Evogene: Q3 Update And Upcoming Catalysts

On November 18 Evogene held its Q3 earnings call and provided an update on its progress including 4 main subsidiaries - Biomica, Lavie Bio, Ag Plenus and Canonic.

With a market cap of just over $105 million, $50 million in cash or equivalent, no debt, and 4 potentially valuable subsidiaries, Evogene remains undervalued.

Biomica reports 50% increase in ORR pre-clinical data using microbiome therapeutic BMC128. Full preclinical data to be presented Jan. 28, 2021. Human "proof of concept" trial in immuno-therapy in 2021.

Ag Plenus' herbicide HERB32 expected to attain "Lead" status next month. Ag Plenus then plan to develop HERB32 from "Lead" into a more valuable "optimized lead".

Lavie Bio's LAV211, "spring wheat" biostimulant, to begin commercial field trials in 2021 in the U.S. followed by commercial sales in 2022. Positive trial results from LAV311 and LAV312 (bio-pesticides).

Headquartered in Israel and with offices in the U.S., Evogene Ltd. (EVGN), (TASE: EVGN), has developed a leading-edge computational predictive biology platform ("CPB Platform") creating next-generation life sciences products with novel modes of actions, ranging from seeds, to microbiome therapeutics, herbicides, pesticides and medical cannabis.

Evogene's 4 main subsidiaries utilize Evogene's CPB Platform. In August and September, I published a 4 part series of articles on Evogene (EVGN). Each of my 4 articles focused on one Evogene subsidiary.

The articles can be found at:

Evogene: Hidden Gems Of Computational Predictive Biology, Part 2 Of 4 - Lavie Bio

All figures referenced in this article are in $USD.

On September 1, Evogene announced that ARK Invest (through ARK Genomic Revolution Multi-Sector ETF (ARKG)), had made a $7 million investment in Evogene (at $1.70 per share), as part of a $10 million private placement. ARK Invest is a leading ETF fund based in New York led by Catherine Wood. The ARK family of ETF funds invests in disruptive technologies (through investments in public companies).

On November 4, Evogene announced the closing of an additional $12 million financing "with an existing institutional shareholder and certain Israeli institutional investors providing for the issuance of an aggregate of (1) 3.92 million ordinary shares at a purchase price of $2.50 per share, and (2) 883,534 pre-funded warrants each to purchase one ordinary share (“Pre-Funded Warrants”). The Pre-Funded Warrants were sold at a price of $2.49 each, with an exercise price of $0.01 per ordinary share. ... "

ARK Genomic Revolution Multi-Sector ETF (ARKG) is Evogene's largest shareholder owning approximately 12% of Evogene's outstanding shares.

Evogene's Q3 2020 Financial Results and Conference call

On November 18, 2020 Evogene released its Q3 2020 financial results and corporate update, followed that morning with a 1-hour conference call. A Seeking Alpha transcript of the call can be found here.

Corporate Summary as of November 27, 2020

(All dollar figures are $USD)

Evogene common shares trade under the symbol 'EVGN' on both the NASDAQ and Tel Aviv Stock Exchange. All references to Evogene shares in this article are to NASDAQ listed shares in $USD.

Shares outstanding - 35,574,954 common shares (or 36,458,488 common shares including all of the pre-funded warrants). The aforementioned figures obtained from Evogene's October 30, 2020 prospectus.

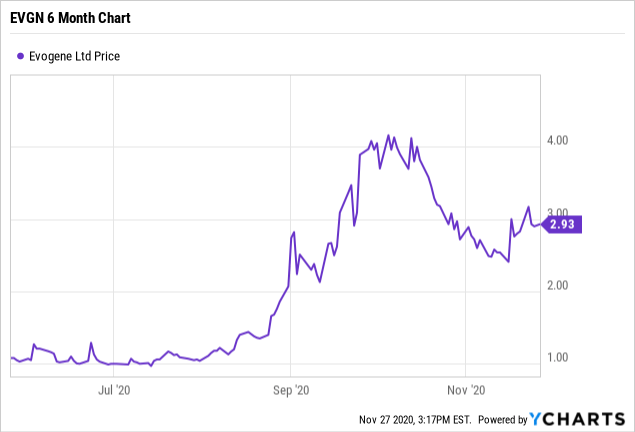

Share price at the close of November 27, 2020: $2.93

52-week share price range: $0.75 to $5.30

Current Market Cap: Approx. $105 million

Debt: no debt other than usual payables

Cash or equivalent: Approximately $50 million (my estimate based upon $43.5 million cash/equivalents as of September 30, 2020 financial statement, plus additional $12 million private placement announced closed on November 4, 2020, less estimated burn rate). The $50 million includes approximately $13 million cash held in Egovene's 72s% owned subsidiary Lavie Bio.

According to its Q3 financial results filed November 18 with the SEC, during the nine-month period January 1 to September 30, 2020, Evogene's consolidated net cash usage was $13.4 million (or $9.3 million excluding Lavie Bio's cash usage). During Q3 2020, Evogene's consolidated net cash usage was $4.6 million (or $3 million excluding Lavie Bio's cash usage).

Evogene's Computational Predictive Biology "CPB" Platform

Evogene claims that its CPB Platform provides it with a competitive edge to substantially increase the probability of successful life-science product development, increase the efficacy, and reduce the toxicity of its life-science products while reducing time and cost to development.

Its strategic partners include major multinational companies such as BASF (OTCQX:BASFY), Bayer (OTCPK: BAYZF), Corteva (CTVA), as well as major regional companies such as Israel-based ICL Group Ltd. (ICL), and various academic and medical institutions.

As of June 30, 2020, Evogene has 121 employees (including its subsidiaries), including 40 with Ph.D. degrees, with multidisciplinary and wide-ranging expertise in biology, chemistry, genetics, agronomics, mathematics, computer science, and other related fields.

Internal Ag-seed trait division and its 4 Main Subsidiaries (Biomica, Lavie Bio, AgPlenus, and Canonic)

In addition to Evogene's internally owned Ag-seed trait division, it has 5 subsidiaries of which 4 are significant, including Biomica, Lavie Bio, Ag Plenus and Canonic.

This article provides an update on the 4 main subsidiaries and upcoming catalysts.

1. Biomica Ltd.

90% Owned subsidiary Biomica Ltd. focuses on microbiome-based therapeutics for the treatment of immune-mediated and infectious diseases.

For some additional background on the science behind the relationship between the gut microbiome and cancer, I recommend reading "Can Patients Gut Microbes Help Fight Cancer" published November 20, 2020 in Science magazine online.

There has also been a lot of excitement this year in the microbiome therapeutics space as very positive clinical data has been emerging, demonstrating the potential enormous value of the microbiome therapeutic approach.

