Palantir Technologies: An In-Depth Look At Whether It Have A Sustainable Competitive Advantage

As speculators circle around Palantir from both the long and short sides, trading volatility has obscured the fundamental picture as to whether the company commands a sustainable competitive advantage.

In this article, I intend to have an under-the-hood look at Palantir as a 'digital resources' play to answer that all-important question.

I believe its Gotham, bundled with forward-deployed field service representatives, has surmounted the barriers to entry and now enjoys switching cost advantage and emerging network effect.

As it diversifies into adjacent commercial verticals through Foundry, Palantir will benefit from economies of scope and scale. Profits will ensue.

Shareholders are betting on Palantir's success in completing the digging of a wide moat. The less anticipatory investors may want to wait until such a moat becomes reality.

There are probably as many investors who are averse to Palantir Technologies Inc. (PLTR), a recent public listing, as those who root for it. The stock has gone parabolic since the start of November 2020. Then, short-seller Andrew Left of Citron Research entered the scene with his twit. All of the trading volatility has obscured one important fundamental question: does Palantir have a sustainable competitive advantage?

Below, I attempt to answer that question with an in-depth look at this interesting company.

What does Palantir do?

As of 2020, Palantir's mission is to help its users, the people doing the hard work on complex, real-world problems by writing software that enables effective analysis against complicated, data-driven problems.

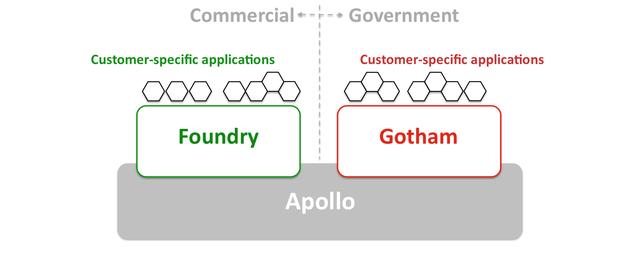

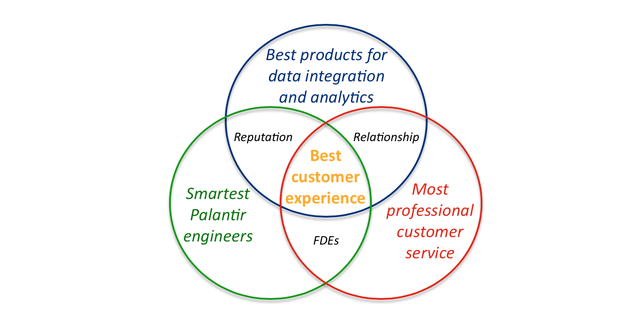

Palantir offers two principal data fusion platforms for integrating, managing, and securing any kind of data at a massive scale, i.e., Gotham for government agencies and Foundry for the commercial market. With forwarded-deployed Field Service Representatives, Palantir transforms massive amounts of disparate information into an integrated data asset that reflects their operations, and layer applications on top of the Gotham or Foundry platform to make the integrated data asset accessible and actionable and for fully interactive, human-driven, machine-assisted analysis (Fig. 1).

Fig. 1. Palantir product offering as of 2020. Source: Laurentian Research based on Palantir description.

Fig. 1. Palantir product offering as of 2020. Source: Laurentian Research based on Palantir description.

On the backend, Palantir runs a system called Apollo as a continuous, automated means to deliver updates to the Foundry and Gotham platforms everywhere they are deployed - cloud, on-premises, and classified networks - without disrupting customer operations. Apollo reduces the demand for field engineering teams to manage software deployments and gives Palantir SaaS operating efficiency in a very heterogeneous environment.

Looking ahead, Palantir is poised to become the default central operating system for data across the U.S. government and its allies. The company also aspires not only to be the central operating system for data at large businesses and even entire industries. To appreciate Palantir's ambition with regard to B2B big data, it may be helpful to recall how much economic benefit has been captured by Microsoft (MSFT) after Windows OS took the lead over MacOS of Apple (AAPL) in the PC era, and by Google and Apple in the consumer mobile phone age with their respective Android and iOS operating systems.

