Theratechnologies: Canadian Market-Stage Company With Late-Stage Pipeline

Theratechnologies has two approved products generating revenue and a strong pipeline of candidates including in NASH.

The NASH candidate is highly interesting and has produced strong mid-stage data.

The company is running low on cash.

I recommended Theratechnologies Inc. (NASDAQ:THTX) to TPT subscribers in early May this year. On May 15, the stock jumped 37% on announcement of early-stage data in cancer.

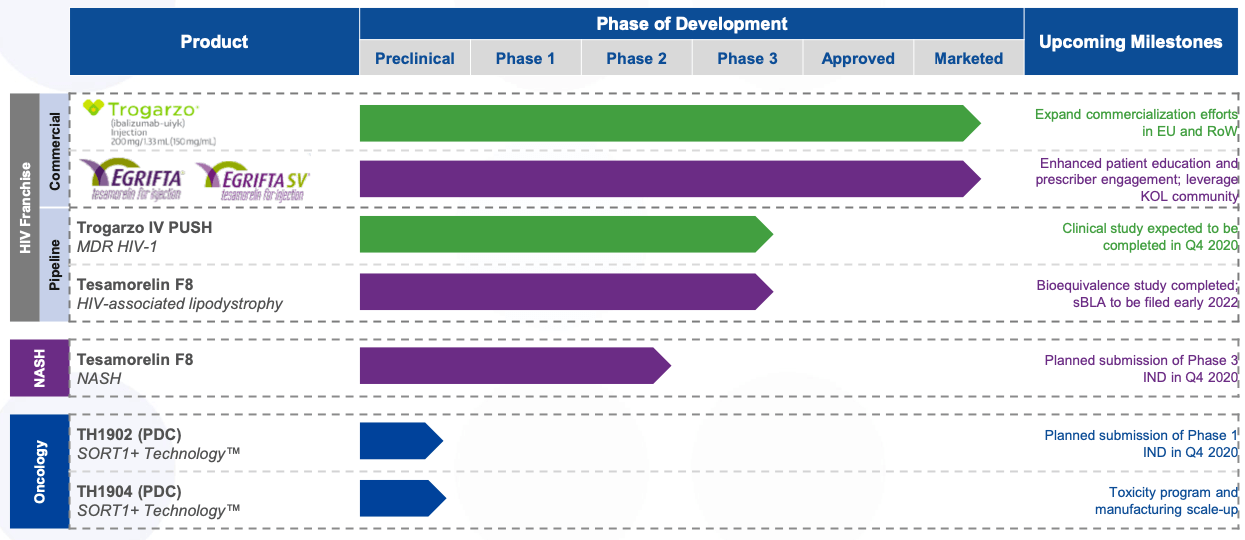

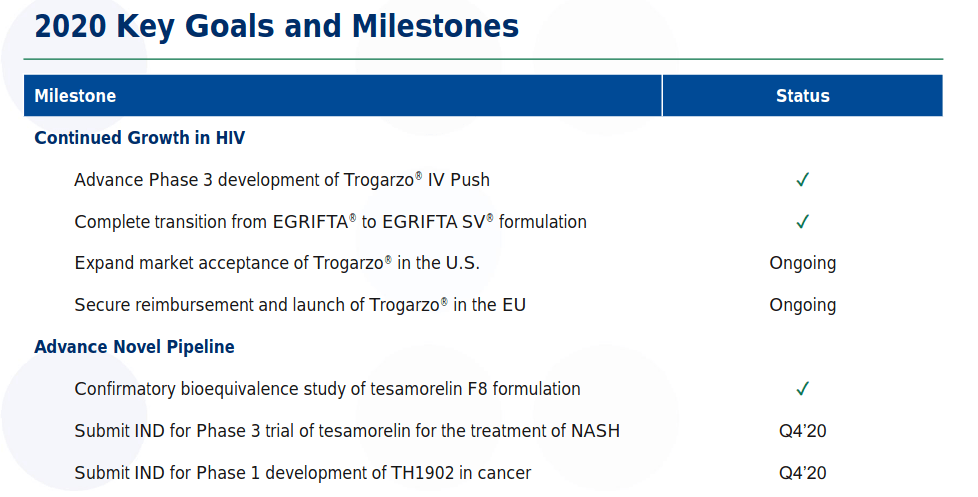

THTX is a market-stage biopharma with three products in the market. These are EGRIFTA and EGRIFTA SV for the reduction of excess abdominal fat in HIV-infected patients with lipodystrophy, and Trogarzo, an injection of ibalizumab for the treatment of multidrug resistant HIV-1 infected patients.

