Eiger Looks Like A Solid Long-Term Play After Zokinvy's Approval

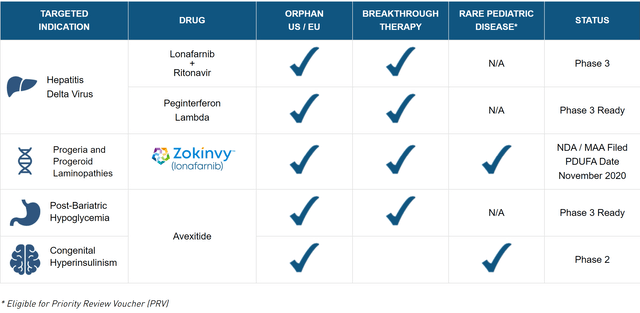

Eiger is solely focused on rare disease opportunities with its big target being hepatitis delta virus.

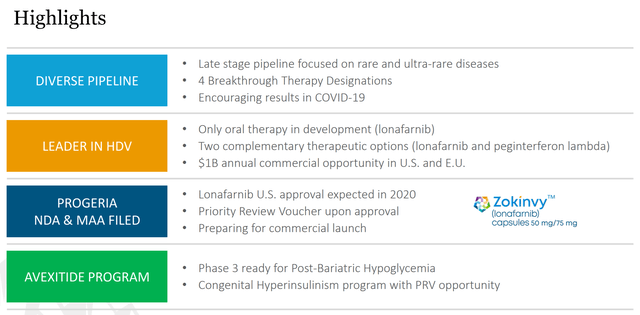

Eiger's first therapy Zokinvy just got approved which nets the company an important Priority Review Voucher that the company then sold and netted $47.5 million in cash.

Despite this, Eiger stock has actually trended down of late, creating a possible long-term buying opportunity in a quality company.

Eiger BioPharmaceuticals (EIGR) is a clinical-stage company focused on developing therapies for rare diseases with no currently approved treatments. Eiger currently has five programs, four of which have received the FDA’s Breakthrough Therapy Designation, including one that just got FDA approved this month, Zokinvy. I’ve been meaning to research this company for a while, and I’m glad I finally got around to it. This article is my initial deep dive thoughts on the company, its prospects, and whether it is sufficiently discounted to be worth consideration for a long-term position.

Eiger's Background and Developmental Programs

Eiger’s main product, lonafarnib, is a farnesylation inhibitor. Farnesylation is a cellular process where an insoluble lipid called a farnesol group is added to a protein which then causes the protein to associate with or attach to the cell membrane.

Figure 1: Eiger’s Pipeline (source: Eiger’s website)

Lonafarnib’s furthest along application is in progeria and progeroid laminopathies. Progeria is an aging disease that affects children. The Progeria Research Foundation says that:

Although they are born looking healthy, children with Progeria begin to display many characteristics of accelerated aging within the first two years of life. Progeria signs include growth failure, loss of body fat and hair, aged-looking skin, stiffness of joints, hip dislocation, generalized atherosclerosis, cardiovascular (heart) disease and stroke. The children have a remarkably similar appearance, despite differing ethnic backgrounds. Children with Progeria die of atherosclerosis (heart disease) at an average age of fourteen years.

Clearly this is a terrible disease, and there are currently no FDA approved treatment options. Progeria is caused by a mutation in the LMNA gene that codes for the Lamin A protein. This protein is critical for the integrity of structure of a cell’s nucleus, but a mutation of this gene causes a farnesylated version to form that is known as progerin. Using lonafarnib thus appears to reverse some of this cellular instability and ultimately the premature aging it causes.

As stated above, Zokinvy recently received FDA approval to be marketed in the US. The company has also submitted an MAA for approval in the EU though Eiger has said the ultimate decision on EU approval is getting delayed somewhat due to COVID-19-related issues.

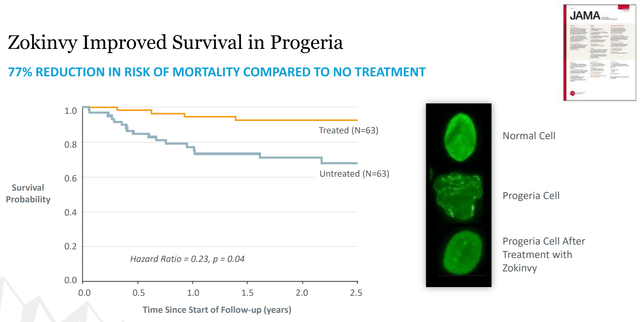

Figure 2: Zokinvy Data (source: Eiger’s October Corporate Presentation)

Eiger had the results of its Zokinvy trial published in the Journal of the American Medical Association (JAMA). As you can see from Figure 2, Zokinvy use resulted in a 77% decreased risk of mortality in progeria patients versus those not treated. That’s huge in a patient population that currently has no treatment options and typically dies by age 14. Based on this kind of data, it wasn't a big surprise for Zokinvy to get approved.