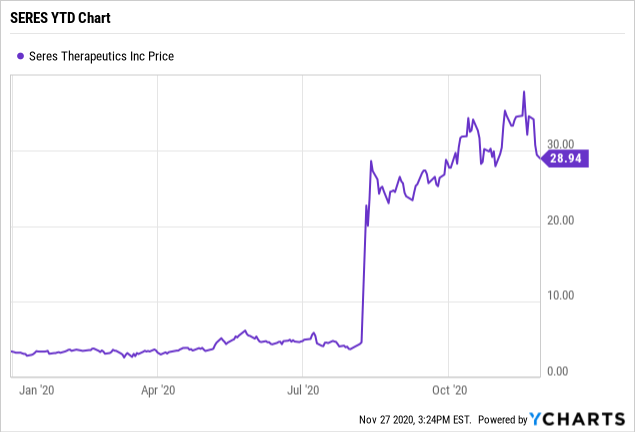

For example, in August of this year Seres Therapeutics, Inc. (NASDAQ:MCRB) reported very strong topline results from its pivotal Phase 3 ECOSPOR III study evaluating its investigational oral microbiome therapeutic SER-109 for recurrent C. difficile infection. Since that announcement Seres' share price has skyrocketed by over 500%. It now has a market cap of nearly $3 billion without an approved drug.

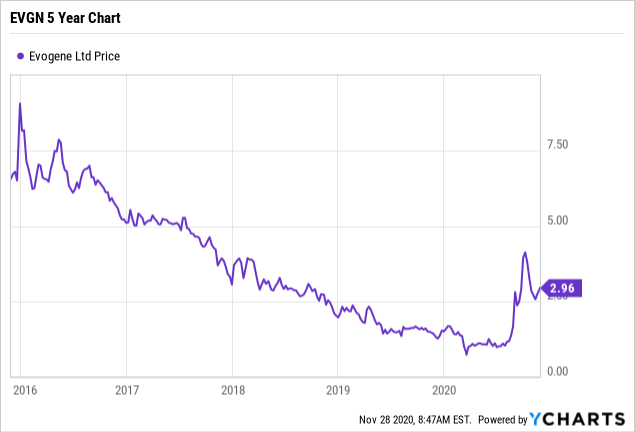

*Seres Therapeutics (MCRB) Year To Date Chart below

Data by YCharts

Data by YCharts

Other emerging microbiome therapeutic biotech companies include:

a. U.K. based biotech 4D Pharma PLC (OTCPK:FRPRF) (DDDD.LN) recently released encouraging Phase 1 trial results of its single strand microbiome live biotherapeutic candidate in immuno-oncology. Its candidate MRx0518 is in phase 1/2 clinical study initially in monotherapy and then in clinical study combination with Merck's (NYSE:MRK) PD-1 checkpoint inhibitor Keytruda which is showing promising results in addressing various cancer tumors including breast, NSCLC, and Renal Cell Carcinoma among others. 4D's approach and data supports Biomica's approach although it remains to be seen whether Biomica's rationally designed 4 strand approach will generate similar, inferior or superior results compared to 4D Pharma's single strand approach. A Merck subsidiary is partnering with 4D Pharma in this study. Merck has also become an investor in 4D.

Recent positive interim results were released by 4D on November 9, 2020 and presented at SITC. The oral presentation is available on 4D Pharma's website and is worthwhile watching. 4D recently announced a merger with a U.S. based SPAC company with a view to becoming listed on NASDAQ which it anticipates will occur in January, 2021.

In 4D's recent presentation, it indicated that its MRx0518 clinical data in immuno-oncology appears to confirm what it saw pre-clinically. If so, that may also be a positive sign for Biomica; and

b. Cambridge, Mass. based Vedanta Biosciences (private) which is advancing its pipeline of Microbiome Therapeutic candidates in various indications. Like Biomica, it utilizes a rationally designed multi-strand approach of up to 11 commensal bacterial strains. A summary of its pipeline and promising clinical results can be found here.

Biomica's Rationally Designed Multi-Strand Live Microbiome Therapeutics

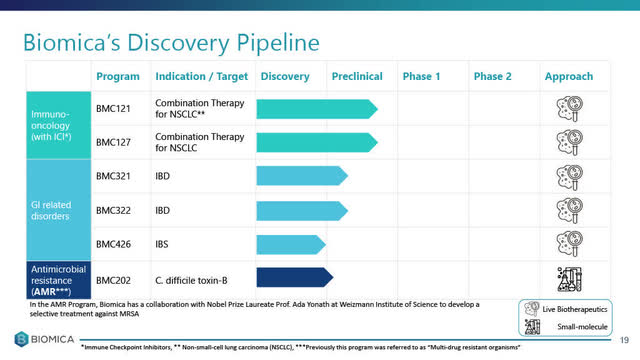

Biomica Ltd. is advancing its rationally designed multi-strand live microbiome biotherapeutics programs in 3 main disease targets including:

(i) immuno-oncology therapy to treat various forms of cancer but initially targeting NSCLC (non-small cell lung cancer);

(ii) IBD (inflammatory bowel disease); and

(iii) IBS (irritable bowel syndrome).

In addition, Biomica has a pre-clinical stage small molecule clinical program addressing AMR - Antimicrobial resistance, specifically C. difficle toxin-B.

*slide below taken from Biomica's August 10, 2020 corporate presentation

On September 8, 2020 Biomica announced positive pre-clinical data for its most advanced live biotherapeutic drug candidate BMC128. When administered in pre-clinical animal studies in combination with an Immune Checkpoint Inhibitor "ICI" (PD-1 or PD-L1 and CTLA-4 checkpoint inhibitor), it reported significantly improved anti-tumor activity and increased animal (mouse) survival.

In my August article on Biomica, there was no discussion about BMC128 but only about its predecessors, BMC121 and BMC127.

The September 8 press release provided little detail about BMC128 positive pre-clinical results but stated,

...In these studies, Biomica tested BMC128, which consists of four live bacterial strains derived from Biomica’s drug candidates BMC121 and BMC127. Treatment with BMC128, both prior to and in combination with ICI, significantly improved anti-tumor activity in mice.

These positive results supplement additional positive data using Biomica’s initial bacterial strain combinations BMC121 and BMC127, which demonstrated anti-tumor activity in animal studies. BMC128 was selected based on further predictive analysis of the results of Biomica’s studies with BMC121 and BMC 127.

Biomica’s immuno-oncology program is based on the premise that the gut microbiome affects the efficacy of cancer immunotherapy, specifically that of the ICI involving the blockade of PD-1 or PD-L1 and CTLA-4, as suggested in scientific literature.[1] In the current study, BMC128 was administered to mice bearing cancer tumors prior to and during ICI therapy. BMC128 is a rationally-designed microbial consortium derived from Biomica’s earlier candidates BMC121 and BMC127, which had been identified and selected through a detailed functional microbiome analysis using PRISM, a proprietary high-resolution microbiome analysis platform powered by Evogene’s MicroBoost AI platform.

Biomica’s current results demonstrate that treatment with BMC128 prior to and in combination with the administration of ICI, significantly reduced tumor volume and increased animal survival compared to ICI therapy alone. Moreover, treatment with BMC128 affected several immunological factors, including specific immune-cells populations known to be involved in tumor destruction.[2]

The study indicates that treatment with BMC128 conditions the immune system and primes it for an efficient, well-orchestrated anti-tumor response. This is in-line with numerous scientific publications, demonstrating the effect of the gut microbiome on the response to ICI, and more specifically a reduced response to ICI in patients with compromised microbiome following treatment with antibiotics.[3] ..."

