Basic-Fit: A Risky Bet On An Unexpected Beneficiary From COVID-19

Basic-Fit is a founder-led best in class gym operator with market-leading positions. They have developed a club format model, which they successfully duplicated in five markets.

Despite the low-barriers to entry, Basic-Fit’s scale provides them with competitive advantages over their smaller competitors, resulting in superior unit costs and in the mature gyms generating 40% EBITDA margins.

Basic-Fit has attractive unit economics, earning 17% ROIC on new club openings, with a long runway to grow their current 902 clubs by +150 clubs per year for 7 years+.

Long-term growth drivers include further consolidation in the market, acceleration of health awareness trends, and a continuation of people trading down from premium to low-cost gyms.

In the short term, COVID is a big negative; but in the long term, Basic-Fit may be a surprising beneficiary of the pandemic, with an acceleration in the above long-term trends.

In this article, we take a dive into Basic-Fit (OTCPK:BSFFF), their unit economics, and the implications of the pandemic on the gym. Management has done a great job in expanding Basic-Fit to where they are today and still sees a lot of expansion opportunities. This long runway for growth combined with the attractive returns on club openings can set shareholders in Basic-Fit up for attractive returns. Despite seeing a plausible scenario of generating low/mid-teens returns from their current share price, the combination of high levels of debt plus the reliance of debt for expansion coupled with a high degree of operating leverage at the club level in the uncertain pandemic environment we are now in, gives me not enough conviction that the risk/reward is sufficient.

Introduction

Basic-Fit (they are also listed under BFIT in Amsterdam) is the European market leader in the value-for-money fitness market. Basic-Fit offers members a fitness experience with high-quality gym equipment against an affordable monthly fee. They offer all the essential services, but not the premium services such as wellness facilities, swimming pools, tennis and squash facilities (which most gym-goers don’t use anyway, but do pay a hefty price for it).

Basic-Fit offers two memberships. Their basic offering costs €19.99 per four weeks, which gives members access to all +900 clubs in all five countries + access to the Basic-Fit app which has many features. They also offer a premium membership (€29.99 per four weeks), with the extra option that you can share your pass (with one other household) and bring a friend along to the gym for free.

Basic-Fit is led by founder and CEO René Moos, who after being a gym operator of various chains since the ’90s, saw first-hand the increasing demand for low-cost gym clubs. He partnered up with a private equity house and acquired Basic-Fit in 2009. Both the CEO and CFO (with the company since 2012) have skin in the game with René owning 16.3% of the shares and the CFO 0.2% (worth €2.6 million, which is more than 2x his total annual remuneration package).

Business overview

Basic-Fit is active in a fragmented, but slowly consolidating market with the low-cost operators taking share of the premium segment. In Europe in 2019, the 30 largest gym operators have a 26.5% market share in terms of members, up from 20% in 2016. The main driver behind the consolidation is scale, which drives better unit economics of the larger operators, enabling them to offer better value propositions and better pricing. Moreover, low-cost fitness clubs have driven market expansion by lowering the barrier for people to sign up for a gym, thereby increasing the penetration rate in markets. Most newbies in the gym naturally choose the most affordable option for a gym in close proximity, which is the typical offering of a low-cost gym. For Basic-Fit, 25% of the new members in FY2019 did not have a gym membership before. The gym industry has been growing by around mid-single digits, while low-cost operators have grown at teen rates or even ~25% (in Basic-Fit’s case) over the past years.

Basic-Fit has a simple business model that is comparable to other low-cost gym-operators like Gym Group (OTCPK:GYYMF) and PureGym. They expand in markets with low levels of fitness penetration and/ or an underdeveloped low-cost fitness segment and where there is a significant price gap between prevailing fitness club prices and their prices.

When Basic-Fit enters a new market or region, they apply a cluster strategy, where they open a bunch of clubs following a predetermined order and pace, creating a strong network in each region in a short timeframe to meet as much of the projected demand as possible. In selecting sites, they look for dense population areas with good availability (public transport, parking, etc.) and analyze the local competitive environment. Location is really key for gym clubs and Basic-Fit’s strategy is to have a diversified network of clubs (cluster) where members can enjoy access to the gym without much travel time from both home and work. First, the focus is on big cities and then they open clubs in suburbs. If you want to understand the expansion and site selection process in more detail, I highly recommend you to take a look at their 2019 CMD expansion strategy presentation.