Approval also resulted in Eiger receiving a Priority Review Voucher that can be used with one of its other products or sold. I was hoping management would sell the voucher, and that is exactly what has now happened. Eiger announced four days after the approval that it had sold the voucher for $95 million which will be split 50/50 between Eiger and the Progeria Research Foundation. This is big because it's a large source of non-dilutive capital that comes at a good time with potentially lucrative HDV therapies advancing in the pipeline.

Figure 3: Eiger Pipeline Highlights (source: Eiger’s October Corporate Presentation)

The other indication for lonafarnib is in combination with ritonavir for hepatitis delta virus or hepatitis D ((HDV)). HDV is by far the most important indication in Eiger’s pipeline.

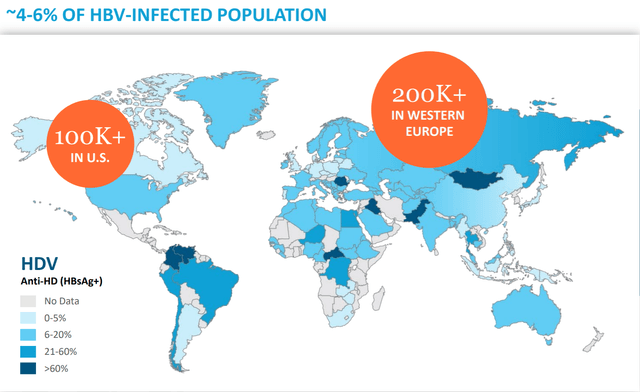

HDV is a viral infection of the liver, similar to the other more commonly known forms like hepatitis B or hepatitis C. HDV though is always a co-infection with the more common HBV and is far more serious than HBV alone. Whereas HBV results in cirrhosis of the liver within 5 years in about 20% of all infected patients, this number balloons to 80% for patients with the HDV/HBV co-infection.

Farnesylation is essential for HDV particle formation which is one of the last steps in the viral replication process. Thus, inhibiting farnesylation with lonafarnib is thought to limit viral spread and allow traditional anti-virals like ritonavir to be more effective.

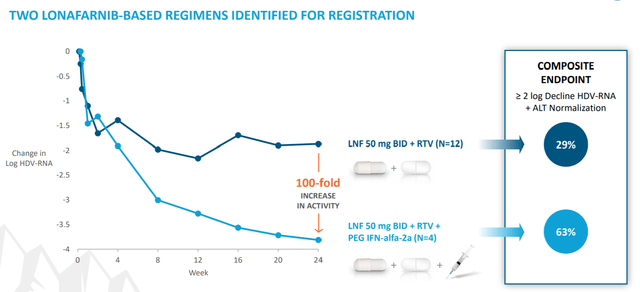

Eiger’s Phase 3 trial in this indication is still currently enrolling. Eiger expects full enrollment by sometime next year. Phase 2 results for lonafarnib in this indication were encouraging, demonstrating a 29% reduction in viral RNA in 24 weeks for the lonafarnib and ritonavir combination. One thing to watch though is that this was in just 12 patients whereas the Phase 3 trial is in 175 patients for this arm.

Figure 4: Lonafarnib Phase 2 Results in HDV (source: Eiger’s October Corporate Presentation)

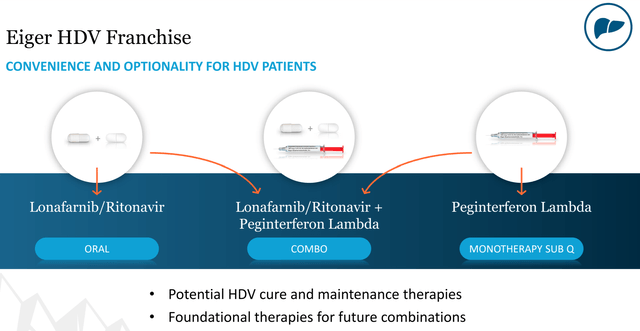

It also does concern me a little the lonafarnib + ritonavir looks to have either just barely or maybe not quite even hit the composite endpoint of a 2 log decrease in viral RNA, but this measure was easily achieved with peginterferon lamba added into the mix. Eiger is also developing peginterferon lamba in this indication, both in combination with lonafarnib/ritonavir and potentially as a monotherapy. One of the benefits of lonafarnib/ritonavir is that it’s an oral therapy, but even the peginterferon lambda treatment is just a subcutaneous injection. Given the lack of other available treatment options currently, the important thing is that Eiger is able to get some combination therapy to market, and this looks likely especially given the strong results of the triple combination in Phase 2.

