When the market collapsed in March, we had our wish list ready to go.

Today, we take a look at a REIT that was at the top of that list.

Conditions for triple-net REITs are fantastic, the whole sector is going to boom.

Buy this elite triple-net before the price runs away from you.

Co-produced with Beyond Saving

The market overreacts. It always has, and it always will. The market will run ahead, pricing in high valuations that only make sense if absolutely everything goes perfectly – which we all know never happens in the real world. Then when faced with a real-world problem, the market will sell off in a panic. With valuations going very low as the market goes from underestimating risk to overestimating risk.

We saw this happen in March. COVID-19 created a lot of "firsts" and a lot of unknowns. Until that time, we had never seen nationwide lockdowns, businesses ordered closed and "shelter-in-place" orders. Nobody really knew what would happen.

The market took what were very real threats to the health of numerous businesses and exaggerated them. At what we now know (with 20/20 hindsight) was market bottom in late March, several voices were calling for investors to sell everything.

While the market ran in fear, we advocated buying. One of the specific picks that we added to our portfolio in late March was W. P. Carey (WPC). WPC is a blue-chip triple-net REIT that we had our eyes on for several years but it was just too expensive.

COVID changed that, allowing us to take advantage of the sell-off and buy a top quality company at a discount. Today, we have a lot more clarity about COVID-19 and there is light at the end of the tunnel with at least two different vaccines that are likely to start being distributed in a few months. WPC has had a good recovery since we recommended it, but is still nearly 20% below pre-COVID highs. WPC's recovery is set to continue. As income investors, it is the time to round out our positions before the stock recovers to its historical valuation.

The Triple-Net Advantage

The term "triple-net lease" is used in real estate circles to describe a lease where the majority of the property level expenses are the responsibility of the tenant, including real estate taxes, building insurance, and maintenance. This allows investors to take a laissez-faire approach and avoid the complications of day-to-day management or the risk of expense inflation.

While rent on triple-net leases is lower than for other types of leases, REITs like WPC have thrived on the business model. Instead of dealing with property management issues, they can focus on acquiring new properties.

The best part is that revenue from triple-net leases is very predictable and reliable. Triple-net leases tend to be long term with WPC's average remaining lease term over 10 years. The leases usually have an "escalator" built into the contract that automatically increases rent during the contract. 99% of WPC's leases have escalators. Finally, the occupancy rate tends to be very high. WPC's occupancy rate is 98.9%.

This all adds up to stable rent, over a long period of time, that rises with inflation. COVID-19 introduced a curve-ball. The fear throughout the REIT sector was that tenants would be unable or unwilling to pay rent.

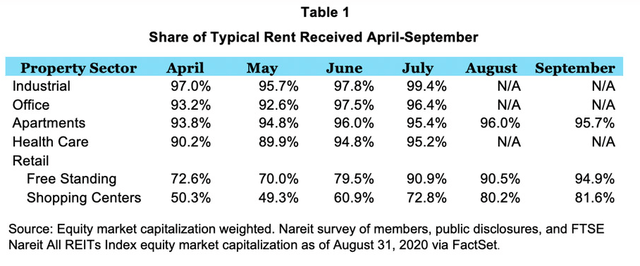

Triple-net REITs fared well compared to other REITs. WPC fared even better.

Source: NAREIT

Source: NAREIT

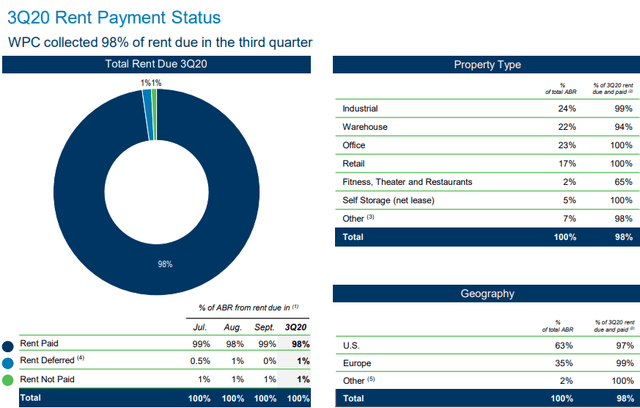

WPC outperformed their peers with rent collections at 96% in Q2 as their low point. For Q3 they were at 98%.

Source: WPC Covid-19 Update – October 30, 2020

Does one quarter of collecting only 96% of rent in Q2, followed by collecting 98% of rent in Q3 and maybe Q4, justify the stock price falling over 40%? Of course it doesn't. The sole weak point in WPC's portfolio is "Fitness, Theater and Restaurants," areas that other REITs have struggled with as well. WPC's superior diversity really helps as they only have 2% of their rent coming from that segment.

