OptiNose's Business Is Thriving While OptiNose Trades At Lower Revenue Multiples Than Peers

After COVID-19 slowed their commercial launch, OPTN is doing an exceptional job selling Xhance. Q3 2020 revenues grew ~50% from Q2 & consensus FY2021 revenue estimates forecast 100% growth.

Professional analysts forecast $700MM in peak Xhance sales (some forecast peak sales in the billions/year). With a market cap of $220MM at $4.30/share, OPTN trades at .3X consensus peak sales.

Trading at 2.0X consensus FY2021 revenues, our proforma operating forecast demonstrates OPTN should have the liquidity to get to break even comfortably without shareholder dilution.

Our analysis concludes third-party professional analysts have quite reasonable OPTN share price targets predicting 300% upside.

At $4.30/share, OPTN is down 26% from a $40MM financing closed August 2020 at $5.85/share (we assume via professional & sophisticated investors after considerable due diligence.

Our analysis concludes OptiNose, Inc. (OPTN) shares could rise ~300% and still trade at revenue & forward-looking EPS multiples consistent with its peers. Our analysis also concludes OPTN has enough of a cash runway to get their core business to break even in FY 2022/2023 if consensus revenue estimates are directionally accurate. Put simply our analysis concludes OPTN shares are materially undervalued at $4.30/share.

OptiNose, Inc. is a commercial-stage biotechnology company focused on ear, nose & throat ("ENT") therapies founded in FY2010 with approximately 225 employees located in Yardley, PA. OPTN's flagship product is called Xhance (fluticasone propionate) that is a nasal spray approved by the FDA on September 18, 2017 for the treatment of nasal polyps from chronic rhinosinusitis. In simple English, nasal polyps are painless growths in the passage of the nose generally resulting from things like allergies, asthma and/or certain immune disorders. Whatever the cause, nasal polyps are not serious but are tangible (non-cancerous) growths and hang down like a tiny grapes in the nose resulting in runny noses, stiffness or post-nasal drip (simple quality of life issues).

OPTN launched Xhance in Q2 2018. Revenues growth was quite respectable as OPTN did the chores necessary to commercialize a new therapy including building a commercial infrastructure, educating the clinical community and obtaining insurance coverage. Per OPTN, today 75% to 80% of potential patients are covered by insurance and they anticipate additional wins and gains in average price per prescription (SOURCE: OPTN's Q3 2020 earnings conference call. 3rd to last question answered by Peter Miller). The COVID-19 phenomenon appears to have had limited impact on OPTN's business & growth in 1H2020. Xhance prescription volumes continue to grow quarter to quarter. Product sales were $15.4MM in Q3 2020. This was growth of roughly 50% from Q2 2020. The average Xhance patient now gets prescribed Xhance 4.9 times. In Q3 2020 a total of 69,000 Xhance prescriptions were written at roughly a net $244/net price to OPTN (SOURCE: OPTN Investor Presentation).

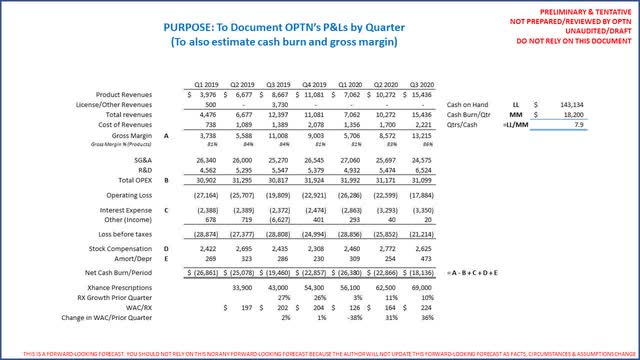

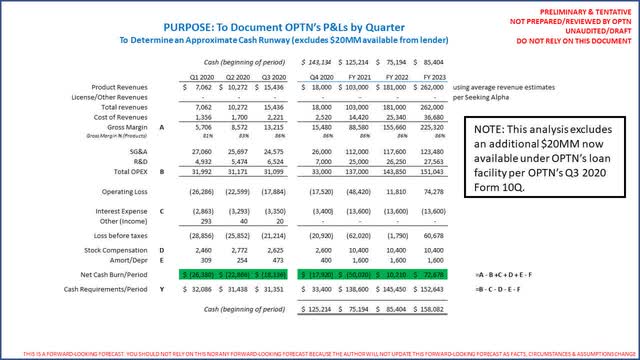

The following is a summary of OPTN's income statement history over the last 7 quarters to track recent sales, prescription growth & gross margin and estimate OPTN's cash runway (assuming sales growth stopped):

