The time has come to look over November's investments and dividends.

The market experienced a vaccine-induced high, which eliminated all but one or two COVID-19 negatives in my portfolio in terms of RoR. The entire portfolio is now significantly up YoY.

The US dollar is showing extreme weakness, with the pairing to the SEK now at 8.50 for one dollar (versus usually 9.00-10.30), meaning despite stock market highs, US investments appeal.

Several companies have reinstituted dividends, and banks are among them.

Annual dividends are higher than ever - and cash is down at least somewhat.

It's time for this month's update, with October investments representing around $16,000 in total, cutting away at my cash position. As I said in my previous articles, my goal is:

"My target remains to have spent the majority of my savings during 2020 and to be above 98% stocks, if not 99.3%, by December, with a target cash amount of a few thousand dollars."

(Source: June 2020 Portfolio Update)

I don't think that I'll be able to achieve this with stocks experiencing vaccine highs, however.

Even with the USD weaker year over year and some appealing things still available, I'm very careful where I invest for the time being.

There has been a significant amount of dividend reinstatement and recoveries, which has resulted in a current forward dividend coverage ratio of 168.05%, despite the dollar showing historically-high weakness. While this is likely to be temporary, I expect further positive dividend news going forward.

November 2020 news update

October saw the continuation of my investment strategy. I identify opportunities on a weekly basis and invest in 1-3 of them, usually in injections of around €500/$500/~5,000 SEK. I continue to do:

- Investments in carefully controlled "cash injections," portioned into an appealing mix of quality, conservative companies, varied in sector and risk.

- The abandonment of certain companies in favor of higher-quality companies. This does not mean the aforementioned companies are poor investments - but I'd rather buy companies that are rarely on sale as opposed to "just" those I've been buying previously.

- The continuation of my ultra-safe dividend stock list with 4 different tiers. This tool has become invaluable to me to efficiently sort opportunities, safeties, and other factors.

This month, I struck hard though, and invested nearly $10,000 in Alfa Laval (OTCPK:ALFVF), filling that position at a time of undervaluation. Since that investment, the position has appreciated nearly 19%.

I continue to focus on a mix of higher-yielding dividend stocks as well as qualitative, more low-yielding companies. These days, I'm looking at a target overall yield of about 3.0-4.5% (down from 5% at the higher end).

My portfolio's total yield is at a current 4.3355%. This, as of November 2020, still includes a large cash portion (causing the drop from last month in yield), larger than 4 entire sectors I hold currently in a 0.65% interest savings account. If invested at a 4-5% standard yield, the invested cash position would result in an overall portfolio yield of 4.62%.

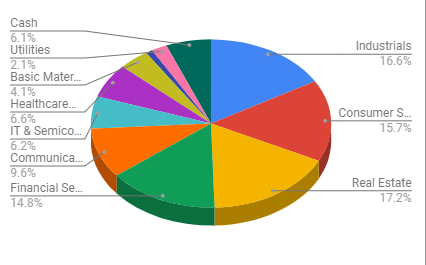

Here is my current total portfolio allocation in terms of sectors and cash.

(Source: Author's Calculations and Data, Google Sheets)

My cash position is down around 2%, which is great, given that I actually rotated some higher-risk investments into some significantly lower-risk ones during the month as well. You will notice the significant increase in my Healthcare/pharma segment, which I owe to increasing stakes as well as values of all my pharma stocks.

In terms of overall balancing, I foresee further increases in IT/Semi, Pharma, and perhaps communications as I continue investing here in the coming month - at least, in the undervalued companies found in the sector here, as well as investing in industrial, particular in aerospace and defense if I see some weakness here. My positions in General Dynamics (GD) and Lockheed-Martin (LMT) are nearly at capacity at this time, but there's room to fill them still.

(Source: Unsplash)

In terms of financial news during November, the news continues to focus on COVID-19. Cases continue to mostly rise, and in most nations, apart from Sweden, lockdowns continue. The EU is still cautioning travel, though the firm signals out of Brussels are that there won't be any lockdowns of borders, merely recommendations. Living in Sweden, we're seeing a supposed increased number of cases - but no one I see is wearing masks, people are still going to the gym, and living their lives as normally - at least here.

It's clear at this point that Sweden won't be officially shutting down anything, except limiting the number of people at public events and meetings, though this is not strictly a governmental thing here either. The reason for this soft touch is multi-faceted, but one of the biggest ones is, of course, money. If the government were to order full shutdowns, they'd also have to pay owners of businesses money, which this government does not want. Hence, everything is kept on a recommendation level, with periodic television appearances of our prime minister expressing his displeasure over our perceived lack of conforming to recommendations.