On October 13 Biomica announced that it had contracted to begin large-scale production of BMC128.

November 18 Update: BMC128 Demonstrated a 50% Higher Overall Response Rate Reducing Tumor volumes in Pre-clinical trials

In Biomica's November 18 conference call, Biomica's CEO Dr. Elran Haber provided additional (albeit still incomplete) details relating to BMC128 pre-clinical trial results. According to the November 18th conference call transcript, Dr. Haber reported that:

... the animals were divided into various treatment groups, and BMC128 was administered to mice bearing cancer tumors prior to and during ICI therapy.

In September, we announced the positive results of these trials, demonstrating that treatment with BMC128 prior to and in combvination twith the adminstration of ICI, significantly reduced tumor volume and increased animal survival compared to ICI therapy alone. It seems that Biomica's bacterial consortia adminstered prior to ICI therapy primes the immune system for an efficient, well orchestrated anti-tumor response, ultimately leading to the most reduced tumor volume and best survivial rate out of all groups. The response to the combination treatment was 50% higher in comparison to the group that received only the ICI therapy..."

In the days following the November 18th conference call, I emailed Dr. Haber to clarify what he meant. His response was that the treatment group which received BMC128 in combination with an anti-PD1 checkpoint inhibitor ("ICI therapy"), saw a 50% increase in their Overall Response Rate "ORR" compared to the group treated with an anti-PD1 checkpoint inhibitor alone.

For those readers unfamiliar with the term Overall Response Rate or ORR in the context of immuno-oncology, it is generally defined as the sum of:

(i) complete responses or CR, where the cancer patient has no detectable evidence of a tumor over a specified time period; and

(ii) partial responses or PR, where the patient shows a decrease in tumor size of over 30% over a specified time period.

ORR does not include stable disease.

See NCBI article discussing the various oncology response definitions found here.

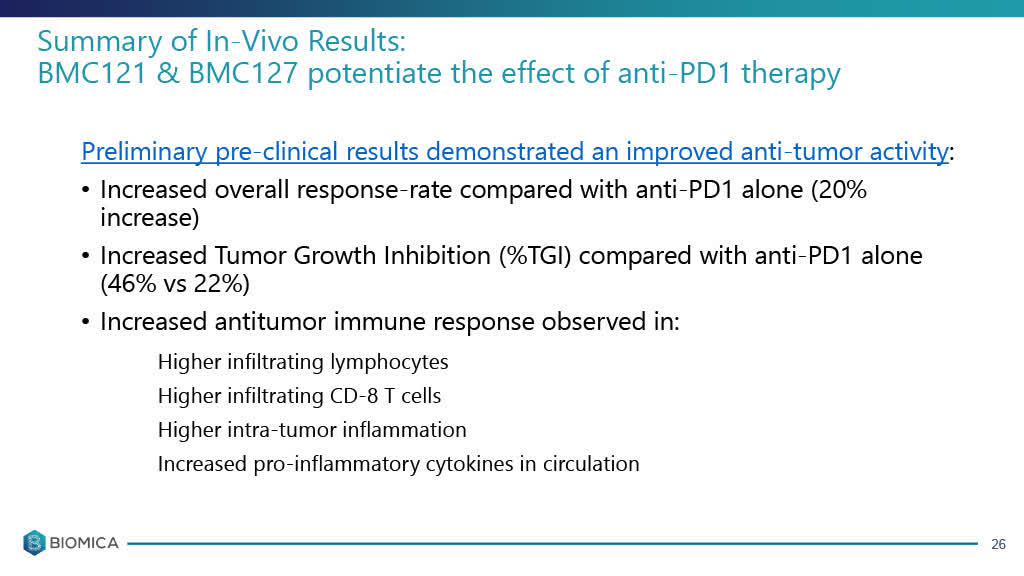

The 50% increase in ORR is potentially a significant improvement over the pre-clinical data which Biomica posted for its earlier stage BMC121/BMC127 candidate which showed only a 20% higher overall response rate or ORR in tumor response when combined with a PD-1 checkpoint inhibitor ("ICI") compared to the group that received only the PD-1 therapy. We will want to see all of the pre-clinical data for greater understanding.

Of course, pre-clinical data in mice does not necessarily translate into the same level of clinical results in humans, but the pre-clinical data so far hold promise.

Below is the old BMC121 & BMC127 pre-clinical trial results showing a 20% increase in overall response rate compared to an anti-PD1 therapy, taken from the Biomica August 2020 slide presentation which I had referenced in my August article on Biomica.

*slide below (old BMC121/BMC127) data taken from August 2020 slide.

In the Q&A section of the November 18 conference call, Haber indicated that he expects Biomica's proof of concept immuno-oncology clinical pilot study with BMC128 to begin at a leading medical facility in Israel in H2 2021 and potentially a couple more leading Israeli medical facilities. In the meantime, Biomica is reviewing a number of different dosing levels in preclinical models.

In addition to targeting NSCLC (non-small cell lung carcinoma), Biomica is evaluating the effectiveness of BMC128 in RCC (renal cell carcinoma) and potentially solid tumors such as melanoma. Dr. Haber indicated that the proof of concept trial could include patients with various types of solid tumors.

In response to a number of questions posed to Dr. Haber during the conference call, he responded that:

a. Biomica plans to present the full set of data results from its BMC128 preclinical trials at a major European microbiome therapeutics conference in Europe in January, 2021. Although Dr. Haber did not specify the European conference, both he and Biomica's VP R&D Dr. Shiri Meshner, Ph.D. are scheduled to speak at the 5th Annual Microbiome Movement Drug Development Europe conference on January 28, 2021. Dr. Haber is scheduled to speak on the European Microbiome Leaders Panel during the morning plenary session on January 28 at 9 a.m. followed by a 12.00 noon (Central European Time) presentation by Biomica's Dr. Shiri Meshner who is scheduled to present on the topic, "From Computational Predictions to Preclinical Performance" in which she is to report new positive pre-clinical results with Biomica's "rationally designed consortia" in Biomica's immune-oncology program, as well as discussing Biomica's new pipeline program of "utilizing functional microbiome analysis for targeting abdominal hypersensitivity in IBS".

b. the Israeli BMC128 "proof of concept of trial" in 2021 will be similar to a U.S. Phase 1/1a clinical study to be conducted in 10 to 15 cancer patients who had been on immunotherapy but where the immunotherapy had failed. Biomica will treat them in the initial study with a combination of BMC128 and an ICI;

c. Biomica plans to use the data obtained from the Israeli BMC128 "proof of concept" trial in discussions that it is planning to have with the U.S. FDA to file an IND to initiate BMC128 clinical studies in the U.S. in 2022 (presumably for a Phase 2 study, assuming the Israeli "proof of concept" pilot study is successful);

d. in explaining why he believed that Biomica's approach with BMC128 of advancing a rationally designed (4 strand) live bio-therapeutic would do better in an immuno-therapy setting than a single strand approach [such as competitor 4D Pharma's single strand approach], is the ability to provide a patient with a targeted functional combination and to target the cancer tumor with a "number of modes of action" thereby enhancing the effectiveness of this rationally designed 4 strand approach.