Above table source: Author created file

Above table source: Author created file

DATA SOURCES:

OPTN Nov. 5, 2020 Investor Presentation

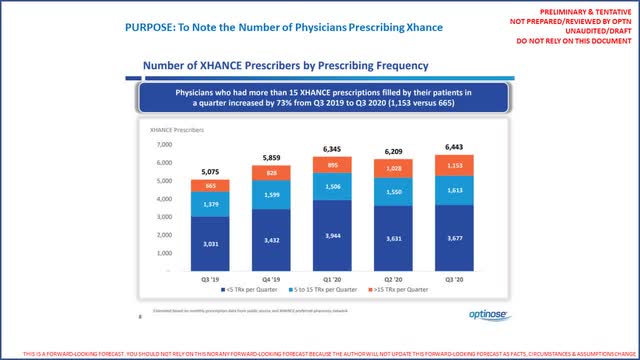

The following is an excerpt from OPTN's November 5, 2020 investor presentation noting that the number of physicians prescribing Xhance continues to grow.

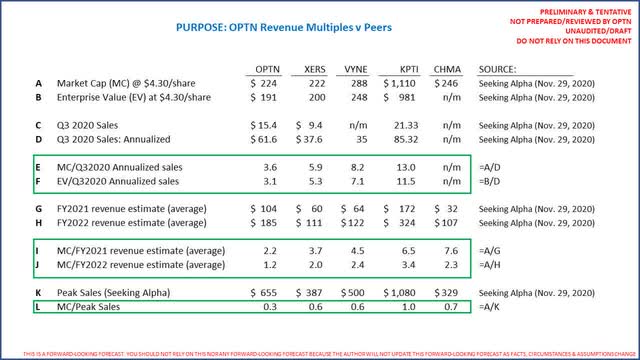

To understand the OPTN per share value proposition, Q3 2020 OPTN product sales were $15.4MM which is $61.6MM annualized. At $4.30/share OPTN's market cap is only $220MM (table below). Hence today OPTN trades at only 3.6X annualized Q3 2020 sales. Gross margins were 86% in Q3 2020 and 83% in Q2 2020. Most important, the range of FY 2021 revenue forecasts predict $90MM to $113MM in FY2021 revenues (with the average FY2021 revenue estimate of these 6 analysts being $103MM per Seeking Alpha). In plain English OPTN trades for 2X FY2021 revenue estimates. More than anything else it is this data point that suggests OPTN is materially undervalues (perhaps by a factor of 2 or 3X). We should also not OPTN just negotiated an additional $20MM draw on their loan facility should Xhance sales exceed $26MM in Q2 2021. Hence we also have an OPTN "blessed" data point that suggests FY 2021 revenue estimates of $103MM are realistic (if they were OK with a $26MM Q2 2021 revenue milestone then an annual $103MM appears reasonable).

The following is an overview of all of these data points compared to other small cap biotech companies that recently (from 2018 - 2020) launched their flagship therapies:

Per OPTN, approximately 30MM people in the United States suffer from chronic rhinosinusitis of which approximately 10MM suffer from nasal polyps. Of the 10MM Americans who suffer from nasal polyps, approximately 500,000 will seek a surgery each year. The standard of care for nasal polyps today are intra-nasal steroids and then surgery. In September 2020, the American Rhinological Society ("ARS") said they would update their nasal polyps treatment guidelines and recommendation patients with nasal polyps try Xhance before moving on to surgery (SOURCE: OPTN 9/16/2020 Cantor investor conference). Because, per OPTN, roughly 500,000 people/year have surgery to treat nasal polyps, our analysis concludes the new ARS guidelines are a transformational value inflection point for Xhance and OPTN. Should physicians comply with the new ARS guidelines say for even only 60% of their patients, that would translate to 300,000 patients per year. At roughly 6 prescriptions per patient that would suggest 1.8MM Xhance prescriptions would be filled just from this patient segment. 1.8MM prescriptions at say $250/prescription is an almost $500MM/year business.

