Why WisdomTree U.S. LargeCap Has Underperformed In 2020

The WisdomTree U.S. LargeCap ETF has lagged the broad market by quite a bit in 2020: Year-to-date returns of 6% vs. the S&P 500's nearly 13%.

The fund tracks a "fundamentally weighted" index, rather than a market-cap weighted one, which helps to explain weak performance this year.

Those who believe that value, cyclical and "old economy" stocks have their best chances of catching up in 2021 might want to consider EPS.

The WisdomTree U.S. LargeCap ETF (EPS), formerly known as the WisdomTree U.S. Earnings 500 Index, has caught my attention. This inexpensive fund that charges a management fee of only 8 bps has traditionally tracked the S&P 500 (SPY) very closely, as the ETF and the index generally invest in about 500 stocks with similar characteristics: US-based, large cap names.

But so far in 2020, EPS has lagged the broad market by quite a bit: Year-to-date returns of 6% vs. the S&P 500's nearly 13%. Today, I take a look under the hood to better understand the discrepancy, and whether EPS' underperformance may represent a mean-reversion buy opportunity.

Credit: Alec Favale @ Unsplash

A quick look at historical performance

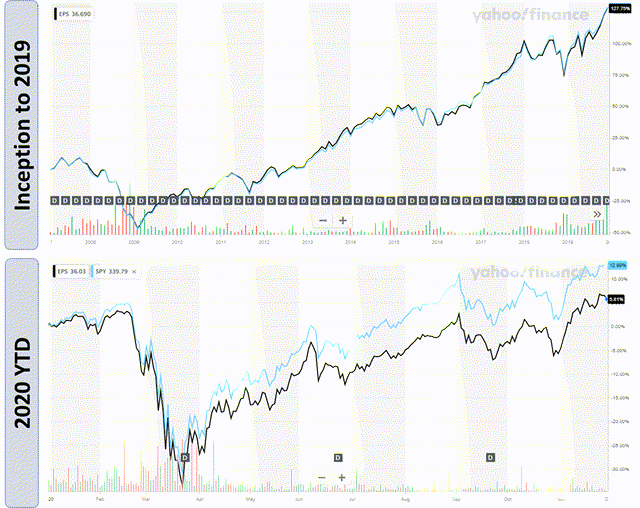

First, let me better illustrate how WisdomTree's fund seems to have gone "off track" in 2020. The first graph below depicts the performance of the fund from inception through the end of 2019. Notice that the black and blue lines, representing EPS and SPY, respectively, have tracked each other almost perfectly. This has been true through bull and bear periods, including the Great Recession of 2008-2009 and the 2011 European Debt crisis.

The second chart below shows that the S&P 500 has leaped ahead of WisdomTree's ETF in 2020. The disconnect did not become noticeable until after the bottom of the COVID-19 crisis, in March. EPS seems to have underperformed fairly consistently throughout the recovery phase.

Source: graphs by Yahoo Finance

What may explain the underperformance

To understand why EPS has been atypically weak so far this year, it helps to take a closer look at the fund's methodology. What stands out at first glance is that EPS tracks a "fundamentally weighted" index, rather than a market-cap weighted one. More specifically, the fund invests in companies that:

Have generated positive cumulative earnings over their most recent four fiscal quarters prior to the index measurement date (December of each year). The index is earnings-weighted to reflect the proportionate share of the aggregate earnings each company has generated. Companies with greater earnings generally have larger weights in the index.

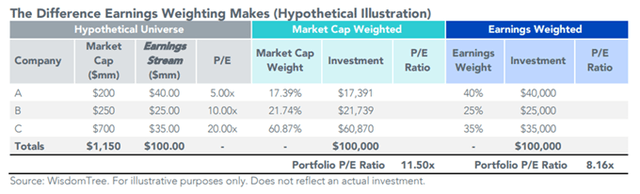

The table below, using a hypothetical example, does a good job at illustrating how the allocations work, in theory. Notice that size of earnings per share, not size of market cap, is the most determinant factor. Because EPS invests more heavily in companies with strong bottom lines, it ends up (1) being more exposed to slightly lower valuation stocks, which in turn tend to be more cyclical, and (2) being less concentrated in big tech names with larger market cap that tend to dominate the S&P 500.

Source: WisdomTree

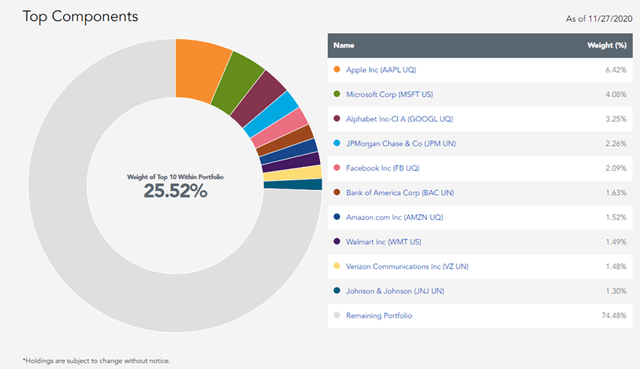

This key difference in the allocation methodology is reflected in the portfolio's profile. See pie chart below, and notice that WisdomTree's ETF invests only about 17% in the FAAMG group. By contrast, SPY allocates nearly 21% to the same Big Tech stocks. Also, 16% of EPS' assets are exposed to the low-valuation and cyclical financial services sector, vs. only a bit more than 10% in the case of the S&P 500.

To be fair, EPS' bias toward higher earnings to the detriment of higher market cap does not quite make it a value fund. For instance, the ETF's average trailing P/E of 25.0x and price-to-book ratio of 3.1x sits just below the comparable metrics for the S&P 500, but still well above the Vanguard Value ETF's (VTV). Yet, EPS' "value tendencies" appear to be significant enough to justify the fund's underperformance in 2020 – a year of stay-at-home trends in which mega cap tech has dominated.

Source: WisdomTree

Is there an opportunity?

I see a couple of bullish cases that can be made in favor of EPS. First, investors that appreciate earnings firepower may feel more comfortable investing in a fund that values this particular factor, rather than one that's more exposed to big tech names that might arguably be too richly priced.

The second point aligns with my belief that value, cyclical and "old economy" stocks have their best chances of playing catch up in 2021, following a long expansionary cycle in the economy that lasted through last year. Should this prove to be the case, mean reversion would suggest that WisdomTree's ETF could produce a few percentage points of returns in excess of the S&P 500 through the next several months.

A helping hand

Stocks have been on a choppy ride this year, and the future still looks uncertain. But my SRG portfolios have been beating the S&P 500 in 2020 and since inception, producing far superior risk-adjusted returns. To find out how I have created a better strategy to grow your money in any economic environment, click here to take advantage of the 14-day free trial today.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.