For the average Basic-Fit club, the timeline is as follows: In the first 6 months of a club opening, the club loses money. After 6 months the membership base is around 1,950 and the club achieves a positive EBITDA. After 12 months, membership is around 2,900. A club is considered mature if its membership base is 3,300 members, 3,500 members, and 3,750 members in the Benelux, Spain, and France, respectively. For a club to mature takes on average 24 months and then the club becomes a cash cow, earning ~ 40% EBITDA margins (50% adjusted club EBITDA, per management’s definitions).

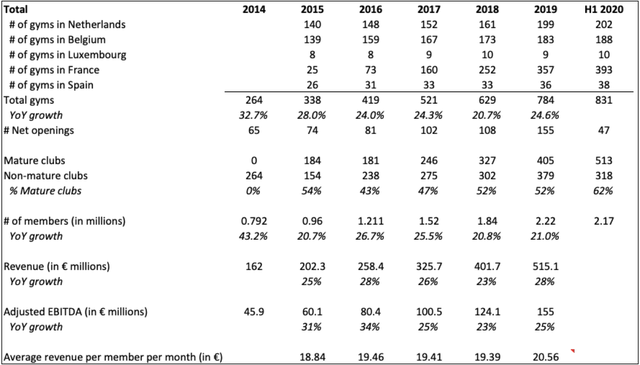

Over the years, Basic-Fit showed to have a proven club expansion model that can be duplicated to further expand in existing and new markets. Since 2014, Basic-Fit compounded both the number of clubs and its membership base by close to 25% per year. With 902 clubs and 2.25 million members (as of October 2020), Basic-Fit is not only the largest but also the fastest growing fitness chain in Europe (measured by the number of clubs and members). The number of gym clubs and their membership base has been growing consistently at >20% rates over the past 5 years.

Source: Created by the author using data from Company filings

Source: Created by the author using data from Company filings

A minimalistic moat, but scale and experience matters

The gym industry itself is not a moaty business. When choosing a gym, one of the primary decision drivers is location. This coupled with the fact that almost everybody can open a gym, leads to the general consensus that there are hardly any competitive advantages in the industry. Sure, everybody can open a gym, but to do so profitably and in a sustainable way (especially in an in-demand location) is a different story.

It is impossible for a small operator to run a gym as cost-efficiently as Basic-Fit does. First of all, Basic-Fit is the largest buyer of fitness equipment in Europe, which gives them bargaining power over their suppliers. Further, due to investments in IT (€10m of investment cost which they can spread over >900 gyms), Basic-Fit can operate a club with only 2.8 FTEs and offer many digital services through their app (at-home video workout, workout schedules, diet schedules and more). This results in Basic-Fit being able to run a gym profitably on locations that most gym club operators are not able to do so. Add to that the national advertising scale that Basic-Fit has, the experience of opening and running (standardized) clubs and the data it possesses over its >2.2 million members (think, for example, of demographic info about the members and gym usage patterns, which they can use not only for improving their service but also as crucial data points for future site selection) and you can clearly see an advantage. Basic-Fit leverages its superior unit costs to keep the membership fees low, which leads to more members per gym on a mostly fixed cost base. This is why they are able to produce the impressive 40% EBITDA margins for their mature gym clubs.

These advantages make Basic-Fit a best in class operator in the industry with members on average staying for 22-23 months, compared to 8-10 months for the industry average.

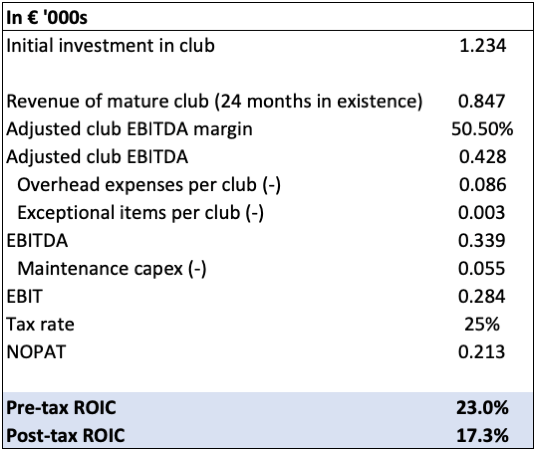

Attractive unit economics

As a result of their scale and their standardized club format, the club expansion comes with attractive unit economics. When opening a new club, the initial investment is ~€1.2 million. After 24 months in existence, a club is mature. The club then does on average ~€0.85 million in revenues with ~€0.34 million in EBITDA (40% margins). Given that depreciation overstates actual maintenance capex needs to sustain a club, maintenance capex is a better proxy. The initial investment in a new club comes against a 17.3% post-tax ROIC on the mature club earnings profile. Management determines ROIC using adjusted club EBITDA instead of NOPAT, and set a hurdle of >30% for every club opening.