Of course, until BMC128 clinical data ultimately becomes available we won't know the answer to the question as to whether Biomica's rationally designed multi-strand (4 strand) live biotherapeutic is more effective than the single strand approach being advanced by at least one competitor.

2. Lavie Bio Ltd.

72% owned subsidiary Lavie Bio Ltd. is focused on developing,

i) bio-stimulants - ag-biologicals for crop enhancement, directly impacting crop yield or abiotic stress tolerance; and

ii) bio-pesticides - ag-biologicals for crop protection, addressing biotic stresses such as insects, diseases and weeds.

Last August 2019, Corteva (CTVA) (a $27 billion market cap company spun off from DowDuPont), made a direct investment in Lavie Bio worth $27.5 million in return for a 28% interest in Lavie Bio and appointed one of its senior people to Lavie Bio's board of directors. The Corteva transaction gave Lavie Bio a valuation of about $100 million back in August 2019. Since then Lavie Bio has made further advancements and in my view more valuable. Lavie Bio was the focus on my second article in this 4-part Evogene series.

For more information about Lavie Bio and its pipeline please refer to Lavie Bio's website Home - Lavie Bio as well as my August 24, 2020 article/

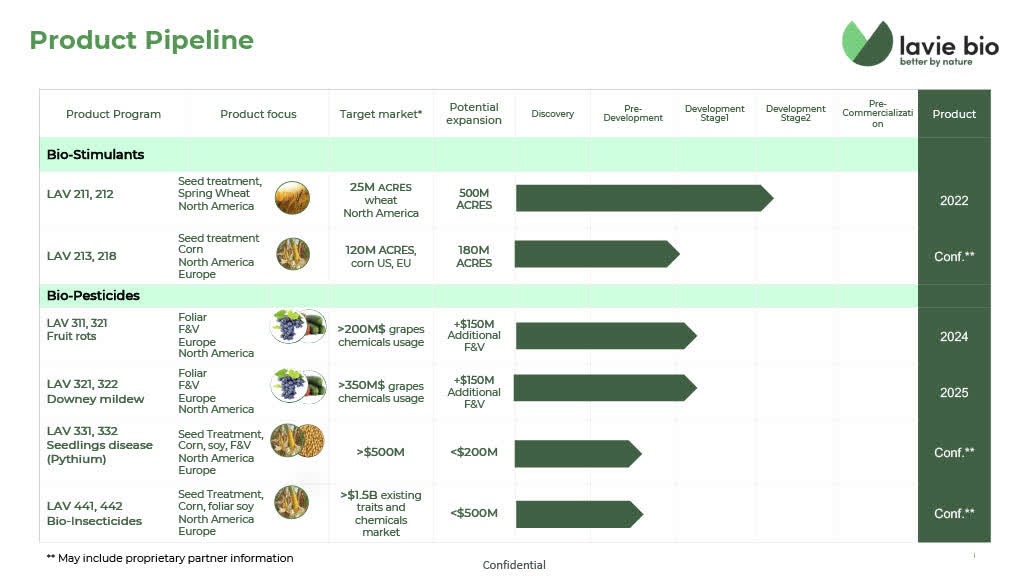

*slide below taken from Lavie Bio's August 20, 2020 corporate presentation

Lavie Bio is at the forefront of a green revolution in agriculture as the industry shifts from the use of chemical-based (toxic) inputs to more natural, non-toxic microbial-based ag-biologicals. This particular green revolution (live ag-biological microbial solutions) has only been possible due to the recent developments in computational predictive biology, genomics, big data (huge specialized databases), and AI.

The demand for these types of novel ag-biologicals is being driven by the consumer who is increasingly demanding non-toxic (or at least minimally toxic) and more natural pesticides, herbicides, biostimulants and other agricultural product inputs. Ag-biologicals (including novel leading-edge live microbial biostimulants, pesticides, herbicides, etc.) are a novel solution developed through the use of the most sophisticated technology, biology and genomics.

Lavie Bio's most advanced product is LAV-211 which is a form of biostimulant seed treatment using microbes. Biostimulants are not as regulated as biopesticides, so the development time to commercialization is shortened by a few years.

As described in more detail in my August 24th article, the trial data demonstrate that LAV-211 improves spring wheat yield by an average of 6% which translates into $20 to $50 additional revenue for a farmer per acre.

During the November 18th question and answer section of the conference call, Evogene's CEO indicated that Lavie Bio is currently collecting the results of field trials for LAV211 in North Dakota and Montana for its spring wheat program, and that it is planning pre-commercial activities for LAV211 in 2021 to begin in 2021 which will include distributing LAV211 to "big farmers" for commercial field trials. It is anticipated that LAV211 will be at a commercial stage and generating revenues in 2022.

While the final pricing for LAV211 has not yet been determined, comparing the pricing of competitive products, the price of LAV211 will likely be in the range of $6.00 to $8.00 per acre or perhaps priced higher as a premium product.

Assuming Lavie Bio (or its partners or agents) can obtain a 20% market share of the first focus market's 25 million acres, that works out to be sales of $30,000,000 to $40,000,000 per annum (based upon 5 million acres calculated at $6.00 to $8.00 per acre) for the test market of "spring wheat".

"Winter Wheat" is another potential market for LAV211. Winter wheat is planted in or about November, before the winter snow. According to Lavie Bio's CEO, the LAV211 market for winter wheat is potentially 5 to 10 times larger than spring wheat. The development testing and timing of LAV211 for "winter wheat" has not yet been released.

LAV211 can also likely be expanded into other agricultural crops such as oats, which is a lucrative market now because of the oat milk market.

I previously estimated that LAV211 has the potential to generate annual revenues in the $100 million range for "spring wheat" and other products with commercial sales in the spring wheat market beginning in 2022. The market for LAV211 could be expanded further to other products but no further details have yet been provided.

LAV311 and LAV312 - Advances into "Development Stage 2"

Lavie Bio's second most advanced products are its two leading microbiome based bio-fungicide candidates LAV311 and LAV312, which target bunch rot diseases. This is a potentially lucrative market. According to Lavie Bioi the market for LAV311/LAV312is estimated to be $200 million per year for the treatment of fruit rot of grapes caused by botrytis cinerea but the market could be a multiple of that figure if applied as a treatment for a wider variety of fruits and vegetables.

On October 29th, 2020 Lavie Bio announced that its experimental vineyard trials with LAV311 and LAV312 generated very positive field trial results which has advanced LAV311 and LAV312 as Development Stage 1 candidates into “Development Stage 2” candidates. This development is an important step towards obtaining regulatory approval with a view to launching LAV311 and LAV312 commercially in 2024 and increases their value.