The data competitive landscape

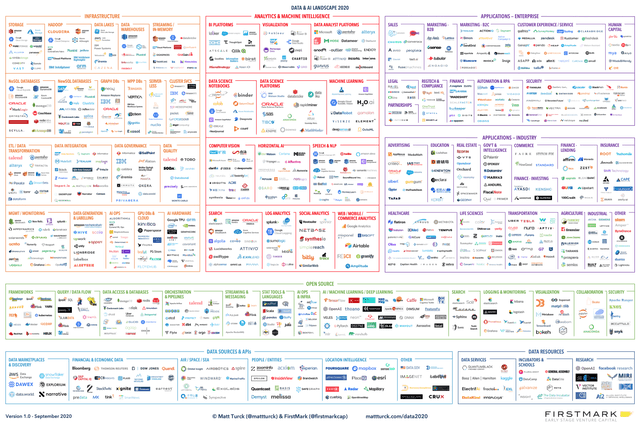

The big data landscape is a sprawling one, with Palantir positioning itself in the 'data analyst platform' field (Fig. 2).

Fig. 2. The big data landscape. Source.

Fig. 2. The big data landscape. Source.

There is a range of potential competitors that offer similar services in some capacity, including (1) traditional IT consultancies, e.g., Booz Allen (BAH) and Accenture (ACN), which lack the technical prowess as well as niche focus; (2) blue-chip data companies, e.g., IBM/i2 (IBM), which cannot scale down efficiently enough to compete on price; and (3) defense contractors such as Booz Allen (BAH), Raytheon Technologies (RTX), Science Applications International Corporation (SAIC), and BAE Systems plc (OTCPK:BAESF), which cannot compete on costs and end-user responsiveness with Palantir. These juggernauts are not nimble enough to pivot away from their legacies and wide-ranging service offerings to effectively match the focus and end-user friendliness of Palantir, although they may occasionally chip away some revenue.

Silicon Valley heavyweights, such as Alphabet Inc. (GOOG), are unwilling to work for the Pentagon citing unethically even though it thought it was okay to collaborate with the Chinese government in project Dragonfly (see here).

There are some smaller start-ups that work in the same general field as Palantir, but they lack the resources (capital and talent) to climb the steep learning curve and compete against Palantir head-to-head. These may include Digital Reasoning, which entered the intelligence field even before Palantir and also received funding from In-Q-Tel, the venture capital firm of the CIA, which seems not to be particularly well run which is why its founder recently returned to the CEO helms; (2) Ayasdi, acquired by the SymphonyAI Group in 2019, which has a core topological analysis platform on top of which custom applications for customers mostly in healthcare and finance are built; and Beijing-based MiningLamp, self-styling as "the Palantir of China" and with US$300 million just raised in a funding round co-led by Temasek and Tencent, which may pose some threat in the commercial arena given it reportedly got business from western firms (see here).

With regard to the OS platform for data especially on the government front, Palantir more or less owns the niche. On the commercial front, Palantir is industry agnostic but is focused on forging ties with approximately 6,000 companies in the world with more than $500 million in annual revenue. Palantir has been saying the real competition is the in-house development projects of its potential customers.

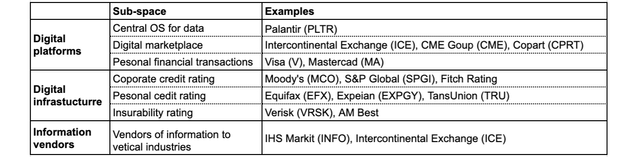

The digital resources space

I believe some of the key characteristics of Palantir can be better understood in the context of what I call the "digital resources" investment space at The Natural Resources Hub (Table 1). This is a group of businesses from various industries, which in a nutshell share the following features:

- A unique value proposition. By accumulating and processing big data, or enabling data-intensive operations, these B2B companies generate recurring, subscription-based revenue from business or government customers.

