Allogeneic cell therapies have a significant cost, convenience and efficiency advantage over autologous.

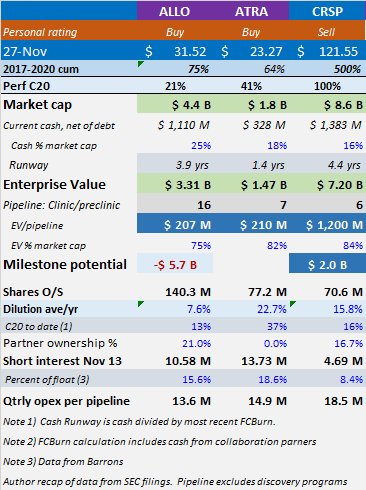

Data from three of the leaders: Allogene, Atara and CRISPR are expected in the next 12-to-24 months to further elucidate safety and efficacy.

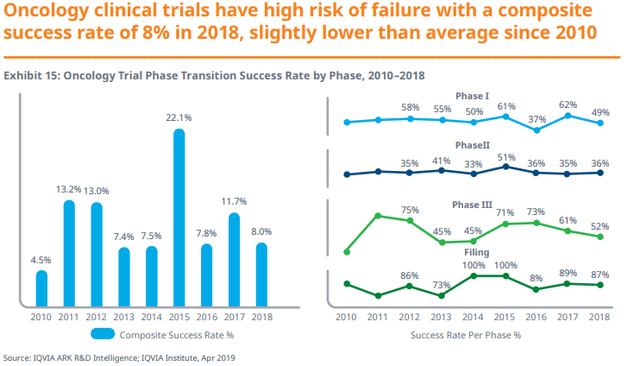

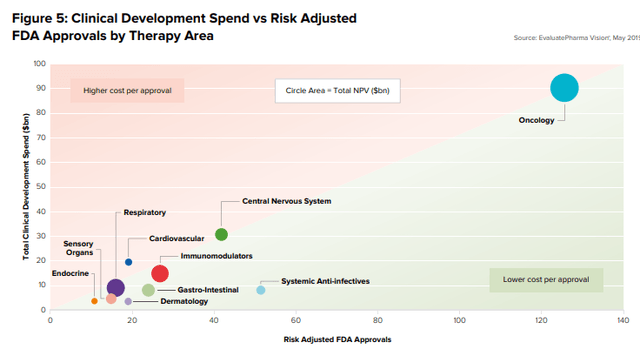

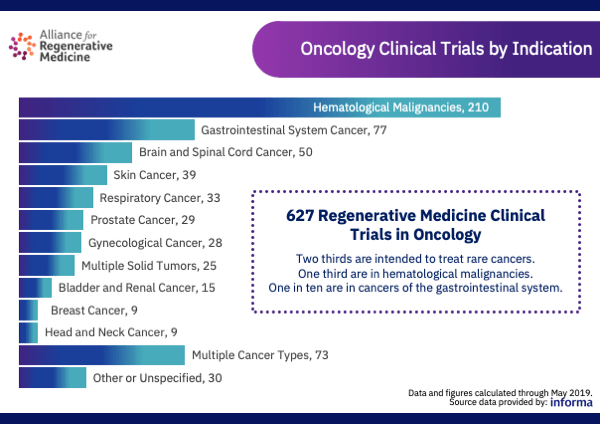

The combination of high clinical failure rates and high net present values make oncology a priority investment segment.

Preview

Allogeneic therapy is clearly a disruptive concept in biology. Standard immunologic dogma holds that any foreign tissue will elicit an immune reaction.

Whether you call it allogeneic, universal, or off-the-shelf, this next wave of oncology cell therapy is likely to be in the news in 2021.