So, how should investors consider, or "trade" these news or invest going forward?

Buy as things go up and down continues to be my stance.

As I'm writing this article, the Dow is "unfortunately" above 30,000 points for the first time. Of course, quite nice, given my portfolio value in total now, but for new investments, it's incredibly bad. Undervaluations which seemed all but self-evident and perhaps would last for years only 1 month ago are now all but gone. To find undervaluations in this particular market, we need to start really digging at the number of stocks we follow, and we also need to consider existing exposure. That's the reason I'll need to be very careful going forward. Even though I'll consider many companies to be appealing buys, I actually have full positions in these companies, meaning I won't invest more in them at this time.

FX continues to be a concern for Scandinavian investors when compared to the past 2 years. The USD, as I'm writing this, is trading at some very appealing lows towards the Swedish crown. Despite the market advances, there's no doubt in my mind that US and Canadian stocks are currently the way to go.

As always, FX isn't a deciding factor in itself, but I may decide on higher levels to invest more - or invest less - due to certain FX trends.

The trends this month show us that it's time to prepare for a more serious dip, and also take advantage of the one we're currently seeing. Never stay complacent - stay informed and keep investing!

Reviewing November 2020 dividends and projecting future dividends

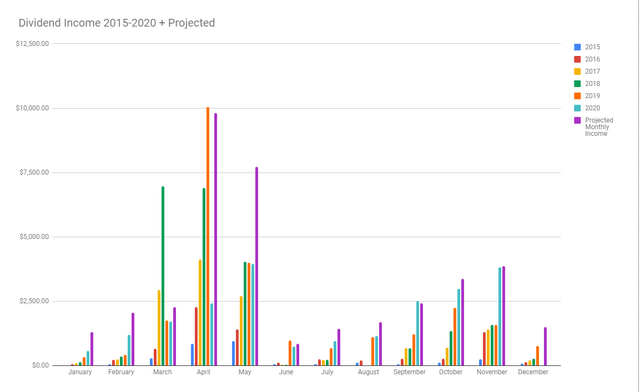

(Source: Author's Calculations and Data, Google Sheets)

The total amount of dividends paid out from my private portfolio this month, in combination with interest income from my savings, was $2,952.12. This has been reinvested. My November dividends came in mostly according to plans, with some surprises from Norwegian companies paying special dividends. As you can see above, I've also been able to significantly increase my overall projected dividends for most of the middle of the year as well - not to mention the initial few months during the year.

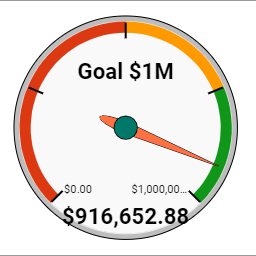

The current average monthly dividend income from my private portfolio, based on the calculation of annual dividends ($38,569/12), is $3,214.50. FX is a big part of this massive increase. My fundamental portfolio size, for the very first time, has also breached a total of $900,000, bringing me within $100,000 of striking distance for my goal for my fundamental portfolio value of around $1M. Of course, if the USD were to advance back up, I'd quickly lose around $100,000 of that value as quickly - all a matter of how things are calculated. Nor is $1M some sort of magical number - at least not for many investors. For someone who started with around $75k around 5-6 years ago though, I'm very pleased with how things have grown.

(Source: Author's Calculations, Google Sheets)

The reason the milestone can be considered relevant is that, once this is comfortably reached, I'll shift my investment style somewhat to include more growth-oriented investment ideas with higher potential returns with a lower emphasis placed on dividend payouts. For the time being, however, I'll continue to strictly focus on my fundamental strategy of dividend growth investment.

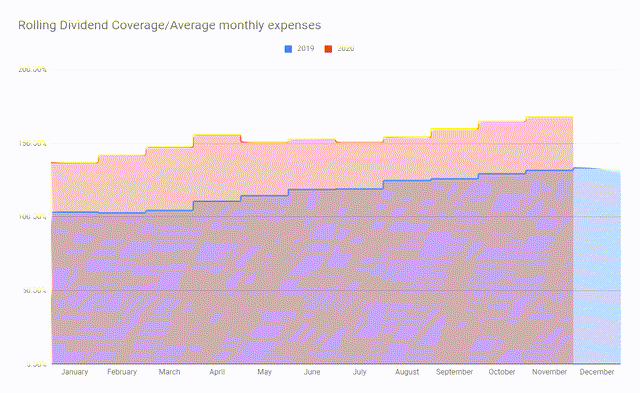

Below, you can view my average income from dividends in relation to expenses (in SEK) for the year 2019/2020.

