OPEC should provide the catalyst for $50.

Iran attack brings Middle East tensions back.

U.S. inventories and production slowdown could add fuel.

Traders have built a large oil short this year.

U.S. dollar election rebound is a risk to the bullish thesis.

I suggested to subscribers of my weekly newsletter that oil would test the $43.50 level last week, and it blew through there to trade at highs above $46.00. This article outlines a bullish thesis for continued higher prices through Q1 2020.

OPEC should provide the catalyst for $50

OPEC members are set for a virtual meeting on Monday and Tuesday to discuss the extension of their supply cuts into 2021. The group had planned to increase supply in January, but the second coronavirus wave saw further lockdowns, and oil demand expectations were adjusted lower.

Another headwind for increasing the oil supply has been the return to production of Libya, which was exempted from the cuts. Libya saw a surge in production to 1.25 million barrels per day after output had been shut down for months due to rebel fighting.

The market is expecting a three-month extension to the current supply cuts, but it’s possible that the group could telegraph something deeper. OPEC knows that a vaccine will be coming in Q1, so if production cuts continue, then energy ministers will want to maximize prices, and this could see crude oil at $50 in December.

Iran attack brings Middle East tensions back

It’s been a relatively quiet time for oil markets when it comes to Middle East tensions, but with the recent attack on an Iranian nuclear scientist, we could see a return to the “war premium” in gas prices.

Iran’s President has blamed Israel for the attack and vowed revenge, and this also comes at a time when U.S. troops are being withdrawn from the Middle East. The initial troop sizes are small but are still a sign of retreat from the area. The U.S. has deployed the USS Nimitz aircraft carrier to the Persian Gulf "as cover for troops leaving Iraq and Afghanistan".

There are hopes in Tehran that a Biden Presidency would re-join the 2015 nuclear agreement which removed international sanctions on Iran in return for control over its nuclear timeline.

U.S. inventories and production slowdown could add fuel

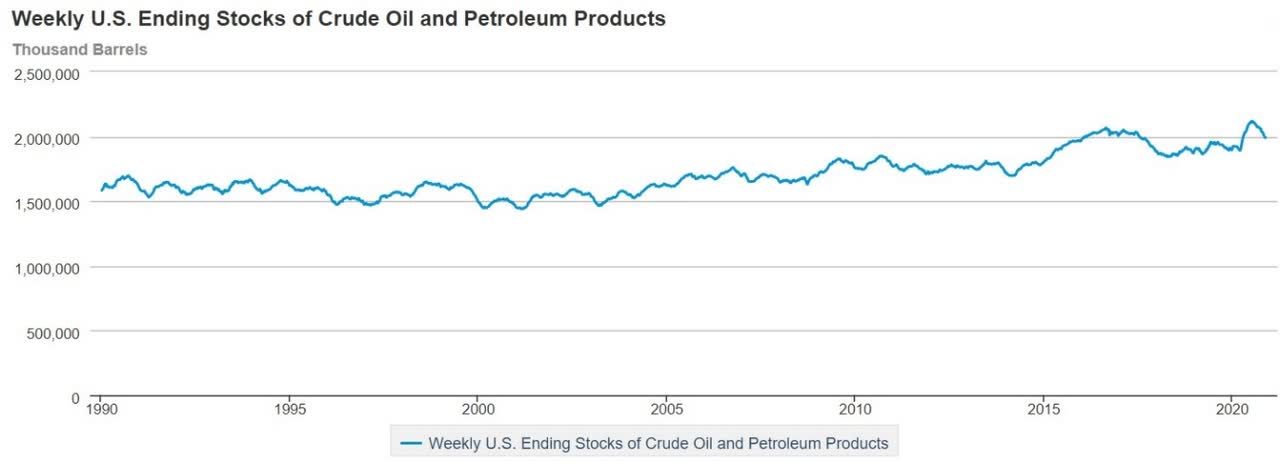

The end of 2020 has seen the emergence of multiple coronavirus vaccine candidates, with the delivery of these being scheduled for as early as the year-end. It is likely that enough doses will have been delivered by the end of Q1 to protect the vulnerable and the lockdown phase can finally end. If this timeline is correct, then we have likely seen the top in oil inventories in the U.S., and the chart is confirming that this is a possibility.

Weekly stocks of crude oil and petroleum products had risen above the 2 billion barrel mark set in 2016, but the number has declined, and we could see this drop to 1.8 billion in 2021 if the economy begins a recovery.