... These vineyard trials, conducted in target locations in Europe and the U.S., resulted in significantly better efficacy and consistency than existing comparable commercial biological benchmarks, and competitive to commercial chemical benchmarks, both tested as part of these trials. The positive results will support Lavie Bio’s current plan to launch its first bio-fungicide product for controlling bunch rots for use in fruit and vegetables in 2024.

Example of treatment with LAV312 against Botrytis Cinerea in vines – untreated control vs treated vines

Damage from crop disease is rising, with current efforts largely depending on chemical crop protection, with fungicide chemicals accounting for $18.7B in annual expenditure in 2019.[2] As a result of increasing disease resistance to existing chemicals and demand for more sustainability practices, there is a well-recognized and rapidly growing need for new and effective solutions, with ag-biologicals being an important tool in addressing this challenge.

Bunch rots are devastating diseases and the estimated annual expenditure on crop protection with existing chemical solutions is in the $100s of millions[3]. New and efficacious biological products can be integrated into the farmer’s existing IPM (Integrated Pest Management) practices thus driving both productive and sustainable practices, while reducing the emergence of pest resistance to existing crop protection solutions.

...

These trials showed that vineyards treated with each of LAV311 and LAV312 demonstrated 60-70% reduction in crop damage due to bunch rots in comparison to the control. ..."

In a telephone conversation with Lavie Bio's CEO Ido Dor on November 3 (to discuss the trial results announced in the October 29th press release), he explained that LAV311 and LAV312 have a novel mode of action (microbiome driven) which have shown similar or superior levels of efficacy compared to chemical pesticides but without the toxicity of current chemical pesticides.

This is potentially a multi-billion dollar market. LAV311 and LAV312 could be used as a bio-fungicide not only in grape vineyards but also for other fruits, vegetables, and plant crops ranging from grapes, tomatoes to cannabis.

Evogene (Lavie Bio) has indicated that it anticipates that LAV311 and LAV312 could be approved and launched for commercial sales in the U.S. in 2024. If so, that would mean that Lavie Bio will be filing for regulatory approval of LAV311 and LAV312 in the U.S. (likely in the states with large markets such as Oregon, California, etc.) by mid-2022 as the approval process typically takes 20 to 24 months from the time of filing.

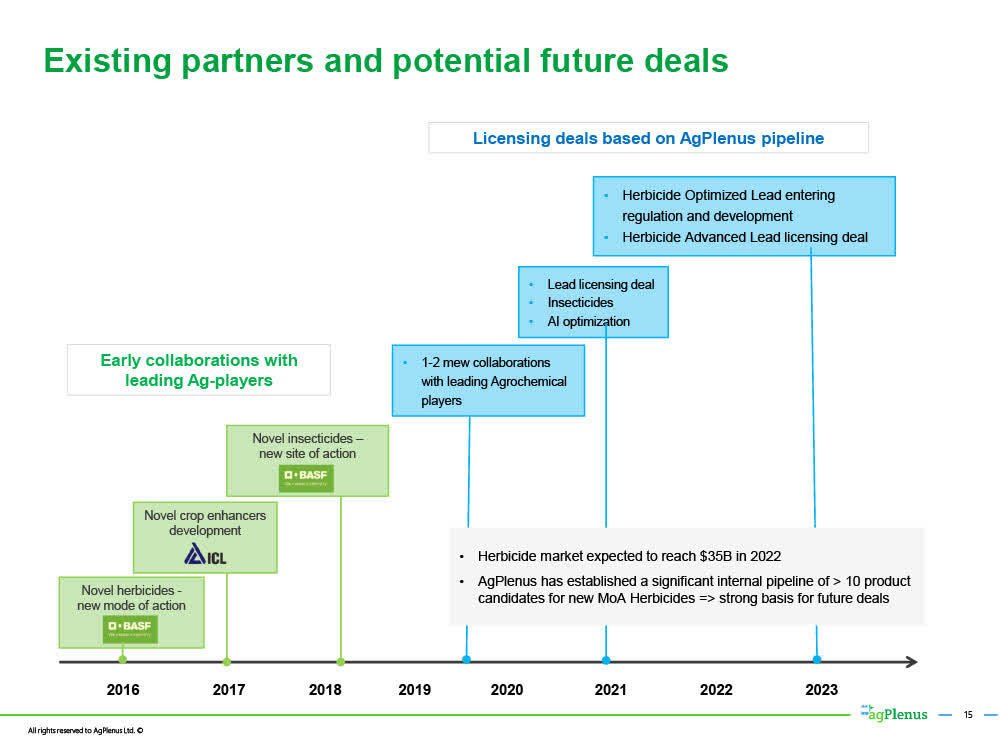

3. Ag Plenus Ltd.

Evogene's wholly-owned subsidiary AgPlenus Ltd. designs and develops novel mode of action non-toxic herbicides, insecticides, fungicides, and crop enhancers to address an urgent need for such new products.

AgPlenus is becoming recognized as a leader in computational predictive biology to identify and develop these chemical compounds with novel modes of action. It is partnering with some of the leading agriculture companies in the world including Corteva, BASF, and Israel-based ICL Group, one of the largest fertilizer companies in the world.

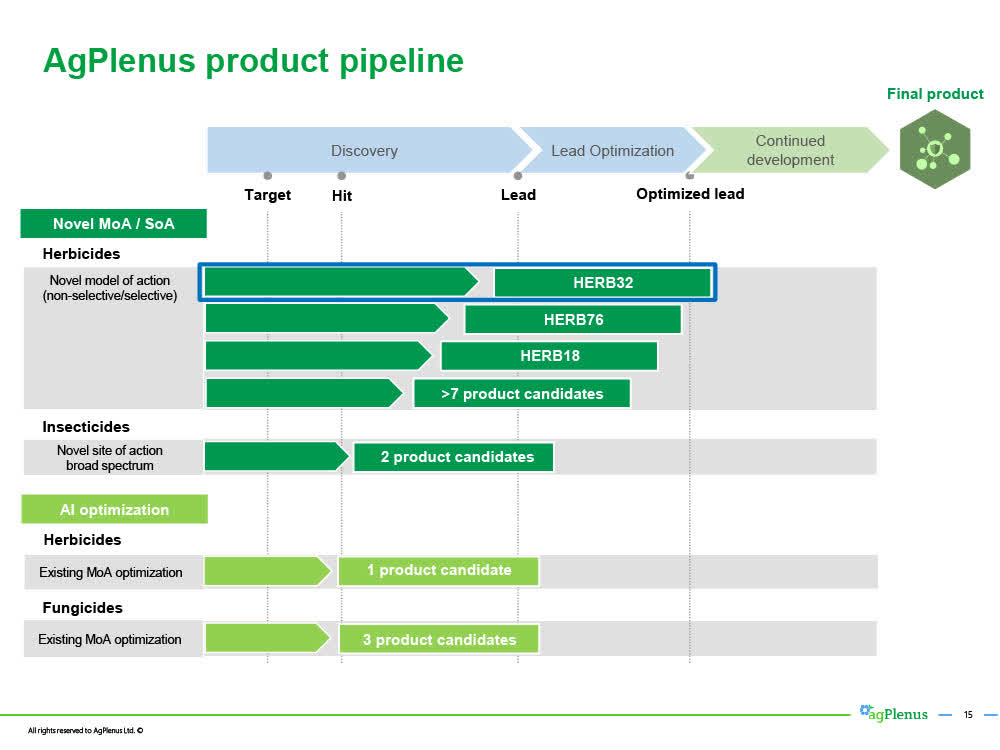

*slide below taken from AgPlenus' August 2020 corporate presentation

Many of the most common herbicides have been banned in various parts of the world because of toxicity, environmental, and pollution issues. In addition, those earlier generation herbicides have started to become weed resistant. This has become a global problem and created an enormous demand for next-generation herbicides with new modes of action (i.e. non-toxic) to help farmers control all weeds and increase crop yields.