Besides that, its pipeline products include F8 Formulation that could be used for the treatment of HIV-associated lipodystrophy; TH-1902 for the treatment of triple negative breast cancer; and TH-1904 for the treatment of ovarian cancer.

The pipeline looks like this:

Source - Corporate Presentation

Commercial products

The company has two commercialized products:

Trogarzo (ibalizumab-uiyk)

Trogarzo® (ibalizumab-uiyk) injection has been approved in the U.S. since March 2018, "in combination with other antiretroviral(s), for the treatment of HIV-1 infection in heavily treatment-experienced adults with multidrug resistant HIV-1 infection failing their current antiretroviral regimen." It is the first intravenous agent approved for the treatment of HIV-1 infection. It is estimated that there are between 20,000 and 25,000 patients with MDR HIV-1 in the United States. Trogarzo was approved by the European Commission on September 26, 2019. In 2019, Trogarzo had sales of $27mn.

Trogarzo®, was in-licensed from TaiMed Biologics Inc., or TaiMed.

EGRIFTA (tesamorelin)

EGRIFTA® (tesamorelin for injection) is approved in Canada for the reduction of excess abdominal fat in people living with HIV who also have lipodystrophy. It is estimated that 15% of people living with HIV in Canada have lipodystrophy.

EGRIFTA SV® (tesamorelin for injection) is a new formulation of tesamorelin which requires a smaller volume of administration and a smaller needle compared to the original formulation. It comes in a single vial, instead of two, and can be stored at room temperature. It is approved in the United States for the reduction of excess abdominal fat in people living with HIV who have lipodystrophy. In 2019, EGRIFTA had annual sales of $35mn.

Pipeline

Trogarzo IV Slow Push - A phase 3 clinical study is ongoing to "test the safety and drug levels in blood when an 800 mg maintenance dose of Trogarzo® is administered as an undiluted IV push over 30 seconds. The drug levels of Trogarzo® using the IV Push will be compared to the drug levels of Trogarzo after an IV infusion using the currently approved method."

