Sangoma Has Highflying Growth With Its SaaS Shift, But I Have Concerns

Sangoma has performed an impressive transition to a SaaS communications model from a one-time purchase hardware model.

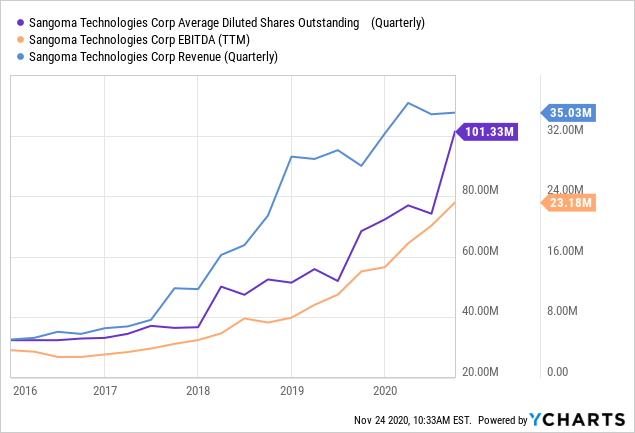

Revenue and EBITDA growth rates have been impressive at 5y 49% and 60% CAGR.

However, much of the strategic shift and top-/bottom-line growth has come on the backs of an aggressive acquisition strategy that has had a strong dilutive effect.

Investment Thesis

Sangoma (OTC:SAMOF) is a Unified Communications provider that has successfully switched from a hardware-based, one-time purchase model to a recurring, cloud-based subscription model. The company has demonstrated strong revenue and EBITDA growth on the back of aggressive acquisitions and has shown durable sales power through its subscription model despite COVID-related headwinds. While there is a lot to like, the company's acquisition model is highly dilutive. Investors may benefit from a small position as we eye the company's ability to grow organically or, as the business develops, perform less dilutive acquisitions, but wait on the sidelines for more clarity before considering a larger position.

Business Overview

Sangoma is a "Unified Communications" provider for small- and medium-sized businesses. It offers cloud-based communications as a service on a subscription basis and is geared to providing a comprehensive suite of communications features.

In short, Sangoma aims to offer small businesses literally everything they need to communicate internally and with customers. This includes a full range of products, from video-based meetings, fax services, voice over internet protocol (VoIP), and hardware including phones and headsets.

The value proposition here is that Sangoma offers small businesses the opportunity to step up from their primary, phone-based communication to a more complete package of communications systems. Small businesses are theoretically able to improve employee productivity by streamlining communications processes instead of relying on scattershot phone calls and e-mails, and you can easily imagine how this would be an important piece of infrastructure development as a small business looks to expand.

One of Sangoma's best and most differentiated features is the ability to tailor options to individual customers. Customers have the ability to choose this piece of the package plus that option, but not that option per their needs. This makes Sangoma a good value proposition, but I think that it also makes it sticky and makes it easy to add revenue per customer as customers upgrade their suite of options subscribed to.

Sangoma has clearly telegraphed that one of its primary means of growth is going to be through acquisitions. Sangoma has made a meaningful acquisition virtually every year for the last decade, most recently acquiring VoIP Innovations for $36 million in October 2019 (plus an extra $6m in potential incentives). While there has been some organic growth (we will get to that later), it is the acquisition strategy that really seems to be propelling the business. The VoIP acquisition, for example, was made at roughly 2x/revenue and 6.4x/EBITDA and was immediately accretive.

Part of the strategy behind the acquisitions has been Sangoma's desire to shift from a one-time, purchase-based business to a recurring, subscription-based business. Good on management for catching on to industry trends early. Fortunately, this shift has gone fairly well, and recurring services revenue now represents 56% of revenue in the most recent quarter and has been over 50% of revenue since Q3 2020 (quarter ending in March of 2020).

This is a strong strategic shift for Sangoma, and CEO Bill Wignall spoke about this in his Q2 of 2020 conference call, explaining:

If, for example, an IT director, at one of our customers is looking at a purchase of say a gateway or our premise-based UC solution, they will see it as a one-time capital outlay. Their CFO gets asked by the IT director to approve this, say for example, $47,000 purchase order. When the economy feels good, the CFO says, yes, sure. But if the CFO is slightly more worried about economic headwinds, as many folks seem to be nowadays, but what seems like an ever increasing number of global flash points these days, then maybe he said it's a good idea, but let's wait a quarter or two and see how things look.

He additionally explains:

We are now extremely focused on growing that services business where the recurring revenue is generated versus the one time product sale type revenue. That is strategically advantageous to Sangoma since it's higher quality revenue, more predictable and it's obviously valued more highly by you and the investment community more generally.

