Visa controls the vast majority of the online debit transaction market, a market position protected by significant barriers to entry.

Plaid is a financial technology (“fintech”) company that allows other fintechs to access consumers’ financial data.

According to a lawsuit from the Department of Justice, Visa sought to acquire Plaid as an insurance policy to neutralize a threat to its US debit business.

The blockage of the acquisition has no impact on Visa’s current intrinsic value, but investors would be wise to watch Plaid as a disruptive technology.

For current Visa shareholders, Plaid is not a reasonto sell. Given high valuations, however,we are cautious about initiating a new position in the stock.

Source: Simplivest Graphics Team

Source: Simplivest Graphics Team

Investment Thesis

Visa (V) is the largest payment processor in the world, having processed approximately $11 trillion in payment and cash transactions in 2019. The company operates in over 200 countries and processes transactions in over 150 currencies.

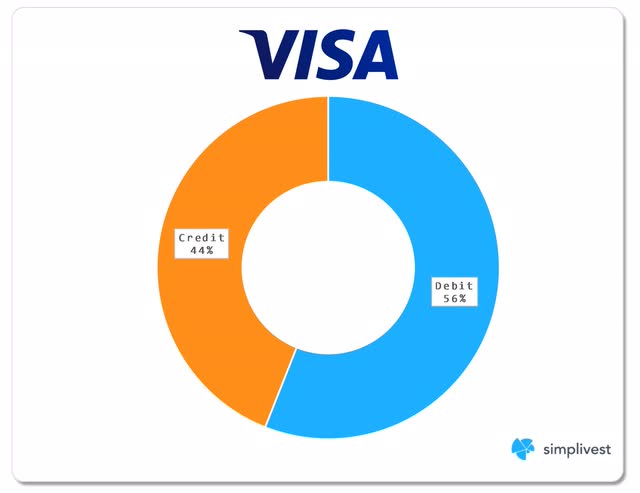

Visa generates revenue by charging a fee on purchases made over its network. As shown below, 56% of Visa's payments volume come from debit transactions.

| TRANSACTION VOLUME |

Chart: Simplivest; Source Data: S&P Global Market Intelligence

Visa market share in online debit transactions is protected by significant barriers to entry caused by the power of its entrenched network. Its network is comprised of in-place relationships with both consumers (cardholders) and merchants (card acceptors). New competitors in the debit business would need to replicate these networks, an arduous task given that they would need to form connections with millions of consumers to attract thousands of merchants and needing thousands of merchants to attract millions of consumers.

Visa's Chief Financial Officer has acknowledged that building an extensive network like Visa's is "very, very hard to do" and "takes many years of investment," but "[i]f you can do that, then you can have a business [like Visa's] that has a relatively high margin." He explained that entry barriers are so significant that even well-funded companies with strong brand names struggle to enter online debit.

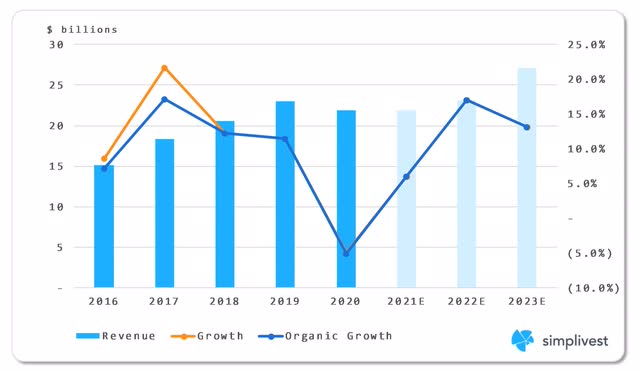

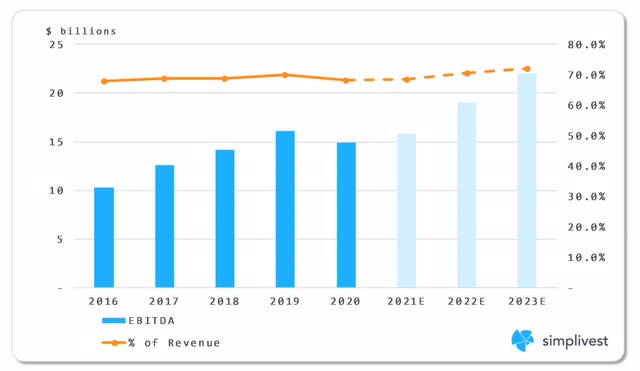

As a result of its dominant position, Visa stamps out highly consistent revenue, healthy profit margins, and robust free cash flow.