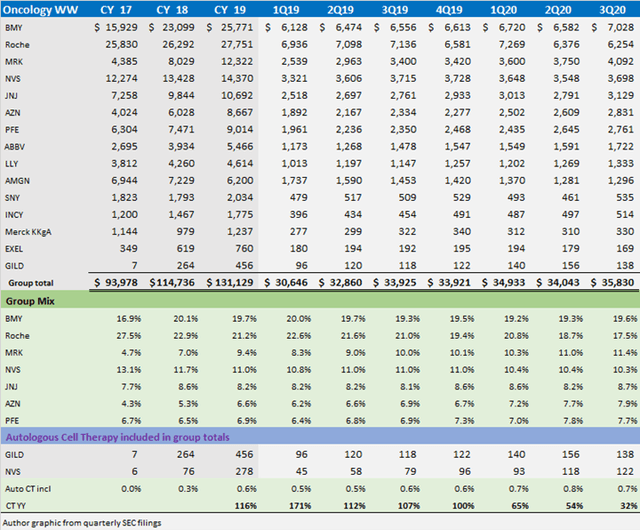

The early revenues from autologous cell therapies have been tepid. Three programs approved-Gilead (GILD) Yescarta/Tegsedi and Novartis (NVS) Kymriah-grew revenues 32% in 3Q20 to a combined $260 million. The first autologous therapy from Bristol Myers (BMY) is expected to be approved in 2021. Though results were likely dampened considerably by the global pandemic, considering the treatment protocols, the fact remains: Three years after the first approvals, autologous cell therapy has only captured 0.7% of the market.

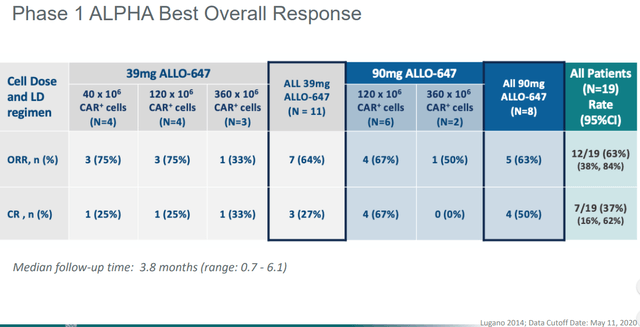

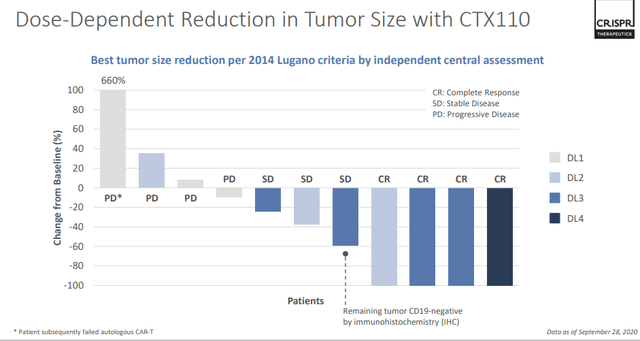

Three leading allogeneic cell therapy companies-Allogene (ALLO), Atara (ATRA) and CRISPR (CRSP)-are expected to provide a longer term update of objective response rate or ORR in the 12-24 months to compare against autologous alternatives. The FDA defines ORR as the proportion of patients with tumor size reduction of a predefined amount and for a minimum time period.

At this point, it remains unclear whether there will be a substantial difference in efficiency between gene-editing technologies in the long term. Allogene/Servier and Cellectis have a first-mover advantage in clinical development. We see the commercial potential of allogeneic cell therapy in hematological malignancies representing an approximately $25 billion to $45 billion market opportunity in the next 3-5 years.