While there may not have been much visibility on this strategic shift a year or two ago, I feel pretty confident saying that Sangoma has been effective in making this move. With recurring revenues stably in excess of 50% and growing, I feel confident that this trend will continue into the future, particularly as Sangoma considers further acquisitions.

On that last front, it is worth taking a moment to discuss Sangoma's recent equity raise. The company closed an $81 million ($75m net to company) upsized equity offering in July of this year. With the balance sheet already in clean shape (this will be the next section) and Sangoma's lengthy history of acquisitions, there is absolutely no doubt in my mind what this capital will be used for. Sangoma is on the hunt to acquire right now, and I suspect the only reason for the delay is pandemic-related headwinds.

Given this raise, you will not be surprised to hear that Sangoma enjoys an exceptionally strong balance sheet with $70m in cash (against its market cap of $240m) versus $42m in debt.

Revenue and Growth

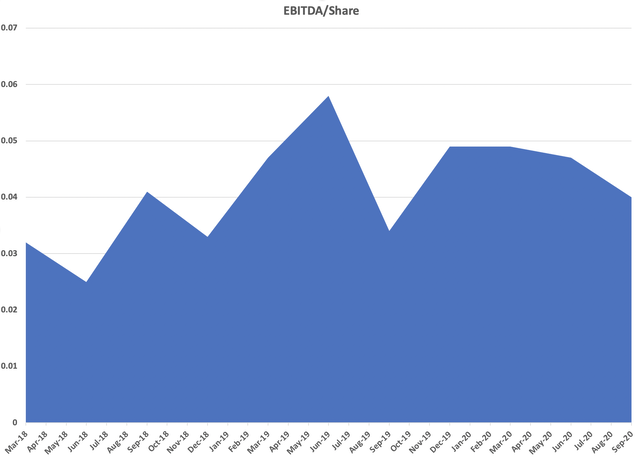

Where investors really get excited about Sangoma, though, is when we start talking about the growth. It's not hard to see why: ever since the subscription-based shift, growth has been stellar.

Data by YCharts

Data by YCharts

These numbers clock in at 5y revenue and EBITDA CAGR of 49% and 69% respectively.

But... things may not be all that they seem - we will get to that later.

Valuation

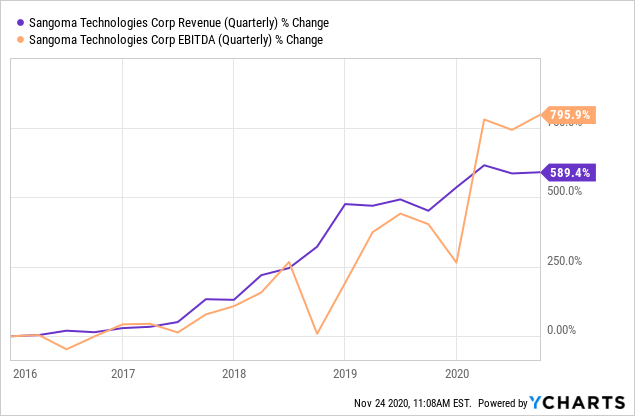

Like most early-stage, software-based companies with strong growth, Sangoma is aggressively valued by most of the classic metrics, with the possible exception of Price to Sales which is not unreasonable at 1.7x.

Data by YCharts

Data by YCharts

The PE ratio looks rich at 45, and Price to FCF is also generous at 23.

However, with Sangoma's lengthy history of acquisitions and with $32 million of goodwill, $36 million of intangibles on its balance sheet, I'm not entirely sure earnings is the right metric by which to judge this company given the significant non-cash depreciation and amortization expenses (you can eyeball this above when you compare P/FCF vs P/E).

Instead, I prefer to use EV/EBITDA, which also helps us adjust for the company's impressive net cash position in addition to those non-cash expenses. This hovers at a more reasonable 15.

Source: Seeking Alpha

Like most companies in today's market, Sangoma has become more expensive in the last six months (the Fed's tidal wave of money has, after all, raised all boats). However, when you consider this company has a 5y revenue and EBITDA CAGR of 49% and 69% respectively, I do think the valuation is not only reasonable but is downright attractive when compared to US-based tech counterparts.

Risks

While Sangoma has been exciting thus far, unfortunately there are some warts... and some significant ones at that.

As with all acquisition-heavy companies, there are two massive risks. First, the price the company pays, and second, how the company pays that price.

In the first case, recent acquisitions have priced at <2x revenue and in the 6-8x EBITDA range. This is completely reasonable.

