S&T Bancorp: Credit Concerns Show A Flashing Yellow Light

The loan portfolio is likely to continue to shrink, largely caused by PPP loan forgiveness early next year.

While the net interest margin is showing signs of bottoming out, I do not believe it will bounce higher anytime soon.

The credit profile is starting to show some signs of slippage and likely put a lid on the overall stock price valuation.

Investment Thesis

Based in Indiana, Pennsylvania, S&T Bancorp, Inc. (STBA) is a $9.2 billion asset holding company and parent to S&T Bank. When looking at the branch map, one can see that STBA is very much focused in Pennsylvania. Nearly all of its 74 branches are located near Pittsburgh and Philadelphia, however, it does have a handful of branches in Ohio (nearly the Akron/Cleveland area).

At the end of the third quarter, the $7.3 billion loan portfolio had a noteworthy commercial tilt. When breaking down the entire portfolio, one can see that nearly 44.5% of the portfolio is dedicated to commercial real estate and 27.6% is marked commercial and industrial. All told, more than 78% is commercial-oriented. While the consumer portfolio makes up the remaining 21.4% of the portfolio, nearly 60% of that amount is dedicated to residential mortgage.

Over the past couple weeks, there has been a fairly massive rotation from growth stocks into value stocks. Personally, I believe that investors would be wise to remember the old adage of “don’t confuse genus with a bull market.” I have a fairly neutral view on STBA. While the credit profile looks to be slipping more than peers, I don’t believe that excessive credit pain will sink the ship.

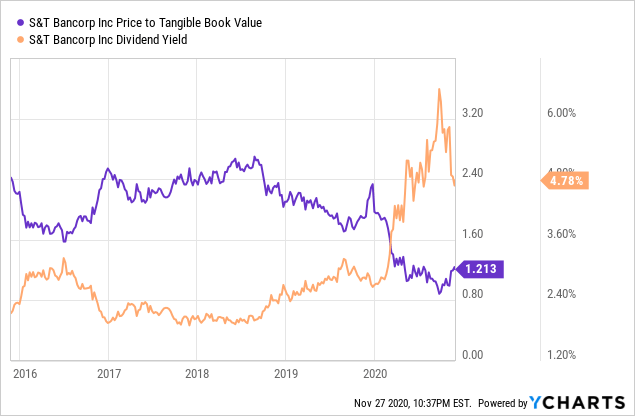

Also, the valuation of 1.21x of price-to-tangible book value per share is below the peer bank average of 1.35x. To me, this makes sense, since the credit landscape seems to be deteriorating a bit faster than peers. With that said, the dividend yield does look fairly strong and very sustainable, but could come into question if the provision continues to remain elevated.

Data by YCharts

Data by YCharts

Revenue Outlook

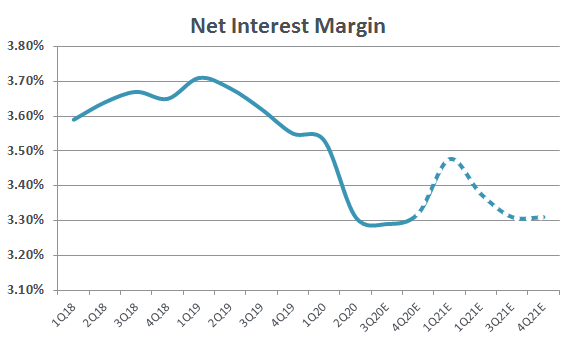

Like most every other bank, STBA has experienced some spread revenue sluggishness and net interest income (NIM) compression. With that being said, STBA’s net interest income compression was much smaller than most banks. The third-quarter levels were down just $800,000 from the second quarter mark. When digging deeper, one can see that the NIM compression was largely dictated by loan yield contraction with limited assistance from deposit funding levels.

Overall loans shrank $153.7 million from the second quarter. According to management, this was caused by limited loan originations rather than paydowns. From a strategic perspective, the bond portfolio was run down by over $86 million to fairly match the planned reduction in brokered deposits. All told, total assets fell $283 million to $9.2 billion.

When looking at the other portion of revenue generation, fee income was something of a shining beacon for the income statement as a whole. Overall mortgage revenue was strong and produced solid linked quarter- and year-over-year growth. Debit and credit card-related fee income was also up linked quarter.

(Source: SEC filings and Author's Estimates)

Upon review of the loan portfolio and past levels of asset sensitivity, I believe that the NIM is likely near its bottom. The one thing I think investors need to remember, PPP loan forgiveness is going to manufacture a "higher NIM". While this will produce stronger net interest income revenue, it will be short-lived, as it is more of "noise" rather than a long-standing changing of the guard for revenue generation. Also, the PPP loan forgiveness will cause the loan portfolio to continue to shrink.