William Blair March 2019 report “Off the Shelf”- The Next Step for Cell Therapy

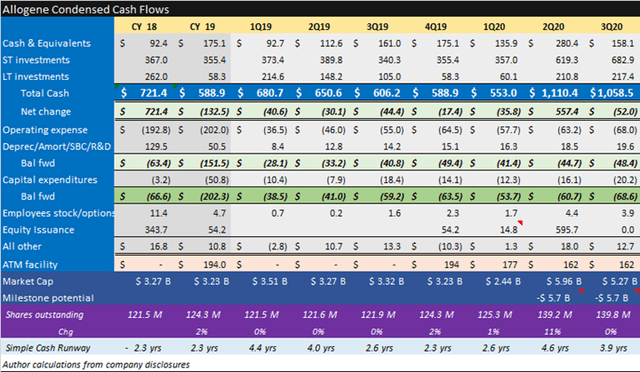

Source: Author calculations

Oncology Overview

The global market for oncology medicines market is large and expanding. The following recap of 15 tracking companies generated revenues of $131 billion in 2019. 18 million people are diagnosed with cancer each year and remains among the leading causes of death. Keep an eye on how many cell therapy trials are “r/r” which refers to cancer patients who relapsed (went into remission, then came back) or refractory (did not go into remission after prior treatment). The need remains high.

Source: Author data from SEC filings

High failure rates and long duration have challenged oncology research efforts along with increased concerns over spending.

Along with a lower likelihood of approval or LoA, EvaluatePharma concluded that oncology was one of the most expensive new therapy areas and the highest net present value due to the unmet need.

Source EvaluatePharma

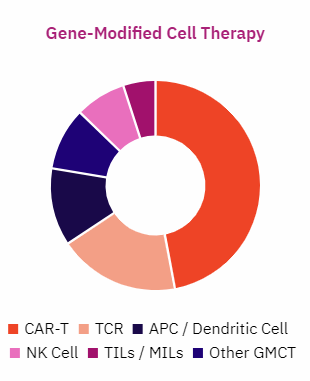

In 2019 there were over 400 companies actively developing 627 clinical regenerative medicine therapies for oncology. There were approximately 380 gene-modified cell therapy active clinical trials.

Source: Alliance for Regenerative Medicine

T-cell therapy

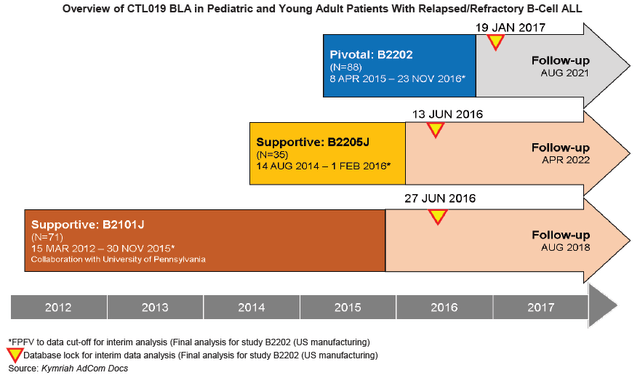

Autologous cell therapy: CAR T-cell therapy is an immunotherapy called adoptive cell therapy. Autologous cell therapy starts with a patient’s blood. An artificial chimeric antigen receptor or CAR is added. Once the blood is infused back into the patient, the CARs identify and attack tumor cells. The three approved CAR-T cell therapies to date all are anti-CD19 directed which means they are designed to target and bind to the tumor-associated CD19 antigen. The following graphic from the Novartis (NVS) Kymriah BLA shows clinical progression over 5 years.