(Source: Author's Calculations and Data, Google Sheets)

Thanks to continuing investments, I've managed to keep my overall income coverage very high and above 168.05%. The only potential danger here is Swedish banks and the consideration the banks put on the 2020 and 2021 dividends, which could seriously hamper this going forward if Swedish banks somehow decided to break with their dividend traditions.

Some of the companies which have paid me dividends during this month include:

Annual Dividends/Bi-Annual Dividends

- Essity (OTCPK:ESSYY)

- NCC (OTC:NCCBF)

- Atea (OTC:ATAZF)

- Norsk Hydro (OTCQX:NHYDY)

- Yara International (OTCPK:YARIY)

Quarterly Dividends

- Bristol Myers Squibb (BMY)

- JPMorgan (JPM)

- Verizon (VZ)

- AT&T (T)

- CVS Health (CVS)

- Toronto-Dominion Bank (TD)

- Lowe's (LOW)

- Mastercard (MA)

- Nucor (NUE)

- American Express (AXP)

- Celanese (CE)

- General Dynamics (GD)

- Ocean Yield (OTCQX:OYIEF)

- AbbVie (ABBV)

- British American Tobacco (BTI)

- Caterpillar (CAT)

- Unum Group (UNM)

- Ameriprise Financial (AMP)

Monthly Dividends

- Realty Income Corporation (O)

- Exchange Income Corporation (OTCPK:EIFZF)

Overall, I'm very pleased with the dividend mix in terms of companies, as it includes a far improved mix of payors in terms of quality compared to 2018/2019 - and I intend for this to continue going forward, in terms of quality.

The crisis has also shown that investing in NA companies as part of my strategy provides a much better dividend "floor" than a simple, European-exposed portfolio.

A European-exposed portfolio has the very real potential to provide zero in terms of dividends during a poor year, while American companies keep paying regardless.

Monthly purchases

My purchase approach continues to guide my investment decisions as we move forward.

"I only purchase stocks I consider fairly valued or undervalued. I don't mind sitting with some (or a lot) of cash on hand, as my goal of financial independence from dividend stocks is reached, and I am in no position where I feel I "have" to invest in anything or keep any certain amount of money in or outside of the market."

(Source: July 2020 Portfolio Update)

This month, the following transactions were made in my private investment account:

- Purchased stock/increased exposure to General Dynamics (GD). This purchase was in response to the stock's undervaluation, thanks to the latest drops.

- Purchased stock/increased exposure to Cardinal Health (CAH). This purchase was in response to the stock's undervaluation and factors discussed in my recent articles.

- Purchased stock/increased exposure to Intel Corporation (INTC). This purchase was in response to the stock's undervaluation and factors discussed in my recent articles.

- Purchased stock/increased exposure to Cisco Systems (CSCO). This purchase was in response to the stock's undervaluation and factors discussed in my recent articles.

- Purchased stock/increased exposure to CVS Health (CVS). This purchase was in response to the stock's undervaluation and factors discussed in my recent articles.

- Purchased stock/increased exposure to Federal Realty Investment Trust (FRT). This purchase was in response to the stock's undervaluation.

- Purchased stock/increased exposure to Lockheed Martin (LMT). This purchase was in response to the stock's undervaluation and factors discussed in my recent article on the company.

- Purchased stock/increased exposure to Bayer (OTCPK:BAYZF). This purchase was in response to the stock's undervaluation and factors discussed in my recent article on the company.

- Purchased stock/increased exposure to Merck (MRK). This purchase was in response to the stock's undervaluation and factors discussed in my recent article on the company.

- Purchased stock/increased exposure to Alfa Laval (OTCPK:ALFVF). This purchase was in response to the stock's undervaluation and factors discussed in my recent article on the company.

- Purchased stock/increased exposure to Essity (OTCPK:ESSYY). This purchase was in response to the stock's undervaluation and factors discussed in my recent article on the company.

Looking forward

The biggest piece of news in terms of dividends and potential payouts this month is that, as of this vaccine-related climb, I've rotated the very last of my oil/energy stocks out of the portfolio in favor of higher safety/defensive stocks in other segments.

As of the end of November 2020, my portfolio no longer holds any oil/pipeline stocks, small or large.

I don't expect that I will be investing in the companies again, due to some of the structural issues with the business side of things here. This shouldn't be taken as some sort of political or "green" statement - those of you who read my articles know that I freely invest in any companies, free from Moraes and norms, both in renewables and previously in oil.

