Bearish Tone In Dollar Index Even If The Incoming Administration Advocates For A Strong Dollar Policy

The dollar index approaches critical technical support- It’s all about the euro.

The treatments for the virus weigh on the dollar.

A strong or weak dollar policy under President-elect Biden’s administration?

The February 2018 low is the crucial level.

UDN is the bearish product that appreciates as the dollar index falls.

The US dollar is the world’s reserve currency, meaning that central banks worldwide hold dollar reserves because of the United States’ political and economic stability. The Trump administration made no secret that it preferred a weak dollar over the past four years. When the dollar’s value falls against other world foreign exchange instruments, US multinational companies become more competitive versus foreign companies. Moreover, a weak dollar can be a useful tool in trade negotiations. President Trump renegotiated NAFTA and it was replaced with the USMCA. The administration viewed a weaker dollar as a benefit during the trade war with China.

After rising to the highest level since 2002 at 103.96 in March when the pandemic caused panic buying. After reaching an eighteen-year high, the dollar index declined steadily, reaching a low of 91.725 during the week of August 31. Since then, the index recovered but has made lower highs and lower lows. At the end of last week, the dollar was a stone’s throw away from its technical support level at 91.725.

The dollar index trades in the futures market on the Intercontinental Exchange. For those who do not venture into the futures arena, the Invesco DB US Dollar Index Bullish Fund (UUP) and its bearish counterpart (UDN) provide alternatives for bullish and bearish risk positions based on the dollar index.

The dollar index approaches critical technical support- It’s all about the euro

I last wrote about the dollar index on Seeking Alpha on October 13 when it was trading at just over the 93 level after falling from 94.795 on September 24. In that piece I wrote, “Currencies can trend for years. My downside target for the dollar index is at the 70 level, and I could see it even lower over the coming years.”

While the dollar is the leading reserve currency, the euro is the world’s number two foreign exchange instrument. The dollar index has a 57% exposure to the European currency, so the euro's path has the most influence on the index. At the end of last week, the dollar index was within striking distance of the 2020 low.

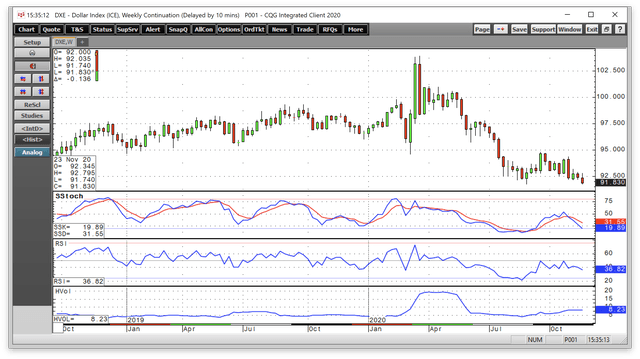

Source: CQG

As the weekly chart highlights, the index traded to a low of 91.740 on Friday, November 27, and settled at 91.801. The index came within 0.015 of the low from the week of August 31. Weekly price momentum and relative strength indicators were trending lower. Weekly historical volatility at 8.23% has been moving higher since late August. After bouncing to a high of 94.795 in late September, the index has made lower high and lower lows.

The treatments for the virus weigh on the dollar

Earlier this year, the US Federal Reserve slashed short-term interest rates to zero percent. The central bank told markets not to expect a higher Fed Funds rate for years. Quantitative easing is pushing rates down further along the yield curve. Lower dollar rates have weighed on the dollar index as the wide differential between the dollar and the euro interest rates narrowed substantially.

Meanwhile, government stimulus increased the US deficit. In May, the US Treasury borrowed a record $3 trillion, blowing away the previous record of $530 billion from June through September 2008. More borrowing from the Treasury is on the horizon as soon as the next stimulus package arrives, probably in early 2021.

Historically low interest rates, a tidal wave of liquidity from the US central bank, and stimulus that increases the deficit increase the money supply and erodes the dollar's purchasing power. Meanwhile, a new administration in Washington DC in early 2020 may pursue a strong dollar policy, but the shift in direction may have just the opposite impact on the greenback.

A strong or weak dollar policy under President-elect Biden's administration?

On January 20, President-elect Joe Biden will become the forty-sixth President of the United States. The Biden administration has pledged to reverse the outgoing Trump administration's policies, which could mean a switch from a weak to a strong dollar policy. However, abandoning the "America First" path and reembracing allies in Europe may have the opposite impact on the relationship between the dollar and the euro currencies. Policy shifts in trade, NATO, climate change, and other factors that divided the US and Europe over the past four years could boost the European economy at the US's expense. Moreover, Democrats and President-elect Biden have supported a more globalist view of the world. The sudden policy about-face could put more pressure on the dollar at a time when low interest rates, narrow differentials between the European and US currency, and rising US deficits are already weighing on the value of the world's reserve currency.

The bottom line is that the rhetoric out of Washington DC may provide support for a stronger dollar, policy changes look likely to have the opposite effect.

The February 2018 low is the crucial level

The critical long-term level of technical support for the dollar index stands at the February 2018 low.