As there has not been a novel mode of action approved herbicide in the market for nearly 30 years, there is significant commercial value in bringing one or more into the market.

AgPlenus' activities focus on the development of novel herbicides, with a strong focus on novel modes-of-action, and on novel insecticides, focusing on new sites-of-action. AgPlenus is also active in fungicides and crop enhancers.

*slide below taken from AgPlenus' August 20, 2020 presentation

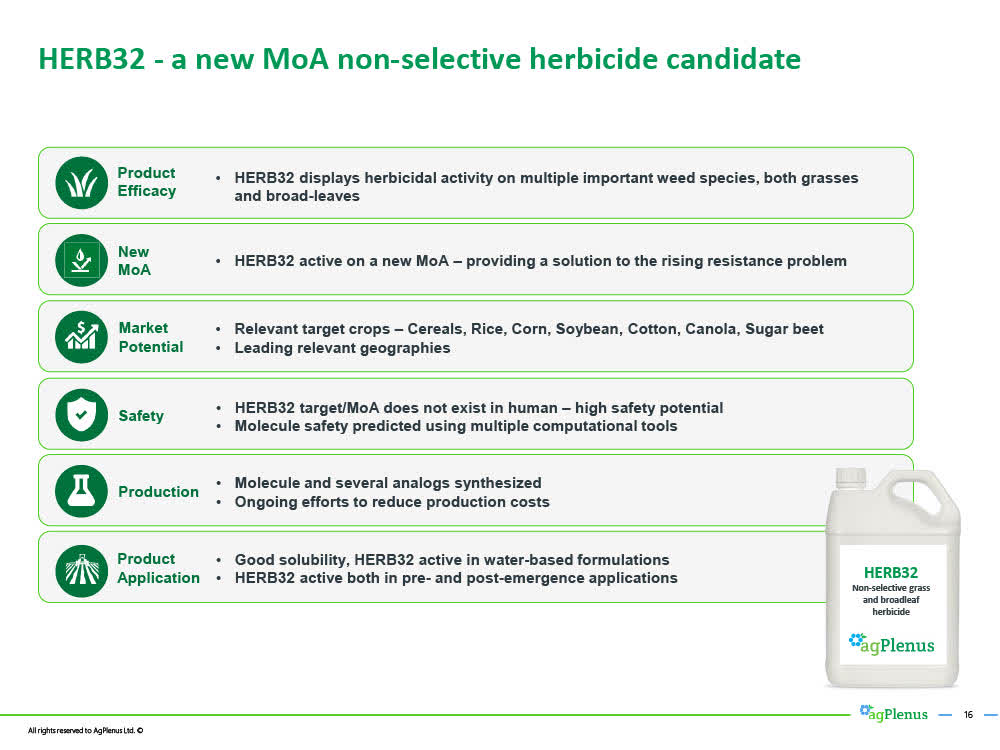

AgPlenus's HERB32 - Novel Mode of Action Herbicide Expects to be a "Lead" next month

AgPlenus' most advanced novel mode of action herbicide is HERB32 and a potential solution to a toxic herbicide such as Bayer's (Monsanto's) flagship herbicide "RoundUp".

During the November 18th conference call, Evogene's CEO Ofer Haviv indicated that AgPlenus was now collecting data from a field experiment conducted by third parties in the U.S. testing HERB32, and expected to have the results and statistics from the trial within the next 2 weeks, and if positive, will announce HERB32 as a "Lead".

*slide below taken from AgPlenus' July 2020 corporate presentation

Having its most advanced herbicide candidate HERB32 attain "Lead" status is an important milestone for AgPlenus. A "Lead" has substantial commercial value in itself and can be licensed out in typical deals in which multiple millions of dollars are paid upfront, additional milestone payments will be paid, and a single-digit royalty generated on commercial sales generated by the Licensee.

However, advancing HERB32 from a "Lead" to an "Optimized Lead", which is expected to take about 18 months, will materially increase the value of HERB32 or as CEO Ofer Haviv stated on the November 18th conference call, "this is where the big, big money is".

As indicated in Evogene's November 18th press release part of the $22 million in funds recently raised by Evogene is expected to be used to develop HERB32 from a "Lead" to an "Optimized Lead".

Once HERB32 attains "Lead" status (and certainly as an "Optimized Lead"), it becomes a very valuable acquisition target for large ag companies such as Bayer, BASF and Corteva.

According to AgPlenus, the value of a commercially ready "novel mode of action" herbicide is enormous as it could generate peak annual sales of U.S. $750 million to $1.5 billion.

In addition to HERB32, AgPlenus has more than 10 in its pipeline that are already "Hits" and are becoming "Leads" in the next few years

Each new novel herbicide, insecticide, or fungicide molecule has similar potential if it reaches a "Lead" or "Optimized Lead" stage respectively.

*slide below taken from AgPlenus' August 2020 corporate presentation.

4. Canonic Ltd.

Evogene's wholly-owned subsidiary Canonic Ltd. has Israel's largest Cannabis R&D facility, is fully licensed, and has a state of the art 22,000 square foot greenhouse, tissue culture and molecular labs. It has also developed proprietary databases to "breed genetically stable varieties for better therapeutic effects and higher yield." For more information, see Canonic's September 2020 corporate presentation as well as my September 23, 2020 article on Canonic.

On November 11, 2020, Evogene announced that Canonic had received licensing approval for the propagation of medical cannabis from the Israeli Medical Cannabis Agency,

... This approval will allow Canonic to proceed with the execution of its commercialization plan of medical cannabis products.

Canonic’s propagation farm, which was established during 2020 and is now fully operational, is designed for the propagation of cannabis seedlings from its R&D greenhouses. These seedlings are expected to be further cultivated by third-party certified medical cannabis growers. The company intends to establish a value chain from genomics to the end-product, with certain parts of the value chain outsourced to sub-contractors. The company intends to deliver its first batch of seedlings to such cultivation farms during 2021. ..."

Starting with plant genetics, Canonic is developing Cannabis varieties that address the medical cannabis industry issues relating to "genetic stability, compound yield, and active compounds". It plans to begin selling its medical cannabis products, beginning in Israel (and then Europe) in 2022. The North American market will be addressed in future years.