However, the company has been aggressively using equity for capital raises and directly for acquisitions. When you add this to stock-based compensation (which has been altogether reasonable), the dilution has been significant.

Data by YCharts

Data by YCharts

In fact, if you eyeball a chart comparing revenue, EBITDA, and shares outstanding, you can roughly guesstimate just how much of an impact the equity dilution has had on shareholders' ability to enjoy the benefits of this growth.

Data by YCharts

Data by YCharts

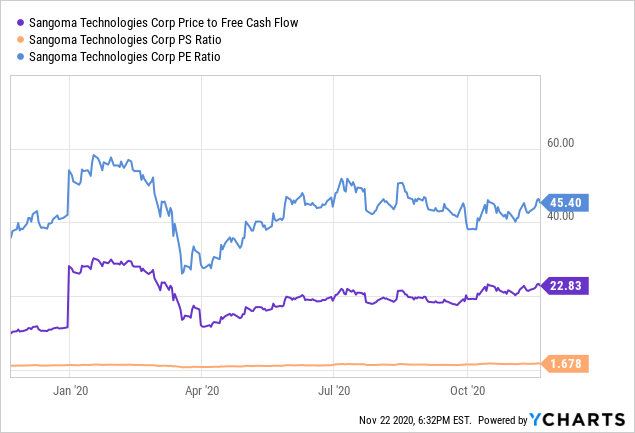

Plugging quarterly EBITDA data against shares outstanding for the last several years into Excel yields a chart that looks like this:

Source: Author's own work

The trend is rising... but only slightly and at a pace far lower than the headline numbers of 5y revenue and EBITDA CAGR of 49% and 69% respectively.

In broad strokes, I think you can look at this two ways.

The first is the purist view: dilution is bad, and companies that throw their equity around this way should be avoided.

The second idea is that a company in the rapid expansion phase needs to pull capital as it is available as it tries to get its products into prime time as fast as possible.

I think you can make a reasonable argument that we should look at Sangoma the second way. We can say Sangoma only relatively recently made the shift from a dying, hardware-based business into a high-growth SaaS business. The company is still trying to aggressively build out its suite of products, and it is still completing the transition to a subscription-based model. It has been aggressive in acquiring other businesses to help make this leap more quickly.

Okay. You can make the argument. It's a decent one.

But, personally, I find myself somewhere in between. Yes, I like the fact that Sangoma is aggressive about acquiring to build out its suite of products, ramp up recurring revenue, and expand its footprint. The acquisitions are allowing it to entrench its competitive position with a strong suite of products. But... no, I don't like that it has massively diluted the equity base to do so, especially with debt so cheap right now. Additionally, with the company trading at a reasonably conservative EV/EBITDA multiple, it is hard for me to see the equity raises as particularly additive (it's not like it's a US-based software company trading at 1,000x 2025 sales, after all). If the company continues along these lines, you could end up with a situation of ever growing revenue, ever growing market cap... and a never growing stock.

My other great concern is the company's organic growth versus acquisition based growth. Sangoma must demonstrate the ability to grow organically, or the cycle of dilutive acquisitions is not going to break. Crunching through the numbers to tell what is organic growth and what is acquisition based - it doesn't release these numbers, another concern - is a little bit difficult, but I would peg organic growth as somewhere in the 3-5% range for the last several years if I had to bet on it. This is somewhat further complicated by recent softness in the one-time purchase business and the fact that the company does not break down its revenue sources. In short, I can't really tell what is coming from where, and it has not yet answered my request for comment.

Conclusion

In the end, Sangoma's investment thesis depends on how you see the strategic shift and nature of acquisitions progressing. While Sangoma has clearly demonstrated the ability to generate subscription-based recurring revenue, it has required an extreme dilutive acquisition effort to do so. The growth of the company has therefore been tremendously impressive, while the growth of shareholders' portion of profits has been less so.

However, there, are reasons to be optimistic. A significant acquisition is likely on the horizon after the company's massive cash raise over the summer. If Sangoma is able to more and more fully complete its strategic transition and/or complete its product suite to finish establishing its competitive position and grow organically, we could see the company either start to slow down its pace of acquisitions or less aggressively finance them to reduce equity dilution. In this position, it is easy to see the company earning the strong multiple other SaaS communications providers enjoy.

Personally, I may initiate a small position if there is a pullback or pending an acquisition announcement, but I will be keeping this one on a short leash as I watch this play out.

Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in SAMOF over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I have no current position but have considered initiation a position. This will likely depend on future price action - specifically a meaningful pullback - or pending an acquisition announcement, which I expect over the next 3-4 months.