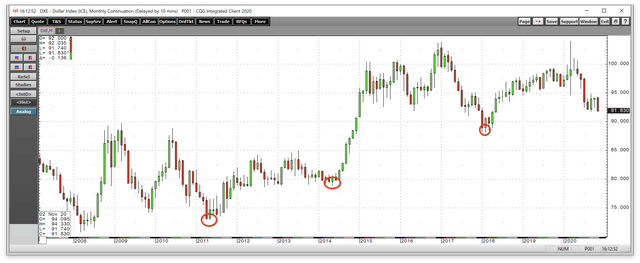

Source: CQG

As the dollar index’s monthly chart illustrates, it is on the cusp of a break below the 2020 low, which could lead to a challenge of the early 2018 low of 88.15. A move below that level could set the stage for a more profound decline to the May 2014 78.93 low.

The 2008 global financial crisis was far different from the 2020 pandemic. However, central banks and governments have used the same tools to combat the economic symptoms in 2020 as a dozen years ago. The only difference is that the amount of liquidity and stimulus today is far greater than in 2008. In the aftermath of the 2008 crisis, the dollar index became highly volatile, eventually falling to a low of 72.86 in May 2011, where the next level of long-term technical support sits. The dollar index could have a long way to go on the downside over the coming years because of the coronavirus’s lingering financial impact on the US economy.

UDN is the bearish product that appreciates as the dollar index falls

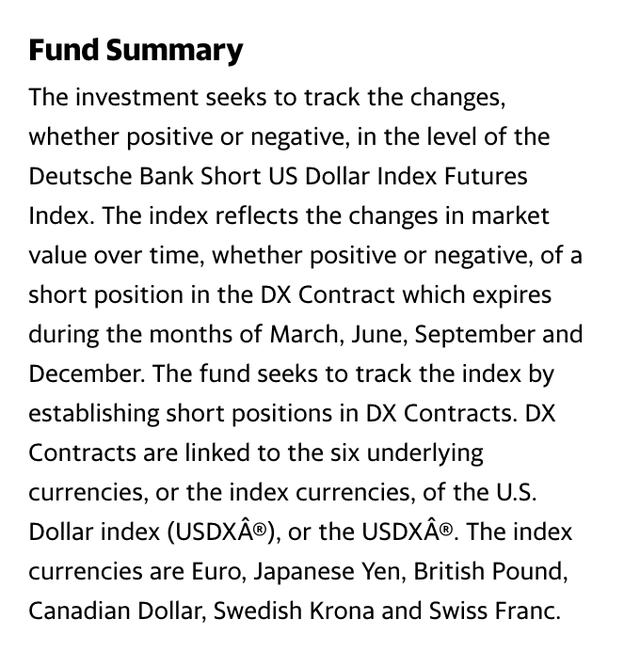

The most direct route for a risk position in the US dollar index is via the futures and futures options that trade on the Intercontinental Exchange or via the over-the-counter foreign exchange market. The Invesco DB US Dollar Index Bullish Fund (UUP) and its bearish counterpart (UDN) provide an alternative for those market participants looking to position on the long or short side of the dollar index. The fund summary for UDN states:

Source: Yahoo Finance

UDN has net assets of $70.95 million, trades an average of 136,203 shares each day, and charges a 0.75% expense ratio. Since my mid-October article on Seeking Alpha, the net assets, and average daily volume in UDN declined.

Meanwhile, the dollar index fell from its late September high of 94.795 to last Friday’s low of 91.74 or 3.22%.

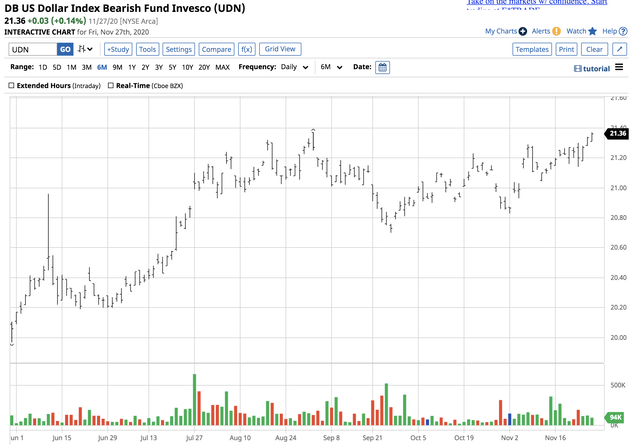

Source: Barchart

Over the same period, UDN rose from $20.70 to $21.37 per share or 3.24% as the product does an excellent job tracking the dollar index on the downside.

We could be on the cusp of a significant move in the dollar index. Technical factors and fundamentals favor a lower dollar even if the new administration states it will follow a strong dollar policy.

The Hecht Commodity Report is one of the most comprehensive commodities reports available today from the #2 ranked author in both commodities and precious metals. My weekly report covers the market movements of 20 different commodities and provides bullish, bearish and neutral calls; directional trading recommendations, and actionable ideas for traders. I just reworked the report to make it very actionable!

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: The author always has positions in commodities markets in futures, options, ETF/ETN products, and commodity equities. These long and short positions tend to change on an intraday basis.