Canonic has two product families under development which it refers to as:

1. MetaYield - cannabis plants and seeds under development which stabilizes and increases total active compounds per plant, as well as develop plants with specific traits to increase compounds per planted area (eg. dwarf plants, plants which flower earlier and which can increase the number of crops planted per year);

2. Precise - developing cannabis plants with stable, specific active compounds (eg. cannabinoids such as CBG, CBC, etc). Canonic is also developing these plants with those compounds which address specific medical needs (eg. pain and inflammation) in conjunction with pre-clinical and clinical medical studies that it is conducting with certain medical institutions.

Canonic Anticipates First Commercial Launch in at least One MetaYield Variety in 2022

Canonic's first commercial varieties will be at least one "MetaYield" variety which Canonic has not provide details other than to advise that the relevant market will focus on the T20/C5 (20% THC, 5% CPD) market. Currently, companies marketing medical cannabis with T20/C5 target are delivering products that may contain active ingredients that are 20% higher or lower than specified on the label.

Canonic plans on reducing that variability significantly. Presumably, details will be released over the next year as pre-commercial activities accelerate.

The initial commercial varieties of Canonic's first two MetaYield cannabis plant varieties are also expected to generate much higher yields per acre and much higher levels of active compounds per plant.

The initial commercial market for Canonic's first two MetaYield varieties will be Israel which has a surprisingly large medical cannabis market for its 9 million population, with an estimated market of approximately $170 million in 2022. Canonic plans to expand quickly into the European market in 2022 which, while fragmented by country, is a multiple of the Israeli market. Canonic plans to reach the U.S. market in 2023 which is a multi-billion dollar market.

Canonic's Precise+ Product Family (Medical Indication focus)

Precise Product #1: Targeting Inflammation: Canonic's first anticipated Precise product will address inflammation. Pre-clinical studies are currently underway with the Hadassah Medical Centre.

If the pre-clinical data gathered from these studies is favorable, it could be a significant catalyst for Canonic. If all goes well, Canonic believes it will begin commercial sales for its medical cannabis products to treat inflammation in 2023, beginning in Israel, then Europe and North America. Canonic estimates that the Israeli annual market size for inflammation alone is in the $70 million range.

Precise Product #2: Targeting Pain: Canonic's second Precise medical target indication is for the treatment of pain. Other indications will follow in the future.

Canonic expects to have its Precision medical cannabis product #2 for the treatment of pain commercially available to be launched in Israel, and then Europe and the U.S. in 2023. Canonic estimates that the market size in Israel alone for this product in 2023 will be in the $217 million range. The medical cannabis markets for the treatment of pain in Europe and the U.S. are anticipated to be in the billions.

How will Evogene Unlock Shareholder Value?

Evogene is a more complicated company to understand, with subsidiaries in different sectors and a lot of moving parts. The parent company and each subsidiary company is valued using different metrics and followed by different analysts and different types of investors. It can be difficult for any single analyst or investor to follow or understand Evogene's value creation without an enormous amount of effort.

For example, the valuation of a microbiome therapeutic biotech company such as Biomica uses very different metrics, and is typically valued at a much higher multiple of its potential, than an ag-chemical or ag-biological company such as Lavie Bio or Ag Plenus. The same can be said of a medical cannabis company such as Canonic which is also subject to the valuation and demand trends in the cannabis sector.

In my view Evogene will trade at a discount because of its complicated corporate structure in creating multiple different subsidiaries in different sectors.

The obvious question then is how and when will Evogene unlock shareholder value?

I was therefore pleased to hear CEO Ofer Haviv begin to address that issue in the November 18 earnings call that,

... these capital raises bring us closer to opportunities to unlock the value of our subsidiaries. Reaching the important developmental milestones, we outline in our company presentation, could put our subsidiaries in an attractive situtation to capitalize on their achievements, such as in the form of investment of a strategic or financial partner, M&A or an IPO."

Evogene's subsidiaries are indeed maturing to a level where they appear ready in the next couple of years to "capitalize on their achievements".

Evogene has already signaled that it has sufficient funding to take Biomica through to its Israeli "proof of concept" pilot study in BMC128 (immuno-oncology). In my view, assuming that Biomica's proof of concept data are positive, as Biomica begins preparation to obtain an IND from the U.S. FDA would be an ideal time to raise funds for its own IPO, thereby beginning a process of unlocking Biomica's value for Evogene's shareholders. I see the timing of this IPO process for Biomica as being in late 2021 or early 2022.

With respect to Lavie Bio and AgPlenus, assuming all goes well, both expect significant milestones in 2022 as Lavie Bio begins commercial sales in LAV211 and AgPlenus' HERB232 herbicide attains "optimized lead" status. I don't believe that an independent IPO is necessary for either Lavie Bio or AgPlenus but 2022 could see a year where the companies are either bought out or significant licensing transactions take place.

As far as Canonic (medical cannabis) is concerned, it has a similar problem as Biomica in that its valuation is buried within Evogene and not understood by investors focused on Ag chemicals, Ag biologicals or microbiome therapeutics. In order to unlock Canonic's value, I believe it needs to be spun out either through its own IPO or through an M&A transaction.

Canonic anticipates commercial sales in 2022 and that may be an appropriate time for such an M&A or IPO transaction as well.

Clearly, one or more of the subsidiaries are getting closer to a stage during the next couple of years where they would be ripe for an IPO (eg. Biomica) or being bought out (such as Corteva, Ag Plenus, or Canonic) as they attain critical levels of corporate achievement. Any such event would be a major catalyst for Evogene's share price.

In my analysis, I have not yet attributed much value to the Computational Predictive Biology platform developed by Evogene, probably because its value is presumably subsumed through the valuation of its subsidiaries or more realistically because I really don't know how to value it independently (although I have canvassed this question with many people much smarter than me and no one seems to have a definitive answer). However, I am very mindful that the independent value of the CPB platform may indeed be substantial. If Evogene proves that its CPB platform is capable of efficiently creating multiple success stories in developing various life science products it will in fact prove out its enormous value. At some point in the future, that value will be recognized.

Summary of Upcoming Catalysts/Milestones

1. 90% owned Biomica

January 28, 2021 - Details of positive pre-clinical results with rationally designed 4 strand consortia BMC128 in immuno-oncology being reported at the 5th Annual Microbiome Europe conference 5th Microbiome Movement - Drug Development Summit Europe 2021

H1 2021 - Complete pre-clinical studies for BMC128 and filing of materials with Israeli regulators to begin "proof of concept" human trials in monotherapy and in combination with an immuno-checkpoint inhibitor (Immune Checkpoint Inhibitor "ICI" (PD-1 or PD-L1 and CTLA-4)

H2 2021 - Begin "proof of concept" pilot human clinical trials with BMC128 in immuno-therapy in one or more major medical centers in Israel.

H1 2021 (my estimate) - Preclinical results released from BMC321 / BMC322 in treatment of IBD in studies currently being conducted at the University of North Carolina at the lab of Professor Balfour Sartor.