- Wide moat. They command a monopolistic or oligarchic position in their niche, protected by enormous barriers to entry, some network effects, and switching costs, which gives them a sustainable competitive advantage over the fellow industry participants they serve. They tend to show resilience during industry crises.

- Dominance in native industry. They are deeply entrenched in their respective native industries. Some of them were even bankrolled at their birth by home industry advocacy groups. They then expand into adjacent industries in pursuit of economies of scope.

- Aggressive acquisitions. In an expansion of their service into adjacent verticals, they usually face a fragmented competitive landscape, fertile for M&A, which further fuels rapid growth.

- Capital and operational efficiency. They develop scalable solutions that are built once and installable or sellable countless times. So, they are capital-light and can operate very efficiently. They typically generate superior profitability and deliver a high rate of returns on invested capital.

Table 1. The competitive landscape of the digital resources space. Source: Laurentian Research.

Table 1. The competitive landscape of the digital resources space. Source: Laurentian Research.

As I shall demonstrate below, Palantir shares most, if not all, of the characteristics of the verified members of the 'digital resources" space. Prima facie, it is a wide moat prospect and worth a deeper examination.

Does Palantir have a sustainable competitive advantage?

In the consumer-oriented internet arena, winners are known to take all thanks to a number of traits, including the economies of scale and scope, network effects, the advantage of big data and machine learning, brand power, switching costs, the attraction of talents, the charisma of hard-driving founders, and benefits of geographical clustering, as has been summarized here.

The same may not be said about the B2B platform race, where peers compete mainly on products, services, and customer experience (see here). The outcome of the competition may not be binary (the winner takes all, and the losers die) due to the lack of viral growth.

The technological edge

As I stated above, B2B platform rivals compete primarily on products, services, and customer experience. Palantir follows the approach of bundling superior technology with top-notch forward-deployed field service representatives.

- In its home industry - intelligence and defense, Gotham was created with native attention to security rules, access privilege, and user action logging. No other systems allow users to draw associations between disparate data sets and to visualize the connections as easily and quickly. Palantir has maintained a laser-sharp focus on developing the world's best platform for data, while its primary competitors such as Booz Allen or Raytheon are widely diversified. From competition outcome to reputation among end-users, Palantir not only has a clear technological edge but also is more cost-effective than competitors (see here and here). That's why Palantir is confident it only needs to be placed in front of the right people to prove its worth.

- But then, what makes Gotham shine are the forward-deployed field service representatives. Palantir field service representatives proved to be not only some of the brightest engineers known to government agencies but also extremely responsive to the needs of end-users. These forwarded-deployed engineers examine customer needs, resolve all data source and complexity issues, and build out applications on top of Gotham. Once the applications are built, they train users on site until the customers are ready to use the product on their own. The forwarded-deployed engineers also bring their experience acquired in the reality of deployment back to Palantir development centers as they rotate assignments.

Although its technology and approach are by no means cannot be replicated, Palantir makes the smart decision of focusing on a narrow scope in the sprawling B2B data landscape and, in that niche, it excels at helping customers solving complex data problems at relatively low costs, which actually takes a lot to accomplish, from well-written software, via responsive backend support, to knowledgeable forward-deployed field service representatives. It is no wonder Palantir has earned a sterling reputation for effectiveness and ease of use in the intelligence and defense circle, which I believe it can parlay into the commercial market (Fig. 2).

Fig. 2. Palantir as a B2B platform provider competes on products, services, and customer experience. Source: Laurentian Research.

Fig. 2. Palantir as a B2B platform provider competes on products, services, and customer experience. Source: Laurentian Research.