Source: Created by author using data from Company filings

Source: Created by author using data from Company filings

The cost structure of a gym club consists primarily of fixed costs (property rent, personnel costs, housing, and equipment costs). There is a significant amount of operating leverage at the club level, with the number of members per club being the key driver to the level of profitability. For the mature clubs (with on average 3,300 members) they break even at around 2,000 members (on an EBITDA level). The subscription fees from the incremental 1,300 members are almost fully pre-tax profits. A decrease or increase of 150 members per mature club already has a roughly 10% impact on EBITDA.

In recent years, Basic-Fit has been able to increase its membership fees by around 5% per year. But I would be careful in viewing this as pricing power since there is a “ceiling.” Basic-Fit defines the low-cost gym sector as <€25 per month. Now with €20.99 per 4 weeks or around €22.5 per month, they almost reached this ceiling. I am not so sure, to what extent management will raise this ceiling, given management’s commitment to keeping the fees low, which forms the core of its value proposition they offer. As an alternative, management tries to lift their revenue per member by offering add-ons, which currently stands at a mere 3% of total revenue. This includes primarily their Yanga sports water, personal trainers, and physiotherapists, who independently offer services to Basic-Fit members and pay a commission to the gym. Newer initiatives include third-party advertisement in the clubs and their own branded protein shakes. Basic-Fit sees great potential in “monetizing its large membership base”. This all sounds very nice and well, but the truth is Basic-Fit is not Apple (NASDAQ:AAPL), its members do not feel that attached or loyal to Basic-Fit. I don’t expect the secondary revenue to be a real contributor, but I see it more as an attempt to try to keep increasing its revenue per member to uphold its margins since its cost base will go up over time (rent agreements are inflation-indexed, wage- and equipment-inflation).

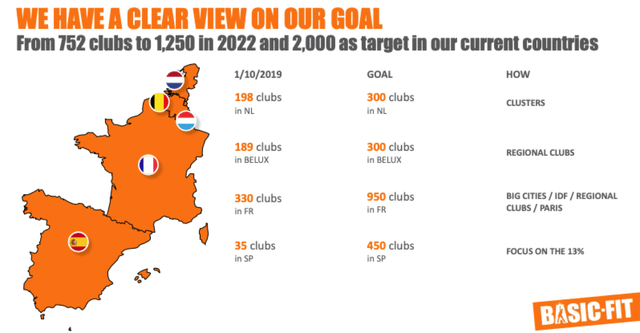

Overview of the markets and long-term growth potential

In the markets Basic-Fit operates, they either hold dominant market positions or they are in the process of obtaining market leadership.

Netherlands

In the Netherlands, Basic-Fit is dominant both in terms of members and clubs having more than double the number of clubs than the number 2 (Fit For Free). I was a member for a few years of Fit For Free and then switched to Basic-Fit and have checked out multiple locations of both and I can tell you there is a real difference between the two. In terms of pricing, they are roughly similar, but the gyms and the machines of Basic-Fit look way better than at Fit For Free (If you don’t live close to see this in person, a quick search of both gyms on Google would do the trick as well).

Belgium

In Belgium, Basic-Fit is also the clear market leader with a market share of >50% (they have 7-8x more clubs than the number 2). Moreover, most of the competitors are active in the premium segment (€40-50 per month). The penetration rate in the country is around 8%, which is low compared to other markets (Netherlands 17%). Growing this penetration rate from 8% to 12% would mean an increase of 440,000 new members. Let’s say they capture 50% of these, then this would add around €55m to revenues (in FY2019 Belgium generated €140m in revenue). I know this is just guesswork, but what I want to highlight here is the value of Basic-Fit being able to lift up the penetration rates in their markets.

