Releasing two top December stocks from the MDA Growth and Dividend Breakout portfolio and two top samples from the November portfolio.

The November portfolio completes the first month +15.33% led by United Microelectronics +31.5% and ViacomCBS +22.7%.

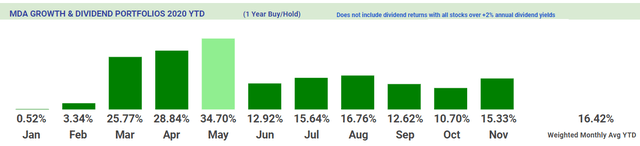

The 11 long-term portfolios released for each month this year are all positive with average weighted gains of +16.42% YTD.

9 out of 11 (81.8%) long-term MDA Growth & Dividend portfolios have already gained over +10.7% over different time periods and as much as +34.7%.

Election year S&P 500 returns since 1928 have averaged +0.57% for November and +1.28% for December in what may be a good sign for year end.

V&M Breakouts: Top Growth & Dividend Stocks For December 2020

Introduction

The Top Dividend Growth stock model expands on my doctoral research analysis on multiple discriminant analysis (MDA) adding new complexities with these top picks. Research shows that the highest frequency of large price breakout moves is found among small cap stocks, with low trading volumes offering no dividends and delivering higher than average risk levels. The challenge with the Top Dividend Growth model is to deliver a combination toward optimal total return with characteristics that typically reduce the frequency and size of price breakouts but deliver more reliable growth factors for higher profitability longer term. Returns to date on the MDA Growth & Dividend selection model for 2020 not including dividends:

Each monthly selection portfolio consists of 5 stocks above a minimum $10 billion market cap, $2/share price, 500k average daily volume and a minimum 2% dividend yield. The population of this unique mega cap segment is approximately 330 stocks out of over 7,800 stocks across the US stock exchanges. While these stocks represent less than 5% of available stocks, their market cap exceeds $19 trillion out of the approximately $33 trillion (57.6%) of the US stock exchanges. Efforts are made to optimize total returns on the key MDA price growth factors (fundamental, technical, sentiment) for the best results under these large cap constraints with high priorities for dividend growth and dividend yield.

Top Growth & Dividend Stocks For December 2020

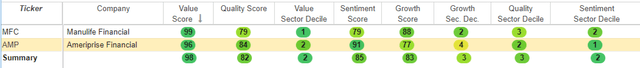

Score Overview of the Growth & Dividend Stocks for December

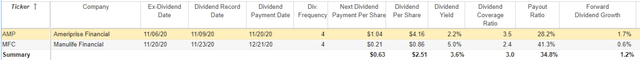

Dividend Calendar

The factors shown are not necessarily the selection variables used in the MDA analysis and dividend algorithms for growth and strong total returns. These additional financial perspectives and reports are included to enhance your investment decisions for total returns.

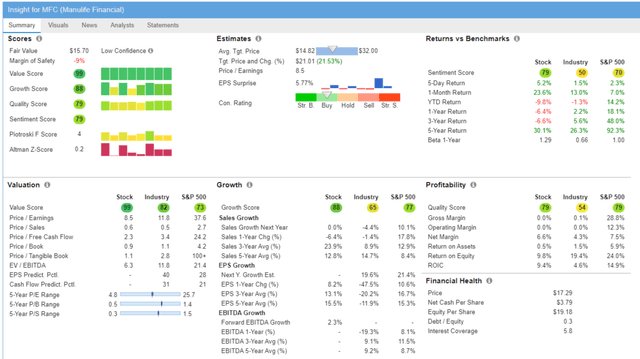

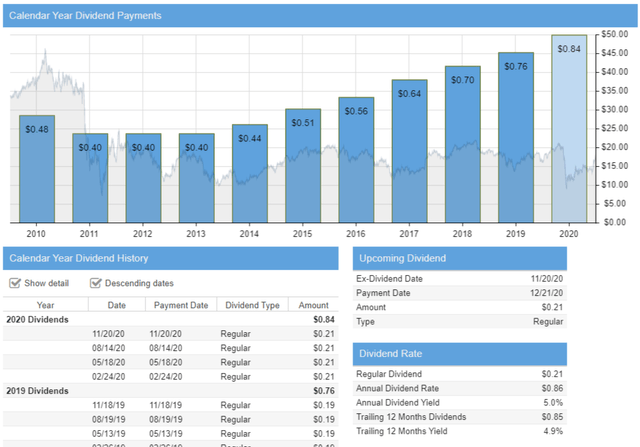

Manulife Financial (MFC)