The double whammy of OPEC being eager to start shipping again, coupled with the green initiatives across the world as well as the current demand slump and the state of many of the companies therein, means that I view the sector as inherently riskier than many others at the moment. I'm not arguing that we'll be using oil for many decades yet - we will. But the current policies from OPEC is no more than a band-aid on cancer. I don't want to be involved in the sector at this point, from a comparative perspective. This means that I see superior risk/reward-ratios in nearly every other sector, except perhaps consumer cyclical. I believe that any investor currently looking at the sector should only do so with extreme care.

The only type of company I could see myself considering here if made to the state would be the most defensively-built and conservatively run pipeline companies or oil majors taking into consideration the shift into renewables for the next 50 years. Even here, however, I prefer different investment alternatives.

For the next month, I've decided to keep an eye on the following companies and may extend my position in one or several of them, depending on which offers particularly appealing valuations at the time:

- Verizon Communications

- Tyson Foods

- Essity

- Flowers Foods (FLO)

- Walgreens Boots Alliance (WBA)

- General Dynamics (GD)

- Amgen (AMGN)

The list is long, and frankly, those aren't all of the stocks I'm viewing at this time - but they're some of the "core" and more importantly, some of the safer, undervalued companies currently out there.

Where to go from here as a dividend growth investor?

As things stand, I believe the correct stance is currently to "take care". With the market climbing and with many of the undervaluations taken for granted now gone or significantly reduced, investors risk placing money at work at what could be less-than-ideal valuations.

Careful stock picking is paramount. As always, I'm working on my "monthly picks", and I'm taking long, careful looks at my portfolio to make sure I'm buying the best possible stocks at the best possible prices for me. That may not always coincide with what may be best for you. Take my current focus on Verizon Communications, for example. The reason for it is because of my overall underexposure to the company. If I did not have a position in AT&T that was nearly full beyond the brim, I would probably be looking at that company instead.

Appeal is, in large part, based on your portfolio composition.

(Source: Unsplash)

Additionally, my investment approach continues to guide me; in particular, when it comes to my current classification system.

"My approach has morphed more along the lines of keeping things simple. For a core investment portfolio with the goal of servicing one's life with the capital and dividends necessary to sustain the lifestyle you're looking to have, you need not overcomplicate your methodology. It may, in fact, be damaging to your goal to do so.

In my work to evolve my own picking process, I've found that I'm investing in and looking at more and more stocks that others may consider boring, or stocks which some may consider being too "low yield" to be appealing. In finance, for instance, I much prefer investing in safer companies yielding 3-4% than unsafe ones yielding 6-7% - where "safer" is my definition based upon the data points I track using my own QO-system."

(Source: June 2020 Portfolio Update)

Once you've reached your individual goal, you may construct portfolios with the goal/s of achieving significantly higher rates of return and, in so doing, accept higher levels of overall risk.

Wrapping up

Going forward, I know that many of the investments made this year will continue to realize further gains in the very long term. As a result of the recent upswing, any lingering portfolio-wide downside of COVID-19 has been eliminated from my overall investments, at least in terms of overall returns. The uncertainty that still lingers is what will happen to some of the Scandinavian and European bank payouts for 2019. Because there is a significant amount of "missing" dividends here, this is a concern for me, and something I intend to in part base my future stance for these companies on.

Of course, payouts will return to normal levels, the markets will at some point return to more of a state of normalcy, and we'll leave the pandemic behind us. I'm trying to put capital to work in accordance with my strategy. I now hold 6.1% in cash - and this is not necessarily something I view as positive.

I'm still more of a subscriber of the "Cash is Trash" mentality, though I still find it challenging to go "all in" in a very short time. I keep investing and know that, eventually, this cash position will actually go down further as more cash is put to work in these excellent companies.

Continue considering your long-term investment goals and where you want to be in 1 year, 5 years, and 30 years. These things, not the whims of writers or other investors, should guide your own investments.

As we move towards Christmas, and as this will be my last monthly update until the 24th, I wish you all happy holidays, happy investing, and good luck in your pursuits - both financial and otherwise.

(Source: Unsplash)

It's been a very difficult year for many of us, and I'm hoping 2021 will be better.

Disclosure: I am/we are long ALL STOCKS MENTIONED. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: While this article may sound like financial advice, please observe that the author is not a CFA or in any way licensed to give financial advice. It may be structured as such, but it is not financial advice. Investors are required and expected to do their own due diligence and research prior to any investment.

I own the European/Scandinavian tickers (not the ADRs) of all European/Scandinavian companies listed in my articles.