| VISA REVENUE TREND |

Chart: Simplivest; Source Data: S&P Global Market Intelligence

As detailed below, the upstart, Plaid, poses a competitive threat to Visa's online debit business, which could possibly disrupt the company's long track record of consistent revenue and earnings.

We believe existing Visa shareholders should watch the DOJ suit and Plaid's development, but it seems too early at this point to hit the sell button due to a material, disruptive competitive threat.

Investors that do not currently own shares of Visa's stock might do well to sit on the sidelines and watch the Plaid saga unfold and also wait for more attractive valuations.

Enter Plaid

Founded in 2013, Plaid is a financial technology ("fintech") company that allows other fintechs to access consumers' financial data. Plaid powers some of today's most innovative financial technology ("fintech") apps, such as Venmo, Acorns, and Simplivest. Plaid's stated mission is to democratize financial services through technology by building beautiful consumer experiences, developer-friendly infrastructure, and intelligent tools that give everyone the ability to create amazing products that solve big problems.

Visa invested in Plaid in early 2019, and was notified in September 2019 that Plaid was pursuing a sale of the company. Plaid does not compete with Visa today, but Visa discovered during its due diligence process that Plaid is developing a pay-by-bank debit service that would directly compete with Visa's debit business. Specifically, Plaid's technology would allow merchants to easily shift transactions from traditional online debit forms to Plaid's pay-by-bank debit service.

On January 13, 2020, Visa agreed to acquire Plaid in part to eliminate the competitive risk to its online debit business. Visa offered approximately $5.3 billion for Plaid, representing a revenue multiple of over 50X and the second-largest acquisition in Visa's history.

DoJ Lawsuit

On November 5, 2020, the Department of Justice ("DOJ") filed a civil antitrust lawsuit to stop Visa's acquisition of Plaid. The DOJ asserts that Visa enjoys a monopolistic position in online debit with 70% market share and that its proposed acquisition of Plaid is intended to eliminate the nascent - but significant - competitive threat that Plaid poses to Visa, thereby allowing Visa to continue its monopoly in online debit.

Visa responded to the suit stating that it "strongly disagrees" with the DOJ, adding that the complaint "reflects a lack of understanding of Plaid's business and the highly competitive payments landscape in which Visa operates." Visa plans to "defend the transaction vigorously."

Immediate Implications for Visa Shareholders

If Visa is successful in acquiring Plaid, it is possible that Visa executives would simply shut down Plaid's pay-by-bank initiative. Shuttering this nascent competitive threat would benefit Visa's online debit business.

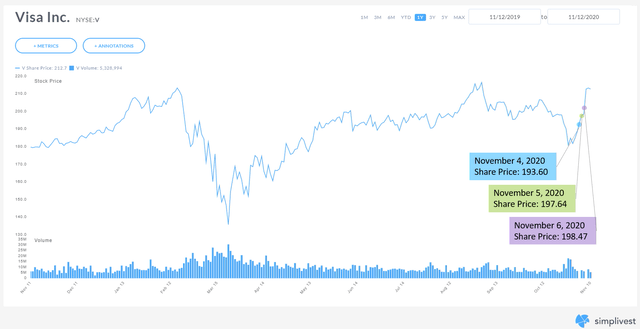

Should the DOJ be successful with blocking the acquisition, Plaid would be able to continue developing the pay-by-bank technology. While this technology could take online debit transaction volume away from Visa, it is too early to estimate the financial impact on the companies. Accordingly, we do not believe there is an immediate negative impact on its intrinsic value. The market certainly supported this view with the companies' stock prices going up after the DOJ announced the suit.

| VISA STOCK CHART |

Chart: Simplivest; Source Data: S&P Global Market Intelligence

An Important Warning Shot

The DOJ's lawsuit made public Plaid's disruptive pay-by-bank technology and highlighted the risk that Visa felt it posed to its online debit business. The risk was sufficient enough that Visa was willing to pay $5.3 billion for the company, which was "an unprecedented revenue multiple of over 50x" and the second-largest acquisition in Visa's history. Recognizing that the deal "does not hunt on financial grounds," Visa's CEO justified the extraordinary purchase price for Plaid as a "strategic, not financial" move because "[o]ur US debit business i[s] critical and we must always do what it takes to protect this business."