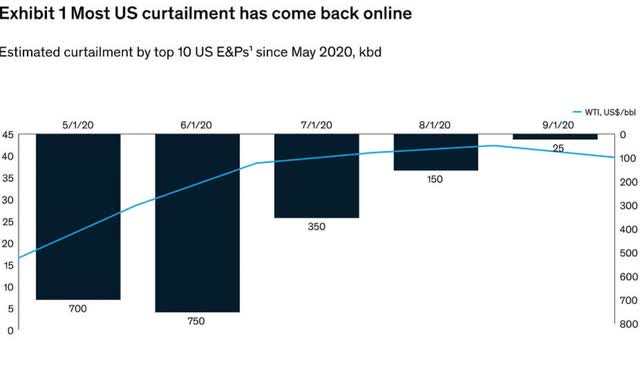

The inventory picture is helped by the fact that, according to analysts at McKinsey, most U.S. production that was shut in at the beginning of the lockdown strategy has now come back on-line. This reduces the risk of a glut appearing in the next 3-6 months.

(Source: McKinsey.com)

The company expects Permian activity to rebound in the first quarter of 2021 but raises some important questions. Some of these are:

- How will reductions in headcount and COVID-compliant workplace safety requirements affect the timeline for well completions?

- Have shut-ins resulted in any degradation of assets that could accelerate declines or reduce recoverable reserves?

- Will the slow return to new drilling activity result in decreased rig supply in the market or consolidation among drillers?

- How will E&P and service companies respond to continuing disruption in the supply chain and personnel? Will they have sufficient resources available when demand returns?

These dynamics will be important in global drilling activity where new drilling will be slowed down by lower headcounts, increased safety regulations and the degradation of assets. If we also factor in bankruptcies and market consolidation, then it’s possible that market demand could outpace new drilling. OPEC has the ability to take up any slack, but these themes could support oil into 2021 and could lead to a decline in U.S. inventories.

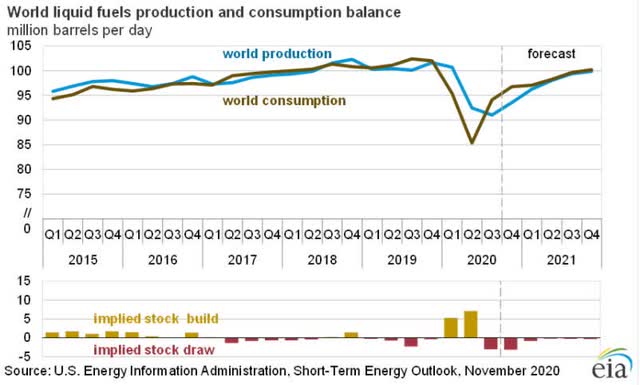

On the global production front, the Energy Information Administration (EIA) sees production and consumption back near 2019 levels in Q4, but the demand side could certainly move faster.

(Source: EIA.)

Increased refinery activity in China is also helping to boost market sentiment, with China's October output seeing a record high. The country processed 59.8 million tonnes of crude in the month, which is equivalent to 14.09 million barrels per day (bpd). China’s recovery from the virus should see this activity continue through 2021.