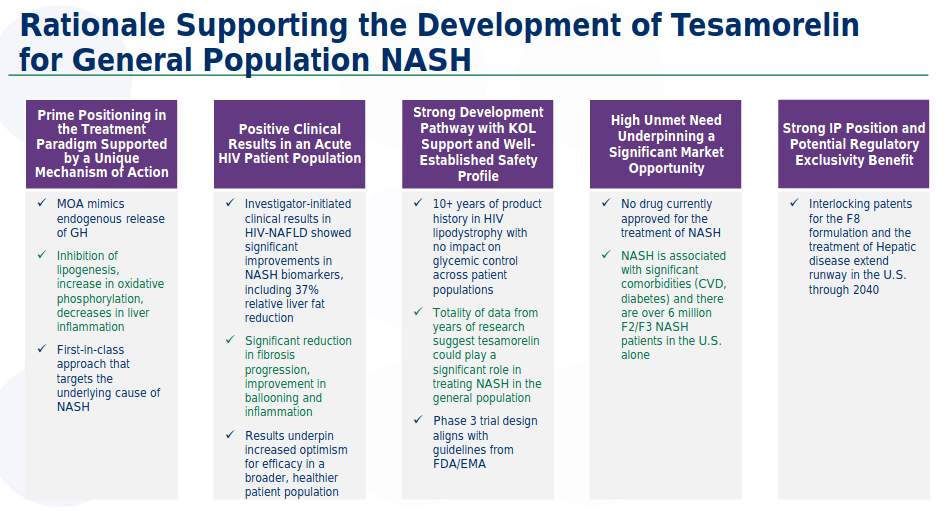

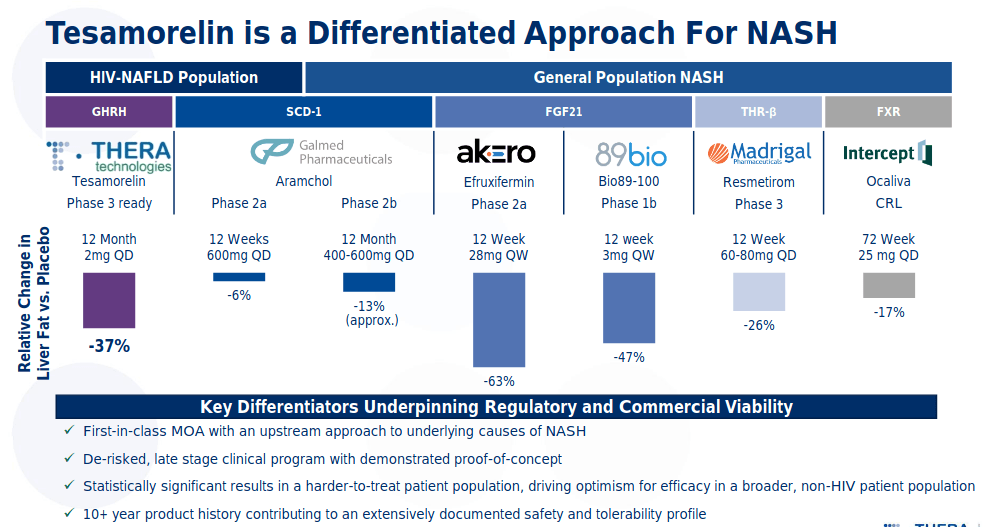

Tesamorelin F8 - This is possibly THTX's most important pipeline candidate. The company will submit an IND for Phase 3 to the FDA and the EMA in 4Q2020. Enrollment will begin in 1Q2021.

The design of the trial will compare Tesamorelin F8 (0.16 ml) to placebo in an 18-month treatment period. The trial will include biopsy-proven F2/F3 NASH patients with a cohort of HIV-NASH patients. The trial is designed to support potential accelerated approval. As per published regulatory guidelines, the primary endpoints will assess NAS score normalisation and absence of worsening of fibrosis stage, or fibrosis improvement ≥ 1 stage and no worsening of NAS.

Theratechnologies intends to use a new investigational formulation of tesamorelin, known as "F8", for the Phase 3 trial in NASH.

The F8 formulation is stable at room temperature for up to seven days after reconstitution and its volume of administration is only 0.16 mL (12.5 times smaller than the F1 Formulation and two times smaller than the current F4 formulation (EGRIFTA SV®), making it possible to have a single multi-dose vial containing seven days of treatment. This formulation has US patent protection until 2033 and a further patent for NASH treatment valid till 2040.

In one-year treatment with tesamorelin in NAFLD patients, it was observed that daily use of the drug reduced hepatic fat significantly (37%) compared to placebo. In addition, 35% of patients treated with tesamorelin demonstrated hepatic fat normalization compared to only 4% in the control group. This study also suggests potential benefits on the prevention of fibrosis.

(Source: Company presentation)

"The data from this sub-analysis show that tesamorelin improves oxidative phosphorylation gene expression, and decreases gene expression involved in inflammation, tissue repair, and cell division. In addition, tesamorelin shifted hepatic gene expression toward a profile associated with a favorable HCC prognosis. These findings suggest potential novel clinical benefits of tesamorelin in liver health," said Dr. Christian Marsolais, Senior Vice President and Chief Medical Officer, Theratechnologies Inc. "The data also support the clinical relevance for the development of tesamorelin as a potential treatment for liver diseases."

Financials

THTX has a market cap slightly less than $200mn. Funds and insiders hold about 16% of the company. The stock is trading between its 52-week highs and lows. The company had revenues of $63.22M in fiscal 2019 (year ends November); $46.9M in nine months.

- Revenue estimates: $65.82M, $89.69M, $110.21M in 2020, 2021, 2022 respectively

- Cash balance: $17.24M (8/31/2020)

- Short-term investments: $9.6M (8/31/2020)

- Cash burn: $40.8M in nine months ending 8/31/2020

- Debt burden: $55.04M

Risks and Bottom Line

THTX is a market-stage company with a steady stream of revenue and a low market capitalisation. It has a very short cash runway and high debt compared to cash reserves. A steady revenue flow can offset that. On the other hand, it has patent-protected assets in major markets like NASH, and the company is relatively less well known. Considering the above, the company may be worth a look.

About the author

Thanks for reading. At the Total Pharma Tracker, we offer the following:-

Our Android app and website features a set of tools for DIY investors, including a work-in-progress software where you can enter any ticker and get extensive curated research material.

For investors requiring hands-on support, our in-house experts go through our tools and find the best investible stocks, complete with buy/sell strategies and alerts.

Sign up now for our free trial, request access to our tools, and find out, at no cost to you, what we can do for you.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.