These quotes are from the DOJ's complaint and we recognize that they may have been taken out of context to support the DOJ's case. For example, they could be footnotes in board presentations, and the DOJ is choosing to emphasize them over Visa's real reasons for acquiring Plaid. However, the $5.3 billion purchase price and the 50x revenue multiple do not lie. Visa wanted Plaid…badly.

The DOJ lawsuit has illuminated the shot across the bow Plaid has made to Visa's online debit businesses. Accordingly, investors would do well to monitor Plaid, especially if the DOJ successfully blocks the acquisition by Visa. If Plaid begins to develop traction into the online debit market, it may be early signs of a material competitive threat to Visa.

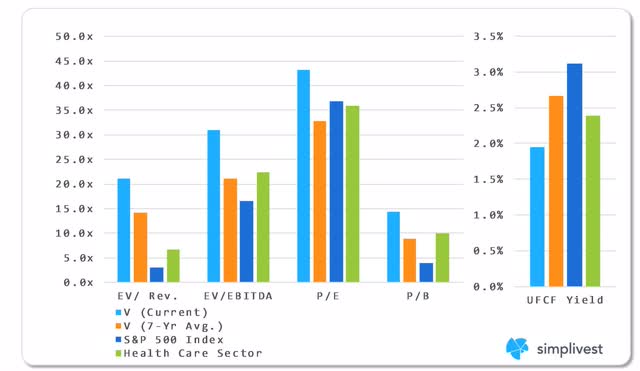

Current Valuation

We like to compare a company's current valuation multiples against its long-term average, the market, and the sector. For Visa, the comparisons are not favorable. Visa trades significant premiums to all of these benchmarks. Accordingly, we find it hard to suggest that now is an attractive time to buy shares of Visa's stock.

| VISA VALUATION METRICS |

Chart: Simplivest; Source Data: S&P Global Market Intelligence

Conclusion

With dominant market positions in the payment processing industry, Visa generates predictable, recurring revenue, and highly attractive profit margins. Debit transactions comprise 56% of Visa's total payment volume.

On November 5, 2020, the DOJ unsealed its civil antitrust lawsuit seeking to block Visa's acquisition of Plaid on the basis that Visa was seeking to extinguish a nascent competitor to its online debit business. The suit made public Plaid's intent to develop pay-by-bank technology that could disrupt Visa's dominant positions in online debit transactions.

Current valuation levels are high by all measurements, so now is not an opportune time to buy.

With Plaid's technology in its nascency and no way of determining its future market impact, there is no immediate impact on Visa's intrinsic value. However, we believe investors would be wise to monitor Plaid's entry into this market and watching for early indications of success in disrupting the status quo.

As the saying goes: "keep your friends close; keep your enemies closer."

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: The information, analysis, conclusions, proprietary calculations, and other content (collectively “Content”) provided herein should not be copied, distributed, published or reproduced, in whole or in part. The Content is based on information obtained by third parties which we deem reliable, but has not been independent verified by Simplivest. The Content is provided “as is” and on an “as available” basis without warranties of any kind, either expressed or implied, including without limitation warranties of merchantability or fitness for a particular purpose. Simplivest is not providing any financial, economic, legal, accounting, or tax advice or recommendations with the Content. The Content does not constitute investment advice or an offer to buy or sell securities and should not be relied upon to evaluate any potential transaction. Neither Simplivest nor any of its affiliates makes any representation or warranty, express or implied, as to the accuracy or completeness of the statements or any information contained the Content and any liability therefore (including in respect of direct, indirect or consequential loss or damage) is expressly disclaimed.