenging the authority of Innoviva and TRC to pursue such a business plan rather than distribute such funds to the Company in a manner consistent with the LLC Agreement and the Company's 85% economic interest in TRC. An arbitration hearing is scheduled for the first quarter of 2021."

Potential Catalysts In 2021

The company has several potential catalysts in the coming year. A positive arbitration outcome to the dispute above is one. Accelerating ramp-up of YUPELRI is another. Sales growth should benefit from the return to normalcy in 2021 with no restrictions on doctor's visits or medical facilities for non-Covid-19 reasons like we saw in spring and summer of this year.

Then there are numerous late stage trial results that will be out next year. Here are the key ones the company listed in its conference call.

Ampreloxetine (TD-9855, norepinephrine reuptake inhibitor (NRI) for symptomatic nOH):

- Ongoing registrational program in symptomatic nOH comprised of:

- Phase 3 four-week treatment study (SEQUOIA) to demonstrate efficacy expected to read out in Q3 2021

- Phase 3 four-month open-label study followed by a six-week randomized withdrawal phase (REDWOOD) to demonstrate durability of response

- Phase 3 26-week open-label study (OAK), which is a long-term extension study that will be ongoing at the time of registration, to allow subjects completing REDWOOD to have continued access to ampreloxetine for up to 3.5 years and to collect safety and tolerability data over the course of treatment

TD-1473 (gut-selective oral pan-Janus kinase (JAK) inhibitor for inflammatory intestinal diseases):

- RHEA (this program consists of 3 separate studies in Ulcerative Colitis):

- Phase 2b eight-week placebo-controlled dose-finding induction study expected to read out in Q3 2021

- Phase 3 eight-week placebo-controlled dose-confirming induction study to start after dose selection based on Phase 2b Induction Study results (to be initiated post-Janssen opt-in)

- Phase 3 44-week placebo-controlled maintenance study in which subjects roll over from either the Phase 2b or Phase 3 Induction Study

- DIONE:

- Phase 2 placebo-controlled induction study in Crohn's disease expected to read out in Q3 2021 with patients given the potential to continue to receive ongoing access to TD-1473 as part of a long-term extension study

Balance Sheet and Analyst Commentary

The current median analyst price target on TBPH is just south of $35.00 a share. Since early November, Leerink Partners ($35 price target), Needham ($40 price target) and H.C. Wainwright ($32 price target) have all reissued Buy ratings on Theravance. Last week Evercore ISI resumed coverage on Theravance with an Outperform rating and $30 price target. Some views from an Evercore analyst:

there is "a lot to like" about Theravance, as well as a lot of "moving parts." The analyst added that next year is "chock full" of news flow and important data readouts for the company, and she likes that there are "multiple ways to win" in 2021."

The company ended the third quarter with nearly $360 million in cash on the balance sheet. Theravance stated it expected a loss of $225 million to $235 million in FY2020 which ends on December 31st.

Verdict

The shares are down approximately 20% over the past 52 weeks. However, the company has plenty of potential catalysts in 2021. Theravance is well-funded at the moment and the shares are significantly below every recent analyst price target. Therefore, the risk/reward profile of this name heading into 2021 seems favorable.

Bret Jensen is the Founder of and authors articles for the Biotech Forum, Busted IPO Forum, and Insiders Forum

Live Chat on The Biotech Forum has been dominated by discussion of lucrative covered call opportunities in small biotech stocks over the past several months. To see what I and the other season biotech investors are targeting as trading ideas real-time, just join our community at The Biotech Forum by clicking HERE.

Disclosure: I am/we are long TBPH. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.