(Source: Finviz)

(Source: Stock Rover)

(Source: Stock Rover)

| Nov-27-20 01:06PM | Strengthening Canada's response to food safety issues CNW Group |

| Nov-27-20 08:30AM | Manulife Investment Management Announces Estimated Reinvested Distributions for Manulife Exchange Traded Funds CNW Group |

| Nov-27-20 08:00AM | Manulife Investment Management Announces Estimated Cash Distributions for Manulife Exchange Traded Funds CNW Group |

| Nov-25-20 09:30AM | Hancock Natural Resource Group completes acquisition of approximately 149,000 acres of timberlands in southern Oregon PR Newswire |

| Nov-25-20 07:30AM | Manulife Investment Management Launches Five Smart Exchange-Traded Funds CNW Group |

(Source: Finviz)

Manulife Financial Corporation, together with its subsidiaries, provides financial advice, insurance, and wealth and asset management solutions for individuals, groups, and institutions in Asia, Canada, the United States, and internationally. The company offers individual life, and individual and group long-term care insurance; and guaranteed and partially guaranteed annuity products through insurance agents, brokers, banks, financial planners, and direct marketing.

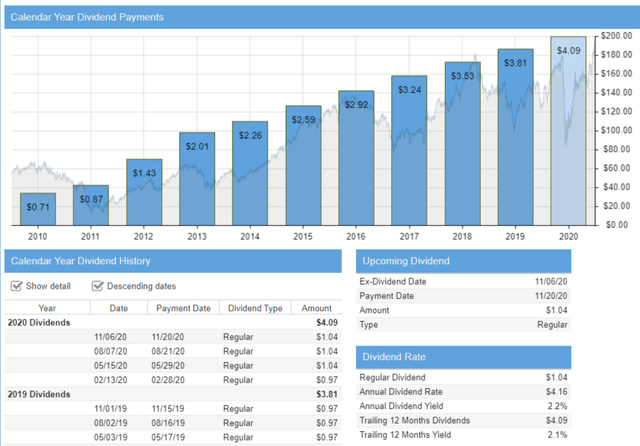

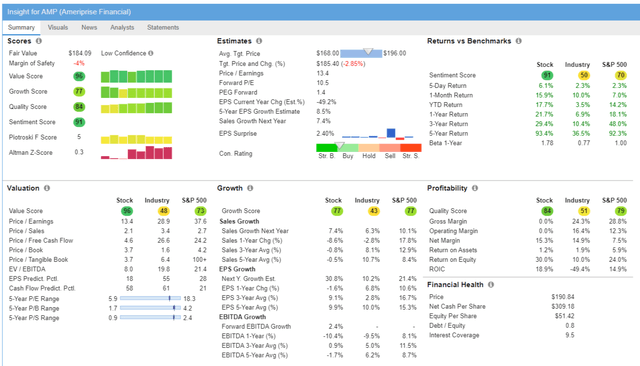

Ameriprise Financial (AMP)

(Source: Finviz)

(Source: Stock Rover)

(Source: Stock Rover)

(Source: Stock Rover)

| Nov-27-20 11:31AM | Ameriprise (AMP) Up 20.2% Since Last Earnings Report: Can It Continue? Zacks |

| Nov-12-20 02:30PM | High-Touch Support and Leading Technology Capabilities Bring Four Advisors to Ameriprise Business Wire |

| Nov-12-20 10:00AM | Ameriprise Financial Connects Employees and Advisors to Volunteer Opportunities Ahead of the Holiday Season Business Wire |

| Nov-10-20 09:15AM | Columbia Diversified Fixed Income Allocation ETF (DIAL) Celebrates Three-Year Milestone with Strong Momentum, Proven Performance Business Wire |

| Nov-10-20 09:05AM | $371-Million-Dollar Team Joins Ameriprise for Client Service Focus, Innovative Technology Business Wire |

| Nov-01-20 07:12AM | Be Sure To Check Out Ameriprise Financial, Inc. (AMP) Before It Goes Ex-Dividend Simply Wall St. |