Source: Kymriah BLA filing

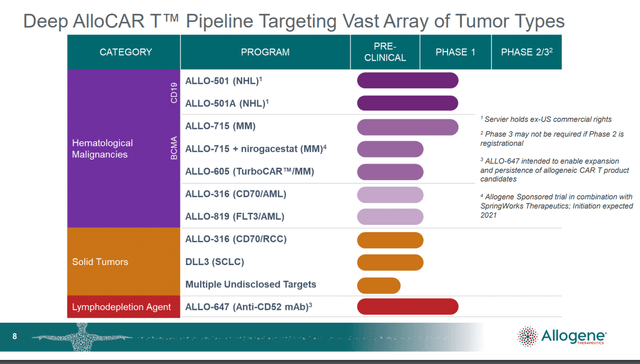

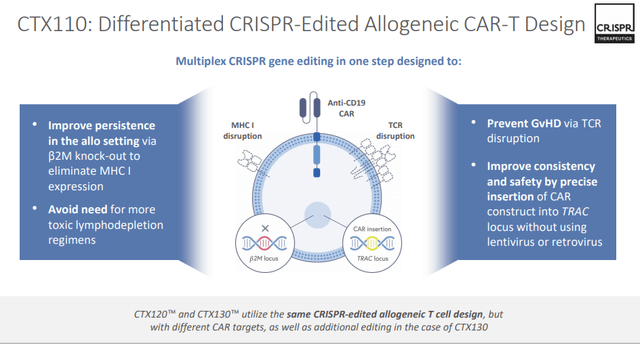

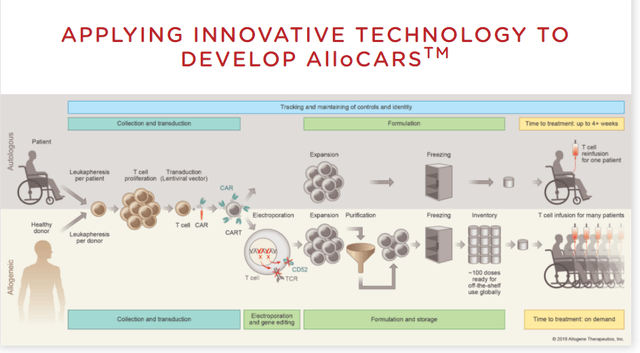

Allogeneic cell therapy (also called Universal or “off-the-shelf”) use a similar process, but begins with blood from healthy people. The T cells are then edited ex vivo (outside the body) to suppress the immune reaction to foreign tissue when infused in patients diagnosed with cancer. In additional to CD19, CD22, CD52, CD70 and B-cell maturation antigens or BCMA are among those being pursued by Cellectis (CLLS), CRISPR and Allogene. Data readouts over the next year may serve to both validate and accelerate platform-based universal cell therapies with approved in-house manufacturing.

Universal is simply a better approach IF safe AND has an ORR similar to autologous

Off-the-shelf therapies have significant benefits, if the clinical data shows they are as effective as autologous. The following Allogene graphic summarizes the processes which yield far less patient inconvenience and much faster treatment capability.

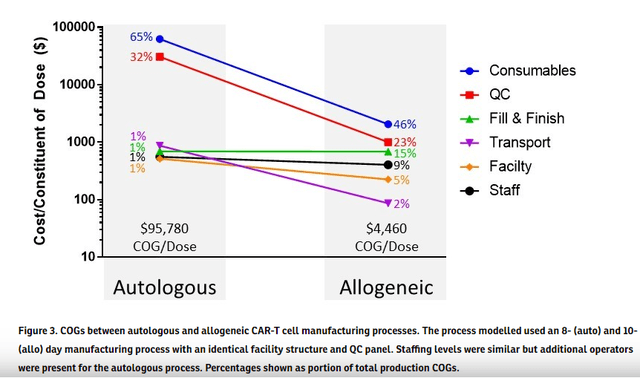

The allogeneic cost per dosing advantage is projected to be significant as depicted in a paper published in Cytotherapy.

Source: Akron biotech website publication of linked article

Summary

Allogene, Atara and CRISPR are leading the allogeneic cell therapy movement addressing a high unmet need in oncology. Oncology programs historically have one of the lowest LoAs in biotechnology, which arguably makes regenerative medicines even more compelling as they are directed to specific antigens linked to the disease. And oncology targets are among the highest NPV for approved medicines. Autologous therapies cost per dose is estimated to be 20x that of universal therapies, are far more disruptive to patients and take far longer to administer. Clinical data in the next 12-24 months should help ascertain whether the immune response can be adequately mitigated and how efficacious allogeneic is relative to autologous.