Growth Ahead

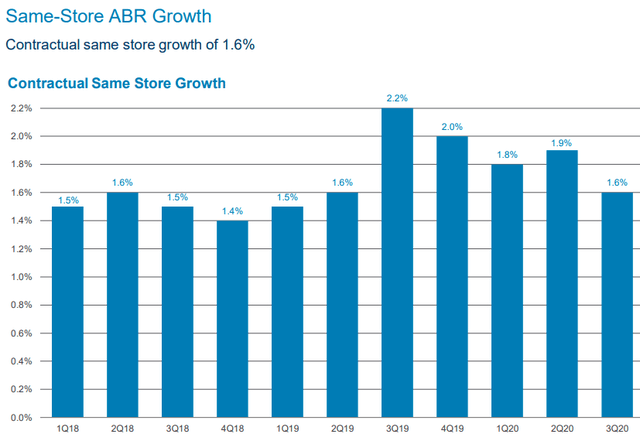

As discussed above, triple-net leases have escalators built in that increase rent on a regular basis. These escalators (or rent increases) help the company to protect itself against inflation.

Thanks to that, WPC saw same-store rents grow throughout 2020 despite the pandemic.

Source: WPC Q3 Investor Presentation

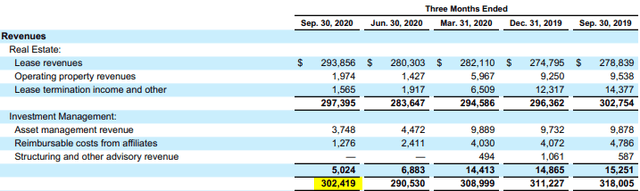

This has helped them provide relatively stable revenue throughout the year.

Source: WPC Q3 Supplement

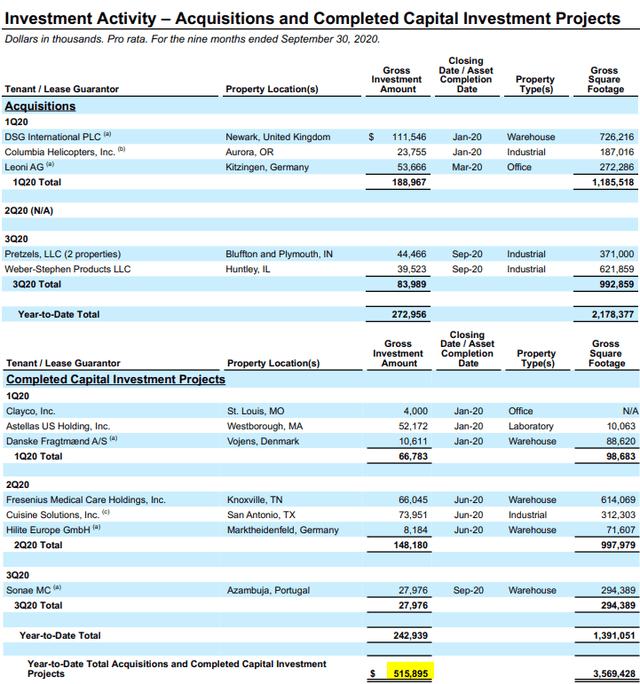

However, the real money is in acquisitions. We want to see WPC buying more properties, especially since right now they can likely get a better price with some COVID uncertainty still impacting the real estate market.

WPC has a lot of liquidity with $152 million in cash, $1.6 billion available on their revolver and $166 million in forward share sale commitments. This puts them in an excellent position to resume meaningful acquisitions.

In Q2, WPC suspended external acquisitions. They resumed acquisitions in Q3.

Source: WPC Q3 Supplement

Source: WPC Q3 Supplement

Year-to-date, WPC has invested about half a billion in acquisitions and expansions for existing tenants. In Q4, they are guiding for an additional $250-500 million in new investments. A very significant step-up in activity at a very favorable time to be investing.

They are well on their way having announced the acquisition of four industrial properties and a sale-leaseback of 27 supermarkets in Europe. In Q2, WPC's acquisitions came to a screeching halt, in Q4 they are back to full speed.