Palantir brand and talent attraction

Given the forwarded-deployed engineers play such an important role in the technological advantage of Palantir (as do the backend developers), it follows that it is critical for it to attract the smartest engineers in the market if that edge is to be maintained and expanded. To that end, the founders have successfully created an aura of mystery around Palantir:

- In-Q-Tel, the venture capital firm of the CIA, being its very first investor; catcher of Osama bin Laden and the would-be preventer of 9/11; buster of the hacker of Dalai Lama's personal computer and Ponzi schemer Bernie Madoff;

- software vendor to a slew of U.S. intelligence and military agencies (including the CIA, FBI, DHS, NSA, Special Operations, the Marine Corps, the U.S. Army and West Point, the U.S. Navy, the USAF, and the U.S. Space Force), police departments like NYPD, the governments of U.S. allies, and commercial businesses Ferrari (RACE), Airbus (OTCPK:EADSF), BP (BP), Merck (MRK), and JP Morgan (JPM);

- helper of the NIH, CDC, and NHS to track the COVID-19 virus, the World Food Program to stop famine, and the National Center for Missing & Exploited Children to fight child exploitation;

- high-profile politicians such as former Secretary of State Condoleezza Rice and CIA Director George Tenet advising, while luminaries Mike Kelly, David MacNaughton, Louis Mosley (grandson of Oswald Mosley), and Fabrice Brégier (former No. 2 at Airbus) joining to lead its Australian, Canadian, British, and French subsidiaries, respectively;

- a dissent in Silicon Valley that takes side with the U.S.A.; let alone the persona of the hard-driving founders, including Peter Thiel who is said to be the smartest guy in the Silicon Valley besides being a co-founder of PayPal (EBAY) and the first outside investor in Facebook (FB), the lawyer-philosopher-hedge fund manager CEO Alex Karp, and the genius engineers Stephen Cohen, Joe Lonsdale, and Nathan Gettings; even Shyam Shankar, the COO, has also been getting a lot of attention...

The mystique proves to be a powerful recruiting advantage; it helps line up a self-replenishing stream of the best applicants from some of the top-ranked colleges and graduate schools, who are confident they are the smartest computer geeks, who join to work long hours with a cultish band of fellow geniuses to solve the world's hardest problems in spite of lower salaries than Silicon Valley juggernauts like Google, Facebook, and Apple (AAPL).

Becoming a publicly-traded company only strengthens the staffing edge, thus posing a serious challenge for the big IT consultancies, traditional defense contractors, and smaller start-ups. Hiring the best talents will undoubtedly help sustain Palantir's technological advantage.

High barriers to entry

There exist extremely high barriers to entry in the intelligence and defense sector. Even the best end-user experience and reputation alone are not enough to get deals closed. Below, I highlight two hurdles.

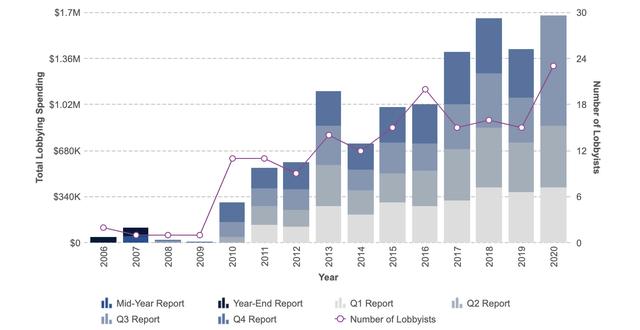

Just to open doors. To open doors and lubricate negotiations, some major defense contractors spend as much as $14 million per year on lobbying.

- Palantir had been quick in learning the rope of getting things done in Washington D.C. It consulted Washington insiders early on and went ahead hiring former senators John Braux and Trent Lott for formal lobbying (see here). Its lobbying spending has been on a steady rise and, in the last few years, reached well over $1 million per year by hiring >25 lobbyists (Fig. 3).