Allogene Therapeutics develops allogeneic CAR-T [chimeric antigen receptor] therapies for treatment of cancers. This is effectively an off-the-shelf solution, as opposed to an autologous solution wherein cells are taken from the patient, engineered in a lab, and reinfused into the patient—a more expensive and cumbersome process. Allogene is run by a proven team with a history of creating and monetizing value. It is the same group of entrepreneurs that sold Kite Pharma to Gilead in 2017. Allogene has over $1 billon of cash, and an impressive technology showing early signs of efficacy. If the data hold, we can see the company expanding into other indications and becoming a significant cell-therapy leader. Eli Casdin Barron’s Roundtable Sep 2020

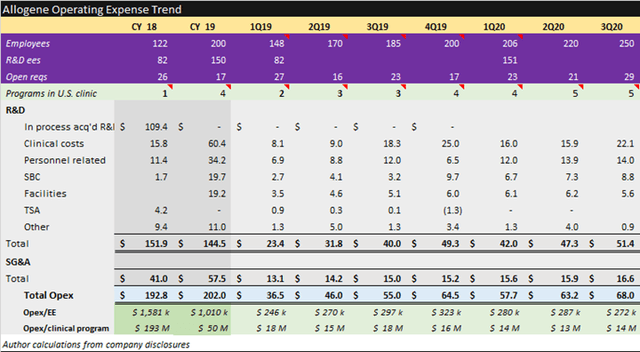

Allogene is a buy at $207m EV per pipeline program. Strengths include the deepest pipeline, a proven management team, a strong cash position and efficient quarterly spending of $14m per asset. Weaknesses include no late-stage clinical programs, significant additional development milestone contingent costs and commercialization contingent milestone and royalty costs.