France

In France, the competitive landscape is relatively fragmented with a few (mostly franchised) mid-sized chains (100-300 clubs), but with a higher monthly fee than Basic-Fit (>€30). However, in the low-cost segment, the competition is less intense with more than half of the clubs in the French market being independent, and most fitness networks operate fewer than 20 clubs. These smaller chains lack the scale to be able to offer the same value proposition as Basic-Fit.

France is the big growth market for Basic-Fit at the moment, starting with 25 clubs in 2015, they now have around 400 clubs, and management aims to have 950 clubs in total in France alone. Part of the growth in France is expected to come from an uptick in the penetration rate, which currently stands at around 9%. In France, around 30% of the new members are first-time gym-users, whilst in new areas, this can even be more than 50%.

Spain

Similar to France, the Spanish fitness market has a low penetration rate (~11%), an underdeveloped low-cost fitness segment, and a fragmented fitness club market with no major fitness chain offering the same proposition as Basic-Fit. With only 38 clubs, Basic-Fit’s presence is still a small player here, but they see the potential to open up to 450 clubs in the country.

The (pre-corona) planning was to accelerate the expansion in Spain from 2022/2023. One of the major risks is that one of the existing or new gym chains will try to capture more market share prior to Basic-Fit. From what I can find, there is no club that is planning to do so (for now). I don’t know to what extent, but one could argue that the fact that Basic-Fit is planning to expand significantly in Spain in a few years may intimidate chains to expand in Spain, given Basic-Fit’s track record of rapid expansion and their subsequent dominating presence in their existing markets.

Source: Basic-Fit CMD 2019

The focus of the expansion, for now, remains on their existing markets with targets to achieve 1,250 clubs in 2022 and 2,000 in total in their existing markets. So far, management has more than exceeded previously set targets of club openings. Management also indicates that they have already performed detailed analyses on several other European countries, that they could enter and unleash their replicable analysis model to conquer those markets. They are continuing to analyze for other European and non-European countries for further expansion. Up to 2022, management guides for 150 club openings per year and >20% annual revenue growth. Thus, plenty of reinvestment opportunities left and if they can keep or even improve their gym club economics, this growth comes at attractive returns.

The key risk factor to their growth story is capital allocation failures. Management seems so determined to open a lot of clubs in a short period of time and to meet their targets (they even continued opening tens of clubs in the midst of the pandemic), that they may start openings at lower incremental returns.

Financials

Basic-Fit is consistently reinvesting in its business by opening new clubs, which in the short term distorts the financials since it takes around 2 years before it reaches its full earnings potential while making a loss in the first 6 months. Currently, 40% of the clubs are still not mature yet. If Basic-Fit now would decide to stop opening clubs, then in two years’ time, all 902 clubs will be mature and will generate ~€305 million in EBITDA (trading at roughly 7x EBITDA).

Moreover, due to lease accounting, depreciation overstates actual capex needs. The combination of the high reinvestment rate in new clubs plus the higher depreciation than capex leads to Basic-Fit screening very poorly and the financials not reflecting its true earnings potential.

The rapid expansion plan of Basic-Fit is not cheap and not fully self-funded, but relies for a large part on debt. Basic-Fit plans to open around 150 gyms per year in the coming years, which is roughly €185 million in expansion capex. In FY 2019, they generated around €100 million in free cash flow (after maintenance capex of the clubs). As a result, to keep growing, Basic-Fit needs to keep on taking more debt. If they can keep growing at their current 20%-ish rates, it will take roughly 3-4 years before they are able to self-fund their expansion (and this even ignores the COVID-19 impact). As of H1 2019, Basic-Fit has a net debt/ EBITDA of 2.3x and their goal is to keep it <3x, with the long-term ambition to bring it down to <2x. Nearly all of the debt is due 2-5 years ahead (this is the most specific they are on). In October, management gave an update to have €170 million of liquidity at hand.

What about COVID-19?

The pandemic and the subsequent lockdowns have put a lot of fear into Basic-Fit’s share price, causing the share price to drop 70% at its lowest point. While currently after the positive vaccine news developments, the share price has almost fully recovered and is near pre-corona levels.