- Palantir also retained former Secretary of State Condoleezza Rice and CIA Director George Tenet as advisers (see here).

Fig. 3. Palantir lobbying spending by year. Source.

Fig. 3. Palantir lobbying spending by year. Source.

To overcome buyer inertia gently and forcefully. Another major challenge faced by Palantir was the department of defense saw it as an outsider that tries to sell software not even in response to any specific requests in its conventional acquisition system, oblivious to the capabilities and cost-effectiveness of Palantir Gotham.

- In response, Palantir allowed free trials of Gotham and provided free services before potential military clients made any purchases; it offered free or reduced-price training to military units that purchased its software. Forward-deployed field service representatives listened to the needs of its end-users and were capable of implementing requested changes quickly.

- Palantir's entrepreneurial approach led to a number of successes with, e.g., some Army military intelligence units and the Marine Corps. Some intelligence officials in the Marine Corps even went so far as to say they would not be surprised to see Palantir remain the de facto standard (see here).

Even though Palantir has demonstrated the efficacy and cost-effectiveness of Gotham, the U.S. Army stuck to the plan of developing its internal intelligence software suite, i.e., the Distributed Common Ground System-Army (DCGS-A) Increment 2, and released a procurement solicitation in December 2015 for its development, thus effectively excluding the ready-to-deploy commercial alternative - Gotham - from being considered. The Army decision was a major blow to Palantir because Gotham does exactly what DCGS-A is trying to do yet at a much lower cost; in other words, the Army is reinventing the wheel, unnecessarily and wastefully.

After a pre-award bid protest filed with the Government Accountability Office had been denied, Palantir sued the Army in the Court of Federal Claims in June 2016, arguing the Army violated the 1994 Federal Acquisition Streamlining Act by not conducting the market research necessary to determine if commercially available items could meet its needs, with or without modification. The lawsuit is an extremely bold move because defense contractors typically dared not to sue its largest customer, even when their interest as protected by the 1994 law had been infringed. The judge ruled in favor of Palantir in October 2016 and upheld Palantir’s argument the Army violated the 1994 law (see here), which was affirmed by the Court of Appeals for the Federal Circuit on September 7, 2018.

Even while the appeal was ongoing, the Army rethought its acquisition plan and, in March 2018, picked Raytheon and Palantir to provide new intelligence analysis platform offerings that could be used effectively at the tactical level in place of DGCS-A. In March 2019, the Army announced Gotham beat out Raytheon's FoXTEN system and won the $20 million first delivery order, as part of an $876 million contract over 10 years. Significantly, the Army's loss in court forced it to transform its procurement process. The Army now follows a “try, buy, decide approach” when it comes to commercially available products (see here). The win in the court is expected to create a lot of opportunities for Palantir down the road.

The distance Palantir has gone to gain access to the intelligence and military market proves one thing: the presence of enormous barriers to entry. In the face of such formidable hurdles, few aspirants have the determination, investment time horizon, and resources to pull off the feat of entering and establishing itself as the de facto standard in that market. Over a time span of 15+ years, Palantir sunk quite a few billions of VC dollars on software development, offering products and services for free or on lean fees, and lobbying and suing to get a level playing field, yet without a single major botch-up over all those years. Those who sneer at Palantir for still losing money after 17 years of investment fail to appreciate how impossible a strategic goal the company has come to set for itself: to become a wide-moat software supplier to the governments of the U.S. and its allies.

Switching cost, economies of scale, and network effect

Having earned contracts from the intelligence and defense sector, Palantir became an insider so to speak, and the barriers to entry work to its advantage. Gotham has been deployed as the platform for data integration at various intelligence and military units displacing the existing system including DGCS-A, a myriad of applications has been developed for the agents, and thousands of end-users have been trained to use those applications on a tactical level in critical missions and battlefields. A switching cost has arisen in favor of Palantir and it will only get higher.