Figure 5: Eiger HDV Franchise (source: Eiger’s October Corporate Presentation)

Eiger just announced positive data from the Phase 2 triple combination study at the Liver Meeting in mid-November. The study met its primary endpoint of a greater than two log decline in HDV RNA at 24-weeks, but the secondary endpoint data was also strong, with 55% of patients showing improved histology and 23% of patients showing HDV RNA levels that were either below the level of quantitation or completely undetectable. A Phase 3 trial for peginterferon lambda should now get underway next year as well.

Peginterferon lamba is also being studied in COVID-19 patients, and there are currently six investigator-sponsored trials underway.

Figure 6: Chart of Lamba for COVID-19 Trials (source: Eiger’s October Corporate Presentation)

The data released so far has suggested that lamba is pretty efficient at boosting viral clearing, but I would still be a little surprised to see meaningful revenue from the COVID-19 indication. While Eiger’s COVID-19 chances may look more promising than most, there are a huge number of potential therapies in development, and the timeline of any eventual approval for Eiger seems to me like it would come after there will likely be multiple vaccines on the market. Thus, I don’t factor this indication into my analysis at all.

Eiger’s last developmental compound is avexitide which is being used to target two additional indications, post-bariatric hypoglycemia and congenital hyperinsulinism, with the first having a Breakthrough Therapy Designation and the second a Rare Pediatric Disease Designation. Avexitide itself is a glucagon-like peptide-1 antagonist that prevents an excess release of insulin to treat these diseases. Eiger says very little about them in its current presentations, earnings updates, and even annual report, so I’m not going to dive in depth here, especially considering this article is on the long side already. That said, any future developments here will represent additional upside to the base case that I model below.

Overview of Eiger's Balance Sheet and Management Execution

Eiger reported having $125 million in cash and equivalents at the end of Q3. This should now be higher with the $47.5 million from selling the Priority Review Voucher. Eiger’s net loss was about $16 million in Q3 which annualizes to $64 million, implying over two years of cash runway at present levels of spending.

This loss is very reasonable for a company with this many late-stage therapies and is an indicator to me of a management team that is being a wise steward of their resources. Another indicator of good management to me is that Eiger only has about 30 million shares outstanding, a very low total for most biopharmas. Even if the company has to raise more capital in the future, it will likely still end up with a below-average share count, meaning that per share earnings will be proportionally higher versus a company that wasn’t as fiscally conservative in their operations.

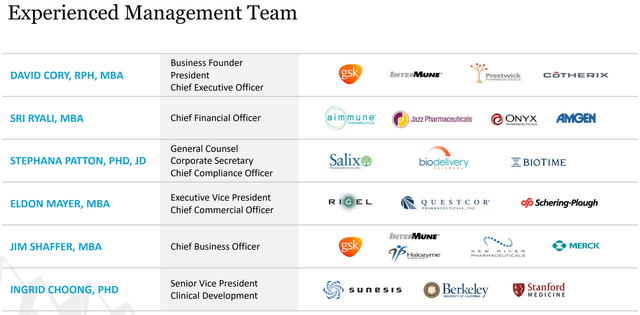

Figure 7: Chart Showing Eiger’s Management Team (source: Eiger’s October Corporate Presentation)

I included Figure 7 just to show how experienced the leadership team is. Actions speak louder than past experiences to me, but when management seems to be acting in a very efficient and thoughtful manner, a high level of experience is a meaningful plus factor to me.

Eiger appears to have a high level of institutional ownership as well. In fact, the number of institutional investors in this company is so high that rather than including an overly large chart here, I would direct readers to go directly to fintel.io themselves and look at the table of 13F filings.

There have been no insider sales of late and several purchases by directors including at a price slightly higher than at present. Management doesn’t own a huge number of shares, but each typically owns over ten thousand shares which should be enough to incentivize them to think primarily about creating shareholder value.

That said, if Eiger struggles to get its HDV therapies to market, the company could be forced to start raising significant amounts of dilutive capital. This is usually the biggest risk with any small biopharma, and it is no different here. I do not view this as likely for Eiger, but any potential investor needs to carefully weigh the non-trivial risk involved.

Eiger’s Market Cap Looks Too Low in Comparison to Future Sales Expectations

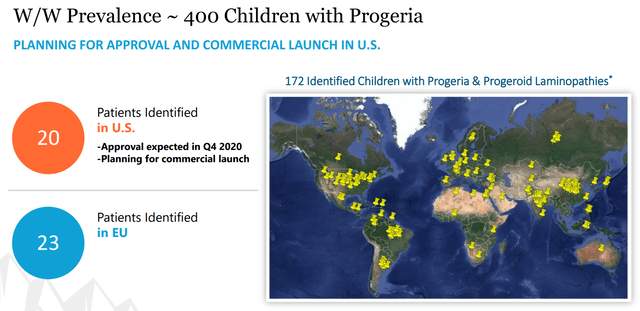

First off, when talking about Eiger's valuation, it’s worth explicitly noting that the Progeria indication will likely have little commercial impact for the company.

