NanoString: Strong Life Science Tools Play But Trading At A Premium

Nanostring is a commercial stage life science tools company with a differentiated spatial genomics tool that is seeing early traction.

Despite COVID disruptions, the company is holding up well and has strong liquidity that will be sufficient to get the company through this pandemic.

Valuation is full at this time and I have a neutral rating on the stock.

Introduction and Investment Thesis

Nanostring (NSTG) is a commercial-stage life science tools company that focuses on providing solutions that allow researchers to get in-depth and clinically relevant insights from a wide variety of biological materials. Although principally focused on North America, the company does have decent international exposure with nearly ~40% of 2019 revenues being done outside of North America. The company's core technology utilizes optical barcoding chemistry to count and label single molecules in a way that is much more efficient compared to standard solutions out on the market today. The company is currently commercializing two core products, nCounter Analysis System and GeoMX Digital Spatial Profiling systems which include both regular system sales as well as recurring consumable sales.

More specifically, nCounter is a genetic analysis tool allowing researchers to analyze up to 800 genes at a time. GeoMX is a spatial genomics tool allowing researchers to analyze gene activity in specific regions of a sample. It is this GeoMX product line that is particularly interesting for the company as it allows for significant improvements on the current immunohistochemistry and immunofluorescence modalities currently on the market. Nanostring's technology allows for spatially resolved readouts of up to 96 targets in a multiplexed assay that allows for better analytical throughput and better clinical utility. We are still in the early stages of adoption so there is significant runway for the company to grow in this space.

Despite COVID, the company is performing well, although it has put a damper on the growth trajectory. As illustrated in the financial summary section, instrument sales were up nearly 60% YoY with strong GeoMX revenues and bookings which should drive strong revenue growth in the forward periods. I believe this is a testament to the company's strong value proposition and growing interest in the company's spatial profiling system. It is also impressive given that, in general, COVID has lengthened sales cycles and has made it more difficult for emerging life science companies to generate growth.

Furthermore, for Q4, the company is expecting revenues to come in slightly higher than Q3, which will indicate continued strong performance, despite COVID related headwinds.

In terms of the company's longer-term potential, I believe that it's highly dependent on the market opportunity. For GeoMX, which operates in nearly a $2B TAM split between translational research and discovery as illustrated below, I believe that given the company's strong differentiation that they should be able to take a meaningful share in this category over time. And given that the most recently completed quarter's revenue was just $30 million, there is a significant opportunity for the company to grow and take share compared to the $2 billion TAM.

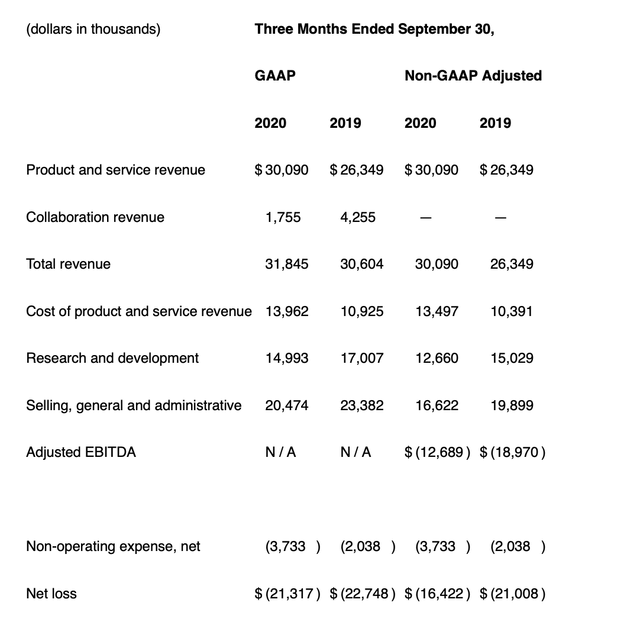

Financial Summary

From a financial perspective, the company most recently completed quarter consisted of overall revenues up 14% YoY or 22% YoY pro-forma the Veracyte transaction. Instrument sales remained strong at $12.9 million representing around 60% YoY growth. This was offset by consumables revenues of $13.7 million or a 11% YoY decline. However, instrument sales are key as they will be the driver of consumable volumes in the future. The fact that instrument sales are strong despite COVID bodes well for the company's sales trajectory post-COVID. On the losses side, net losses remained stable YoY.

From a liquidity perspective, the company is fine with nearly $231.0 million in cash and cash equivalents at the end of the quarter. This goes up to $446.8 million pro-forma the equity raise in October.

Risks

One of the major risks is competition, with the company competing with many large and scaled companies including Bio-Rad, Agilent, Fluidigm, Illumina, Qiagen, and 10x Genomics. These competitors have similar gene analysis tools that compete directly with Nanostring. However, I believe that the company's highly automated platform with the ability to do a variety of simultaneous analyses is a material differentiator vs competitor solutions and should allow the company to gain market share over time.

Although these competitors may pose a risk further down the line, I believe that given the company's strong patent portfolio that replication will be difficult. The most likely eventual outcome here is that Nanostring will be acquired vs these company's trying to replicate Nanostring's technology internally. Furthermore, the company has seen strong traction and validation across numerous peer-reviewed publications including Pathology and Nature, which a competitor solution will also have to garner as well.Finally, COVID is an issue with the company as continued disruptions will likely lead to longer sales cycles that may lead the company to miss revenue targets. Additionally, localized government shutdowns may cause manufacturing disruptions that similarily will have a negative impact on the company's revenue growth.

Valuation and Conclusion

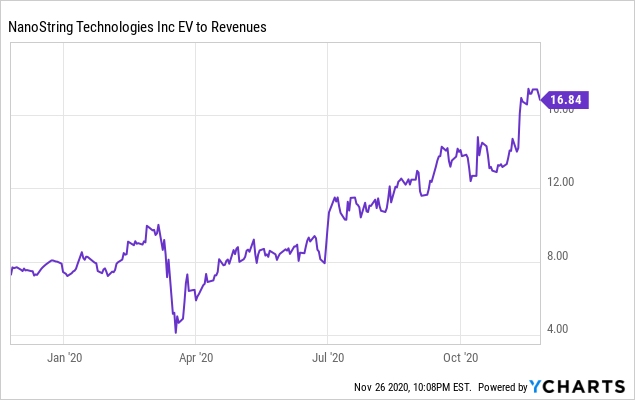

From a valuation perspective, the company trades at nearly 17x revenues, which is quite high. Although arguably justified given the high instrument revenue growth, I believe that the stock is fully valued at this time. Thus, despite the significant traction and differentiation of Nanostring's core technology, I believe a neutral rating is fair at this time and will look to build a position if the stock price comes down.

Data by YCharts

Data by YCharts

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.