As more contracts are signed with the U.S. government and its allies, Palantir will begin to enjoy economies of scale, thanks to the large fixed costs incurred for building the software once and the relatively low costs associated with deploying it countless times.

Just playing out according to Palantir's plan, Gotham is increasingly being used for sharing disparate data sets across different government agencies. Once those siloed data sets are all integrated on Gotham, there will emerge a huge network effect, further heightening the existing barriers to entry. Under such a network effect, a new entrant may land an isolated deal sporadically, but it is beyond me how this hypothetical incursor can dislodge Palantir by convincing dozens of stodgy government agencies to simultaneously give up perfectly-functional, mission-critical Gotham and install an unproven piece of software instead. That's why I believe Palantir's competitive advantage in the government sector will prove to be sustainable.

The commercial market

As I discussed above, 'digital resources' companies tend to expand into adjacent verticals for the benefit of economies of scope. Palantir's expansion into various industries in the commercial sector is precisely for that end. The same technological know-how sharpened in defense deployments can be parlayed into serving the commercial sector. The utilization of Apollo, the backend system for continuous, automated software update deployment, doubles as it supports Foundry in addition to Gotham. The corporate resources are shared by operations in both sectors, resulting in lower overhead per dollar of revenue. The direct sales force will be able to cross-sell Gotham to some commercial customers. Diversification into additional industries reduces the risk associated with the slowdown of individual industries. As opposed to the high barriers to entry in its home industry of intelligence and defense, the commercial world tends to have more competitors. However, economies of scope will likely offset the narrower moat.

Network effect in the commercial sector

Over the long term, Palantir (PLTR) estimates the total addressable commercial market contains ~6,000 companies with more than $500 million in annual revenue (see here). Palantir began to develop Foundry for the commercial sector in 2012 and launched it in 2016. Foundry is poised to become a central operating system not only for individual institutions but also for entire industries. In 2017, e.g., the five-year, $300 million partnership with Airbus allowed Foundry to expand into a platform for the aviation industry, which today connects data from >100 airlines and 9,000 aircraft around the world.

If successful, an industry-wide central operating system for data will effectuate an extensive network effect. However, to get there, Palantir needs to rapidly grow the commercial top-line. Foundry pulled in $340 million in 2018 and $397 million in 2019. Commercial revenue grew 35% from the 3Q2019 to the same period one year ago (see here). How will Palantir further accelerate commercial sales momentum?

Commercial sales strategies to accelerate the network effect

In the near term, Palantir plans to focus on building partnerships with institutions that have the leadership necessary to effect structural change within their organizations - to reconstitute their operations around data. Buy-in from the top brass is imperative. Hopefully, Palantir can leverage its reputation and relationships gained in the government sector, as in an early case in which NYPD, then a customer, introduced Palantir to its first commercial client JP Morgan (JPM).

Palantir used to have a policy of not hiring direct salespeople, given how intelligence and military contracts are acquired and serviced and perhaps due to a post-dotcom bubble belief "technology is primarily about product development, not distribution". However, there is absolutely no viral growth in B2B as there occasionally is in B2C. The common practice in the 'digital resources' space is to maintain a large force of salespeople each managing a few customer accounts, with responsibilities such as opening new sales territory, scouting for client needs, scaling within existing customer accounts, coordinating technical presentations by engineers, securing technical support for clients, and managing customer relationships. Palantir began to recruit direct salespeople in end-2018. The commercial sales growth in 2019 seems to prove the concept of direct sales works, so Palantir is poised to triple the headcount of the sales force.

Historically, data-inundated organizations either build in-house or buy dozens of off-the-shelf products and sew them together, both approaches having been proven inefficacious in a rapidly changing and increasingly uncertain world. Foundry offers the third, and better, option for those organizations. However, Palantir comes to realize that, in the near-term, institutions do have an imperative to stick to their internally-built software. So, Palantir makes its own solutions fully modular such that customers can "take what they need, build on what they have" (see here). Such a flexible approach should help overcome corporate inertia to reach out for external assistance and accelerate customer onboarding, and create a new way of going to market with channel partners.