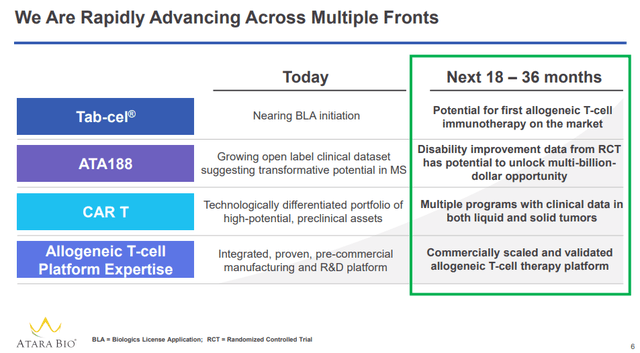

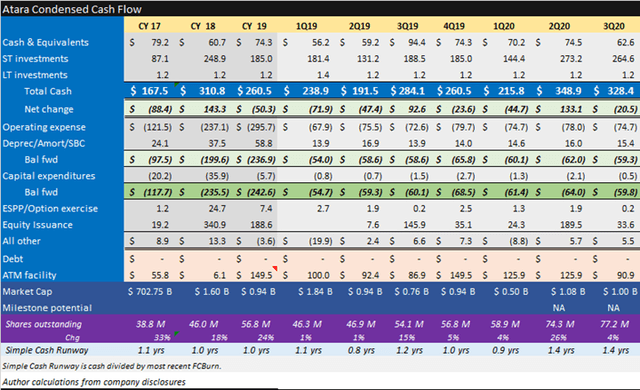

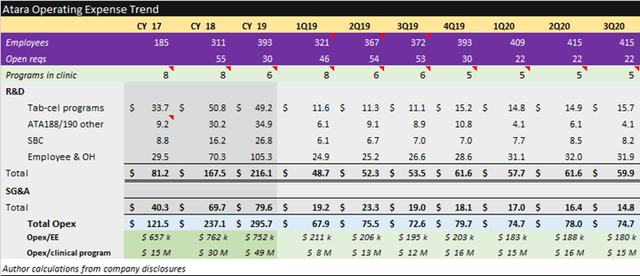

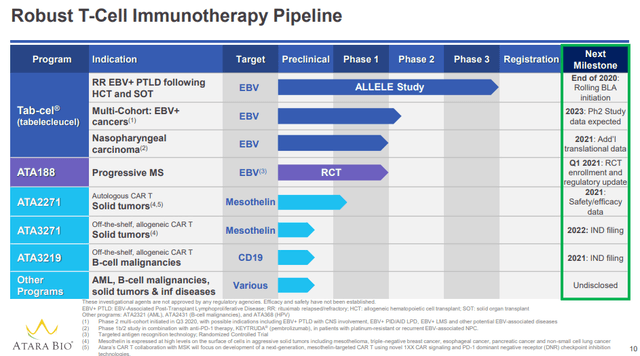

Atara is a buy at $210m EV per pipeline program. Strengths include late-stage assets, expected BLA filing in 2021, ownership of programs, in-house manufacturing and efficient quarterly spending of $15m per asset. Weaknesses include cash position requiring ongoing use of at-the-market line to fund operations and small available market for lead indications.

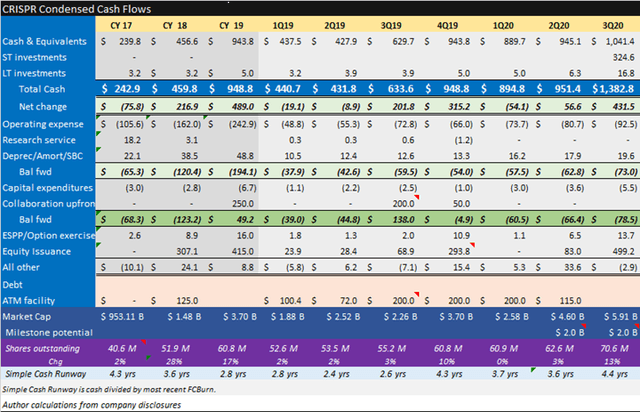

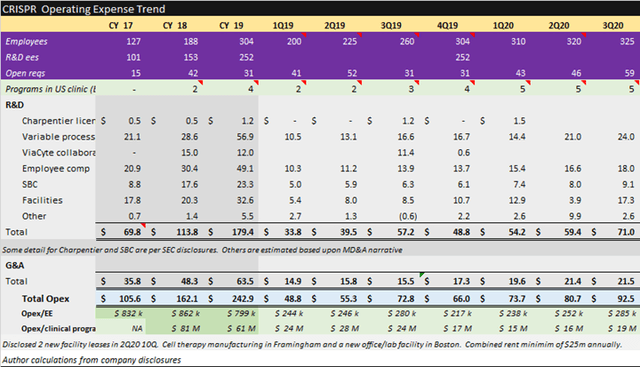

CRISPR is a sell at $1.2b EV per pipeline program. Strengths include the CRISPR brand, a strong cash position and good early data. Weaknesses include excessive valuation, no late-stage clinical programs, time to complete in-house manufacturing and questions about safety in CTX110.

Supplemental details follow.

Allogene Supplemental Information

When Allogene completed their IPO registration filing, they reported having 16 preclinical assets which were transferred from Pfizer (PFE) for a 25% stake in the company. This gave them an early first-mover advantage in allogenic cell therapy but at a cost. This asset transfer arrangement also calls for potential milestone obligations of up to $5.7 billion plus royalty expense.

- Cellectis entitled to development and sales milestones of up to $2.8B ($185B per target) plus royalties (high single digit percent).

- Pfizer entitled to $840M in development and $325M in sales milestones plus royalties (single digit percent).

- Servier is entitled to $137.5M in development and $78m in sales milestones plus royalties (teens percent)

Source: Allogene November 2020 investor presentation

Atara Supplemental Information

Source: Atara November 2020 Corporate Presentation

Source: Atara November 2020 Corporate Presentation

CRISPR Supplemental Information

Source: CRISPR November Corporate Presentation

Disclosure: I am/we are long ALLO,ATRA. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.