Figure 8: Progeria Prevalence (source: Eiger’s October Corporate Presentation)

As you can see from Figure 8, Eiger only knows of 20 patients in the US and 172 worldwide. This is a de minimis market opportunity because of the small patient population even if you include all 172 currently known patients and use the orphan drug pricing that Eiger estimates for HDV.

The real opportunity is clearly then in HDV which has a much larger patient population.

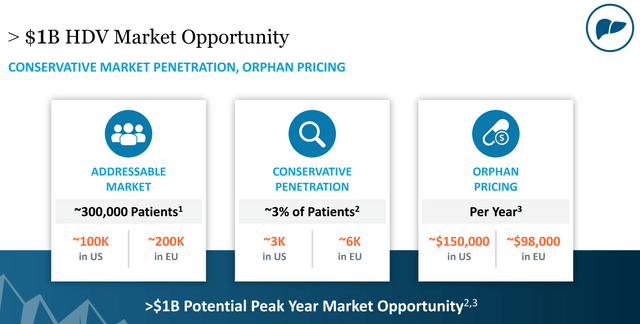

Figure 9: HDV Prevalence (source: Eiger’s October Corporate Presentation)

Figure 10: HDV Market Facts (source: Eiger’s October Corporate Presentation)

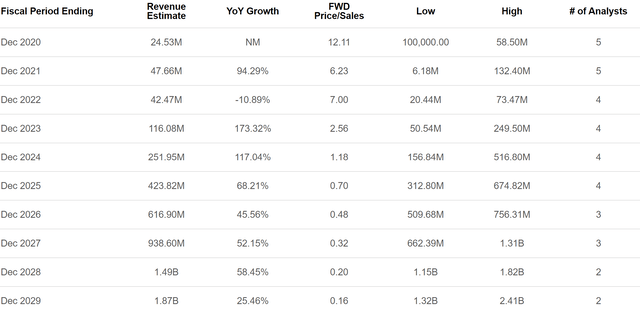

Looking at analyst estimates of Eiger's future revenue, it's clear that there's big potential upside given current expectations. Eiger's HDV therapies are expected to start making a substantial commercial impact in 2022-2023.

Figure 11: Eiger Revenue Estimates (source: Seeking Alpha)

I’m really struggling to see a significant bear case here aside from Eiger just not getting any therapies approved for HDV. The company’s current market cap is just under $300 million, which is less than the lowest of four analyst estimates for 2025 revenue shown in Figure 11. Given that the industry average for a company that at that point would have been commercial-stage for four years is 4x to 5x sales, the potential for upside from here is strong.

To sum it up, Eiger looks like a quality company at a compelling valuation. Management seems to be doing a good job managing cash flow and has already successfully guided one drug to market. It will be interesting to watch Eiger's HDV opportunity play out over the next few years, and an investment in the company now looks to have a good balance of risk and reward for the long-term investor.

This is a delayed release article from my Marketplace Service, Biotech Value Investing. Subscribers received this 30 days ago along with my discounted cash flow model and more detailed thoughts on Eiger's fair value. I've since updated the article based on recent news, and I believe the investment thesis is still applicable today. Biotech Value Investing provides coverage of my approach to finding high-quality, value-oriented companies in biotech and using the inherent volatility of the sector to my advantage by using options to help generate a high compounded return while ensuring optimal entries and exits. Check us out today with a free trial.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I’m not a registered investment adviser. Please do not mistake this article, or anything else that I write or publish online, as any type of investment advice. This article and anything else that I post online are for entertainment purposes only and are solely designed to facilitate a discussion about investment strategy. I reserve the right to make any investment decision for myself without notification except where required by law. The thesis that I presented may change anytime due to the changing nature of information itself. Despite the fact that I strive to provide only accurate information, I neither guarantee the accuracy nor the timeliness of anything that I post. Past performance does NOT guarantee future results. Investment in stocks and options can result in a loss of capital. The information presented should NOT be construed as a recommendation to buy or sell any form of security. Any buy or sell price that I may present is intended for educational and discussion purposes only. Please think of my articles as learning and thinking frameworks--they are not intended as investment advice. My articles should only be utilized as educational and informational materials to assist investors in your own due diligence process. You are expected to perform your own due diligence and take responsibility for your actions. You should consult with your own financial adviser for any financial or investment guidance, as again my writing is not investment advice and financial circumstances are individualized.