Palantir plans to partner with cloud-hosting channel partners, such as Amazon (AMZN), to drive commercial revenue growth. It was Amazon that helped facilitate the partnership between Palantir and the Colombian government. Palantir developed Visor COVID-19, a digital instrument built on top of Foundry hosted in the AWS infrastructure and offering a unified, near real-time view of the state of the pandemic using the largest integration of open data and depersonalized epidemiological data in Colombia.

International sales already account for fo 46% of the total revenue as of the 3Q2020. As part of its international growth plan, Palantir has set up subsidiaries in Canada, Australia, the U.K., France, and other countries in the last few years. In Japan, it took a different approach and chose to form a joint venture in partnership with Sompo Holdings, Inc., which subsequently invested $500 million in Palantir. The JV launched in June 2020 “the real data platform for security, health, and wellbeing”, powered by Foundry, to accelerate the digital transformation of Japanese governmental institutions and industries ranging from healthcare to automotive to manufacturing. The JV is also working on onboarding the Japanese government.

Risk abounds

Public relation disasters can damage its image in the eyes of the next generation of software engineers; this is an area that Palantir, now a public company, should allocate additional resources to. A Snowden-like incident can set Palantir back appreciably, impacting client relationships and employee morale alike.

Palantir must penetrate its chosen market swiftly to enlarge the switching cost, expand the network effect, and heighten barriers to entry, lest a resourceful competitor launches a dogged challenge in the government sector or its smaller imitators strike it lucky in the commercial market and steal potential customers. A well-intended acquisition can turn sour, contaminating the entire operation.

As far as I can see, the management team at Palantir is paranoid enough to allow any blind spots unaddressed in its business execution. However, Black swans do happen.

Investor takeaways

I believe Palantir has an inchoate durable competitive advantage, which acts as an economic moat to protect its business from invaders, which seems to be widening judging from new developments since the IPO.

- In the self-created niche of supplying the operating systems for data for government agencies, Palantir clearly delivers a peerless customer experience with superior technology bundled with top-notch forward-deployed field service representatives.

- Gotham has become the default operating system for data at some U.S. government agencies, where Palantir enjoys switching costs.

- Palantir seems to have also built a brand that helps attract top-notch talents, which sustains its technological edge.

Now that it has kicked open the door of the U.S. government agencies by winning a critical lawsuit against the Army, Palantir is expected to achieve rapid penetration of that market. Gotham is increasingly being used for integrating siloed data sets across different government agencies, which in time will result in an enormous network effect, further heightening the barriers to entry for aspirant entrants.

The company is aggressively diversifying into adjacent commercial verticals and international markets for economies of scope. Revenue growth, both from the government and commercial sectors, will lead to economies of scale. Down the road, Palantir will have the pricing power at its disposal to drive profitability.

At this time, the share price of Palantir may seem to have gotten ahead of itself - a point to be further explored elsewhere. The shareholders are taking risks to bet that the company will succeed in digging the wide moat and that years of profitable growth will follow.

Less anticipatory investors may want to wait until Palantir has completed building such a wide moat. For these investors, the entry opportunity may come in the form of a major sell-off during a general market recession or in an idiosyncratic crisis down the road.

Palantir Technologies is a new idea in the 'Digital Resources' space uniquely covered by Laurentian Research. If you'd like to read about his valuation of this stock, let him know by hitting the 'Follow' button; otherwise, you may hit 'Like' below. In any case, you definitely should check out The Natural Resources Hub to see the incredible investment returns delivered by the Live TNRH® Portfolio to the happy members of this hidden-gem Marketplace service.

Click HERE for a free trial. You'll be pleasantly surprised!

Disclosure: I am/we are long PLTR. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.