Unquestionably, the pandemic has severe short-term implications for gyms that are being forced to be closed for months. All Basic-Fit’s clubs were closed for 3 months starting in March. Basic-Fit offered its members the options to keep paying/ supporting the gym, freeze their fees, or keep paying and receive it back in the form of discounts spread over multiple months. 75% chose the latter, allowing Basic-Fit to keep receiving cash and in the process to build up €30 million in payables related to customers. With France and Belgium being closed again and gyms in France set to be opened on January 20th at the earliest, this amount will surely grow significantly larger. At the end of June, the mature gyms had on average 3,078, compared to 3,329 a year ago, which seems small, but as I said due to the operating leverage this hits the gyms hard.

With around 2/3 of Basic-Fit’s membership base being below 40 years (i.e. at low risk from COVID), it seems that Basic-Fit so far weathered the first-wave not that bad (membership base as of October is almost the same as of March, albeit with 71 more clubs). However, with France and Belgium now being closed, and in the Netherlands, only 30 people are allowed in the gym at the same time, I am not sure for how long people are still eager to stay as members (at least until it gets back to normal).

A longer-term fear is the speculation that people will not return to the gyms, with working out at home clearly taken off. However, few people either have space or the financial resources to set up an at-home workout area and purchase the equipment (a Peloton bike is almost $2,000 plus $40 per month subscription). Putting cost and physical issues aside, there are further reasons why people like to work out at the gym. For a starter, the setting and environment in a gym usually lead people to put in more effort in their workout. Second, people like social interaction, especially with people working more from home, and people don’t want to be trapped at home all day and rather work out in a different environment.

Instead of the negative consequences of the pandemic, there is a good case to be made that Basic-Fit will end up benefitting from the pandemic once the dust settles. The most obvious is that the crisis will likely accelerate the long-term trend of increased health awareness. The pandemic once again highlights the importance of a healthy lifestyle, which easily could lead to people giving the gym (another) chance. Second, during recessions, low-cost gyms are generally beneficiaries since members trade-down from their premium-gym to a cheaper alternative. Third, the pandemic may increase the consolidation trend in the industry. Many of the small independent gym operators do not have the scale and without access to finance will struggle and many of them will be or already are bankrupt. But the more developed large-scale operators with access to capital markets are better equipped to handle this crisis.

If anything, I would say in the medium and long run, the pandemic will only accelerate the shift towards lower-cost gyms, albeit with a much smaller group of operators than pre-pandemic. This is just one of the several scenarios that could play. If it goes the other way for Basic-Fit with at-home workouts taking share of the physical gyms, with the high fixed-cost base and high debt levels, it can get ugly rather quickly.

Conclusion

The bull case for Basic-Fit would be assuming that they can continue to successfully expand their presence and achieve the 1,250 clubs by the end of 2022 (and 2,000 or more somewhere in the future) and assuming they are able to maintain or even improve their margins. Then those 1,250 gyms will generate around ~€425 million in EBITDA in 2025 and that even ignores all the other gyms that are opened between 2022 and 2025 (which certainly hold value). Then you could easily envisage low/mid-teens returns from today’s share price. In this scenario, Basic-Fit will be able to continue successfully to expand in their existing markets, with the same number of members or more per gym and/or increase in revenue per member (further membership fees raises and successful expansion of their add-on revenues). Further upside could come from Basic-Fit not only weathering the pandemic, but getting even stronger after it with small players getting out of business, an acceleration of market consolidation, and people trading down from premium to low-cost gyms.

One thing that gets me a bit itchy is the high level of debt. It may be sensible to take on this amount of debt to fund their expansion and to execute their cluster strategy and quickly gain dominant positions in their markets. Yet, I am not a huge fan of this amount of leverage, especially on a primarily fixed-cost base coupled with an uncertain environment like this. We don’t know how long gyms will be closed in France and Belgium and whether gyms will close again in the Netherlands or not. Plus, will this environment with only a limited amount of people being allowed to exercise in less-than-ideal circumstances, lead to people canceling their subscriptions? A drop in the membership base can quickly result in a significant decrease in cash flows generated by the clubs, which could limit the expansion plans, both in terms of internally generated cash flows and the amount of debt they can take on (even if the members come back next year). This could set back Basic-Fit’s growth story by years.

Although, I think the bull case scenario is not unlikely and if you are comfortable with the probability of this scenario occurring and the level of debt taken on by the company, then even after the recent share price rally, you may set yourself up for low/mid-teens returns at the current price. However, for me personally, I find the risk/reward not favorable enough. Especially with the combination of significant financial leverage and operating leverage at the club level with the current uncertain environment, which is mostly outside of management’s control.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.