Traders have built a large oil short this year

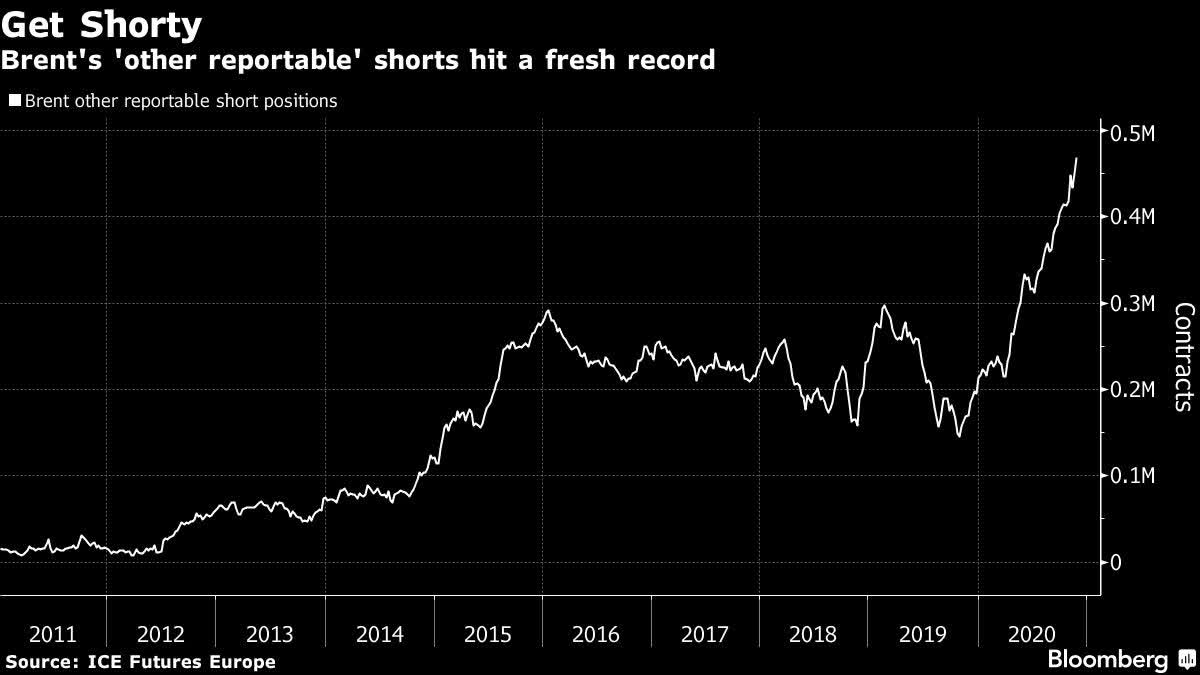

Bloomberg wrote this week about a large short position that has built up in Brent oil this year:

Traders categorized as "other reportables" by regulators and exchanges now hold a record short position of almost 470,000 Brent futures contracts, according to ICE Futures Europe data.

(Source: Bloomberg)

One has to wonder whether this is a bad bet, with traders getting heavily short in anticipation of a virus second wave, before the surprise vaccine announcement.

A crude oil rally into year-end could lead to a big short squeeze in Brent, and this would skew WTI due to arbitrage opportunities.

U.S. dollar election rebound is a risk to the bullish thesis

Crude oil has benefited from a big drop in the U.S. dollar in 2020. The greenback soared in March as a safe haven, but the Federal Reserve balance sheet growth, alongside a huge stimulus package, saw the Dollar Index on the retreat, with lows under 92 to end November. Another stimulus package is expected in early 2021, and this should keep the dollar under pressure. The dollar is also being hit against foreign currencies as analysts see the incoming President giving up on the “America First” policy of President Trump.

The outgoing President is continuing his legal challenge at the Supreme Court, but news networks are already looking at the potential scenarios of how he could turn the election picture around.

A Rutgers Law Professor told Yahoo Finance:

It is a very likely possibility that President Trump could win the election in court. We have lots of indicators of what the justices might do — particularly if the challenge is around Pennsylvania, and the challenged ballots that might come in the day after the election... Justices Alito, Thomas, and Gorsuch, have already expressed a willingness to disallow the counting of those ballots. It is expected that Amy Coney Barrett might join them in that. You have what you need for the makings of the Supreme Court deciding the outcome of the election.

This would rock markets, which are positioned towards a Biden victory, and a rebound in the dollar could dent oil's recent gains. Trump has been more supportive of the energy sector than his possible successor, but dollar gains could outweigh any pro-energy sentiment in the near term.

Conclusion

The oil industry was heavily bruised in March with the drop in futures contracts to negative prices. The industry has been on the defensive since then, with efforts to protect balance sheets and fears of another price drop. The emergence of vaccine candidates may not immediately boost energy balance sheets, but there is a possibility of oil prices rising further into 2021.

If 2020 is really the end of virus lockdowns, then we could see oil demand return to pre-virus levels by the middle of next year, while we also see Middle East tensions rising again. An OPEC boost could help prices to $50 by year-end, with the potential for prices to move back to the $65 levels of January 2020 as early as the end of Q1 2020.

I am now providing a larger selection of ideas exclusively to Seeking Alpha readers through my own Marketplace service. Global Markets Playbook is suitable for both active and long-term investors. Get involved now with a 14-day free trial.

I am now providing a larger selection of ideas exclusively to Seeking Alpha readers through my own Marketplace service. Global Markets Playbook is suitable for both active and long-term investors. Get involved now with a 14-day free trial.

Disclosure: I am/we are long CL1:COM. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.