Finally, I believe the recent mortgage-related fee income is likely to simmer near current levels before compressing a little as we enter 2021. While this will likely cause a little less revenue, there will likely be a net benefit for the expense line too. I say this because the mortgage business (for most banks) typically carries a lower profit margin (compared to the bank as a whole).

Credit Analysis

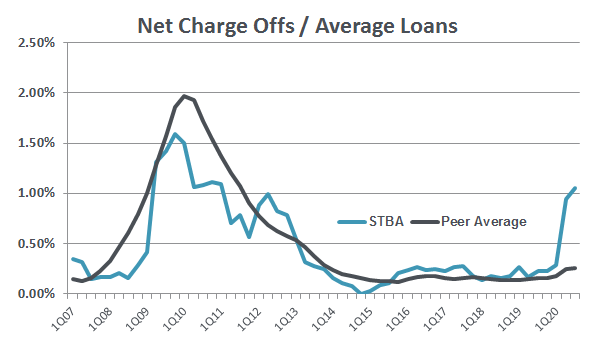

While most STBA followers already know, the second quarter of 2020 had a fraud incident that caused $59 million in net charge-offs (NCOs). If one were to back out the related provision associated with the fraud NCO, the “core provision” would have been $28 million. While the third quarter of 2020 had a $17.5 million provision, investors should keep a keen eye on the credit profile over the next couple quarters.

(Source: SEC filings)

To a credit-focused investor like myself, the third-quarter press release had a key statement that raised a yellow flag for me:

During the third quarter, a $21.3 million CRE relationship, which was placed on nonaccrual in the first quarter of 2020, was charged down by $10.0 million leaving a remaining outstanding balance of $11.3 million.

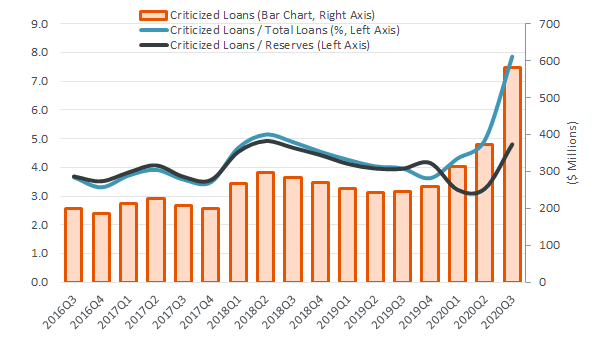

While this one loan is already being addressed, from a credit perspective the next thing I did was look into the criticized loan portfolio to see if it truly was a one-off or more a credit underwriting problem.

(Source: SEC filings)

As one can see from the chart above, not only are criticized loans being to climb higher, but the ratio of criticized loans-to-reserves (black line above) is also working higher. To me, this still pretty much disqualifies the bank from being an investment in the near term. While in most recessions criticized loans typically do go up, I believe STBA is a bit excessive and more of an underwriting problem.

In my mind, I think the bank will need to have sizable loan loss provision expenses for the foreseeable future. This will likely eat into the future profitability profile and put a lid on any sizable returns. From a modeling perspective, I don't see STBA earning a 1.00%+ ROA for the foreseeable future (my financial model is at the bottom).

Concluding Thoughts

Whenever there is a sizable rotation in the market, the rising tide typically lifts all boats. In my mind, I think we are past the first leg of this rotation and the market will start to pick "winners" and "losers" for any sub-sector (like banks in general).

Due to its recent price appreciation, juxtaposed against its credit profile, I think STBA is likely going to tread water while the rest of the "winners" in the banking sector continue to grind higher.

Since the banking sectors is so homogeneous, it's hard for generalists to see the massive differences from one bank to the next. Because of this, I think STBA could see marginal upside, only if the rest of banks continue to outperform. However, in my mind, STBA is going to underperform bank peers until its credit problems are addressed.

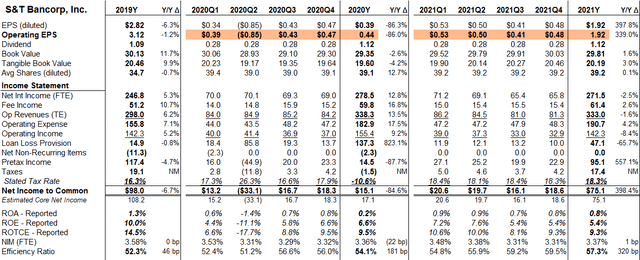

(Source: SEC filings and Author's Estimates)

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.