Impact of Debt

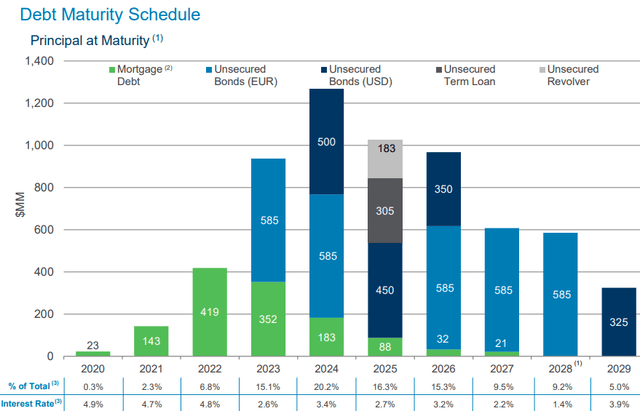

So with rent collections closing in on 100% and new acquisitions back to a normal pace, some investors might expect that WPC price upside is only to the high-$80's (where it was trading back in February before the crash). However, there is another factor that is enormously beneficial for WPC. Interest rates have come down dramatically.

WPC just issued bonds last month at only 2.4%. Over the next several years, WPC has secured mortgage debt maturing that is in the high-4%s.

Source: WPC Q3 Investor Presentation

Rent is going up, and WPC's interest expense is going down. WPC will enjoy greater profits from new acquisitions, while also having interest savings as they refinance older debt. This is why low interest rates are a tail-wind for REITs.

With interest rates lower, WPC's valuation today is cheaper than it was pre-COVID. WPC could easily be trading over $100 by the end of 2021. This is a 40% upside from here.

Dividend

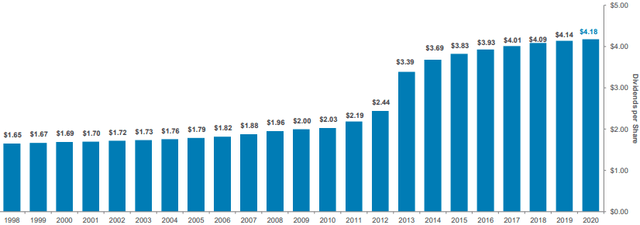

As income investors, we appreciate a reliable dividend. WPC was able to sail through COVID without cutting their dividend. In fact, they have actually raised their dividend three times this year.

This adds to their 22-year streak of dividend increases.

Source: WPC Q3 Investor Presentation

During that streak, WPC went through several periods of economic turmoil including the Dot-Com bust, the Great Financial Crisis and now COVID. Track record is not everything, but a company that is capable of providing growing dividends through all of that turmoil puts it in an elite class.

For the foreseeable future, WPC will have no problem continuing to grow their dividend.

Conclusion

The triple-net strategy is one that WPC has mastered. Long-term leases, with high-quality tenants and regular rent growth add up to a portfolio that provides strong reliable income. In many ways, COVID-19 was the ultimate test of underwriting as weaker tenants were unable to pay rent. WPC passed with flying colors.

Now it is time to look to the future, and that is what WPC has done. WPC has plenty of liquidity on hand and a very favorable lending environment. WPC is doing exactly what they should be doing, they are growing their portfolio by buying properties on the cheap. In Q4, they will nearly double their investments year-to-date and we do not expect them to slow down.

Conditions are favorable, and WPC can take advantage of their access to capital build their income stream. We are confident that the quality they are buying today is just as high as the quality they were buying before.

Even if you missed the steep discounts in March, WPC remains a strong-buy today. WPC pays a 5.9% yield that is set to continue to grow every quarter as it has done in the past. Plus capital gain potential of 40%.

Additionally, WPC is only three years away from reaching "Dividend Aristocrat" status. Investors buying today can benefit from the dividend raises, and the extra attention that reaching dividend aristocrat status brings.

This opportunity will not last forever. WPC will experience significant growth through acquisitions and interest savings. When the market figures that out, we will fondly remember the days when we could buy WPC for only $70.

Thanks for reading! If you liked this article, please scroll up and click "Follow" next to my name to receive our future updates.

High Dividend Opportunities, #1 in Dividend Stocks

HDO is the largest and most exciting community of income investors and retirees with over 4,400 members. Our Immediate Income Method generates strong returns, regardless of market volatility, making retirement investing less stressful, simple and straightforward.

Invest with the Best! Join us to get instant-access to our model portfolio targeting +9% yield, our bond and preferred stock portfolio, and income tracking tools. Don't miss out on the Power of Dividends! Start your free two-week trial today!

Disclosure: I am/we are long WPC. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Treading Softly, Beyond Saving, PendragonY, and Preferred Stock Trader all are supporting contributors for High Dividend Opportunities.