(Source: Finviz)

Ameriprise Financial, Inc., through its subsidiaries, provides various financial products and services to individual and institutional clients in the United States and internationally. It operates through five segments: Advice & Wealth Management, Asset Management, Annuities, Protection, and Corporate & Other. The Advice & Wealth Management segment provides financial planning and advice, as well as full-service brokerage services primarily to retail clients through its advisors. The Asset Management segment offers investment management, advice, and investment products to retail, high net worth, and institutional clients through unaffiliated third party financial institutions and institutional sales force.

Top Growth & Dividend Stocks From November 2020

Each set of five stocks in the monthly selection articles are intended for long-term growth and dividend returns measured over a 1-year period. Last month, none of the Growth & Dividend stocks were released publicly, and now, two additional sample stocks are being released. November selections are up +15.33% led by United Microelectronics (UMC) +31.5% and ViacomCBS (VIAC) +22.7%. These two selections continue to have strong long-term total return potential and remain very popular with members.

United Microelectronics Corporation

ViacomCBS Inc.

Prior Long-Term Gainers to Consider

This section is a brief review of strong prior selections that have delivered on the long-term growth forecast YTD. These prior portfolios are available in my list of published articles and complete stock selections are available in the members' area. From the start of the year across all the long-term Growth & Dividend MDA selections, the following stocks have significantly outperformed on price alone, not including dividends.

| Symbol | Name | Return Since 2020 Selection |

| (NTES) | NetEase, Inc | +52.47% |

| (INFY) | Infosys Ltd. | +61.65% |

| (TSM) | Taiwan Semiconductor Mfg. | +83.40% |

| (KLAC) | KLA Corp. | +76.80% |

| (BLK) | BlackRock, Incl | +62.54% |

| (GRMN) | Garmin Ltd. | +44.22% |

| (CMI) | Cummins Inc. | +40.08% |

| (LUV) | Southwest Airlines Co | +48.69% |

| UMC | United Microelectronics Corp. | +45.51% |

| VIAC | ViacomCBS Corporation | +34.52% |

| AMP | Ameriprise Financial Inc. | +36.18% |

| (TROW) | T. Rowe Price Group Inc. | +25.94% |

| (CLX) | Clorox Co. | +27.39% |

Returns YTD on the MDA Growth & Dividend selection model for 2020 not including dividends:

Conclusion

These stocks continue a live forward-testing of the breakout selection algorithms from my doctoral research applied to large cap, strong dividend growth stocks. None of the returns listed above includes the high dividend yields as part of the performance and would further increase total returns for each stock. These monthly top Growth & Dividend stocks are intended to deliver excellent long-term total return strategies leveraging key factors in the MDA breakout models used in the small cap weekly breakout selections.

These selections are being tracked on the V&M Dashboard Spreadsheet for members and enhancements will continue to optimize dividend, growth, and higher breakout frequency variables throughout the year.

All the very best to you and have a great week of trading!

JD Henning, PhD, MBA, CFE, CAMS

If you are looking for a great community to apply proven financial models with picks ranging from short term breakouts to long term value and forensic selections, please consider joining our 900+ outstanding members at Value & Momentum Breakouts

If you are looking for a great community to apply proven financial models with picks ranging from short term breakouts to long term value and forensic selections, please consider joining our 900+ outstanding members at Value & Momentum Breakouts

- Subscribe now and learn why members are hooked on the Momentum Gauge® signals!

- The Premium Portfolio is up 22.90% YTD through November

- Now into our 4th year, this rapidly growing service has consistently outperformed the S&P 500 every single year!

*** One time 20% Discount Offer starting Now through Nov 30th. Last chance before January price increase ***

See what members are saying now - Click HERE

Disclosure: I am/we are long TNA, LABU, BNKU, FNGU, NAIL. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.