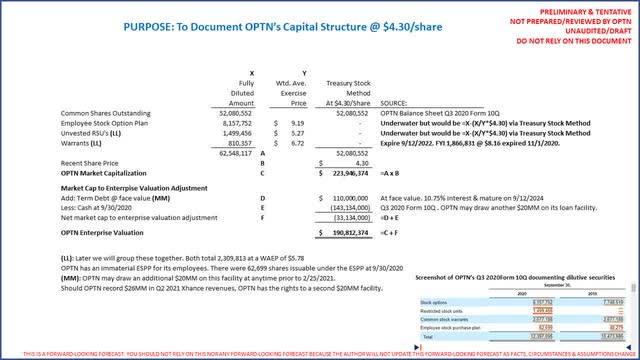

OPTN's capital structure is simple with one class of common stock and traditional dilutive securities for a company at their phase of the typical biotech's life cycle. The following is an overview of OPTN's market cap and enterprise value at $4.30 per share:

SOURCE: Author created file using OPTN's Q3 2020 Form 10Q

SOURCE: Author created file using OPTN's Q3 2020 Form 10Q

As noted, OPTN ended Q3 2020 with $143MM cash and, per OPTN's Q3 2020 Form 10Q (footnote 9) have earned another $20MM draw on their existing debt facility for exceeding $14.5MM in Q3 2020 revenues. We created a roll forward of OPTN's liquidity starting with the $143MM cash on hand and created an operating forecast using average revenue estimates (per Seeking Alpha) and moderate increases in operating expenses as shown below:

Hence considering our analysis above uses published sales estimates coupled with reasonable increases in recent actual expenses (and excluded the additional $20MM available under their loan facility), our analysis concludes OPTN should not require a material dilution in the future. The current loan is with Pharmakon Advisors (a very well respected biotech investor) and does not require repayment to begin until 12/15/2022 when the loan's principal must be repaid in 8 even quarterly installments with the loan "maturing" on 9/14/2024. Our analysis concludes OPTN will be profitable with enough cash on hand to easily repay the loan to its terms.

Hence considering our analysis above uses published sales estimates coupled with reasonable increases in recent actual expenses (and excluded the additional $20MM available under their loan facility), our analysis concludes OPTN should not require a material dilution in the future. The current loan is with Pharmakon Advisors (a very well respected biotech investor) and does not require repayment to begin until 12/15/2022 when the loan's principal must be repaid in 8 even quarterly installments with the loan "maturing" on 9/14/2024. Our analysis concludes OPTN will be profitable with enough cash on hand to easily repay the loan to its terms.

OPTN's pipeline includes 2 ongoing Phase 3 clinical trials for Xhance to treat chronic sinusitis (versus its chronic rhinosinusitis label today). Bost Phase 3 trials are expected to read in Q4 2021. Should the Phase 3 clinical data be good enough to lead to eventual approval, OPTN has noted the market for Xhance will double. We should note on OPTN's Q3 2020 earnings conference call, an analyst noted OPTN's Phase 3 trial in chronic sinusitis is well ahead of the next potential therapy. We were unable to determine who is developing a potential competing therapy. We should also note Gossamer Bio (GOSS) recently reported their rhinosinusitis therapy in development failed a Phase 2 trial.

It is for all of these reasons our analysis concludes professional analysts' estimates of $700MM+ in peak Xhance sales appear reasonable. These include:

1. Jeffries analyst estimate from 2018 (at the time of launch) estimates of $2.4Billion in peak sales.

2. RBC Capital predicts 100%+ rise in 3 stocks

3. Cantor Fitzgerald predicts OPTN at $27/share

Perhaps most important, in late August 2020 OptiNose closed a $40MM round of financing at $5.85 per share. Our analysis concludes OPTN's business has only improved since closing this financing at $5.85/share with OPTN beating Q3 2020 consensus estimates as well as earning the additional $20MM loan facility (and the GOSS failure). As of this writing, investors can buy OPTN for 25% less than these investors did only a few months ago.

Conclusion

Our net analysis concludes that, in addition to all of the third-party endorsements noted above, because OPTN trades at much lower revenue multiples than its peers and OPTN appears to have numerous roadmaps to getting the business to break even with no shareholder dilution, our analysis concludes OPTN is dramatically undervalued.

OPTN was not consulted in the preparation of this article.

Disclosure: I am/we are long OPTN. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.