H1 2021 - Discovery phase completed and initiation of pre-clinical studies in regards to advancing IBS.

H1 2022 (my estimate) - Clinical results from "proof of concept" BMC128 trial in immuno-oncology.

H1 2022 (my estimate)- Filing of IND with the FDA in U.S. for BMC 128 (Phase 1b/Phase 2) clinical trial in immuno-oncology.

Late 2021/ H1 2022 (my speculation) - Biomica launches an IPO on NASDAQ raising funds in anticipation of beginning US BMC128 clinical trials and the development of its microbiome therapeutic pipeline.

2. 72% owned Lavie Bio - Ag biologicals

2021 - LAV211 (for treatment of spring wheat) advances into the pre-commercial development stage in U.S. in anticipation of a 2022 commercial launch.

2021/2022 (my estimate) - Potential milestone payments from Corteva as Lavie Bio's biostimulant candidates for corn advances into development stages.

Q1 2022 - First commercial sales in LAV211 for treatment of "spring wheat" in initial 25 million-acre spring wheat North Dakota/Western Canada market

H2 2022 - Biopesticide LAV311/LAV312 (recently advanced into Development stage 2) -regulatory filing in various U.S. states.

2022 to 2024 - Expansion of LAV211 sales for "spring wheat" into larger territories as well as potential expansion into other products (2022 to 2024) (market potential >$100 million).

2023 - Biopesticide LAV311/312 (fruit rot of grapes, and other fruits and vegetables) pre-commercial stage in 2023

2024 -LAV311 / LAV312 first commercial sales (2024) (potential market >$200 million to more than $1 billion).

2025 - Biopesticide LAV321/LAV322 (Downey Mildew) expected commercial sales in 2025 (potential market >$350 million).

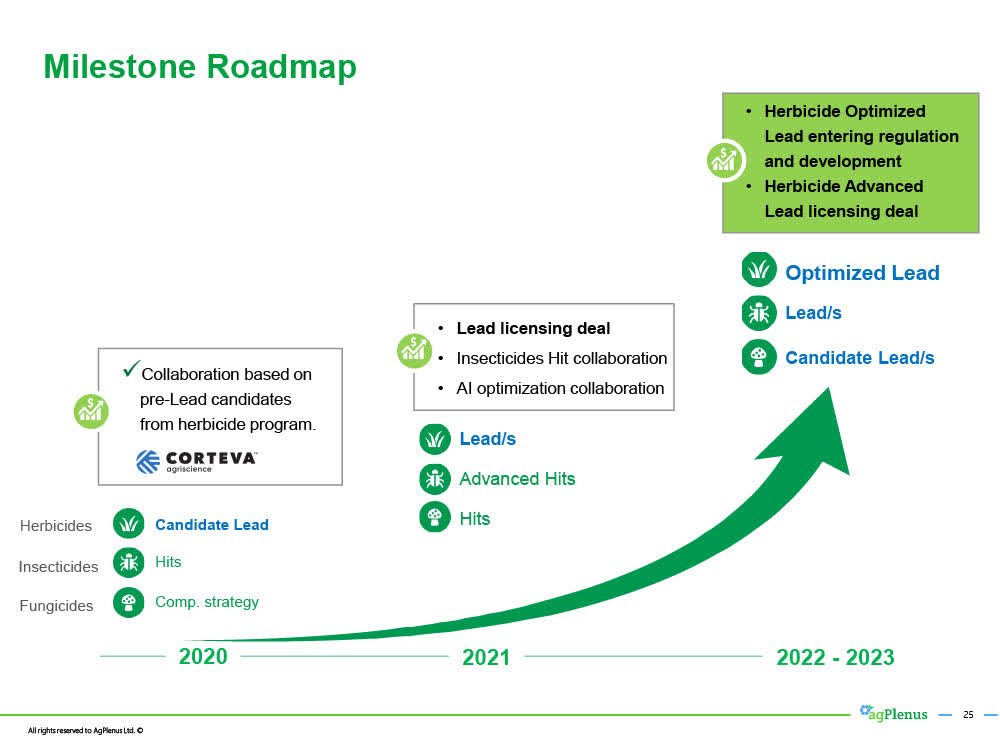

3. Ag Plenus - Ag Chemicals

December 2020 - Novel mode of action herbicide HERB32 becomes a "Lead".

2021 - H2 2022- HERB32 undergoes additional trials and optimization studies and becomes an "Optimized Lead" in H2 2022.

H2 2022 - licensing deal for HERB32 (as an "optimized Lead") with one or more major agriculture company.

2021 to 2024 - Various other pipeline herbicides, pesticides and insecticides in Ag Plenus' pipeline attain "Lead" and "Optimized Lead" status, with potential licensing deals.

4. Canonic (Medical Cannabis)

2021 - 2022 - Release of trial results for its MetaYield and Precise products, including the release of data in 2021 from its pre-clinical medical studies.

2021/2022- Pre-commercial activities in 2021 for its MetaYield products in anticipation of commercial launch in 2022.

Evogene Investment Thesis

With a market cap of approximately $105 million (including cash of approximately $50 million and no debt), on a sum of parts basis, Evogene is undervalued.

Evogene's computational predictive biology platform is creating substantial value through its subsidiaries which will hopefully be recognized and unlocked in next couple of years. Recently, Evogene has been attracting additional investment from sophisticated investors such as ARK Invest (through its genomics ETF fund (ARKG)) which is now Evogene's largest shareholder, owning approximately 12% of the company.

With multiple upcoming catalysts and milestones, each of its 4 main subsidiaries is making substantial progress, and materially increasing shareholder value.

With many significant upcoming milestones and catalysts among its 4 main subsidiaries, if all goes well, Evogene may handsomely reward investors in the next few years.

During its recent November 18th earnings call Evogene's CEO articulated his thoughts about Evogene's plans to unlock shareholder value through a strategic or financial partner, M&A or an IPO of one or more of its subsidiaries. Hopefully, those plans will become clearer in 2021.

Investment Risks

Notwithstanding the potential significant upside, Evogene remains a relatively early stage ag-tech/ biotech company with no material current or predictable future revenues, suitable for investors with a high-risk tolerance. An investment in Evogene could result in the loss of some or all of your investment.

Before making an investment in Evogene, you should do your own due diligence and obtain professional advice to determine whether it is an appropriate investment for you and the sizing of such an investment.

Investment risks include, but are not limited to, the possibility of developmental trial failures, underwhelming clinical or other test results, competition, IP infringements, patent challenges, regulatory issues, loss of key personnel, share dilution, difficulty in raising new funds either at the parent or subsidiary level in the future, the failure of management to execute upon its business plan including marketing, difficulty in acquiring partners or entering into licensing deals and general market risks.

Evogene's business model is frequently dependent on collaborating or partnering its assets at various stages of development. There is a risk that those collaborations or partnerships may not materialize or may not be as lucrative or as timely as hoped for or anticipated.

For further details of the potential risks involved, see the risk factors set out in the company's most recent public SEC filings including its Form 20F filed on July 27, 2020.

Disclosure: I am/we are long EVGN. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.